Law firms have used Microsoft Excel in their businesses for many years. While many law firms might consider Excel an affordable, familiar, and easy-to-use software, depending on spreadsheets to manage your firm’s client invoicing can create many problems. Problems include data entry errors, version-control issues, and invoice tracking complexities. These issues can turn the billing process into a time-consuming and frustrating task for your law firm.

Stop using Excel for legal billing and add time back into your day

According to the Smartsheet report, Automation in the Workplace, more than 40% of employees surveyed spend at least one quarter of their week doing manual, repetitive tasks. Lawyers are not immune to this unproductive fate, recording only 2.9 billable hours per day on average, according to the latest Legal Trends Report. The rest of their time is spent on various non-billable activities, including preparing and sending invoices, processing payments, and updating trust ledgers.

If you’re still using Excel for billing at your law firm, you’re wasting valuable time—billable time—on repetitive, time-consuming, manual data entry tasks. For small firms and lawyers just starting to build their practice, this lost time can be a serious barrier to growing your practice.

Legal spreadsheet billing errors can be costly

Data entry errors are a common problem for law firms still using Excel to invoice their clients. The probability of human error is between 18% and 40% when manually entering data into simple spreadsheets. That’s why it’s no surprise that almost 90% of operational spreadsheets contain errors.

Even if you think your invoices are accurate, a study found that common methods of verification, like visual checking, resulted in 2,958% more errors than double entry. However, automation reduces the error count to virtually zero. Learn more about streamlining your law firm invoice process here.

In addition, the simplest mistakes have the potential to scale at an alarming rate. Consider these gut-wrenching examples of costly spreadsheet errors:

Barclays

Interested in acquiring some of Lehman Brothers’ assets, Barclays submitted an Excel spreadsheet that hid—instead of deleted—nearly 200 cells in the spreadsheet. When the Excel doc was converted to a PDF, all the rows appeared, and Barclays ended up purchasing 179 contracts it didn’t want.

TransAlta

A cut-and-paste error cost this Canadian power generator $24 million. The mistake caused TransAlta to purchase more U.S. power transmission hedging contracts at an elevated price.

Fidelity

The omission of a minus sign on a net capital loss of $1.3 billion—should’ve been a net gain—led to a discrepancy in the dividend estimate for the Magellan fund of $2.6 billion.

You may like these posts

Stop saving law firm files locally

If your firm is still using on-premise storage to save billing data, you’re missing out on the benefits of cloud storage:

- Retrieve information easily.

- Collaborate more.

- Scale affordably.

- Recover from disasters more smoothly.

- Enjoy comprehensive, multi-layer security.

Office Online (free version), Office 365, and GoogleDocs are great options for saving files. But using a dedicated cloud-based legal billing solution is the smartest choice for storing and managing confidential client billing and financial data.

Legal billing solutions meet your needs better

Cloud-based legal billing solutions make managing every stage of the legal billing process—time and expense tracking, invoicing, bill creation, bill review, trust accounting, collections, and payments—easier and more efficient.

Quick invoice creation

With an automated, cloud-based billing solution for law firms, you can create and approve invoices from anywhere, anytime. Plus, many solutions enable you to track time directly within the billing software, eliminating the need to input and calculate each individual invoice.

Faster payment

Sophisticated legal billing solutions support flexible payment options (including credit cards) and allow clients to pay multiple bills at once to keep income flowing. Plus, by automating invoice management, you won’t have to worry about tracking unpaid bills, adding interest to late payments, or updating payment records.

Secure and safe billing

Automation removes the inherent risk in manual processes, while cloud-based encryption channels for transferring data ensure billing is secure. In fact, a Gartner report noted that very few security breaches have occurred in the public cloud. Most breaches continue to involve on-premises data center environments.

Multiple billing options

Legal billing software offers you the flexibility to invoice clients based on hourly rates, retainer, flat fee, or contingency.

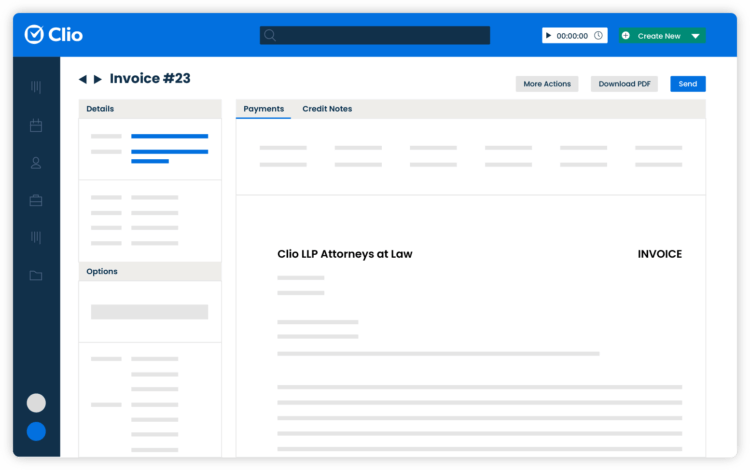

Manage bills more efficiently and get paid faster with Clio

Clio simplifies invoice management, helping you reduce the time you spend on tracking time and expenses. You can also generate invoices with one click.

Track the status of unpaid bills, apply discounts to early payments, or add automated interest to late payments from one central location. You can even schedule and automatically send outstanding balances to clients to ensure you never miss a billing deadline.

Plus, automated credit card payment plans—coupled with the ability to accept payment for multiple bills at the same time—reduce collection time and increase cash flow.

Clio helps you take control of your billing process. You can personalize Clio to meet the unique needs of your law firm and clients: branded invoices, customized billing plans, tailored payment profiles for clients, and more. Plus, sophisticated reporting capabilities enable you to generate financial reports that offer big-picture insights. If you’d like to see how Clio can transform your billing process, watch Clio Manage in action. And for everything you need to know about invoicing for lawyers, check out our ultimate guide and best practices for law firm billing.

We published this blog post in October 2021. Last updated: .

Categorized in: Accounting

Get paid faster, save time, and reduce outstanding bills

Download our free e-book and learn the 7 easy steps to easier, more efficent billing

Get the e-book