2021 Legal Trends Report

Introduction

Adapting to rapid technological change

- Introduction. Adapting to rapid technological change

- Part 1. Client expectations have changed

- Part 2. Technology advantages among growing firms

- Part 3. How lawyers are investing in their firms

- Part 4. Lawyers want to know more about their business

- Part 5. Setting new standards for legal service

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

Since the spring of 2020, COVID-19 has sparked radical changes in our personal and professional lives. But the question that should be on everyone’s mind is, what’s next? While it’s tempting to imagine that everything will return to what was once considered “normal,” the reality is that in adapting to the challenges of COVID-19, many law firms have discovered new capabilities that will reshape the delivery of legal services in the years and decades to come.

The technology playing field has leveled

One of the most significant points of reference in the past two years is the mass adoption of cloud technologies—a trend that accelerated rapidly early on in the pandemic. According to survey data collected for the 2020 Legal Trends Report, the majority of law firms adopted technology to a level never before seen in legal during the pandemic:

- 85% were using some form of software to manage their firms

- 83% were meeting clients virtually

- 79% were storing firm data in the cloud

- 73% accepted online payments

- 62% supported electronic documents and e-signatures

Research data also showed the vast majority—95% or higher in most cases—plan to continue to use these technologies beyond the pandemic, which is a clear indication that this technology adoption has become the norm for most firms.1 Other researchers have confirmed this trend within the legal industry: Thomson Reuter’s 2021 Report on the State of the Legal Market found that 84% of surveyed partners expected their firms to increase investments in technology after the pandemic.2

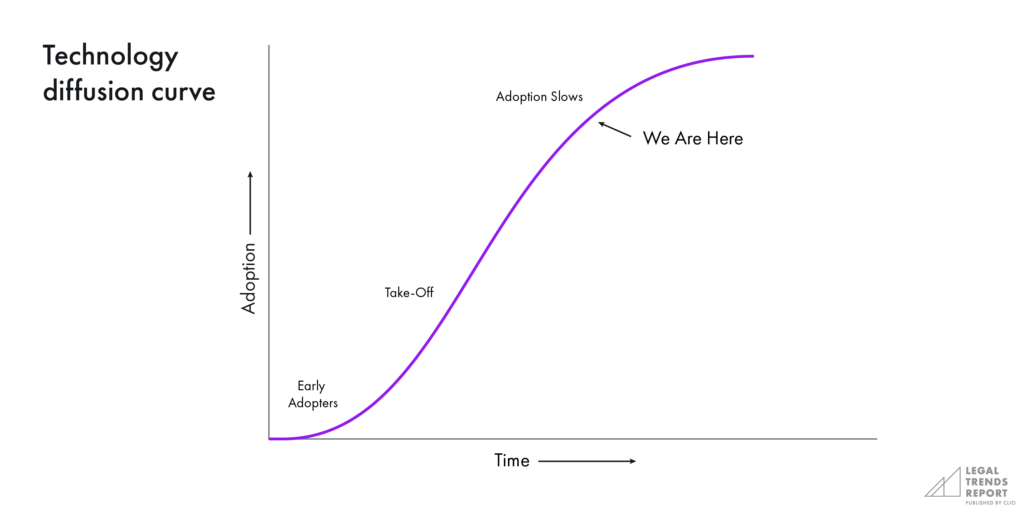

We’ve analyzed the spread of remote work through the lens of a technology diffusion curve, a conceptual framework developed by professor of communications Everett Rogers. This framework defines diffusion as the process by which a new innovation is communicated through certain channels over time among members of a social system.3 This spread of technology can be visualized on a diffusion curve, which divides the process of adoption into several stages.

The earliest stages of this diffusion involve early adopters: individuals and organizations that recognize the value of the technology early and adopt it before others do. At some point the spread typically accelerates, reaching a critical mass of adoption, which speeds the spread even further. Finally, as we reach the end of the curve, few potential adopters are left and the spread slows considerably.

Rogers’s theory of technological diffusion covers both the planned and spontaneous spread of new ideas, and he contends that the end result of this spread is societal change, as human behaviors are altered by new technologies. The changes we’ve seen in the wake of the pandemic are examples of spontaneous spread which have resulted in significant societal change. While the challenges of the pandemic that drove the mass adoption of remote technologies will subside, the spread of these innovations has dramatically altered consumer expectations as a result of exposure to more flexible, convenient methods of interaction. These changes to how people interact are here to stay, and as more and more legal professionals adapt to these new preferences, those who do not are going to be left behind entirely.

