2019 Legal Trends Report

Introduction

Closing the gap

- Introduction. Closing the gap

- Part 1. This is what law firm growth looks like

- Part 2. Clients want more than just referrals

- Part 3. More than half of clients shop around

- Part 4. Putting 1000 law firms to the test

- Part 5. How prepared is today's lawyer to drive their firm's success?

- Part 6. Hourly rates and KPI data

- More Data. Dig deeper into the LTR datasets

The market for legal services faces a critical paradox. On one hand, the vast majority of law firms say they want to increase their revenues, yet they have trouble finding business. On the other, clients struggle to get help with their legal problems.

This paradox represents a market gap that shouldn’t exist—and one that presents an enormous opportunity for firms that can build a strong business approach for their legal practice.

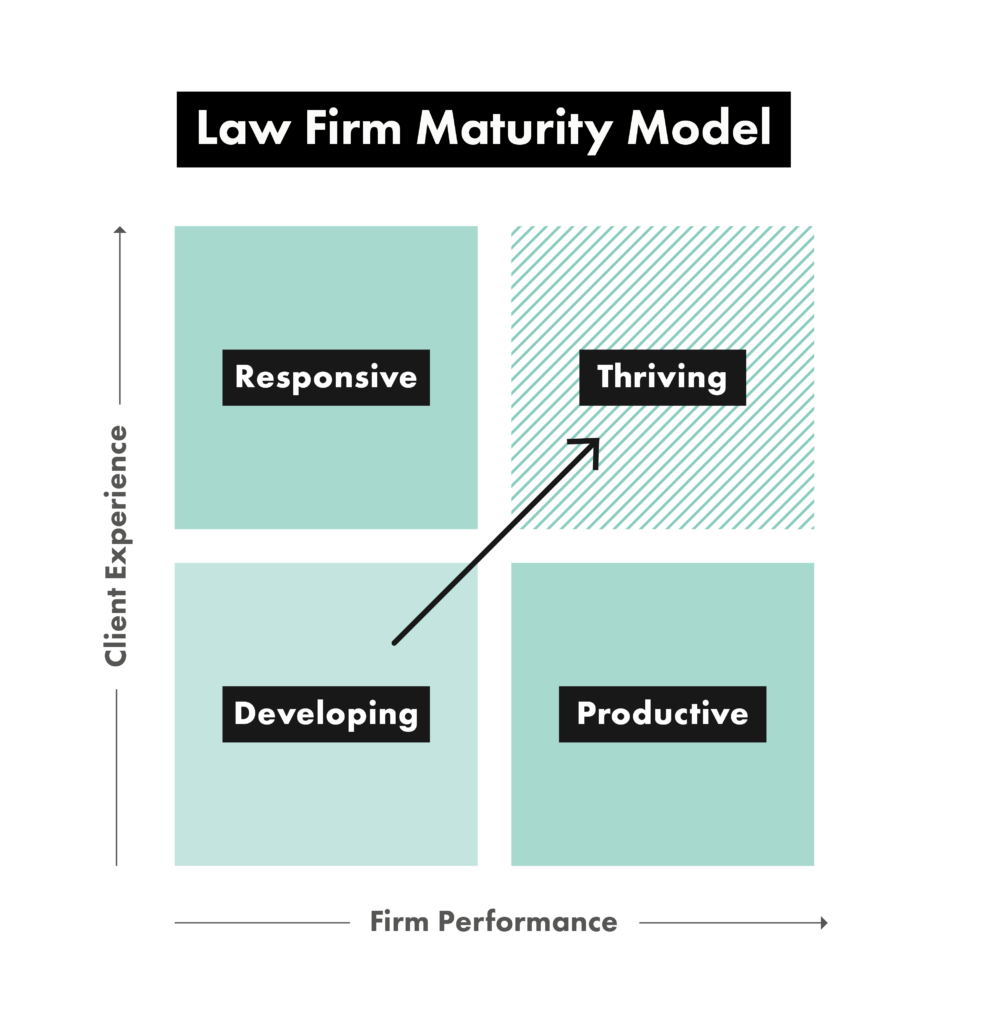

Many high-growth firms are getting it right. We call these “thriving” firms because they’ve been able to achieve substantial year-over-year revenue growth that is both consistent and predictable. We believe that these firms have achieved high growth over a sustained period of time due to two critical factors: a focus on client experience and firm efficiency. We’ve illustrated this growth path in a new format: the Law Firm Maturity Model.

In the bottom-left quadrant are new firms or firms that have either struggled or have yet to achieve the success they want. Firms that progress along the client-experience axis are those that become responsive to client needs. These are the firms that know how to attract new business and earn strong satisfaction among their clients. Firms that progress along the firm-performance axis put more time toward revenue-generating tasks for clients, while keeping overhead costs low and investing in productivity initiatives. Thriving firms progress along both axes. These firms consistently increase the amount of business they bring in while capturing the full value from all of the client-facing, revenue-generating work they perform.

We can learn a lot from high-growth firms—and we believe more law firms should. Not only are these firms achieving major success in the form of rapidly expanding revenues, they’re doing it while closing the market gap and delivering more legal services to the clients who need them.

In the pages that follow, we’ve created the most extensive, in-depth analysis on how lawyers can drive new business and achieve greater success for their firms.

Thriving firms achieve predictable, high growth over time

New this year

Since 2016, the Legal Trends Report has uncovered the most groundbreaking insights into the business of legal practice in the 21st century. Now in its fourth year of publication, we’ve expanded the scope of our research to include new approaches to understanding some of the most pressing realities that lawyers—and their clients—face today.

Determining what drives law firm success

We conducted the first-ever longitudinal data analysis to determine how thriving firms achieve consistent, long-term growth in revenue over time, and what distinguishes them from firms that haven’t seen any growth or have shrunk over the same period. By comparing growing, stable, and shrinking firms over a five-year period, we’re able to show how key performance metrics impact success.

What clients really look for when hiring a lawyer

We surveyed consumers to shed more light on how they look for a lawyer, what they expect when reaching out, and what drives them away. Our findings show that referrals aren’t the only means clients use to seek a lawyer, and that clients have a high bar for deciding who to reach out to—and who to ultimately hire.

Putting law firm responsiveness to the test

What’s it like shopping for a lawyer in 2019? To answer this, we emailed 1,000 law firms, and phoned 500 from the same group, to determine just how prepared lawyers are to earn the business of potential clients when they reach out. In doing so, we’ve collected the largest primary data set on law firm responsiveness—which puts a spotlight on key opportunities for law firms to be truly competitive in acquiring new clients.

Data sources included in the 2019 Legal Trends Report

We use a range of methodologies and data sources to build a comprehensive understanding of how lawyers run their firms in today’s market for legal services. This year, we’ve expanded the scope of our data sources even further to uncover new insights unlike any before.

Clio data

The Legal Trends Report uses aggregated and anonymized data from tens of thousands of legal professionals in the United States. This includes data from January 1, 2013 to December 31, 2017, which was used to conduct our longitudinal analysis of law firm success. In reviewing actual usage data, we identify large-scale industry trends that would otherwise be invisible to law firms.

Law firm survey

We surveyed 2,507 legal professionals, representing both Clio users and non-Clio users. By assessing the existing needs and strategies of law firms, we’re able to better align our data analyses with real law firm goals.

Consumer survey

We surveyed 2,000 consumers to understand what they look for when searching for professional legal services and what types of experiences they expect. Our sample was representative across all adult age groups, genders, and geographic regions in the United States.

Email and phone outreach

We emailed a random sample of 1,000 law firms in the United States, and then phoned 500 of these firms, to assess responsiveness and quality of service. Our sample had equal representation across five practice areas, including Family, Criminal, Bankruptcy, Business Formation, and Employment, and comprised firms of all sizes.

- Aggregated and anonymized data from tens of thousands of legal professionals

- 2,507 legal professionals surveyed

- 2,000 consumers surveyed

- 1,000 law firms emailed for legal services

- 500 law firms phoned for legal services

2019 Legal Trends Report

Part 1

This is what law firm growth looks like

- Introduction. Closing the gap

- Part 1. This is what law firm growth looks like

- Part 2. Clients want more than just referrals

- Part 3. More than half of clients shop around

- Part 4. Putting 1000 law firms to the test

- Part 5. How prepared is today's lawyer to drive their firm's success?

- Part 6. Hourly rates and KPI data

- More Data. Dig deeper into the LTR datasets

For the first time, we’ve significantly expanded the scope of our data analysis to look at longitudinal, multi-year trends.

Over the last 11 years, Clio has established itself as the system of record for the legal profession, benchmarking key business insights across tens of thousands of law firms—which we’ve reported in the Legal Trends Report for the past four years. Now, in formulating the industry’s first longitudinal research, we’ve further validated the critical business metrics that ultimately contribute to law firm growth.

Through this analysis, we illustrate how thriving law firms increase their revenues more and more over time—and why struggling firms see their revenues decline. From the data in this section, we discuss how critical business inputs contribute to exceptional, long-term growth in firm revenue—serving as a roadmap for any law firm to follow.

Building our analysis

To better understand what distinguishes thriving law firms from others, we leveraged aggregated and anonymized data from thousands of law firms to design a comparative analysis that zeroed in on three distinct groups defined by their total revenue growth between 2013 and 2017:

- Growing firms. Firms that grew their revenues by at least 20% over five years.

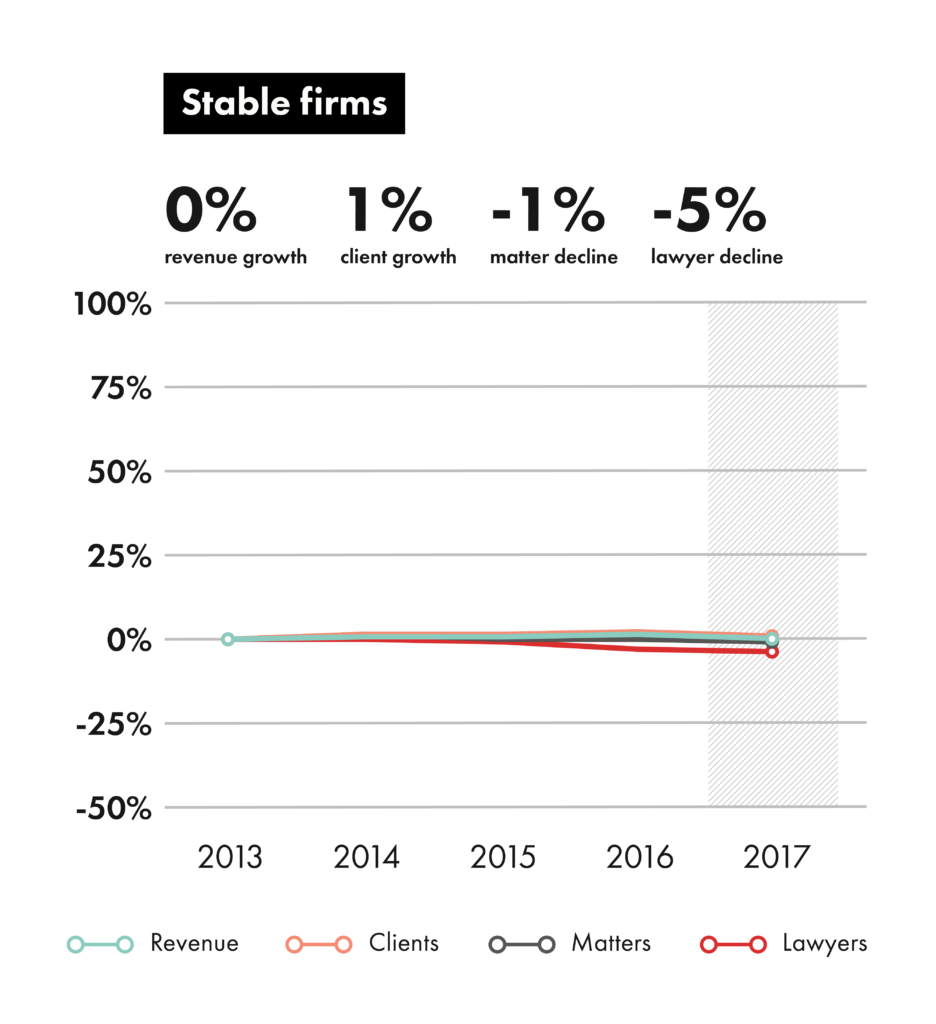

- Stable firms. Firms that neither grew nor declined by more than 20% over five years.

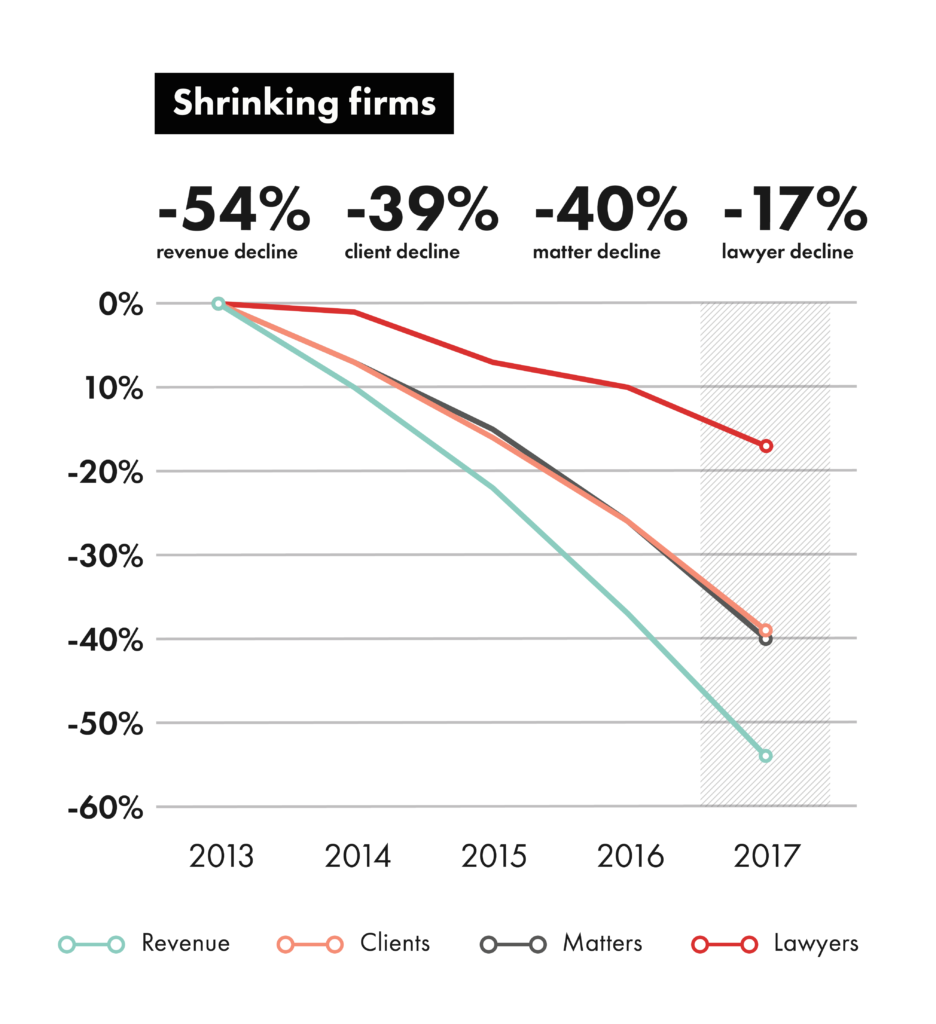

- Shrinking firms. Firms that saw their revenues decline by at least 20% over five years.

