Thanks to the convenience of digital payments, legal clients have been paying for goods and services for years with a simple tap or click on their device.

Unsurprisingly, they’ve now come to expect that same level of ease when paying their legal bills. Rather than go through the burden of paying with cash or check, clients are demanding to use their debit and credit cards.

If that very thought unleashes a litany of questions and concerns, don’t fret. Thanks to advances in legal payment processing solutions, droves of law firms have seamlessly integrated online payments into their existing operations—while remaining compliant and ethical in the process.

In this post, we’ll run through everything you need to know to do exactly that.

The evolution of payment options at law firms

To understand how technology is transforming the future of attorney billing, it’s helpful to reflect on the past.

Before online legal payment solutions, lawyers would manually track their billable hours throughout the day with old-fashioned pen and paper, or an Excel spreadsheet. They would then be responsible for creating invoices for each client by listing out all billing entries, multiplied by their hourly rates—while adding in any additional client expenses.

Sound tedious? That’s not all.

After manually creating an invoice, legal professionals would have to carve out time in their already packed days to send out their bills each month. Once a check arrived in the mail, they would make a trip to the bank to deposit it.

It goes without saying, this process doesn’t lend itself to productivity.

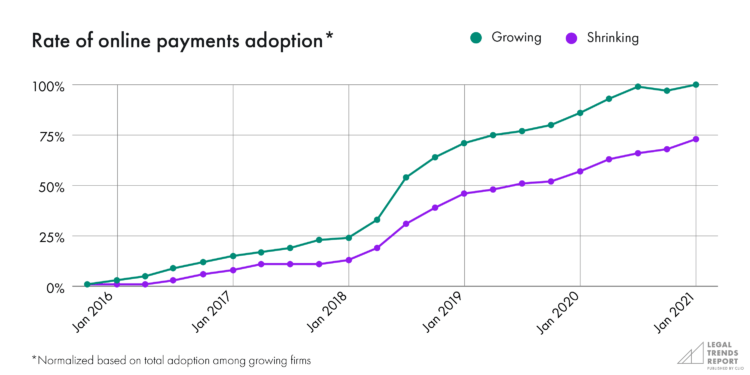

Although the legal industry relies on traditional ways of doing things, many firms are embracing technologies to enhance the payment process. In particular, they’re automating time-keeping, streamlining billing, making collections effortless, and giving clients choice when it comes to how they opt to pay (while getting paid faster in doing so).

While these shifts have been gradually occurring for years, the COVID-19 pandemic has rapidly accelerated the adoption of technology in the legal industry.

In astonishingly short order, law firms were forced to rethink their traditional work environments to meet clients in a world gone largely virtual.

While this required many legal professionals to step outside of their comfort zones, the payoffs of doing so have been profound. Firms can generate up to 34% more revenue by optimizing realization and collection, according to the 2022 Legal Trends Report.

Legal payment processing: Why online payments matter

Today, online payments are no longer a “nice-to-have.” Whether you’re a small law firm or a large law firm, online payments are a necessity for you and your clients.

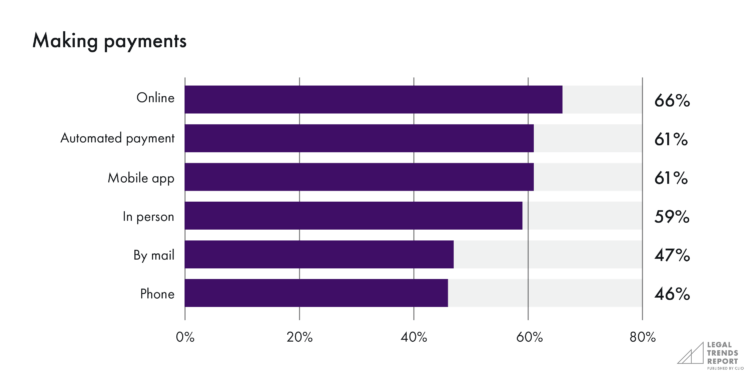

When scouring the market before choosing a law firm, payment options are at the top of their wish list. In fact, the 2021 Legal Trends Report found that online payments are preferred by 66% of consumers, followed by automated payments (61%), and payments via mobile app (61%).

This shouldn’t come as a massive surprise. Online payments provide a more seamless experience, which clients have become accustomed to in their daily lives. By offering multiple payment methods, you’ll make it easier for your clients to pay as they can choose what works best for them.

And that translates into faster payments. For example, we’ve found that 57% of online payments are paid the same day they are billed.

This helps tackle what’s often a major point of friction in the attorney-client relationship: collections.

For instance, if you’re a small law firm, you’re likely having to wear a lot of hats, and having an online payment and billing system can streamline tasks that eat up a lot of time, like dealing with late payments.

By spending less time chasing money, you’ll be able to spend more of it on work that improves your firm’s cash flow and ultimately boosts your bottom line.

It’s worth mentioning that online payments have been especially beneficial for remote legal clients. The abrupt shift to virtual work in recent years has made it easy for clients to easily pay their bills from anywhere, at a time that works for them. As we’ve learned, legal clients prefer options that prioritize convenience over any direct forms of interaction.

You may like these posts

Benefits of online payments for law firms

Client benefits aside, law firms also see an abundance of advantages by using legal payment solutions. We’ll highlight the most notable, below.

