The practice of law is demanding in many ways, one of which is the need to comply with the rules of professional conduct for lawyers. These ethics rules are intended to protect the public and maintain the integrity of the legal profession. Accordingly, attorneys must be familiar with the applicable ethics rules and guide their professional conduct with them in mind.

In this article, we will cover some of the critical professional conduct rules that affect lawyers daily. Of course, these rules can vary between states—so be sure to review the ethics rules for your specific jurisdiction.

What are the rules of professional conduct?

The ABA Model Rules of Professional Conduct are a set of legal ethics rules that were created by the American Bar Association (ABA) in 1983 and are continually updated over the years.

The Model Rules are not legally binding. Instead, they serve as a nationwide model for attorney ethics rules, with states free to enact their own ethics rules.

Nonetheless, most states have adopted some form of the ABA Model Rules. Accordingly, we will examine attorney ethical duties using the Model Rules framework.

What are the ethical duties of a lawyer?

A lawyer’s ethical duties are summarized in the preamble to the ABA Model Rules, which outlines an attorney’s various responsibilities and obligations.

A lawyer is a representative of clients and an officer of the legal system. As stewards of the law, they play a vital role in maintaining justice. As such, lawyers must maintain the highest standards of ethical conduct.

These ethical duties include:

- Performing competently and diligently.

- Maintaining communication with clients.

- Keeping information confidential when it relates to the representation of a client.

Attorneys must either avoid conflicts of interest with their clients or deal with them appropriately when they arise. In addition, they must conform to legal requirements, use legal procedures only for legitimate purposes, and demonstrate respect for the legal system.

What is unethical for a lawyer?

Actions that are unethical for a lawyer would violate the general ethical duties outlined above. For example, it is unethical for an attorney to be professionally incompetent, fail to communicate with a client, or improperly disclose confidential client information.

Undisclosed conflicts of interest are also unethical, as are any illegal or unscrupulous activities, such as suppression of evidence or misleading statements made to courts.

This is why it is critical to understand the rules of professional conduct for lawyers and how they apply to your specific situation and practice area. Unethical activity not only sullies an attorney’s reputation—it can also lead to malpractice claims. While there are steps that can be taken in response to malpractice claims, it is better to minimize the potential for these claims to arise.

Rule 1.1 Competence

One core ethical duty for attorneys is to perform their work with competence. This means legal practitioners have an obligation to do their jobs at certain minimum levels of ability. Model Rule 1.1 provides that lawyers must provide clients with “competent representation,” which is defined as exhibiting the necessary amounts of legal skill, knowledge, thoroughness, and preparation.

The official comments on Rule 1.1 detail what is expected from attorneys to be deemed competent. A recent notable addition to the comments addresses the use of technology in the legal profession. Specifically, comment 8 provides as follows:

“To maintain the requisite knowledge and skill, a lawyer should keep abreast of changes in the law and its practice, including the benefits and risks associated with relevant technology [emphasis added], engage in continuing study and education and comply with all continuing legal education requirements to which the lawyer is subject.”

Therefore, it’s critical to learn the essentials of technological competence for law firms.

Rule 1.4 Communications

Beyond competence, attorneys’ ethical rules also require a certain level of communication with clients, as addressed in Model Rule 1.4 dealing with attorney-client communication. Communication with clients is critical, since failure to communicate is one of the top causes of legal malpractice claims.

Two important facets of Rule 1.4 ethics are responding to client questions and keeping clients in the loop. Specifically, attorneys must keep clients reasonably informed of the status of their legal matters. Lawyers must also promptly comply with client requests for information. These tasks can be burdensome for busy legal professionals who are often working under time crunches.

Technology can help with the tasks of client communications, especially with regard to client questions and case status updates.

For example, a secure communication portal, such as that offered by Clio, can help tremendously with general client updates. Clients can use the portal to access all the relevant information for their legal matters. This empowers clients while also reducing the amount of follow-up, phone call intake, and email responses required by the firm. As Nicholas Hite of Hite Law Group puts it:

“I tell [my clients] ‘you’re going to get an email, and it’s going to give you access to essentially everything that I have for your file. It’s all right there, and you can go to it whenever you want. You don’t have to wait for me to call you back or wait for me to respond to your email.’ That’s really empowering for my clients, that they feel that they can participate and take charge in managing their own cases.”

Law firms would also be well-advised to grow comfortable with the use of cloud computing, while familiarizing themselves with the applicable ethics rules for the cloud. If you find a provider that complies with your firm’s ethical duties, a cloud solution can bring a wealth of benefits.