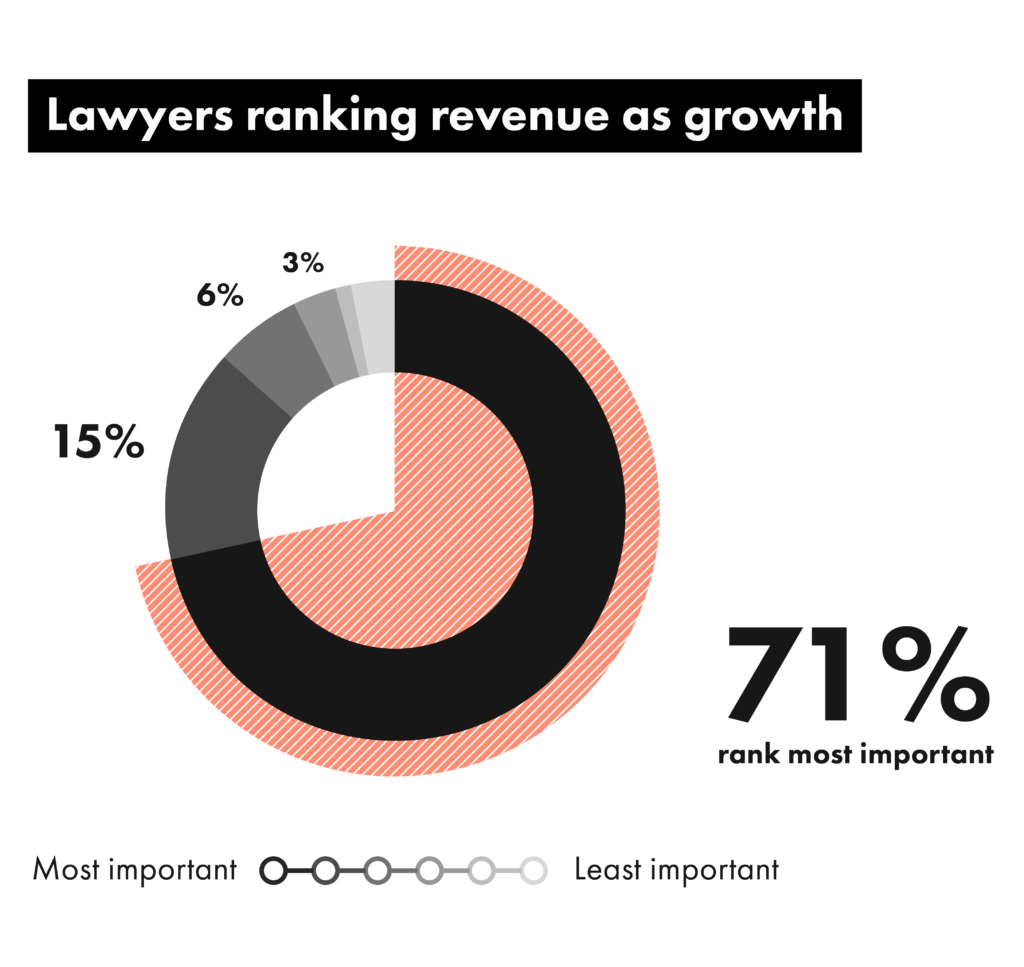

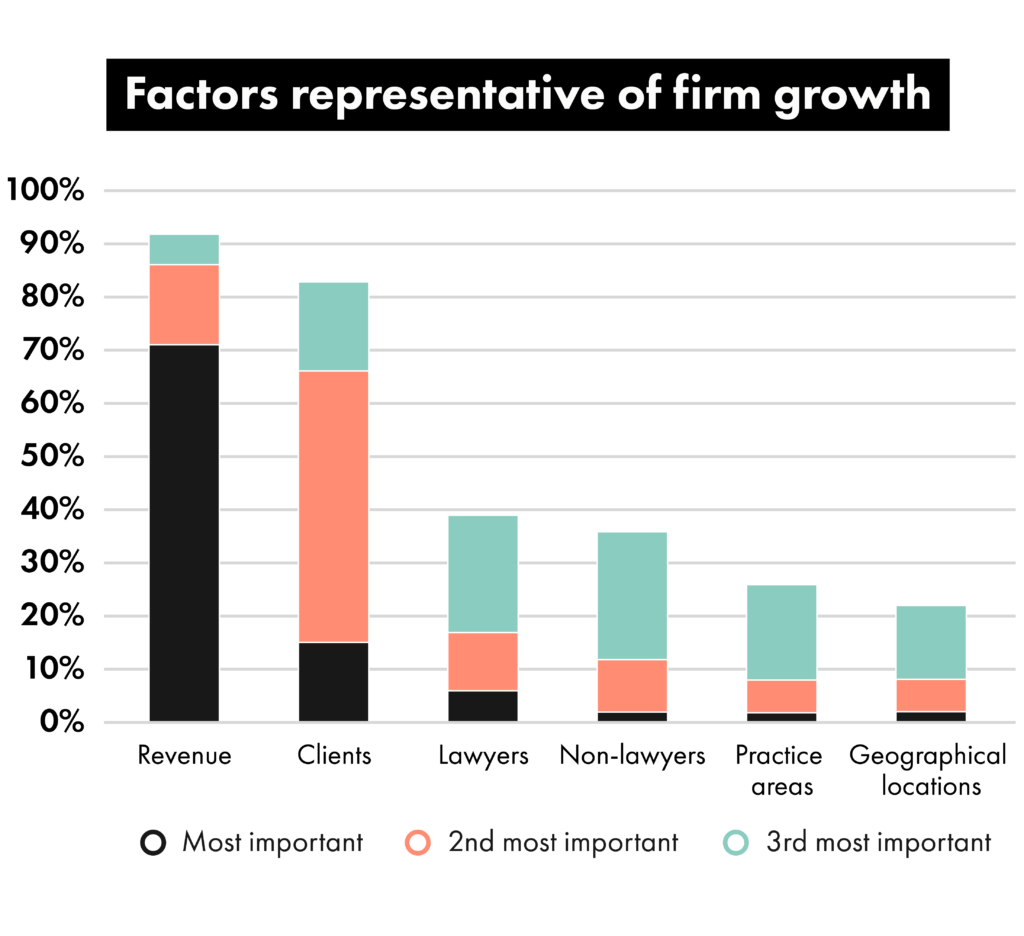

Why did we focus on revenue? Aside from being an objective and quantitative benchmark for success, 71% of lawyers say they consider revenue their most important indicator for law firm growth. Revenue is also a standard measure for the overall health of a business—from small private entities to the very largest—and is a key output for the other business metrics that we compare.

Growing firms grew 20% to 30% year over year

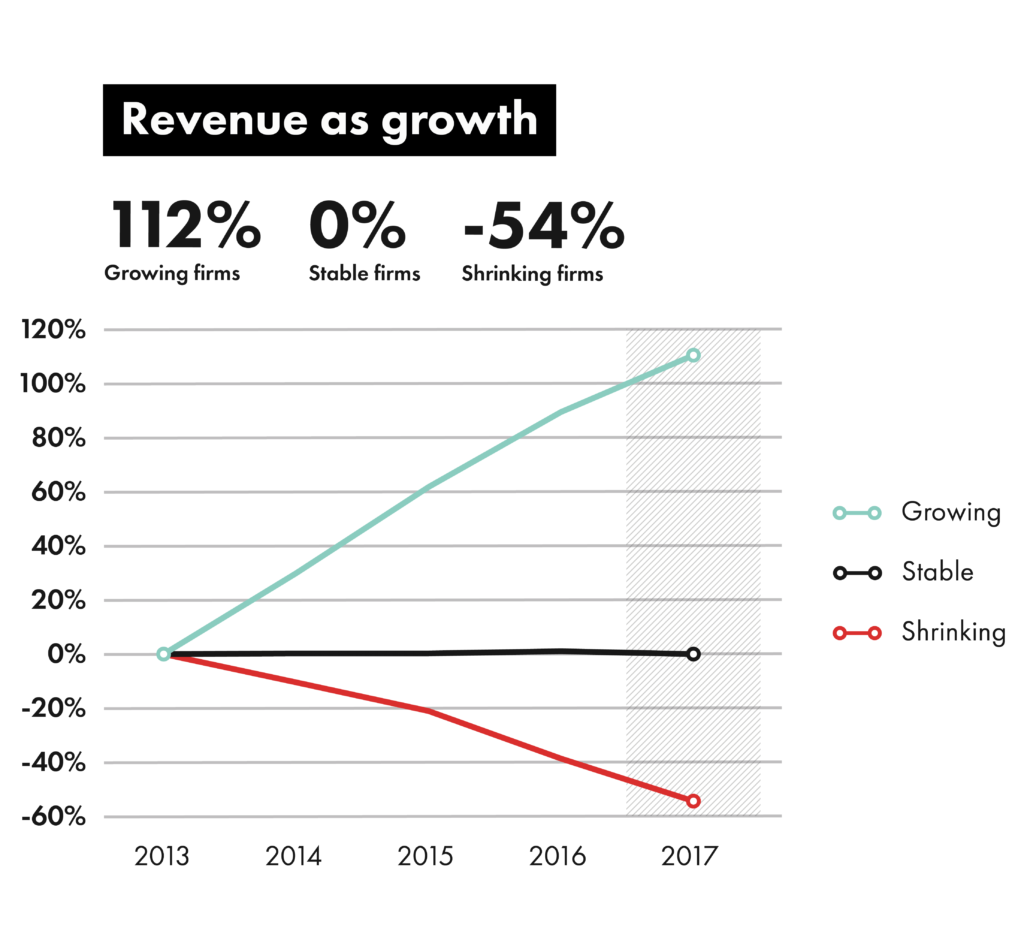

When looking at the total increase in revenues, we determined that growing firms actually grew by 20% to 30% year over year to achieve an average of 112% growth between 2013 and 2017—making them a prime example of the thriving firms described within the Law Firm Maturity Model.

On the other hand, shrinking firms saw their revenues decrease by 54%, meaning they took in less than half the revenue in 2017 as they did in 2013. Stable firms maintained approximately the same level of revenue over the same period.

Each group has their own distinct patterns for growth—and these trends stayed consistent even when we controlled for firm size and practice area.

- Shrinking firms saw revenues decline by more than 50%

More lawyers and clients explain part of revenue growth

So what drives growth? The first two metrics we looked at were the average number of lawyers within each firm and the overall number of cases and matters worked among growing, stable, and shrinking firms.

At the start of our analysis, we expected that total revenue earnings would correlate strongly between the number of lawyers hired and the number of clients and matters worked. For example, if a firm were to double the number of lawyers at the firm, it would follow that the firm’s capacity for work would also double. Similarly, if that firm worked twice the number of cases, they would essentially double their earnings.

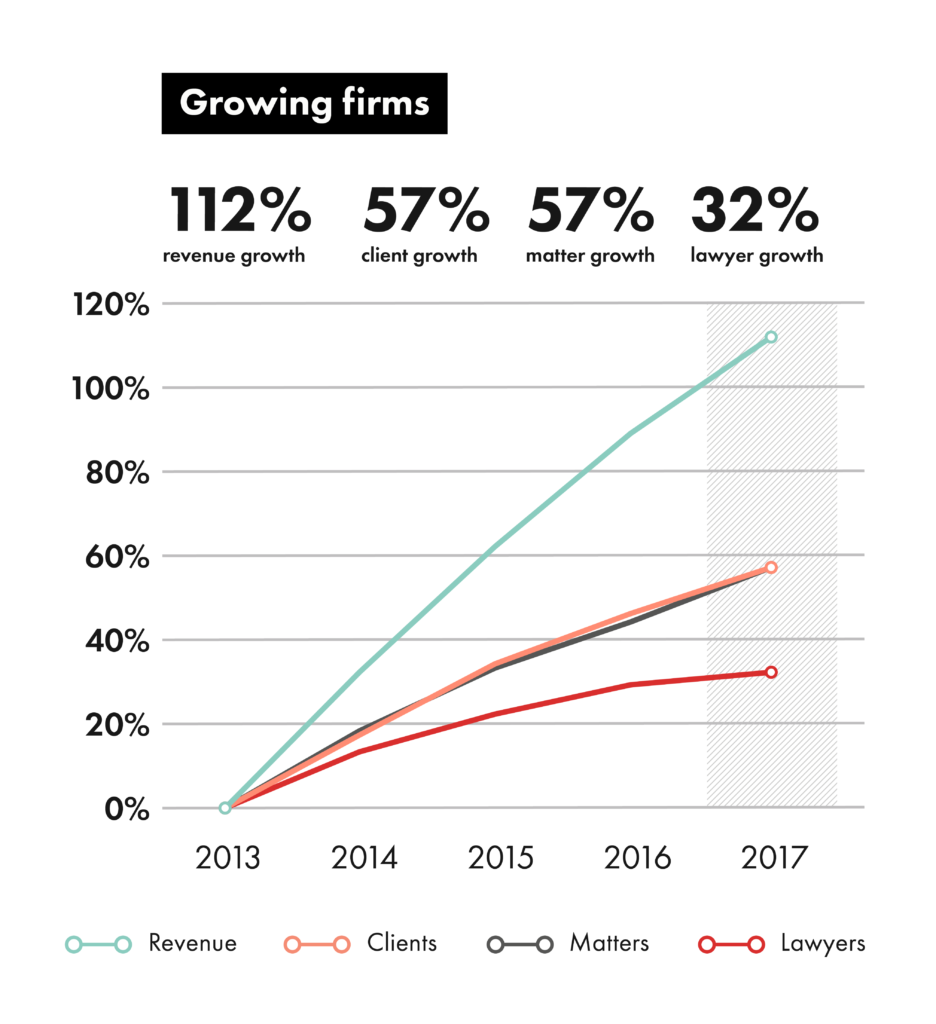

It turned out this wasn’t exactly the case. In fact, growing firms took on proportionately more cases and clients relative to the number of lawyers they brought on. While growing firms increased their number of lawyers by 32% over five years, the number of cases they worked increased by an impressive 57%.

