Decrease the time from between sending a billing and getting paid

-

Avoid chasing payments by automating reminders

Automatically send reminder emails to clients notifying them of any bills or outstanding balances, customized with easy-to-use templates.

-

Make it easy for clients to pay with online payments

Securely accept credit card, debit card, digital wallet (Apple Pay or Google Pay); or collect eCheck payments from a pay now button in electronic bills or click-to-pay links embedded in emails; or even by phone.

-

Collect more with customized payment plans

Break large bills into manageable amounts on a schedule that fits their needs, helping you collect more outstanding balances.

A better payment experience for you and your clients

-

Online payments are now included in your Clio Manage subscription

Credit card, debit card, digital wallet (Apple Pay or Google Pay), and eCheck processing

Regulation-compliant trust accounting

Automated payment plans

Industry-low and transparent flat-rate transaction fees -

A legal payments solution your firm can trust

-

Industry-compliant trust accounting

Clio handles all trust-related transactions in compliance with IOLTA rules. With earned and unearned funds kept separate, funds in your trust account are protected from all third-party debiting, including processing fees and chargebacks.

-

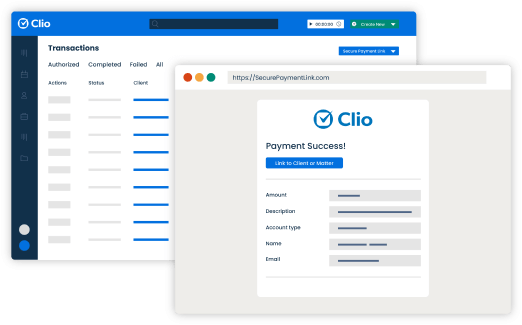

Secure PCI compliant payments

Clio uses the payment industry’s most advanced security measures—with bank-grade protection of your client’s data and proactive fraud detection—so you can safely accept online payments and store card details for future transactions.

-

Real-time insights into your finances

Stay on top of all your transactions with financial reports and instant payment notifications to get a real-time view of any outstanding balances. Create automated payment reminders for any bills that need additional follow-up.

Simple, transparent pricing with no hidden fees

Clio

vs.

Third Party Processors

Third Party Processors

Blank

2.95% for all standard cards

3.5% for American Express

Credit & debit card transaction fees

Blank

Up to 4.5% + fixed fee

Blank

1%

eCheck fees

Blank

Up to 1.5%

Fees vary

Blank

No fees

Card network fees

Blank

Fees vary by transaction and card type

Blank

No fees

Other fees

Blank

Fees vary

(Monthly memberships, processing minimum penalties, additional trust accounts, and PCI compliance)

Clio

vs.

Third Party Processors

Third Party Processors

Blank

2.95% for all standard cards

3.5% for American Express

Credit & debit card transaction fees

Blank

Up to 4.5% + fixed fee

Blank

1%

eCheck fees

Blank

Up to 1.5%

Fees vary

Blank

No fees

Card network fees

Blank

Fees vary by transaction and card type

Blank

No fees

Other fees

Blank

Fees vary

(Monthly memberships, processing minimum penalties, additional trust accounts, and PCI compliance)

Improve your collections with Clio Manage

Join this free 30-minute webinar on January 26, 2022, at 12 pm PST to learn how to start collecting more efficiently with online payments.

FAQ

What information is required to set up payments in Clio Manage?

Firm information:

- Business type

- Business name

- Employer identification number (if applicable)

- Business email, phone number, and address

Personal Information for all firm owners with at least 25% ownership:

- Name

- Date of birth

- Social security number

- Phone number

- Address

- Bank account and routing numbers for any accounts you want to connect to Clio Payments

How is this solution different from the payment options previously provided by Clio?

Clio has offered online credit card payments to customers through an integration with LawPay since 2015. In October 2021, we launched built-in payment processing to Clio Manage, which can be utilized without connecting to a third party payment processor. The new Clio Payments comes with more flexible payment plans, the ability to accept eCheck payments, and the option to securely store your client’s preferred payment details. Plus, because it’s in Clio Manage you get a real-time view of your transactions and support from the Clio team you already know and love.

Where is it available?

Clio Payments is available to customers in the US and Canada.

What is Clio’s advanced chargeback guarantee?

Credit card disputes happen, and if and when they do, Clio has you covered. Chargebacks are fees charged by banks when a client disputes a charge, but rest assured that a credit card chargeback or ACH reversal of funds will never be taken from your trust account. If a chargeback occurs you will be alerted and our team will walk you through the dispute process without any need to share private information. Our dispute resolution process is seamless, automated, and self-serve in order to protect client-attorney confidentiality.

How does Clio handle trust payments and IOLTA account protection?

Clio protects your trust account from any 3rd party debiting fees and processing fees are always taken from your operating account. In fact, Trust Account protection is listed in Clio’s terms of service. You are in control of where payments are deposited to – your trust account or your operating account and you can count on real-time and monthly reporting for all your trust accounting needs.

What is Clio’s secure eCheck?

Avoid the risk of canceled checks and added paperwork by accepting eCheck payments securely with a simple and transparent rate. With just a few clicks, your clients enter their financial institution information to securely deposit payment into your account. Unlike other providers, Clio instantly verifies your customer’s bank account with no waiting period.

Are automated bill reminders available on the EasyStart plan?

Automated bill reminders are available to North American customers on EasyStart, Essentials, Advanced, and Complete plans, and all customers in EMEA.

Clio Payments resources

Have questions? We’re here to help.

Chat with us online, call 1-888-858-2546 or email us at [email protected].