Increase in revenue

As lawyers grapple with challenges such as inflation and higher payroll costs, finding new ways to boost revenue is key to growth. Fortunately, online legal payment processing solutions can help.

In 2020, Clio found that firms using online payments, client portals, and client intake and CRM software saw 6% year-over-year growth during some of the most intense periods of the pandemic.

They also collected nearly 40% more revenue per lawyer compared to firms not using these technologies, 2021 Legal Trends Report. This can be attributed to a number of factors, from working smarter each day, to gaining an edge over the competition by giving clients greater convenience.

Greater efficiencies

Chances are, you would jump at the opportunity to have more time in your day. After all, the average lawyer completes only 2.9 hours of billable work in an eight-hour work day, according to the newest Legal Trends Report.

Legal payment solutions give lawyers the gift of time by streamlining and automating mundane administrative tasks. No matter where they are, lawyers can generate an invoice from tracked time in a single click.

These solutions allow for automated payments so that clients don’t need to remember when a bill needs to be paid. They also record payments automatically and sync this data to your accounting platform, so you’re always up to date (and don’t have to worry about error-prone manual data entry).

Enable passive bill collection

Manually processing payments can take up a significant chunk of time each day.

With online payments, clients can instantly pay from anywhere using credit card, debit, or eCheck with click-to-pay links. This eliminates the need for someone at the law firm to be physically present to process the payments—while giving clients the check out experience they’re already used to.

This feature allows legal clients to pay remotely at their convenience.

Close the access gap to justice

Legal services are out of reach for many people—to the extent that 61% of people say they cannot afford to deal with a legal problem. Yet, access to legal services can affect so many aspects of someone’s life, and can ultimately determine whether they have a job or a home.

Legal payment solutions allow you to accept online payments and offer payment plans, which makes services more accessible and affordable. This helps you serve more clients and reach those who otherwise wouldn’t have been able to take legal action.

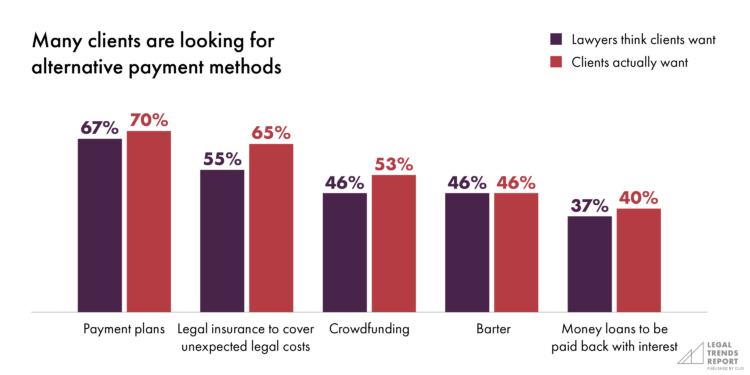

The 2022 Legal Trends Report found that 70% of consumers want the option to pay a lawyer via a payment plan and 53% want the opportunity to crowdfund their legal bills. The top legal payment processing solutions not only make this possible—they also make it easy to do.

Online payments and trust accounting compliance

Collecting payment for the work you do is integral to the success of your business, so, choosing the right legal payment processor is critical.

For lawyers, this means ensuring that you choose a payment processor that is not only safe and secure, but also handles IOLTA (interest on lawyers’ trust accounts) trust compliance. In order to ensure trust account compliance, law firms need to maintain accurate records showing the flow of funds in these types of accounts.

Of course, steps can be taken to ensure this.

A few best practices are to:

- Keep the trust account fund and your matter fund completely separate.

- Ensure credit card payments are deposited correctly and fees aren’t debited or taken from a trust account.

- Never move unearned funds from your trust account to an operating account.

This is why it’s a good idea to use a legal payment processor that understands the unique needs and regulations of law firms. They will have safeguards in place to keep your law firm trust accounting compliant and ensure your funds are protected from potential third party debiting (such as fees).

Depending on your jurisdiction, you may also be required to have a trust account with an approved financial institution. It’s important to check these requirements before you set up an account.

Concluding thoughts on online legal payments

Law firms have no shortage of choice when it comes to choosing a payment processing provider, including generic solutions like PayPal and Square.

However, those vendors aren’t built specifically for law firms—and they don’t meet the requirements to be compliant with trust accounting rules.

To fully realize the benefits of legal payment solutions, it’s best to choose a legal-specific payment processor. This will help you be more efficient with your billing process and save time, while eliminating the risk of inadvertently breaking IOLTA rules.

Using a cloud-based practice management solution like Clio Manage enables firms to offer a range of billing options to clients, such as scheduled payments, or split-billing to allow for multiple payees, making it easier and more efficient for firms to manage their entire billing processes in one central location–eliminating the need for third-party billing tools.

After all, that’s exactly the experience that your team and clients have come to expect.

Interested in learning more? Read our guide on Legal Payment Processing Solutions.

We published this blog post in September 2022. Last updated: .

Categorized in: Accounting

Financial Management Essentials for Small Law Firms in 2025

Elevate your firm's financial health and maximize efficiency in 2025 by uncovering accounting best practices, strategies for faster billing and payment collection, and the power of a single solution for firm operations.

Watch Now