The same goes for the gravity-defying revenue growth among these firms, which saw their total revenues jump by over 100%. To put this in perspective, revenue growth for these firms increased at three times the rate at which they brought on new lawyers, and casework increased at twice the rate.

In other words, these firms increased the number of clients they worked with while also increasing the amount of revenue collected from the work they performed. Meanwhile, shrinking firms saw the reverse compounding effect. These firms reduced the number of lawyers they had by 17% and reduced their total number of cases by 40%, resulting in a drop in revenue of 54%.

While revenue growth correlated with an increase in the number of lawyers and cases worked by each firm, this growth was vastly disproportionate, which indicates that other factors are contributing to the success of these growing firms—and which may also explain the negative performance of shrinking firms.

Growing firms took on increasingly more cases and clients

The power of utilization

Since first publishing the Legal Trends Report in 2016, we’ve benchmarked several critical business metrics for the legal industry, which include utilization, realization, and collection rates. These metrics are discussed in more detail—and with updated figures for 2019—in Section 6 of this report. These critical business metrics also make up a significant portion of our analysis of growing and shrinking law firms.

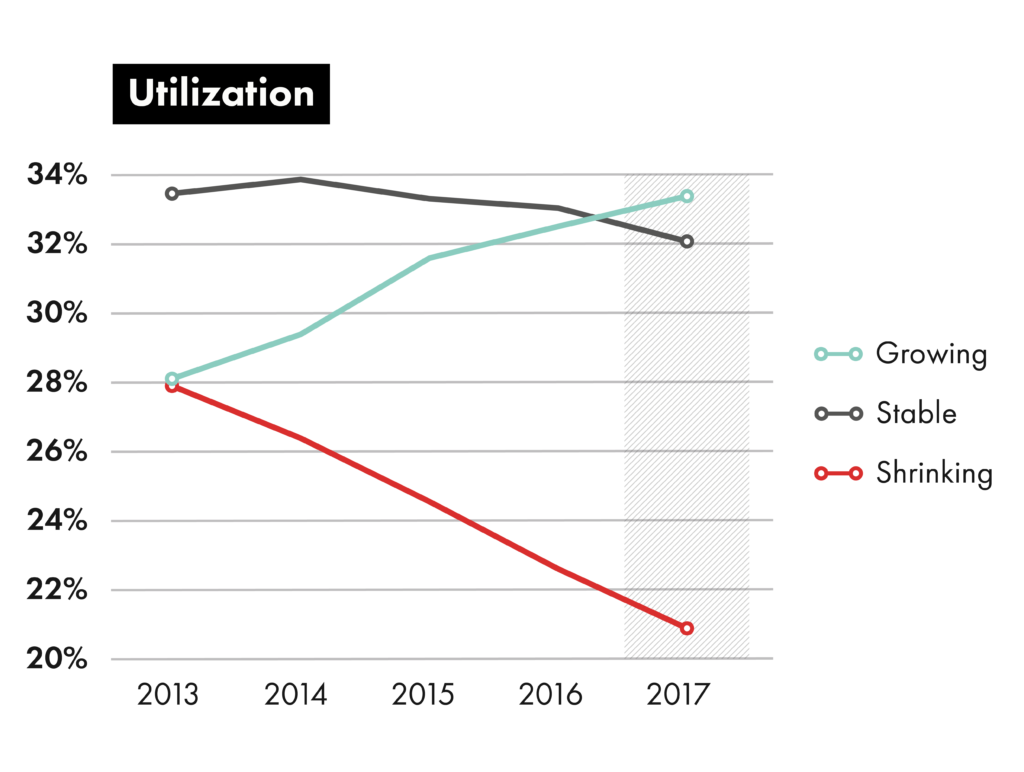

Utilization rates turned out to be a key driver for revenue growth among growing firms.

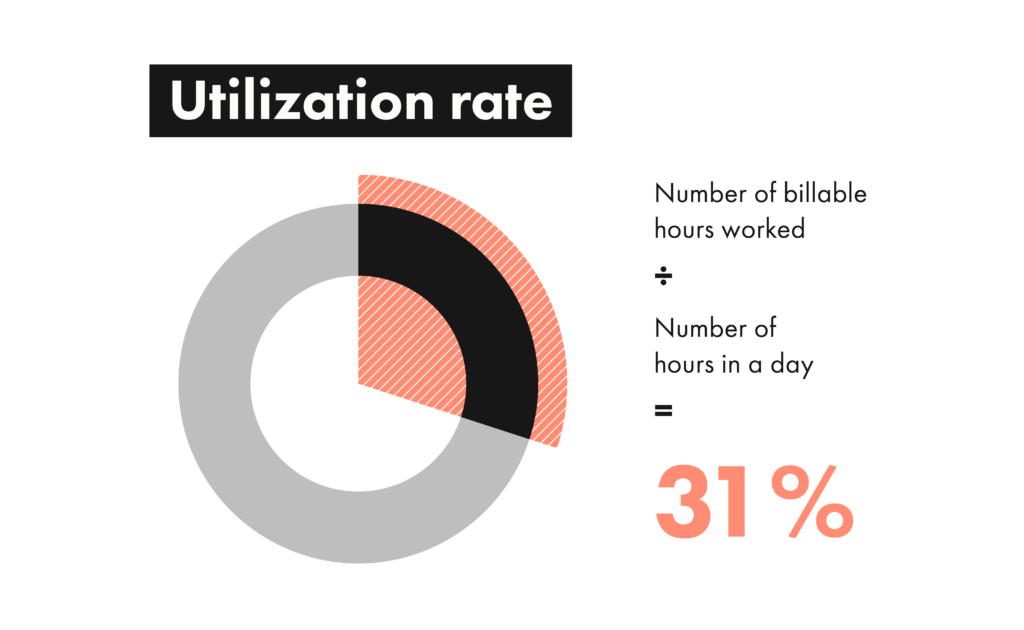

- Utilization is a measure of how many hours a lawyer puts toward billable work on a given day.

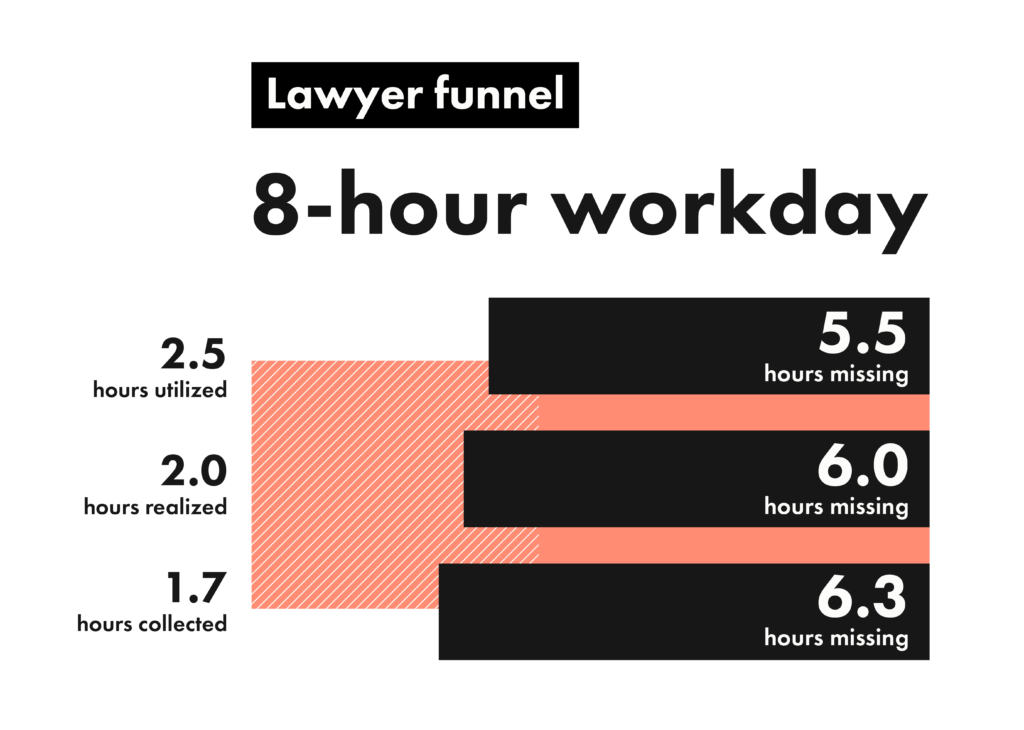

The average utilization rate for law firms this year was 31%, which means the average lawyer spent only 2.5 hours on billable work each day—a trend that’s stayed relatively consistent over the last four years of reporting.

When looking at individual cohorts, we see that stable firms have the highest rate of utilization compared to early data from growing and shrinking firms. Over time, however, growing firms increase utilization rates to 33%, surpassing stable firms. Meanwhile, the opposite is true for shrinking firms, which see utilization rates steadily decline each year, falling from 28% to 21%.

The impact of utilization on firm revenue can’t be understated. High utilization rates indicate that firms are able to bring in more business, and that lawyers are more focused on performing billable work. Boosting productivity per lawyer was at least as important as adding more lawyers to the firm.

Growing firms therefore have the highest earning potential, while shrinking firms struggle to build their revenue opportunities. To put this into perspective, the difference between 21% and 33% utilization is 12% of a day, which equals about a full hour’s work—or five hours every week. Compound that difference week after week, for every lawyer at the firm, and it’s clear why growing firms are in a much better earning position than shrinking and even stable firms.

- Thriving firms achieve predictable, high growth over time

Growing firms get more out of their work

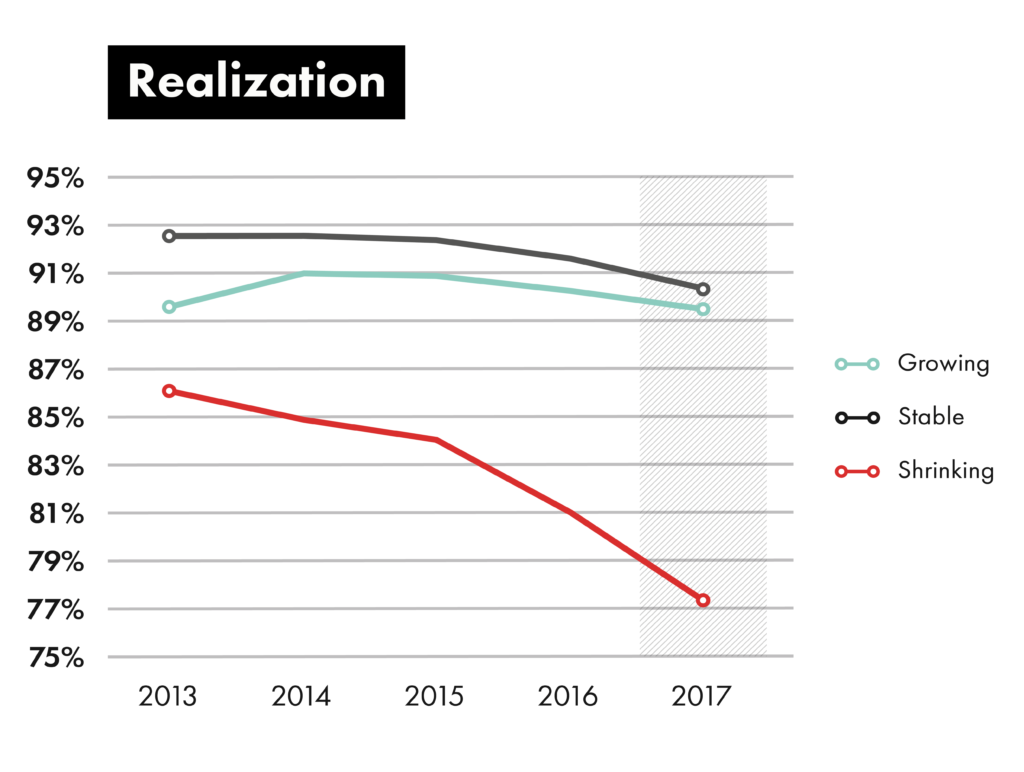

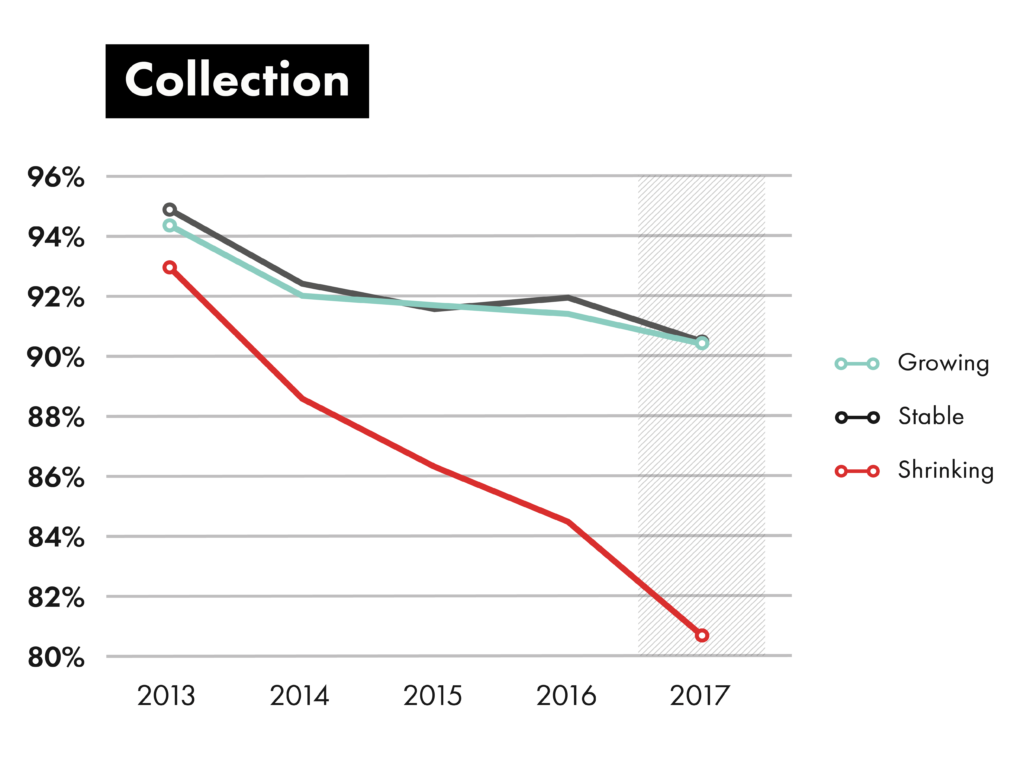

Realization and collection rates are two other key business metrics we looked at, both of which show major divergence between growing and shrinking firms:

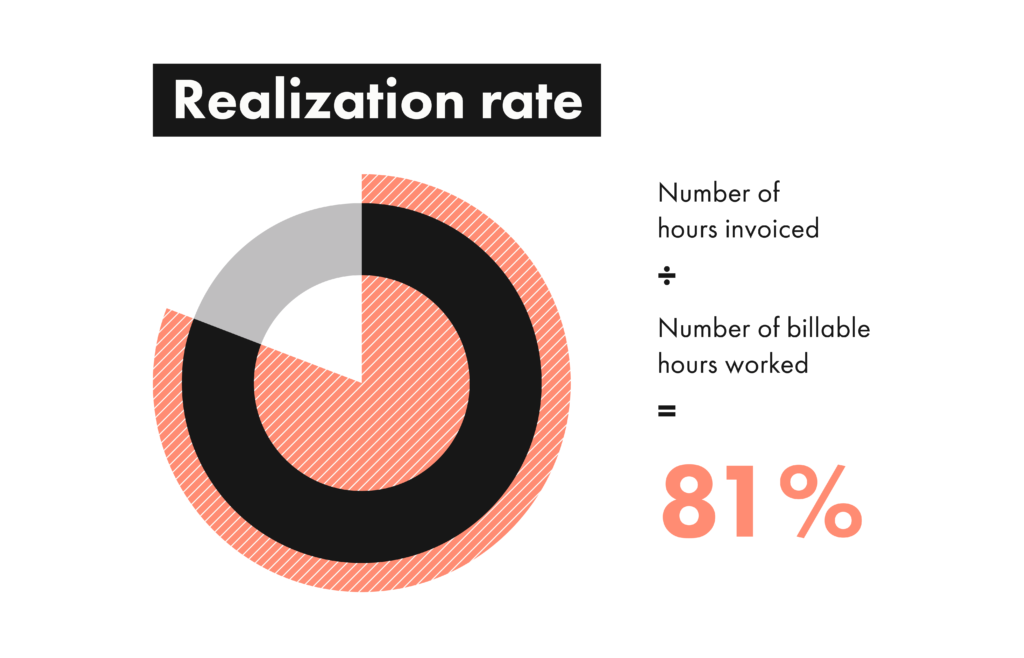

- Realization measures the amount that a firm invoices compared to the amount of billable work performed.

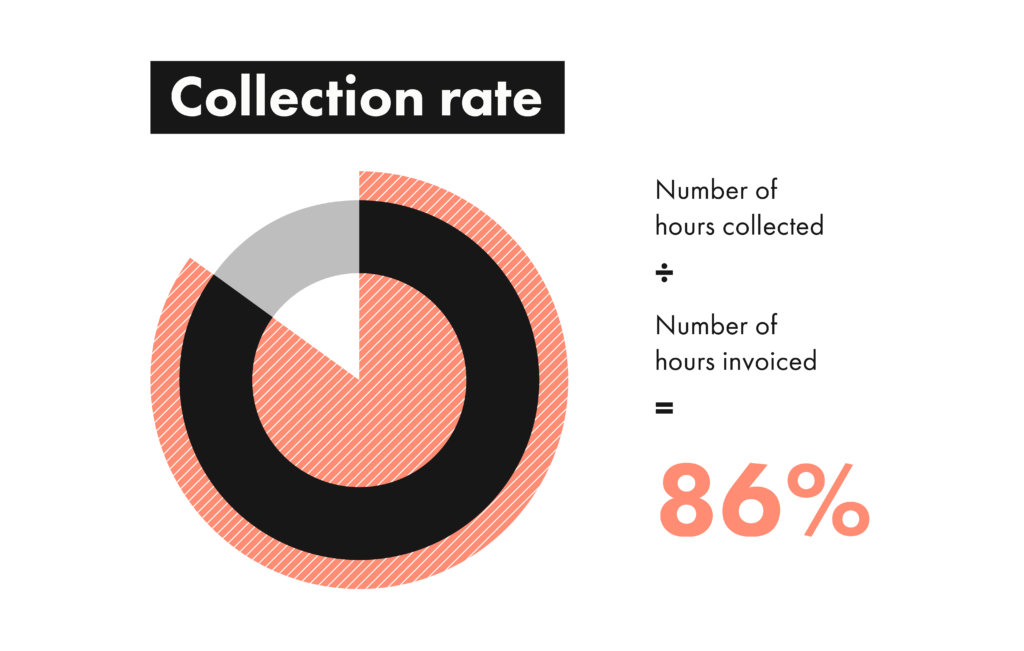

- Collection measures the amount that a firm collects compared to the amount invoiced.

Both of these are critical metrics for business performance, as they assess how much value a firm brings in based on the amount of work performed. If realization and collection are high, it means that firms are getting the full value of the work performed.

Growing firms start out with 90% realization, while shrinking firms start at a lower realization of 86%, which steadily declines to a shockingly low 77% over time. This means that shrinking firms increasingly don’t charge for the work they do.

Stable firms show the highest realization of all three groups, reaching as high as 92%. This indicates that growing firms are more likely to conduct billable work that never actually gets invoiced when compared to stable firms—though, both maintain high realization above approximately 90% at all times.

When it comes to collecting payments from clients, growing firms track nearly identically with stable firms, and both maintain higher collection rates above 90% at all times. Shrinking firms, on the other hand, see drastically diminishing collection rates to 81% over time. This suggests either they don’t have proficient processes in place for collecting payments reliably, or they aren’t able to find the types of clients that are more likely to pay them.

The result on overall business revenues is that shrinking firms earn increasingly less over time from the work they perform, while growing and stable firms are able to maintain relatively high earnings for every hour worked.

- Shrinking firms fail to charge for the work they do at an accelerating rate

Factors not associated with growth

We compared the results from this analysis across different types of law firms to determine whether factors such as practice area or firm size would yield unique trends, but the data followed similar trajectories—and any dissimilarities were minimal.

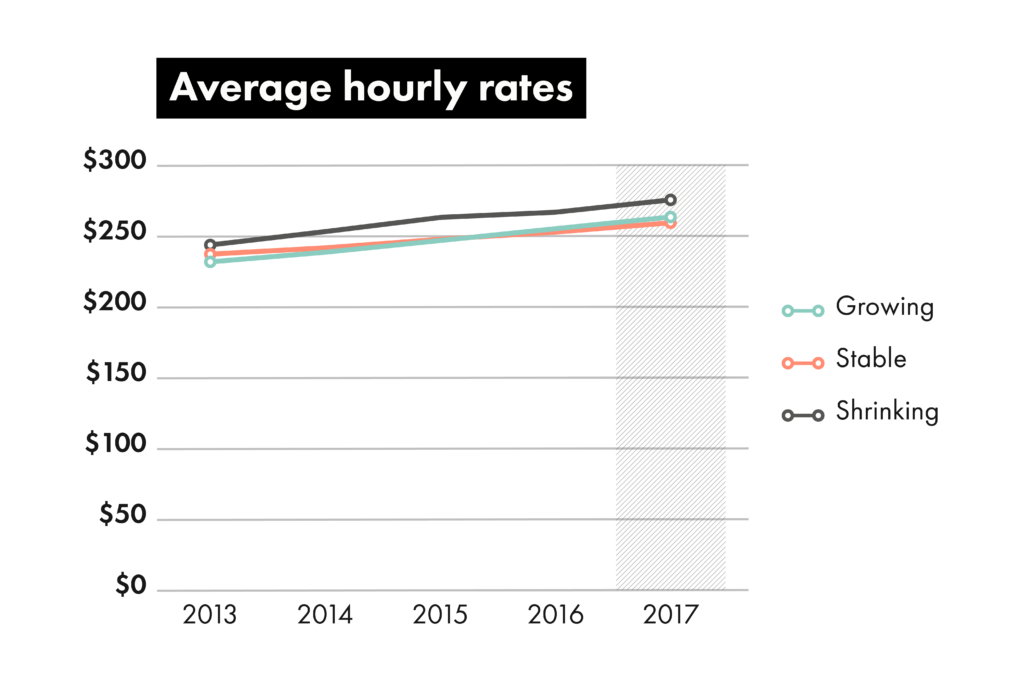

Average hourly rates were another factor that we compared. We wanted to see if firms that grow their revenues increased their hourly rates at a higher rate than others, but this wasn’t the case. When comparing hourly rates across each group, all three followed a very similar trend in line with the data outlined in the Billable Hour Index, which is discussed in detail in Section 6.

What does this mean for lawyers?

It’s clear that there isn’t one specific factor that defines the type of substantial increase in revenue that we see in growing firms. And, in fact, simply increasing hourly rates—which might seem like an obvious strategy—is not effective in driving long-term growth. Instead, real growth is a result of two factors:

- Generating more business. Growing firms increase the amount of work they bring in compared to the number of lawyers they have.

- Strong business metrics. Growing firms improve utilization rates over time while maintaining high realization and collection rates.

In other words, growing firms know how to bring in more business while also increasing the capacity of their lawyers to do more work and collect more revenue for every case and client they bring in. Both of these factors align with the firm-performance axis of the Law Firm Maturity Model, outlining a critical measure for how firms should focus their business strategies for success. The sections that follow illustrate key factors that contribute to better client experiences.

2019 Legal Trends Report

Part 2

Clients want more than just referrals

- Introduction. Closing the gap

- Part 1. This is what law firm growth looks like

- Part 2. Clients want more than just referrals

- Part 3. More than half of clients shop around

- Part 4. Putting 1000 law firms to the test

- Part 5. How prepared is today's lawyer to drive their firm's success?

- Part 6. Hourly rates and KPI data

- More Data. Dig deeper into the LTR datasets

In Section 1 of this report, we determined that growing firms know how to consistently bring in new business. A critical component to bringing in new business is to understand how today’s client looks for a lawyer.

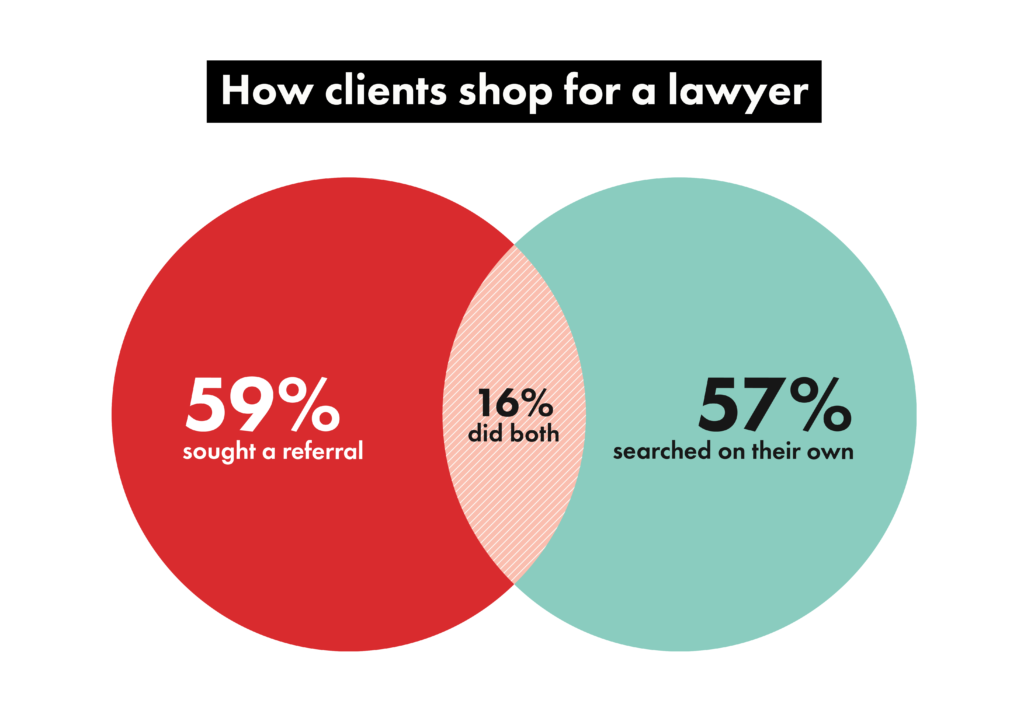

But what are potential clients really looking for when seeking legal help? To find out, we surveyed 2,000 consumers to learn how clients ultimately choose one lawyer over another. One of the most interesting things we learned is that—despite being recognized as the primary driver for new business—not all clients rely on referrals to find a lawyer. In fact, many opt to search on their own.

When comparing these methods of looking for a lawyer, 59% of clients sought a referral from someone they know or have been in contact with, but 57% searched on their own through some other means—and 16% did both.