What is important is that the benefits of this technology adoption were not limited to consumers—they’re also granting greater resiliency, better quality of life, and better client services to lawyers and their firms. Based on data from the 2020 Legal Trends Report:

- 68% were more prepared to handle future disruptions

- 68% said technology helped their firms deliver better client experiences

- 58% said technology improved their work-life balance4

The implications of this mass-scale technology adoption cannot be understated, and we’re likely only seeing the start of a major shift in mindset among lawyers and their clients. Where legal work used to take place primarily in an office, the pandemic forced law firms to demonstrate that this work could be done from virtually anywhere. While these arrangements may have introduced significant friction in developing new processes for communication and collaboration—especially when dealing with complex court procedures—they afforded many benefits in the form of reduced commuting time, increased family time, and for many, increased productivity. In fact, data from last year’s report showed that firms embracing key technologies actually grew their revenues despite the pandemic causing widespread economic contraction. In 2020, firms that were using online payments, client portals, and client intake and CRM software saw 6% year-over-year growth during some of the most intense periods of the pandemic—and collected nearly 40% more revenue per lawyer compared to firms not using these technologies.5

If nothing else, the potential benefits to efficiency and productivity shouldn’t be ignored. According to research conducted by the National Bureau of Economic Research in April 2021, work-from-home arrangements in America are expected to increase by four times compared to pre-pandemic levels, and are expected to increase productivity in the US by about 5%.6 Research from the Southampton Business School in the UK also found that 88.4% of people reported getting as much or more work done while working from home during the first lockdown between March and July 2020.7

Underlying these changes, and the outcomes they’ve created, businesses worldwide are now considering: What will the future of work look like? The answer to this question has huge implications for how businesses should invest resources into their workplace—and how they approach designing client services.

A client-centered future

To determine what’s best for law firms—or any business for that matter—legal professionals should be asking themselves: What’s best for their clients? This is the principle behind client-centered law firm design, which is a framework that begins with establishing a deep understanding of what clients are looking for. This mindset enables firms to anticipate their clients’ needs, often before they recognize those needs themselves. The goal is to make working with a law firm as easy and effortless as possible.

When assessing the possibilities, it’s worth considering how the nature of our interactions have been fundamentally altered in the past two years. How important is in-person communication when face-to-face interaction is possible through video conferencing software? To many lawyers—and their clients—the answer to this question may very well be: a lot. But that’s not to say there aren’t certain aspects of a legal matter that could be improved in a way that is complementary to those crucial in-person moments.

The benefits that legal professionals have seen in adopting new technologies translate into benefits for clients as well. Solutions like e-signatures can mean that a critical milestone no longer needs to be held up by traditional barriers—like scanning and mailing a wet signature or simply getting the right parties together at a particular time and place.

It’s worth recognizing that in a rapidly changing world, not everyone has been affected by COVID-19 in the same way. When it comes to legal services, not all consumers will have the same needs and expectations. This puts the onus on law firms to tailor their services accordingly. Flexibility and adaptability are key. At the same time, law firms also have a great opportunity—and arguably a responsibility—to coach their clients on the best, most efficient means of working with the firm.

The stakes are high for lawyers, as the market for legal services is a competitive space for attracting and retaining clients. As the research in this report demonstrates, the firms that are able to adapt to meet the needs of their clients in a planned and purposeful way are the ones that will reap the rewards. Meanwhile, those that remain set in their ways risk closing themselves off from valuable market opportunities, which will only have an increasingly negative impact on their bottom line as the market continues to evolve.

What’s new this year

Assessing change. Consumer expectations have shown rapid, seismic shifts in the past two years, and building the flexibility and resiliency to cope with future upheavals is more important now than ever before. This year’s report delivers new insights about these lasting changes and how the future consumer will find, choose, and work with a lawyer who harnesses the power of cloud-based legal technology.

Identifying opportunities. The COVID-19 pandemic has continued to impact everyone, but has also continued to present opportunities for positive change. Our analysis of aggregated and anonymized user data from tens of thousands of legal professionals explores how firms have coped with the impact of the pandemic and even found success during it. By closely examining some of the most successful law firms, we’ve also uncovered valuable insights into how the legal landscape is shifting, and what law firms can do to keep themselves on stable ground amidst these changes.

Firm resources. To build a thriving legal practice that is prepared to meet the demands of the future, lawyers should prioritize the types of business investments that will have the most impact for clients and for those at their firms. Survey research in this report looks at how in-touch lawyers are with their business today, and where they’ve prioritized their spending. We also offer insights about where future spending should be prioritized to remain competitive amidst changing consumer expectations.

Data sources

The Legal Trends Report uses a range of methodological approaches and data sources to deliver the best insights about the state of legal practice and strategies for future improvement.

Clio data

We’ve analyzed aggregated and anonymized data from tens of thousands of legal professionals in the United States. This data provides important insights about how technology is being used by legal professionals and the impact it has on firm performance.

