Handle your legal accounting with confidence

Avoid hunting down receipts, manually logging transactions, and reconciling accounts across multiple platforms or papers with cloud-based accounting software built for attorneys.

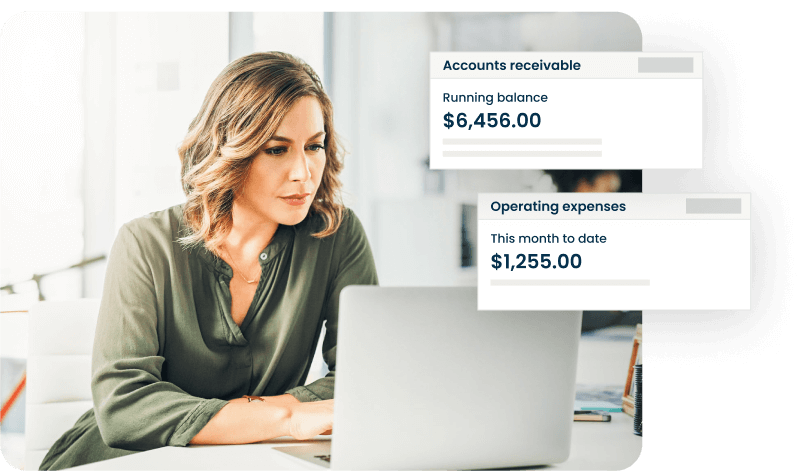

Manage your finances in one system of record

Automate financial workflows, transaction matching, and account reconciliation in compliance with jurisdictional requirements, so you can manage your law firm’s bookkeeping—and limit manual data entry—with confidence.

- Manage and track finances in one place

- Get a real-time view of money you’re owed and owe

- Enjoy accurate financials with automated syncs across Clio

- Automatically match transactions from your bank account to your books

Stay compliant with industry regulations

Stay secure, compliant, and audit-ready. Clio’s attorney accounting software gives you the peace of mind knowing that every trust transaction is recorded compliantly in your ledger according to industry regulations.

- Keep earned and unearned funds separate

- Reconcile trust and operating accounts

- Access reconciliation and ledger reports

- Manage trust funds at every stage

Make data-driven decisions

Get a complete picture of your firm’s financial performance by recording, managing, and analyzing every financial transaction related to running your firm in a deeply connected system.

- View financial insights at a glance

- Oversee your firm’s cash flow in real time

- Manage vendors and expenses

- Generate reports to file with your taxes

- Get accounting best practices

Looks like something went wrong. Please refresh this page to try again.

You may also want to check your browser's tracking protection settings.

Still stuck? Give us a call at 1-888-858-2546.

Frequently Asked Questions

What is legal and trust accounting software?

Legal and trust accounting software is the best way for small to mid-sized law firms to comply with rules that many legal jurisdictions have regarding funds held in trust on behalf of a legal client.

How is legal accounting different from general accounting?

Law firms have additional rules and regulations when it comes to managing client funds. Since these rules are unique to law firms, generic accounting solutions weren’t built to meet those particular needs. Many law firms prefer to use a legal accounting solution that has built-in protections to keep them compliant at all times.

What is trust accounting?

Trust accounting is the process of tracking and managing client funds that are held in trust. Unearned funds must be held separately from earned amounts until the point in which they are put toward the client’s case. Proper trust accounting processes put in place by each individual jurisdiction require law firms to manage those funds in a particular way.

What are the basics of trust accounting compliance?

The fundamental aspects of a lawyer’s duty when it comes to handling client funds include:

Identification: Depositing funds into an account specifically labeled as a trust account.

Segregation: Keeping client funds on deposit separate from a lawyer’s operating or personal funds.

Accounting: Lawyers must create and maintain appropriate records of funds belonging to their clients.

These are some of the basics of trust accounting compliance, but some U.S. states also have additional rules if you’re handling client funds.

One of the advantages of using Clio’s legal-specific trust accounting software is that it is built to provide trust accounting functions that are easy to manage and maintain.

Will trust accounting software help me meet IOLTA requirements?

Yes. You can create an account in your trust accounting software specifically for IOLTA transactions. You can then monitor all payments, interest, and disbursements through that fund.

Does Clio have the specific report required for trust accounting compliance in my jurisdiction?

Our trust accounting software allows you to complete three-way reconciliation using Clio Accounting. Clio Accounting uses the bank feed matching process to automatically connect transactions from the ledger with what’s in the bank account. With all three sources of information conveniently available in one place, Clio makes it quick and easy to reconcile and access current or past reports for compliance purposes.

Take control of your legal accounting today

See how Clio can help you run a more efficient and profitable practice.

Looks like something went wrong. Please refresh this page to try again.

You may also want to check your browser's tracking protection settings.

Still stuck? Give us a call at 1-888-858-2546.

Legal accounting software for law firms resources

Check out these helpful law firm accounting resources to get you started.