How clients shop for a lawyer

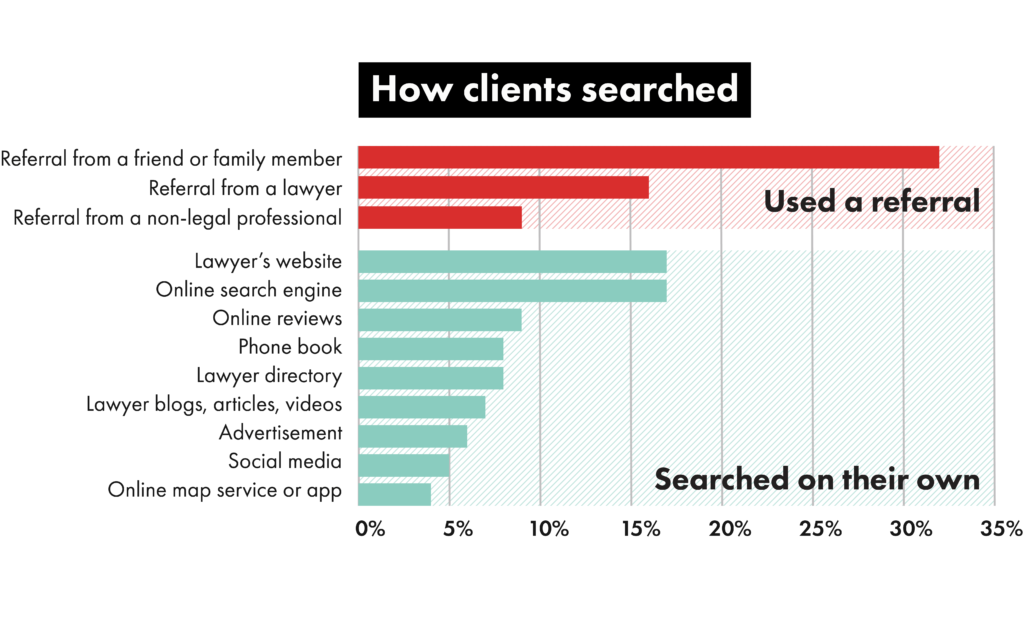

When we look at how clients shopped for a lawyer, we see that 59% sought a referral of some kind. Friends and family members were the most common source for a referral (32%), followed by referrals from a lawyer (16%) or another non-legal professional (9%). (A non-legal professional could include an accountant, real estate agent, or someone else working in a profession related to a certain type of issue.)

Additionally, 18% of clients said they would never seek a referral from a friend or family member, 17% said they would never get a referral from a non-legal professional, and 14% said they would never get a referral from another lawyer.

But referrals aren’t the only way to find a lawyer—57% (about the same number that sought a referral) looked for a lawyer on their own. Methods such as using an online search engine (17%) and visiting a lawyer’s website (17%) were the most common among those who have ever shopped for a lawyer.

These findings suggest that lawyers who focus on building their business from referrals only—while neglecting the many other sources out there—are missing out on significant business opportunities.

18% of clients said they would never seek a referral from a friend or family member

Referrals aren’t the only way to find a lawyer

Is one method of searching for a lawyer better than the other? To answer this question, we identified which methods clients were most likely to use first—and then looked at whether those clients were likely to use other methods afterwards.

If clients find what they’re looking for using one method, there would be no reason to use another method later on. Conversely, if clients can’t find what they are looking for using one method, this would indicate that these methods aren’t as useful to potential clients—and potentially less fruitful for law firms.

It turns out that clients are nearly just as likely to search for a lawyer through their own means first (39%) as they are to first seek a referral of any type (45%)—and 16% indicated they couldn’t remember. Online search engines were the most common first step for clients who didn’t first seek a referral, but potential clients may use a range of resources as their first step to seeking a lawyer.

When we look at how mutually exclusive these two groups are to each other, the results show that there is relatively little overlap between those who seek a referral first and those who seek on their own through some other means:

- Of those who sought a referral first, only 16% also looked on their own.

- Of those who looked on their own first, only 17% also sought a referral.

While those who looked on their own were more likely to use more than one method, they didn’t feel the need to also seek a referral. In other words, consumers tend to either seek referrals or do their own research to find a lawyer. Rarely do they do both.

- Consumers tend to either seek referrals or do their own research to find a lawyer

Clients want information more than anything

In fact, 45% of consumers who have experienced a legal issue agree that their challenge is finding a lawyer they are confident is right for them. Regardless of how they search for a lawyer, the majority of consumers indicated that each of the following were important to them:

- 77% want to know a lawyer’s experience and credentials (also ranked the most important).

- 72% want to know what types of cases they handle.

- 70% want a clear understanding of the legal process and what to expect.

- 66% want an estimate of the total cost for their case.

While potential clients say they want an estimate of total cost for their case, that doesn’t mean they don’t see the value in hiring a good lawyer. 62% who have ever hired a lawyer say it’s worth paying a high price for a lawyer if they are very good.

Millennials are shifting attention online

When we look at the differences between younger generations compared to older ones, we can also see that perceptions and behaviors shift with younger generations.

For example, younger generations and those who have never hired a lawyer before find the whole experience of searching for a lawyer more challenging and intimidating. 39% of Gen Z and 40% of Millennials admit to being intimidated by lawyers compared to 30% of Gen X and only 20% of Boomers.

- Younger generations are more likely to care about a lawyer’s website (49% of Gen Z and 48% of Millennials compared to 34% of Gen X and 21% of Boomers).

- Younger generations are more likely to care about a firm’s brand and image (45% of Gen Z and 36% of Millennials compared to 28% of Gen X and 19% of Boomers).

- Younger generations are more likely to care about a firm’s online reviews (46% of Gen Z and 53% of Millennials compared to 39% of Gen X and 25% of Boomers).

- Younger generations are less likely to value referrals from lawyers (47% of Gen Z and 46% of Millennials compared to 56% of Gen X and 60% of Boomers).

The takeaway? Firms looking to attract younger clientele, who likely have more potential for repeat business and long-term referrals, should consider focusing on digital channels where brand and image are important.

What does this mean for lawyers?

When it comes to shopping for a lawyer, consumers follow many paths. Seeking a referral may be the most common means, but many rely instead on other methods that focus heavily on online search and a firm’s web presence. Increasingly, we also see younger generations prioritize electronic methods over referrals.

In other words, firms that focus only on building their referral network to find new business will miss out on growing opportunities to find new clients across other channels. Firms that want to maximize their opportunity for new business should look at marketing their firm across as many channels as possible—especially through online search and with their website.

Regardless of how firms promote their services, lawyers must ensure they provide the right information to prospective clients by highlighting their range of experience, making it clear what types of cases they handle, and providing a clear understanding of what to expect from a case and how to proceed.

Technology is making it increasingly easier to research law firms online—and firms that adapt to how clients look for their lawyer today, and in the future, will have the fullest opportunity for growing their business. Those that don’t adapt will miss out on expanding their opportunities for finding new clients.

The next step is to do everything right when these clients eventually reach out—helping ensure better success in actually getting hired.

- Technology is making it increasingly easier to research law firms online

2019 Legal Trends Report

Part 3

More than half of clients shop around

- Introduction. Closing the gap

- Part 1. This is what law firm growth looks like

- Part 2. Clients want more than just referrals

- Part 3. More than half of clients shop around

- Part 4. Putting 1000 law firms to the test

- Part 5. How prepared is today's lawyer to drive their firm's success?

- Part 6. Hourly rates and KPI data

- More Data. Dig deeper into the LTR datasets

Marketing to potential clients is only part of the work required to actually get hired, and regardless of how clients look for a lawyer, there’s a good chance they’ll reach out to more than one.

44% of clients believe that they need to shop around and talk to more than one lawyer to find one that’s right for them, and 57% of those who have ever shopped for a lawyer say they contacted more than one law firm.

Even though clients are likely to shop around, firms that focus on client experience will have a better chance at making a great first impression—and deter them from looking any further. 42% of consumers surveyed say that if they like the first lawyer they speak with they won’t need to speak with any others.

An initial conversation with a law firm marks the beginning of that client’s journey with the firm—and clients view that first interaction as an indicator for the overall experience of working with the firm. Leaving a bad impression will only drive potential clients away.

- 42% of consumers surveyed say that if they like the first lawyer they speak with they won’t need to speak with any others.

What do clients look for when first contacting a lawyer?

Making a good impression isn’t just about picking up the phone or answering an email—clients need to have reason to believe that the lawyer they contact is the right lawyer for them.

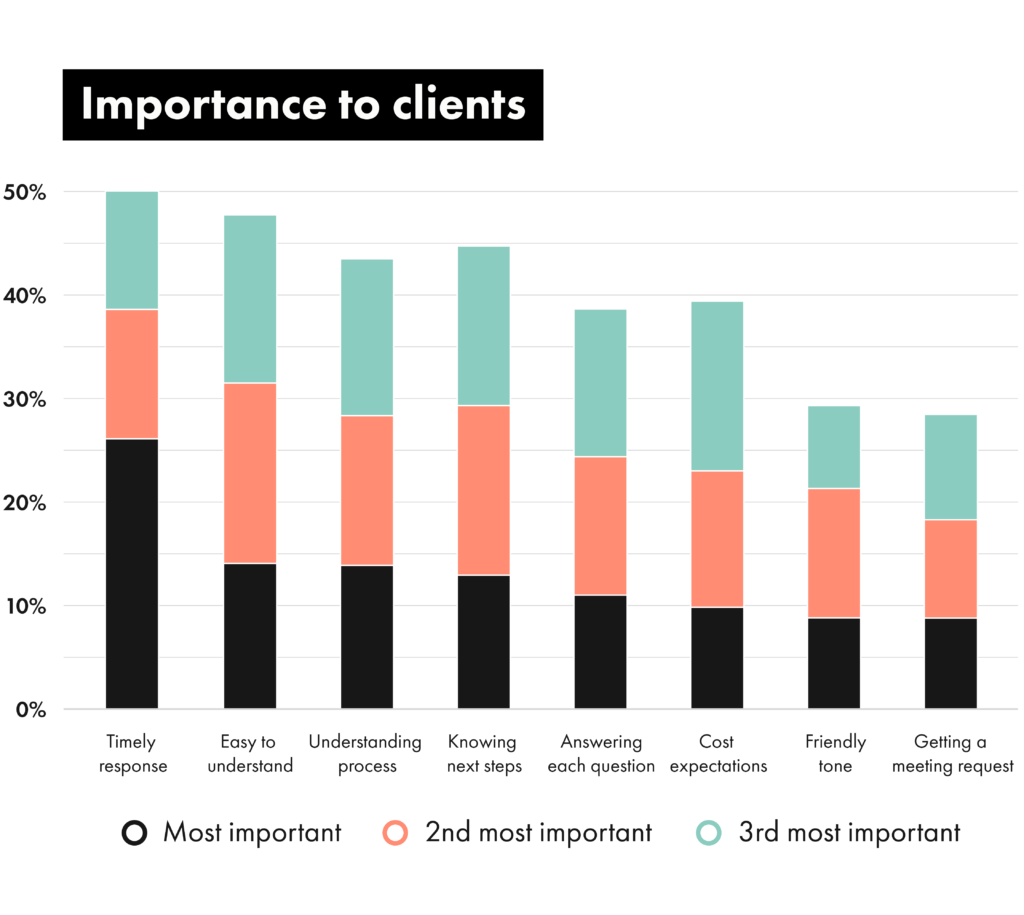

Of those who have ever experienced a legal issue, 82% agreed that timeliness was important to them. Clients also have an appetite for knowledge and want to get as much information about their case as possible:

- 81% want a response to each question they ask.

- 80% say it’s important to have a clear understanding of how to proceed.

- 76% also want to get a clear sense of how much their legal issue could cost.

- 74% want to know what the full process will look like for their case.

The friendliness and likeability of a lawyer’s tone is also important to 64%, but this isn’t as common as the need to have a solid foundation for understanding their case and how to proceed.

When we asked consumers to rank what factors were most important to them when speaking with a law firm, responsiveness was ranked highest overall. But there was a relatively even distribution across each factor, suggesting that clients are conflicted on which is most important—and that they are in fact all important.

Lawyers need to give equal weight to how quickly they respond and how well they respond.

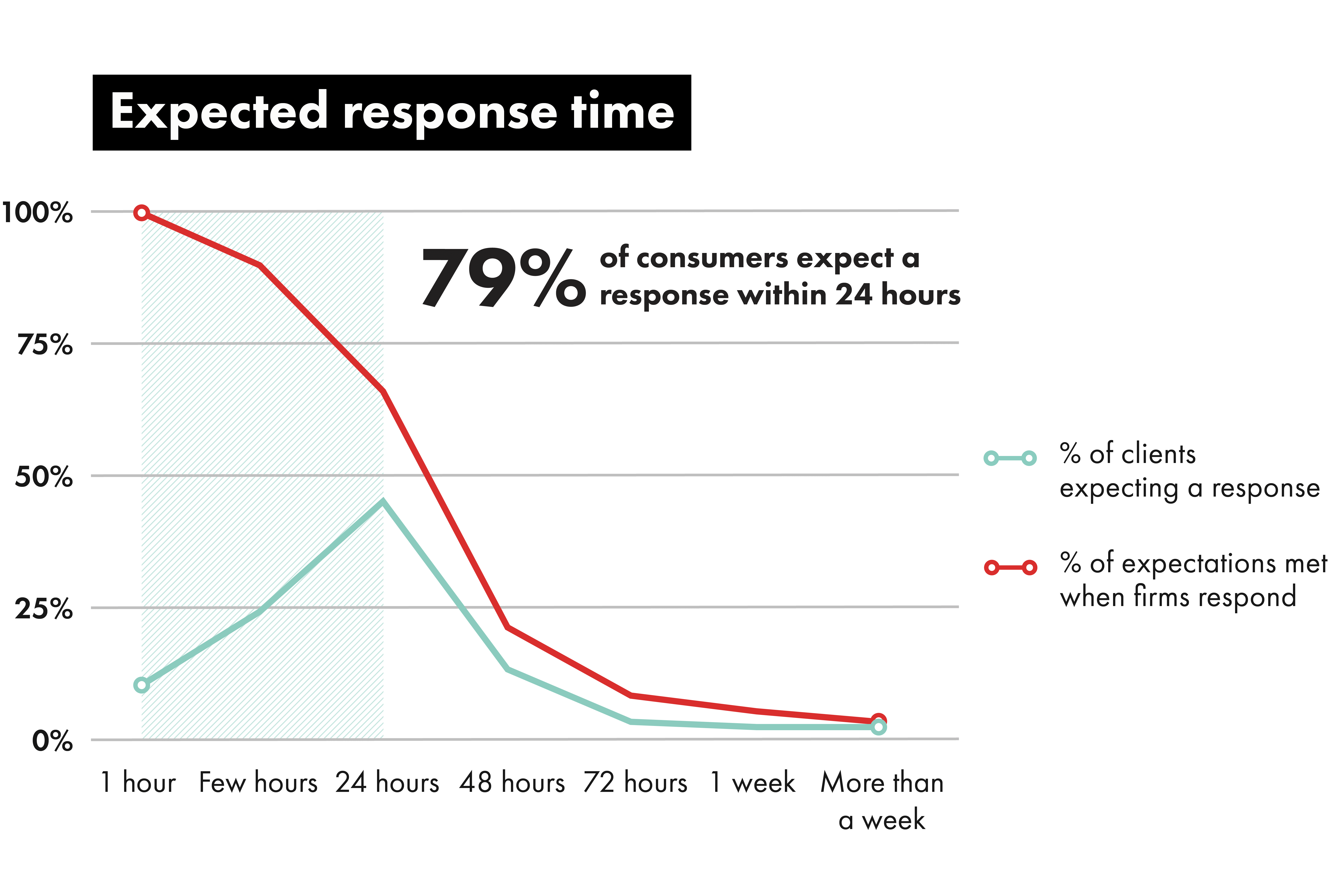

Law firms should respond within 24 hours

How quickly do potential clients expect firms to respond when leaving a phone message or email? 10% expect a response within an hour, 24% within a few hours, and 45% within 24 hours. In other words, responding beyond 24 hours means missing the expectations of 79% of those who reach out. Only 5% of clients said they would expect a response beyond 72 hours.