Legal professional and consumer surveys

We surveyed 1,056 legal professionals and 1,002 consumers in May and June 2021. The consumers included in this survey are representative of the US population by age, gender, region, income, and race/ethnicity based on the most recent US census statistics. The answers to these surveys offer insights into how legal professionals can become more aligned with consumer preferences in 2021 and beyond.

Longitudinal study

This year’s report includes a multi-year study of over 1,600 law firms. These firms have been grouped into three cohorts—growing, stable, and shrinking—based on their year-over-year revenue performance. An assessment of these groups has helped us to understand what successful firms are doing to drive that success, and what struggling firms can do to catch up.

Legal Professional Interviews

We conducted interviews with legal professionals to understand how the pandemic affected their firms and how adaptations to these changes might continue in the future. These interviews also provided important perspectives on how the pandemic impacted legal professionals’ work-life balance, their interactions with clients, and their work within the court systems.

Endnotes

[1] “Legal Trends Report 2020.” Burnaby: Clio, October 2020, 56-57.

[2] Jones, James W., and Milton C. Regan, Jr. “2021 Report on the State of the Legal Market.” Washington, D.C.: Thomson Reuters Institute, January 2021, 12.

[3] Rogers, Everett M. Diffusion of Innovations. Fifth. Toronto: Free Press, 2003, 41.

[4] “Legal Trends Report 2020,” 57.

[5] Ibid., 34-35.

[6] Barrero, Jose Maria, Nicholas Bloom, and Steven J. Davis. “Why Working From Home Will Stick.” Working Paper. NBER Working Paper Series. Cambridge: National Bureau of Economic Research, April 2021, 31.

[7] Bajorek, Zofia et. al, “Working from Home under COVID-19 Lockdown: Transitions and Tensions.” Work After Lockdown. Southampton: University of Southampton, January 2021, 6.

2021 Legal Trends Report

Part 1

Client expectations have changed

- Introduction. Adapting to rapid technological change

- Part 1. Client expectations have changed

- Part 2. Technology advantages among growing firms

- Part 3. How lawyers are investing in their firms

- Part 4. Lawyers want to know more about their business

- Part 5. Setting new standards for legal service

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

The rapid adoption of technology among consumers and law firms will have profound effects on the way in which legal services are delivered. As legal professionals and their clients develop more familiarity with the capabilities at their disposal, new forms of interaction will open up opportunities for better firm efficiencies and improved client experiences.

Within the highly competitive legal market, consumer demand is what ultimately dictates which businesses see the greatest success. This means that businesses that are best at delivering on consumer expectations are the ones that will secure more clients, resulting in more referrals and opportunities for future growth.

[Resiliency] is just learning how to change with the times, learning how to be okay. Doing something different and being okay interacting with your clients like you never have before.

How mediums influence interaction

With the rapid adoption of new technologies, it’s important to recognize the immense impact this has had on the fundamentals of how we interact and communicate with each other. These changes are best analyzed within a theoretical framework developed by communication theorist Marshall McLuhan: The medium is the message. The concept describes how our very structures of communication are often more important, and have a greater impact, on our lives than any information that may be transmitted through these mediums.1

The implications of McLuhan’s theory can be understood through the example of the light bulb: while it doesn’t carry any information in and of itself, its very nature shapes our relationship with day and night, changing the way that we think about time and interaction. The invention of trains and automobiles offer further examples, as each shaped how we structure the development of our cities and infrastructure while also altering our perception of time. Technology has always had the ability to reorient both the time and spatial arrangements of our interactions—even allowing us to be in more than one place at any given time.

What does this mean for legal? Any law firm operating in 2021 needs to acknowledge that—in less than two years, through cloud-based technologies—our communication infrastructure has evolved immensely, to the point that we need to reevaluate the nature of interaction within the context of legal service delivery, and what it will look like both now and in the years to come.