Rule 1.5: Fees

Attorney ethical rules also extend to billing for legal services and costs. As stated in Model Rule 1.5, attorneys may not charge for fees or expenses that are “unreasonable.” To ensure that clients do not challenge your fees, the best practice is to make legal bills as clear and accurate as possible. For hourly billing, this would mean including detailed notes in bills that describe the work performed.

What about credit card processing fees?

A subset of this ethical consideration applies to those law firms that accept client payments via credit card. Specifically, these firms may want to know if they can pass on credit card processing fees to their clients.

It is generally not recommended that firms pass on these surcharges to clients, but instead absorb these fees as the cost of doing business.

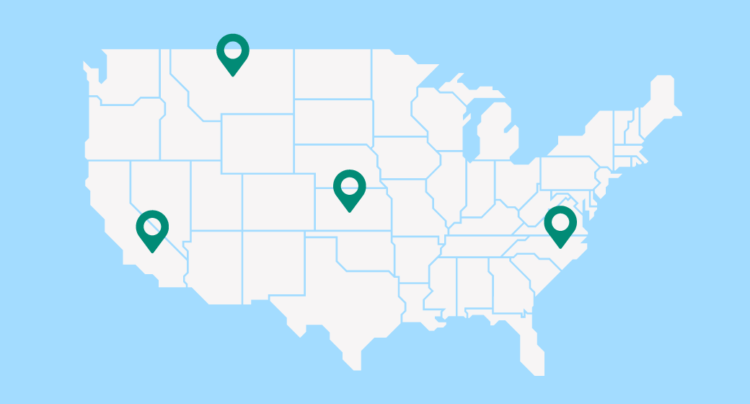

Some states expressly prohibit passing on these surcharges to clients. Other states may have ethics rules with less prescriptive language, such as only allowing credit card charges for services actually rendered to clients or expenses incurred on their behalf. Arguably, processing fees are not included in these categories, so passing on these fees to clients could result in an ethical breach. Always check the ethics rules of your own jurisdiction for their specific position on credit card processing fees.

Rule 1.6 Confidentiality of information

Attorneys have an ethical duty to keep information confidential if it is related to their representation of the client. A component of this duty, as stated in Model Rule 1.6, is to “make reasonable efforts to prevent the inadvertent or unauthorized disclosure of, or unauthorized access to, information relating to the representation of a client.”

A 2016 class action against a Chicago-based law firm demonstrates the gravity of a breach of this duty. The lawsuit was for an alleged failure to protect confidential client information. Notably, the suit did not accuse lawyers at the firm of inadvertently sharing client information. According to The American Lawyer, the complaint did not include any claim that data was actually stolen or used against clients. Instead, the class action solely focused on the fact that lax data security could have put client information at risk.

Fortunately, modern legal technology can mitigate these risks through its offering of secure tools for communications. Legal software tools with high security standards, such as Clio, can ensure the most up-to-date and effective security protocols are in effect for all client information and communications.

Rule 1.15 Safekeeping Property (Trust Accounts)

Model Rule 1.15 deals with an attorney’s ethical duties in safekeeping property for clients. Attorneys must keep client funds in client trust accounts and maintain complete records of trust funds. These client trust funds can include settlement funds, or legal fees and expenses paid in advance by the client.

Ethics rules governing trust accounts vary from jurisdiction to jurisdiction, but they generally share some common elements.

First, there is a strict prohibition against commingling firm funds with client trust funds. In addition, ethics rules generally require the firm to maintain accurate records of funds going in or out of the trust account. Most states have a trust account reconciliation requirement, with bank statements needing to be reconciled with the firm’s internal records

The trust accounting process can be complex, with transfers from the trust account to the firm’s operating account required to pay expenses or third party fees. This leaves a lot of traps for the unwary legal professional dealing with a trust account. A legal trust accounting tool like Clio provides peace of mind while handling the trust accounting process efficiently and accurately.

You may like these posts

Final thoughts on rules of professional conduct for lawyers

The rules of professional conduct for lawyers are integral guidelines for an attorney’s day-to-day conduct. The rules outlined above are only a small sampling, with ethical rules governing other areas such as lawyer advertising. Every lawyer should become well-versed in the ethical rules for their jurisdiction for the sake of their career, the legal profession, and society at large.

Lawyers should also keep in mind how the right technology can aid in compliance with their ethical duties. Cultivating tech awareness and competence is simply a good practice for responsible legal professionals, similar to having malpractice insurance in place. Consider how you can leverage technology to both comply with ethical rules and excel as a legal practitioner.

Clio has been approved by 100+ bar associations—learn more about how Clio can help your firm today.

Note: The information in this article applies only to US practices. This post is provided for informational purposes only. It does not constitute legal, business, or accounting advice.

We published this blog post in May 2024. Last updated: .

Categorized in: Business