Given that clients are likely to reach out to more than one firm when experiencing a legal problem, being the first to respond will help make a better impression.

Phone is the most important channel, but email and in-person are significant

Of those who indicated how they first reached out to a law firm, 68% said they reached out by phone, 25% by email or an electronic form, and 26% in person.

Clients have diverse preferences for how they reach out to a lawyer. Firms that want to make the most of every potential opportunity for business should be prepared to deliver a great client experience from the start of every interaction, across a variety of methods.

Lawyers actually drive clients away

We asked clients what reasons they had for not hiring the lawyers they reached out to. 64% indicated they contacted a law firm that never responded—either through phone or email. For any firm looking to find new business, not responding to potential clients means not getting hired.

But clients also agreed that there were many other reasons for not hiring some of the law firms they corresponded with, and these align with our findings in Section 2 of this report. Clients need information that confirms a firm can help them with their particular problem, and they need to know that the firm is ready to help.

- 65% didn’t get any indication on what to do next.

- 64% didn’t get a sense of how much their case would cost.

- 62% didn’t understand the process for their case.

- 61% didn’t get enough information they could understand.

- 52% said the lawyer they spoke with wasn’t likeable or friendly enough.

64% contacted a law firm that never responded

What does this mean for lawyers?

Most lawyers want more clients, yet many law firms are failing to convert the clients that reach out to them—specifically through phone or email. According to the consumers we surveyed, the law firms that aren’t getting hired are the ones that do a poor job of responding to client inquiries or that don’t provide the type of information that clients are looking for.

The consumer data in this section is illustrative of how firms can align their business strategies to focus on the client-experience axis of the Law Firm Maturity Model. Firms that want to increase how much they get hired should look at those first client interactions, as each one is a valuable sales opportunity for earning new business. Given that many clients shop around and speak to multiple law firms, firm that prioritize responsiveness with potential clients are likely to make a good impression. Firms that can demonstrate both responsiveness and provide quality experiences are the ones that will get hired.

To better understand just how well law firms respond to clients, and how they can improve, we put together an in-depth market analysis, which is explained in detail in the next section.

- Firms that provide responsive, quality service will get hired more

2019 Legal Trends Report

Part 4

Putting 1000 law firms to the test

- Introduction. Closing the gap

- Part 1. This is what law firm growth looks like

- Part 2. Clients want more than just referrals

- Part 3. More than half of clients shop around

- Part 4. Putting 1000 law firms to the test

- Part 5. How prepared is today's lawyer to drive their firm's success?

- Part 6. Hourly rates and KPI data

- More Data. Dig deeper into the LTR datasets

It’s not easy shopping for a lawyer in 2019. Our survey research shows that 32% of clients who have ever shopped for a lawyer don’t expect a law firm to get back to them, and 64% of those who contacted a lawyer they didn’t hire said a law firm didn’t respond to their phone or email. Yet, 89% of legal professionals we surveyed said that they respond to phone and email inquiries within 24 hours.

To assess how well law firms are prepared to meet the needs of potential clients today, we put them to the test. We emailed 1,000 law firms and phoned 500 randomly selected from the same group.

Designed to evaluate the responsiveness and quality of service provided by each firm, we hired a third-party research company to contact each firm with a brief list of questions that a typical potential client would have when they first reach out. The questions pertained to a particular legal issue tailored to the firm’s practice areas and inquired about overall cost and options for booking a consultation.

The data from this analysis represents the first and only primary assessment of law firms of this magnitude, and the results provide strong implications for the state of client services—and indicate there is plenty of opportunity for firms to distinguish themselves from competitors.

- We emailed 1,000 law firms and phoned 500 randomly selected from the same group

Our analysis assessed the client services provided by 1,000 randomly selected law firms in the United States. We tailored our outreach to correspond with the type of law practiced by each firm, across five different issue types:

- Family (child custody)

- Criminal (domestic abuse charge)

- Bankruptcy (debt elimination)

- Employment (racial discrimination)

- Business (incorporation)

To be eligible for our analysis, firms needed to have:

- An active web presence (such as a live website, a social page with activity in the three months prior to the study, or an active directory page).

- A publicly available email and phone number.

- Information available that indicated they handle legal issues related to the ones used in our study.

We also confirmed that all 1,000 law firms in our analysis received our email communications. For any emails that resulted in an email bounceback, we removed the associated law firm from our sample and replaced it with another to ensure that we achieved 1,000 successful email deliveries.

Law firms struggle with email

The results from our study show that the majority of law firms are unable to follow up with clients who reach out via email. 60% of law firms didn’t respond to our emails at all.

Given that this is the preferred method of initial outreach for 25% of potential clients, this means that these firms are missing out on a sizable portion of their potential market.

The 24-hour window

Of those who did respond, 82% did so within 24 hours. 11% responded after 24 hours, and 7% after 72 hours. There are a couple of takeaways from this. First, if a law firm is going to respond to a client inquiry, they’ll likely respond in a day. Second, if a firm doesn’t get back to their client inquiry in a day, there’s a good chance they won’t respond at all.

- 60% of law firms didn’t respond to our emails

Getting information through email is hard

Few firms seem able to provide more than a brief response when communicating via email. Only 29% of law firms that responded via email were able to provide a response that was timely, clear, answered at least one question, and provided some information on either booking a consultation or cost.

- 58% had a likeable tone.

- 57% provided information that was clear and easy to understand.

- 28% provided clear next steps.

- 27% referenced similar legal situations or demonstrated knowledge of the issue.

- 27% provided some information on rates or overall cost.

- 13% provided information on what to expect from the legal process.

While most email responses were still timely and within 24 hours, 71% were unsatisfactory in terms of the information provided.

- Only 28% of firms provided clear next steps

Lawyers prefer the phone

Even the firms that responded to us wanted to avoid email:

- 53% of all the emails we received requested that we phone the office instead of communicating through email.

- 15% of emails didn’t provide any information and asked only that we phone them instead.

Law firm email scorecard

| % Firms | Evaluation | Criteria |

| 0.5% (2 law firms) | Excellent |

|

| 5% (20 law firms) | Good |

|

| 23% (93 firms) | Adequate |

|

| 71% (284 firms) | Unsatisfactory |

|

Law firms are better at answering their phones but rarely return calls

Compared to email, law firms were more responsive through phone, but not by much:

- 56% of law firms answered our calls.

- 39% of our calls went to voicemail—of which 57% didn’t return our call within 72 hours.

- 5% of our calls were unanswered.

In total, 73% of firms either picked up or phoned us back—meaning that, we were unable to reach 27% of law firms by phone.

- 57% of law firms never phoned us back

Law firms don’t provide enough information over the phone

While many firms picked up the phone to speak with us, few were able to provide a lot of key information, and even fewer were able to demonstrate their knowledge and experience in working with similar types of cases. Many firms would only discuss information related to a case or questions related to rates and cost in a follow-up meeting.

- 56% provided rate information (hourly or fixed fees)—9% provided a total cost estimate.

- 50% explained the legal process and indicated next steps.

- 49% answered most questions asked. 11% would only answer questions in a follow-up appointment.

- 43% would not discuss rates or cost over the phone.

- 11% referenced case examples with contextual information.

43% of firms wouldn’t discuss rates or cost over the phone

Law firm phone scorecard

We calculated an overall conversation score that takes into account how well each firm we spoke with handled our communications. This score was calculated by averaging performance scores for:

- Number of questions answered

- Demonstrated experience with the particular case

- Information on rates or overall cost

- Information on next steps

| % Firms | Evaluation | Criteria |

| 7% (20 law firms) | Excellent | These firms were able to provide detailed information on nearly all content criteria (scoring 80% to 100%) |

| 9% (26 law firms) | Good | These firms did not meet all requirements but provided detailed information for approximately 75% of our criteria (scoring 70% to 80%). |

| 22% (62 law firms) | Adequate | These firms provided the minimum amount of information to be deemed adequate (scoring 50% to 70%). |

| 61% (61 law firms) | Unsatisfactory | These firms did not meet the criteria for more than half of our performance drivers (scoring less than 50%). |

Lawyers provide more information than assistants

Lawyers generally provided more information when they answered the phone compared to assistants.

- 66% of lawyers who we spoke to over the phone were able to answer the majority of questions we asked them compared to 43% of assistants.

- 38% of lawyers provided detailed information about the firm’s experience handling similar types of cases compared to 13% of assistants.

- 66% of lawyers provided rate information (either hourly or fixed fee) compared to 54% of assistants.

Lawyers picked up the phone 24% of the time compared to 71% of calls that were answered by an assistant (5% were answered by an automated phone system). While lawyers are likely much better equipped to provide this type of information over the phone to a potential client, there were still a large number of calls answered by an assistant that were able to provide this information—either by the assistant or by transferring directly to someone else.

While many lawyers have room to improve their initial communications, equipping assistants with the ability to better answer questions and provide information is a major opportunity for the legal industry to improve client services. Making lawyers more available to potential clients will also help get them the information they need quicker.

Little gets communicated through voicemail

Only 43% of law firms responded to our voicemails. For our analysis, all returned calls were forwarded to a voicemail system of our own, of which 86% of responding firms left messages (14% ended their call without leaving a message). Similar to email, most of these responses (86%) came within 24 hours, indicating that firms are either likely to get back to their clients within a day or not at all.

When leaving a voicemail, few firms provided information in response to the questions we asked.

- 36% provided rate information (hourly or fixed fees)—0% provided a total estimated cost.

- 14% explained the legal process and provided next steps.

- 4% answered most of our questions.

- 0% referenced cases with contextual case information.

We calculated voicemail scores based on the same criteria as our phone conversation scorecard. From the data we collected, it’s clear that being able to answer when a client calls gives the firm a much better opportunity to provide information and service. Missing the call and having to deal with voicemail is unproductive for everyone.

Law firm voicemail scorecard

| % Firms | Evaluation | Criteria |

| 0% (0 law firms) | Excellent | These firms were able to provide detailed information on nearly all content criteria (scoring 80% to 100%) |

| 0% (0 law firms) | Good | These firms did not meet all requirements but provided detailed information for approximately 75% of our criteria (scoring 70% to 80%). |

| 4% (3 law firms) | Adequate | These firms provided the minimum amount of information to be deemed adequate (scoring 50% to 70%). |

| 96% (81 law firms) | Unsatisfactory | These firms did not meet the criteria for more than half of our performance drivers (scoring less than 50%). |

Comparisons between email and phone

Not surprisingly, firms that responded to our emails were more likely to provide better phone service —but not by much.

Of those who answered our emails:

- 60% picked up the phone, compared to 54% for those who didn’t answer our email.

- 36% went to voicemail, compared to 41% of those who didn’t answer our email.

- 58% answered our voicemail, compared to 34% of those who didn’t answer our email.

- 3% didn’t get answered by a person or voicemail, compared to 5% of those who didn’t answer our email.

Those who didn’t respond to our emails were slightly more likely to have a poor conversation score (73%) than those who did respond to their email (63%).

What does this mean for lawyers?

Based on our surveys, client expectations for law firms are low—and data from our email and phone analysis suggests this is rightly so. When it comes to bringing in new clients, firms that exceed these fairly reasonable expectations are the ones more likely to get hired.

In the context of the Law Firm Maturity Model, this assessment suggests that the majority of firms have a long way to go in progressing along the client experience axis to becoming a responsive firm. Firms that are too busy to respond or to take the time to deliver quality communications may also be suffering from a lack of efficient processes that allow for this type of focus.

Regardless of the reason for not providing better client experiences—whether it’s that firms aren’t willing or aren’t able to focus more on this aspect of their firm—these types of service experiences will undoubtedly hold back firms from achieving high-growth success.

At the same time, this deficiency presents a major opportunity for law firms to innovate and differentiate themselves within their markets. Firms that meet—or exceed—expectations will capture more clients as they reach out. Firms that are able to then fulfill their client work in a similar manner will also grow their referral opportunities down the road.

- 71% of firms didn’t meet the criteria for an adequate email response

2019 Legal Trends Report

Part 5

How prepared is today's lawyer to drive their firm's success?

- Introduction. Closing the gap

- Part 1. This is what law firm growth looks like

- Part 2. Clients want more than just referrals

- Part 3. More than half of clients shop around

- Part 4. Putting 1000 law firms to the test

- Part 5. How prepared is today's lawyer to drive their firm's success?

- Part 6. Hourly rates and KPI data

- More Data. Dig deeper into the LTR datasets

When it comes to ensuring their firm’s success, how prepared are today’s legal professionals? To learn more about how lawyers think about success—and where they struggle—we surveyed over 2,500 legal professionals to learn more about how they think about and plan their success.

It turns out the vast majority of law firms are focused on growth.