New client demand for remote options

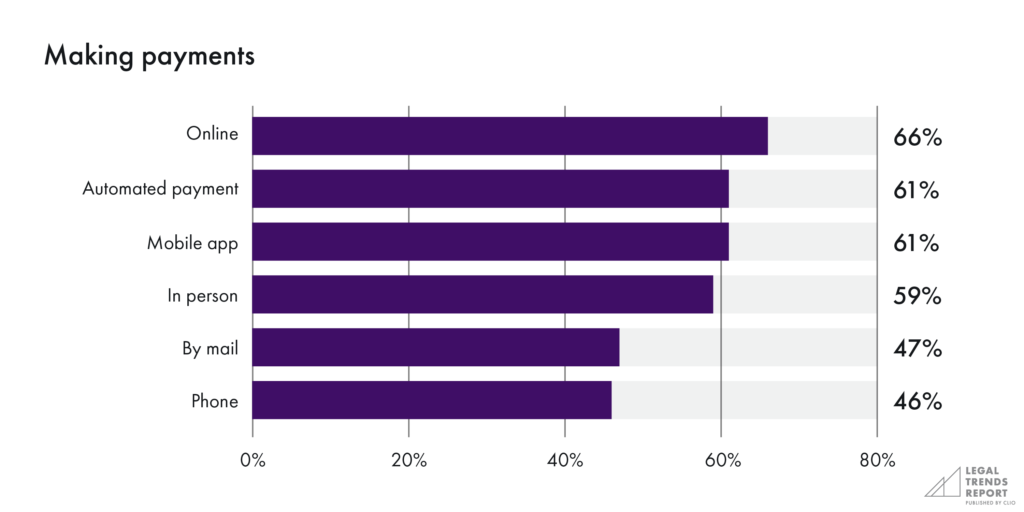

Online payments (66%) are the top choice, followed by automated payments (61%) and payments via mobile app (61%).

With more opportunities to connect with people remotely, it is no surprise that we also see significantly more appetite for remote communications when working with a lawyer.

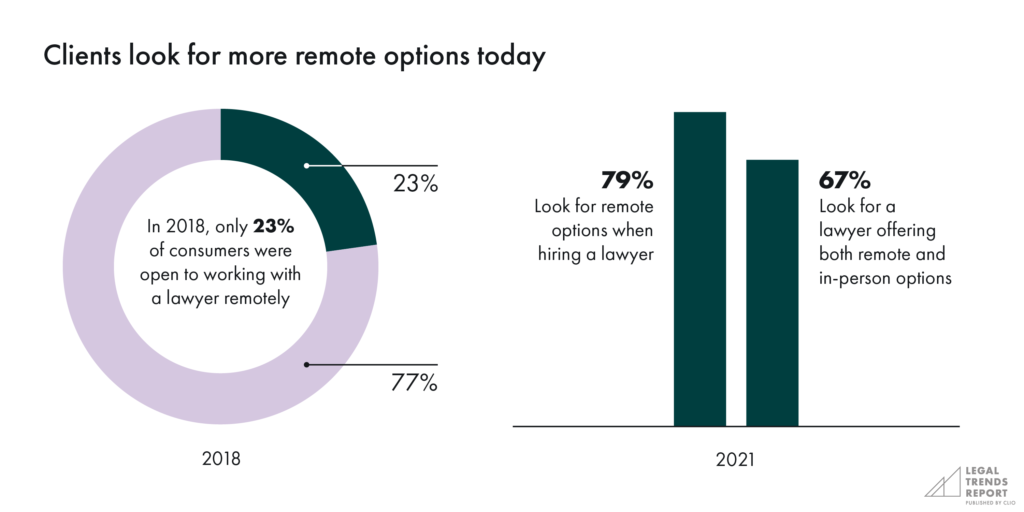

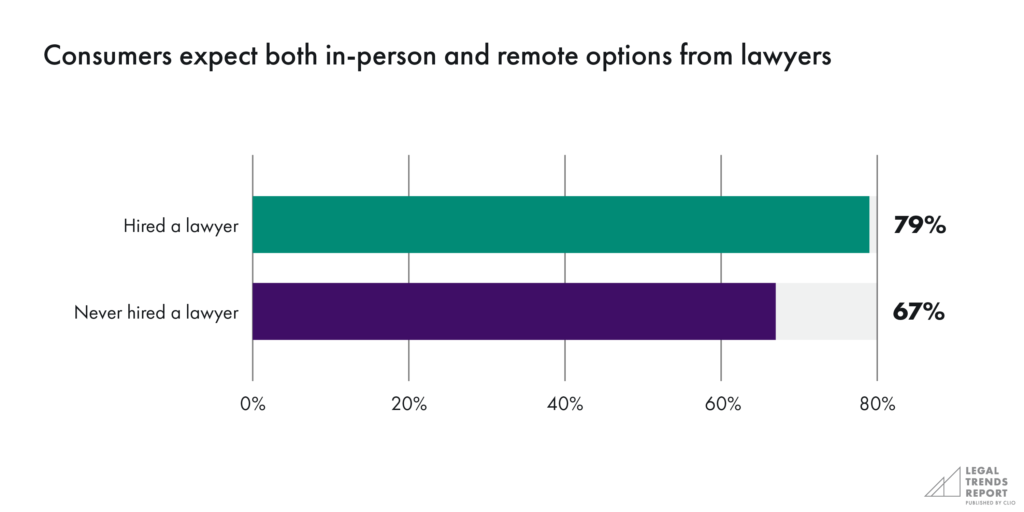

According to research in the 2018 Legal Trends Report, only 23% of consumers were open to the idea of working with a lawyer remotely. This year, however, 79% of survey respondents saw the option to work remotely with a lawyer as an important factor that would have a positive influence on their decision to hire that lawyer.