87% of lawyers agree they want their firms to grow over the next three years—and 67% say they want to grow more than a little. And when it comes to growth, lawyers rank revenues and client base as the top two areas they want to see grow. But how prepared are lawyers to achieve these goals?

There is no question: being a lawyer is a tough occupation. 76% of lawyers say they are overworked and 68% say they are underappreciated. On the bright side, the majority love being a lawyer (69%) and really like working with clients (82%).

But, as the Law Firm Maturity Model illustrates, there are two critical components—beyond having expert knowledge of the law and giving great legal advice—to running a successful business in legal. One component is the effort that goes into understanding and delivering quality client experiences. The other is organizing everything in the firm to be productive and making sure everything gets done in an efficient manner. Both are essential to achieving the type of growth law firms strive for.

- 87% of lawyers want their firms to grow

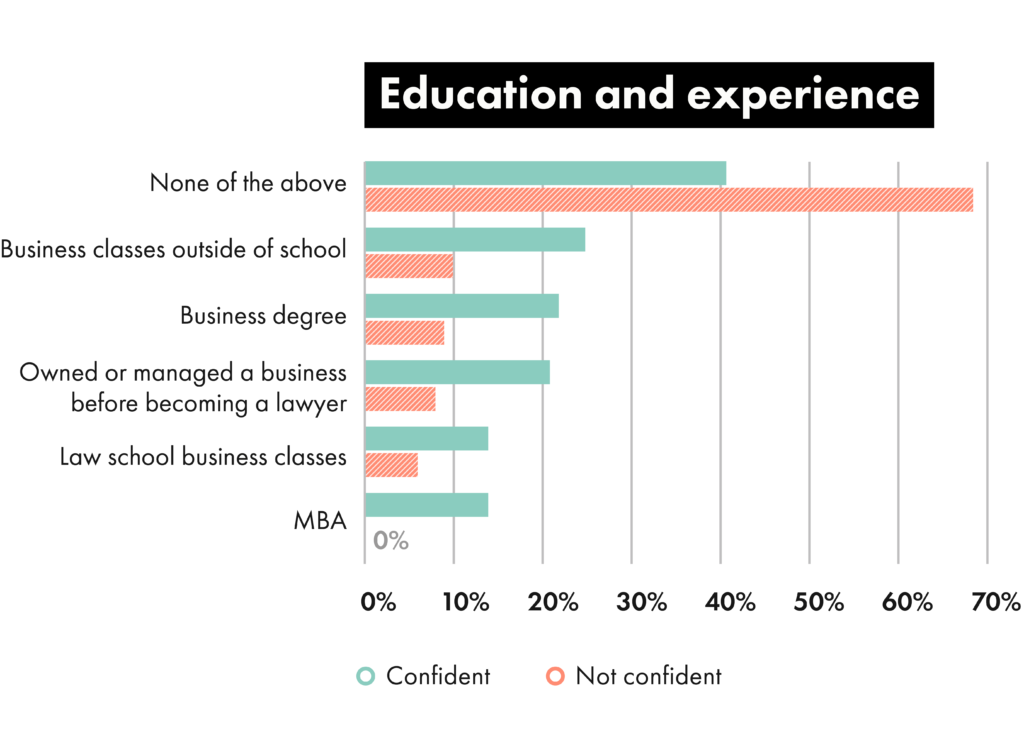

Half of managing lawyers aren’t confident in managing their business

When it comes to those responsible for managing the business aspects of a firm, our research shows that a significant proportion of managing lawyers don’t feel prepared to handle the business side of a law firm. While 92% are very confident in their skills as a lawyer, only 53% are confident in running the business side of their firm.

Despite being a critical component to the growth and overall health of a firm, lawyers are rarely trained in the management side of running a practice as part of their education or licensing. In fact, only 7% agree that law school prepared them to run the business side of their firm. Bar associations are a slightly better resource, but not by much: only 23% agree that their bar association provides adequate business training.

- Only 53% of managing lawyers are confident in running their business

Training and experience brings confidence

To better understand what makes some lawyers more confident than others, we looked at the range of training and experience between each group.

As it turns out, those who are confident are much more likely to have some prior business training or experience—which may include having an MBA (14%), owning or running a business prior to becoming a lawyer (21%), majoring in business in college (22%), taking business classes outside a formal school setting (25%), or taking business-management classes in law school. 41% say they have no prior training or experience.

Of those who aren’t confident in running the business side of their firm, 69% report having no business training at all. Additionally, 72% say they don’t know enough about running a business.

Those confident in running the business side of their practice are also much more prepared and more likely to invest time and resources into their learning. 62% of those confident in managing the business side of their firm frequently read books or articles related to running or growing a business and 36% frequently take courses. Only 43% of those not confident spend time reading about running their business better, and only 18% take courses.

What differentiates those who know how to run a business?

Lawyers who are confident about managing the business side of their firm tend to worry a lot less about it. Only 32% are worried about something falling through the cracks compared to 78% who aren’t confident about their business.

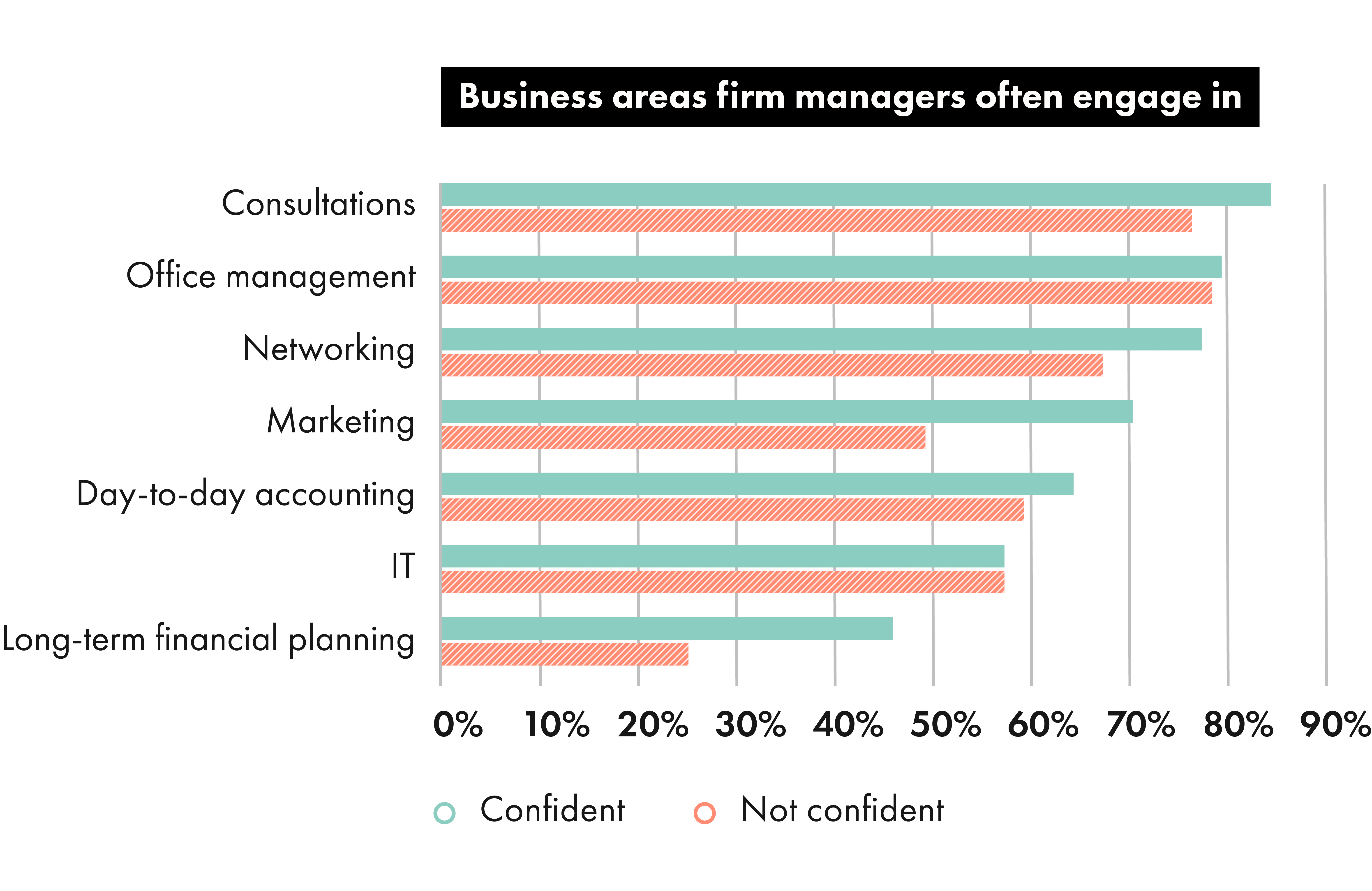

To get a better sense of how lawyers prioritize their work in managing their firm, we asked lawyers how often they perform various tasks or duties and compared responses between those confident in running their firms to those who aren’t.

The responses show that those confident in running their firm are more engaged in some key business aspects of their firm than lawyers who aren’t confident in managing the business aspects of their firm.

Two areas in particular show a significant disparity in how those who are confident spend their time compared to those who are not confident. For one, even though both cohorts indicated they spend generally less time on long-term financial planning, only 25% of those not confident did at least sometimes, compared to 46% of those confident in running their business. The other area to call out is marketing, which more confident lawyers (70%) indicated spending time on compared to those not confident (49%).

What does this mean for lawyers?

A famous study showed that 93% of Americans believe they are above average when it comes to driving ability (an obvious statistical impossibility, since only 50% can be above average). The study is illustrative of a cognitive bias known as illusory superiority, which sees individuals overestimate their own abilities in relation to others.

Those confident in running their firm are more engaged in the business

What’s interesting is that when it comes to the practice of law, lawyers don’t have this same overconfidence. While 73% of lawyers agree that they’re different than most lawyers, only 56% agree that they are better than most lawyers. In an industry where success is often dictated by the facts of a case and the judicial system outside of any one lawyer’s control, it’s often most practical to focus on what a lawyer can control: achieving the best possible outcome for a matter.

The same goes for running a successful business. While 87% of lawyers want to see their firm grow over the next three years, not every lawyer knows how. Focusing on success and increasing revenues on their own are outcomes that may be at least partially outside of the firm’s control. Instead, focusing on key inputs discussed in this report provide important leverage points that are both controllable and impactful. The client experience and firm performance axes within the Law Firm Maturity Model provide two critical vectors to prioritize.

As discussed in the first section of this report, some firms know how to achieve year-over-year growth, while others see their prospects dwindle. Knowing how to earn clients and maintain high standards for business are two key factors to success.

Sections 2 and 3 in this report outline a comprehensive look at how clients shop for a lawyer and what they look for when they reach out. Ultimately they’re looking for clear information and responsiveness. As Section 4 shows, these are qualities that many firms lack.

Managing a business effectively means getting the most opportunity out of the resources available. Those who have training or experience in running a business are much more prepared to spend time learning about and applying themselves to the business side of their firm—for the betterment of both the firm and their clients.

Confidence alone may not be enough to grow a firm’s business, but there’s a good chance that future analysis will show that improving the business side of a law firm—not just the ability to practice law—leads to greater firm success in the long term.

- Key business inputs are both controllable and impactful

2019 Legal Trends Report

Part 6

Hourly rates and KPI data

- Introduction. Closing the gap

- Part 1. This is what law firm growth looks like

- Part 2. Clients want more than just referrals

- Part 3. More than half of clients shop around

- Part 4. Putting 1000 law firms to the test

- Part 5. How prepared is today's lawyer to drive their firm's success?

- Part 6. Hourly rates and KPI data

- More Data. Dig deeper into the LTR datasets

For the past four years, the Legal Trends Report has provided benchmarking data on some of the most critical business metrics that determine law firm performance. In this section, we’ve updated the data for 2019 and included new discussions on why this data is relevant to firms today.

Hourly rate and the Billable Hour Index: How much does a lawyer typically charge per hour?

As a service-based profession, any revenue earned by a law firm almost exclusively comes from the time a lawyer puts toward billable work on behalf of their clients—and hourly billing is still the predominant method for billing among law firms. As such, we analyze hourly billing rates to determine how revenue-earning potential changes over time.

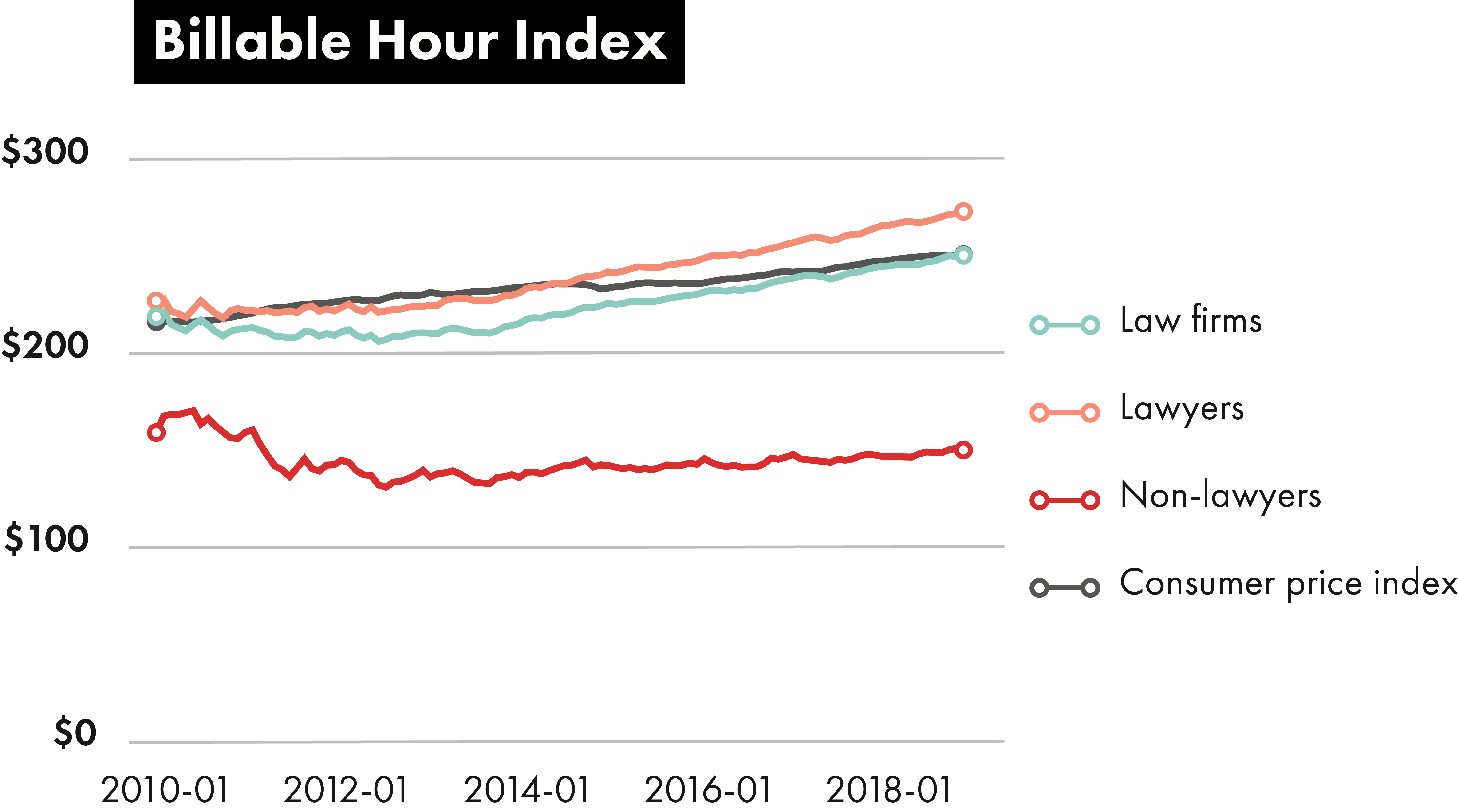

In what we call the Billable Hour Index, we see that after remaining relatively flat up until 2014, hourly rates have steadily increased on average to $253 in 2019.