This isn’t to say that clients expect a fully remote legal experience. In fact, 67% said they would look for a lawyer offering both remote and in-person options when searching for an attorney. This figure increased to 79% among consumers who had hired a lawyer in the past.

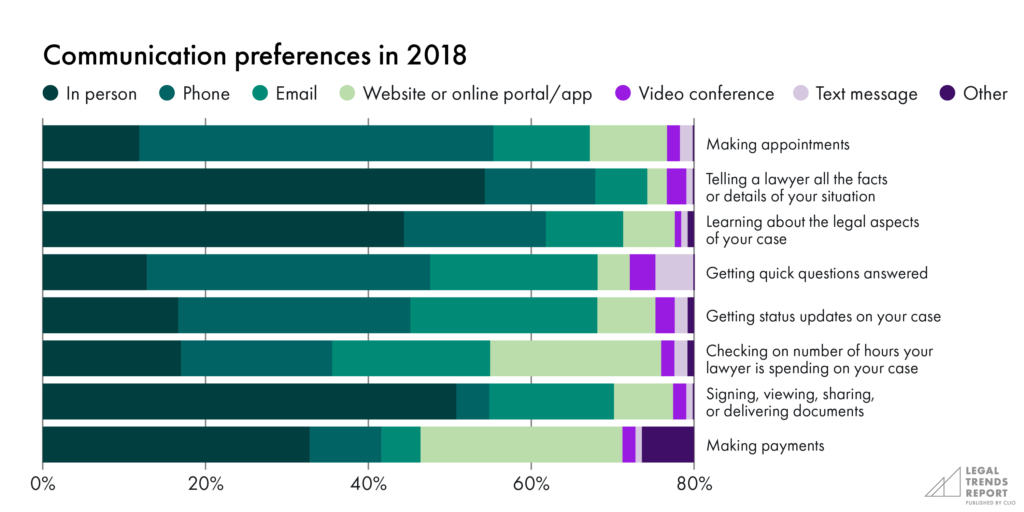

It’s worth noting that remote communication is not a new concept, even in the sometimes slow-to-adapt legal space. Phone, email, and even physical mail have long been established forms for communication within the context of legal practice. However, just three years ago, research from the 2018 Legal Trends Report showed a clear preference for in-person communications.2

In fact, that report looked at which formats for communication were most preferred across multiple touchpoints throughout the client journey. Results showed that in-person communications were especially preferred early on in a legal matter, and other forms of communication—phone, email, and text communications—were only preferred later on in a matter and for quicker check-ins.

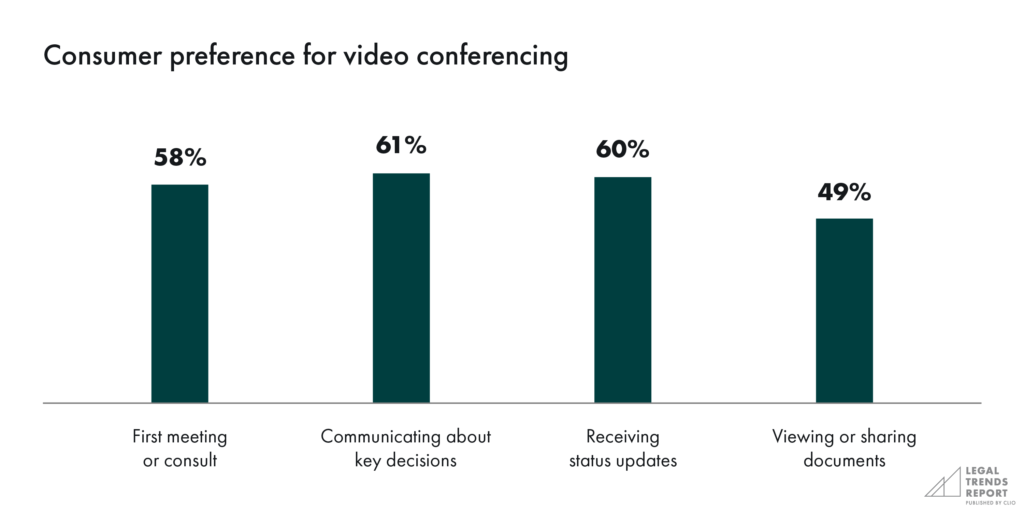

Significantly, our 2018 survey research included an option to select video conferencing as a preference for any communication point in a legal matter, but due to the miniscule number of respondents who chose this option, it was included in the “Other” category along with text messaging.3 Overall, no more than 4% of consumers preferred to communicate through video conferencing at any stage within a legal matter. This year, however, more than half of respondents indicated a strong preference for video conferencing across multiple touchpoints when working with a law firm.

New client expectations across the client journey

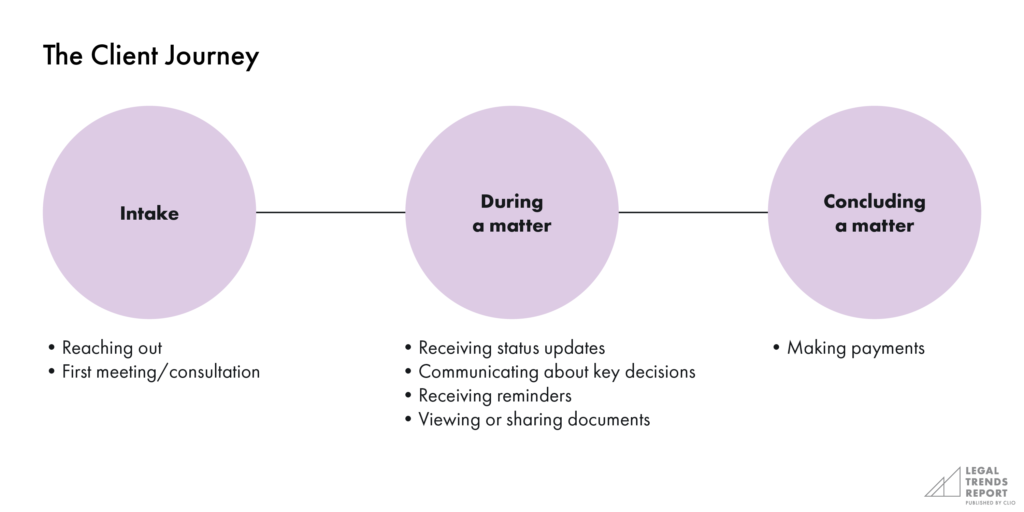

When looking at the range of mediums available to clients and their law firms, results from this year’s research indicate that consumers today express a much more diverse set of preferences about how they want to communicate, and that these preferences vary across touchpoints throughout a legal matter. We can look at these touchpoints in three distinct phases: intake, during a matter, and concluding a matter.

Client intake

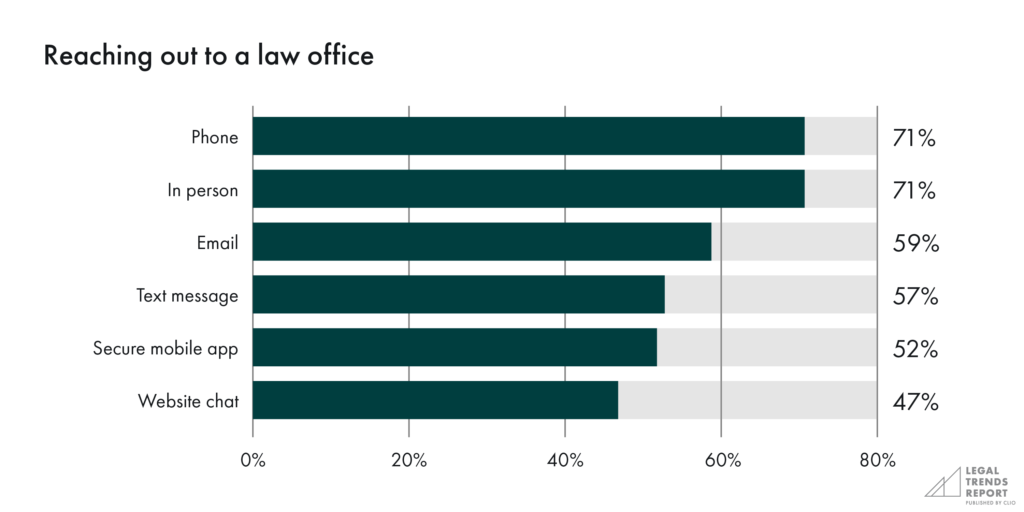

Similar to data from 2018, traditional forms of communication remain the top preferences among clients when at the first stages of a legal matter. Phone (71%) and in person (71%) are equally preferred when initially reaching out to a law office, with email (59%) and text (53%) appearing as strong alternatives.