This trend follows closely with the Consumer Price Index, which we use as a benchmark indicator corresponding to the actual purchasing power and living wages in the United States.

Similar to previous years, non-lawyer rates have remained relatively stagnant.

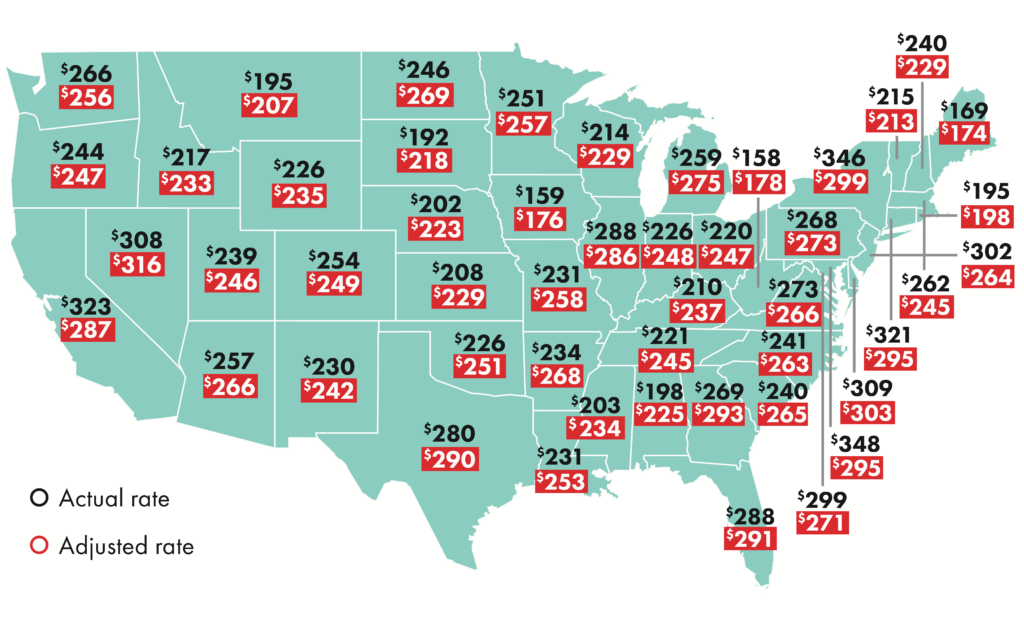

Regional rates adjusted for cost of living

Similar to how we compare lawyer rates to the Consumer Price Index, we also compare average regional rates to estimations on the overall cost of living within each state. “Actual” rates are the rates that a lawyer charges, and “adjusted” rates have been adjusted to reflect cost of living data—providing a better point of comparison in terms of how much a lawyer earns relative to their purchasing power within each state.

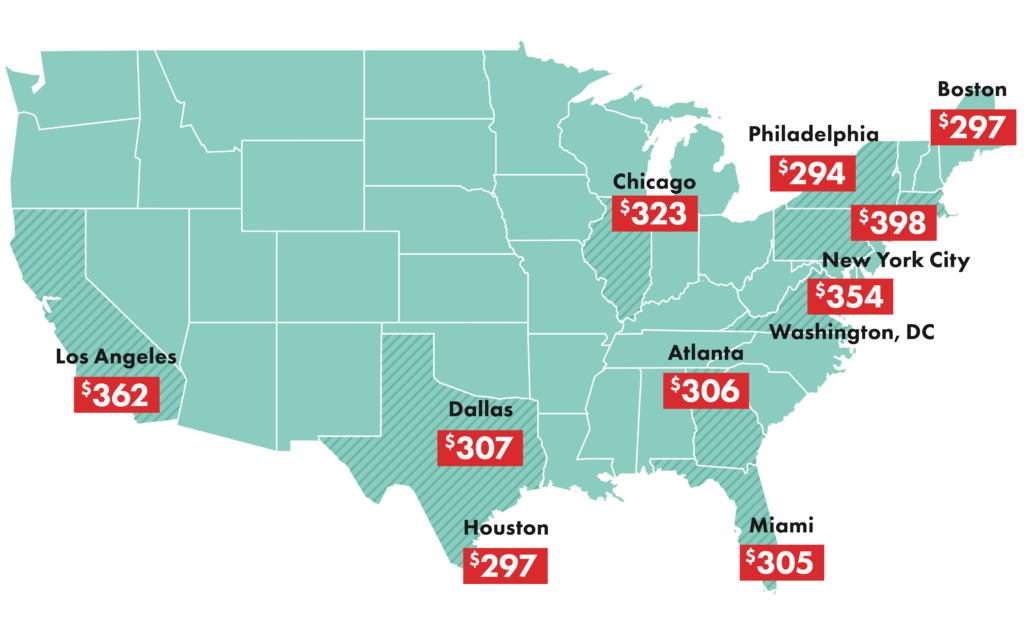

Hourly rates for large metropolitan areas

Key business metrics for firm performance

Since 2016, we’ve defined specific business metrics to reflect how efficient law firms are at performing billable tasks in relation to invoicing and collecting payment. Utilization, realization, and collection rates provide powerful insights into how productive a firm is in generating revenue.

Utilization rate: How much of a day is dedicated to earning money for the firm?

Utilization rate measures the average time a lawyer puts toward billable work on a given day. When compared to the total number of hours available in a day, we get a percentage that we call a utilization rate.

Based on aggregated and anonymized data from tens of thousands of lawyers, we determined that the average lawyer worked just 2.5 hours of billable work each day in 2018. When we compare this to a standard 8-hour workday, we calculate a national average of 31% utilization for the typical lawyer.

Average utilization rates for the legal industry have stayed consistent in the four years we’ve been publishing the Legal Trends Report. While this number is much lower than what other industry reports publish, other reports are based on self-reported survey data, which can often suffer from social desirability biases when it comes to reporting sensitive information like earnings. People are also more likely to report on the good times or fail to take into account the ups and downs of a broader time scale for a full working year.

The benefit of this analysis is that it looks objectively at data trends across tens of thousands of legal professionals over the course of a full year.

- The average lawyer worked just 2.5 hours of billable work each day in 2018

Realization rate: How much billable work makes it to an invoice?

Realization measures the amount that a firm invoices compared to the amount of billable work performed at a law firm.

We know that not every hour worked gets billed for. In fact, 19% of the time lawyers work doesn’t make it to a bill. There could be a number of reasons for this. Last year’s report suggests the most common reasons for lawyers discounting billable work are: empathy for the client, the client’s ability to pay, or the belief that too much time was tracked to begin with.

Regardless of the reason behind the loss in realization, the data suggests that a significant amount of time is wasted on work that doesn’t earn any revenue. Firms can improve realization by ensuring the work they take on will be billable in the first place, or making sure they have the processes in place to ensure that work makes it to a bill.

Collection rate: How much billed time gets collected?

Collection measures the amount that a firm collects compared to the amount invoiced at a law firm.

Not every hour billed gets collected upon. Of all hours invoiced to clients, 14% never get paid. This could mean that clients just aren’t able to afford their legal bills, or it could mean that law firms don’t do a good job of following up on their invoices. Regardless of the underlying cause, low collection rates mean money earned gets left on the table, leading to firms suffering costly revenue shortfalls.

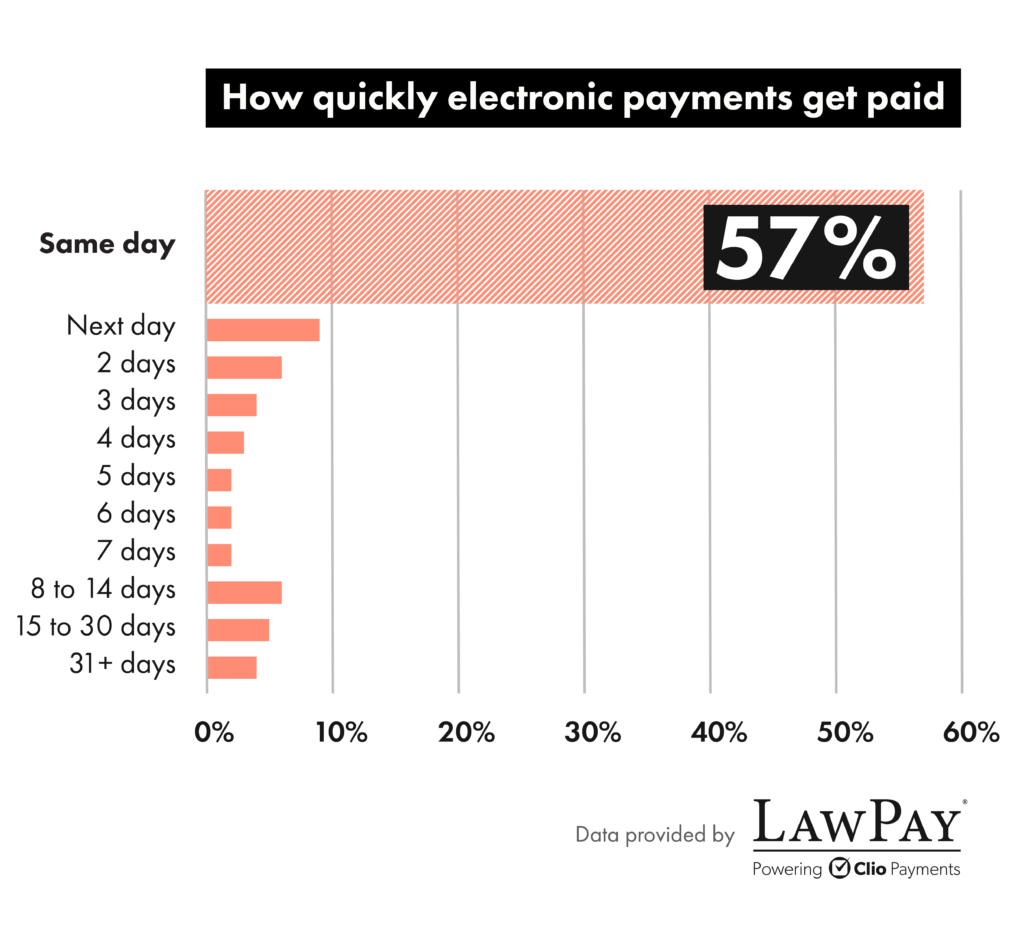

One way to make fee payments easier for both clients and firms is to use electronic payments. According to survey data from last year’s Legal Trends Report, 50% of clients are more likely to hire a lawyer who takes electronic payments, 47% are more likely to hire a lawyer who accepts automated payments or fund transfers, and 40% would never hire a lawyer who didn’t take credit or debit cards.

Electronic payments also get paid faster, making collections easier and saving follow-ups when bills are past due. In fact, 57% of electronic payments get paid within the same day they are billed, and 85% get paid within a week.

- 57% of electronic payments get paid within the same day

The lawyer’s funnel

When put together, these utilization, realization, and collection rates make up the lawyer’s funnel to earning revenue for the firm. The largest potential for earning is at the top, and that potential shrinks at each stage—which means that each stage is a critical opportunity for improving firm earnings.

To illustrate the devastating effect that the funnel can have on law firm revenue, we can calculate an average effective rate based on industry averages.

Based on an average industry rate of $253, a lawyer can expect to bring in $2,024 of revenue for the firm if they billed for a full 8-hour day.

Since the average lawyer only puts 31% of an 8-hour day toward billable work, this reduces maximum potential daily earnings to $627.

When we apply an 81% realization rate, average daily earnings shrink to $508.

Finally, when factoring in an 85% collection rate, average effective daily earnings fall to $432.

- Earning potential shrinks at each stage of the funnel

2019 Legal Trends Report

More Data

Dig deeper into the LTR datasets

- Introduction. Closing the gap

- Part 1. This is what law firm growth looks like

- Part 2. Clients want more than just referrals

- Part 3. More than half of clients shop around

- Part 4. Putting 1000 law firms to the test

- Part 5. How prepared is today's lawyer to drive their firm's success?

- Part 6. Hourly rates and KPI data

- More Data. Dig deeper into the LTR datasets

Download the full report with expanded data tables

The Legal Trends Report features aggregated and anonymized data from tens of thousands of legal professionals across the United States. Download the pdf version to get access to the full report, including appendices that include hourly rates and business metrics based on state, metropolitan area, and practice area.

Compare hourly rates

Clio’s Hourly Rate Benchmark Calculator instantly compares how your hourly rates measure up to other legal professionals in your state and practice area.

Browse previous reports

Now in its fourth year of publication, each Legal Trends Report features unique research into some of the most pressing issues in the legal industry. Read previous reports for data on how clients prefer to work with lawyers, client satisfaction, and common challenges faced by legal professionals today.