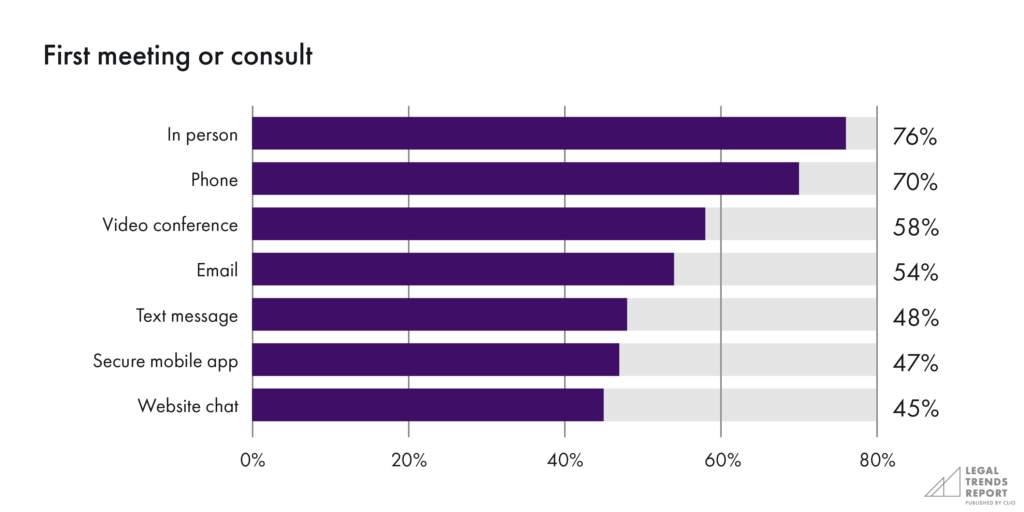

When it comes to a first meeting or consultation, the most stand-out takeaway from our survey data is that video conferencing ranked very highly among consumers. While in-person (76%) is the most commonly preferred, with phone (70%) the next most common, video conferencing (58%) is the next-most viable option among clients, demonstrating a radical shift compared with how low this preference appeared in our 2018 data.

At this stage in a legal matter, real-time communication with the opportunity for quick back-and-forth communication is likely most important. While many still seek traditional formats for communication, video conferencing has quickly become a strong alternative for many clients.

During a legal matter

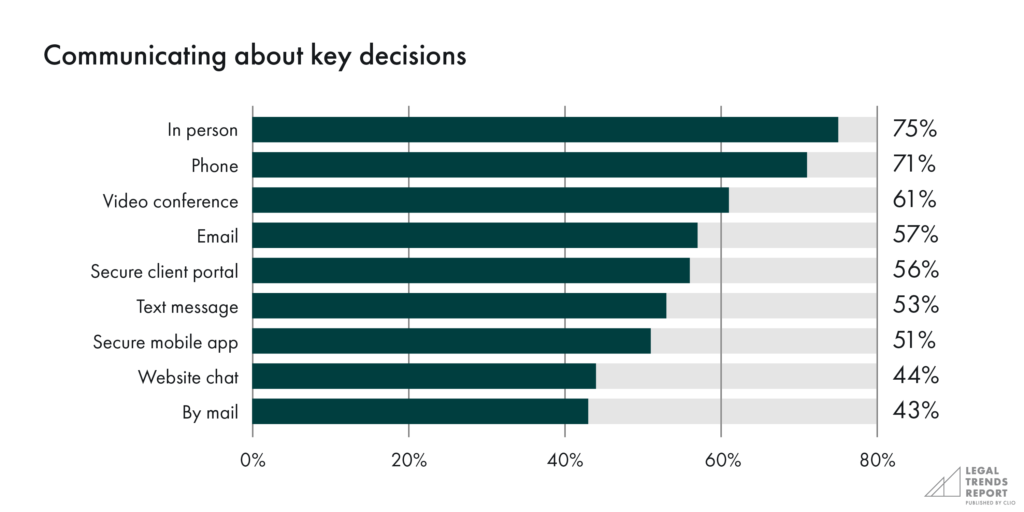

When looking at key milestones within a legal matter, traditional methods of communication are still preferred among consumers. For communications about key decisions within a legal matter, in person (75%) and phone (71%) are the most preferred, but once again, video conferencing (61%) is the next best option. Presumably, the option to discuss details in real-time is perceived as most important to many consumers at this stage in a matter.

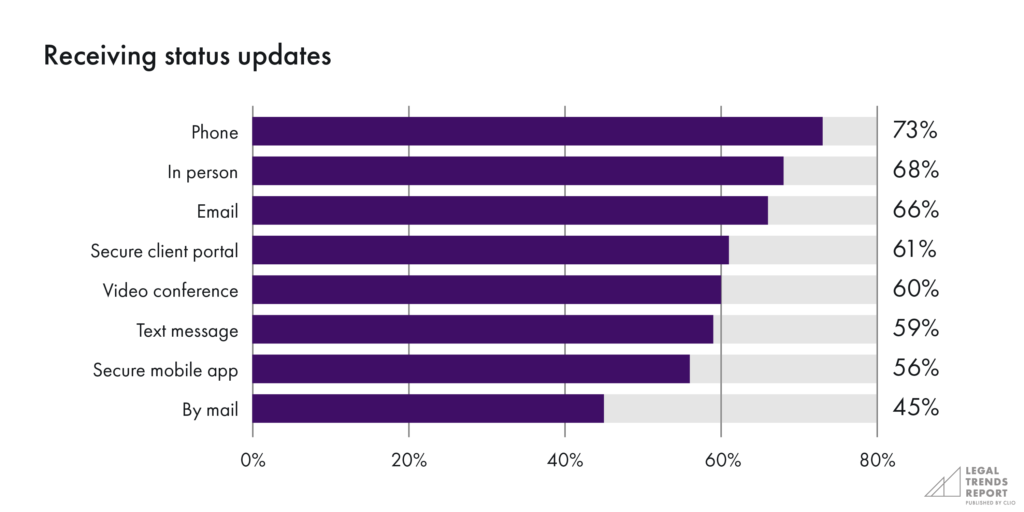

For status updates, we see that more informal and asynchronous options—the types of interactions that don’t need to happen in real time—have higher preferences among consumers. Phone is the top choice (73%) and in person (68%) is the next best option. In this case, video conferencing (60%) falls lower on the list, but email (66%) and secure client portals (61%) are seen as more preferential—indicating that at these points in a matter, less formal options that allow clients to review information at their convenience may be a better option for many.

Transactional interactions

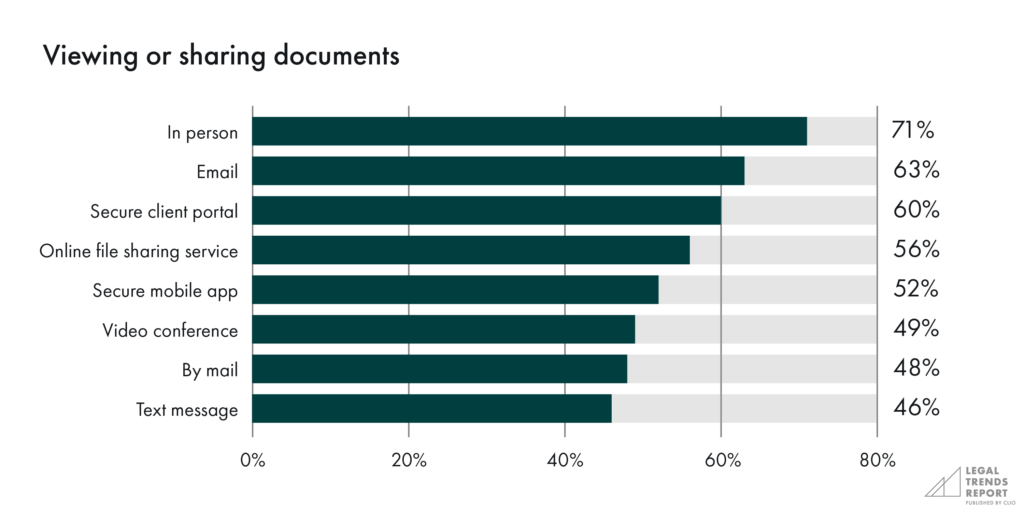

When it comes to key interaction points like viewing and sharing documents, in-person communication (71%) again is the most preferred option among consumers. In this case, we also see strong preferences for several other options. Email (63%) is a top choice, as well as secure client portals (60%), and online file-sharing services (56%), indicating that more passive, asynchronous communications may also be ideal in many cases.

For making payments, it’s clear that online options are strongly preferred by consumers. Online payments (66%) are the top choice, followed by automated payments (61%) and payments via mobile app (61%). In-person payments (59%) sit near the bottom of the list. At this stage, clients prefer options that prioritize convenience over any direct forms of interaction.

It may be worth noting that for both of these more formal, transactional interactions—as well as communications about key decisions and status updates—communicating by physical mail is the least favored option among consumers, which suggests that, at a minimum, firms should be prepared to offer paperless experiences for their clients.

We couldn’t let the pandemic stop the mission. So we had to adapt, and luckily our files were all in our Clio document management… and we were paperless. So we had access to those things.

New expectations for tech-enabled interactions

One of the biggest takeaways from consumer survey data this year is that more tech-enabled forms of communication—those that go beyond traditional formats—have become a standard expectation among clients.

Throughout the duration of a legal matter, video conferencing in particular is a format in which consumers express a high degree of preference across multiple stages. At the same time, other forms of communication and information sharing have become much more preferred than they were previously—these include text messaging, secure portals, mobile apps, and most notably, online payments.

This growing shift in communication preference is something that lawyers should consider when designing their client services. The firms that adapt to these preferences are the ones that will attract more clients and achieve higher satisfaction rates and referrals. Conversely, lawyers who don’t adapt to these circumstances risk closing themselves off from a growing segment of the market, and introducing friction-filled interactions with clients who expect different, better experiences.

Balancing the old and the new

As much as we appreciate [more electronic communication features and video chat], I think the clients do too. They don’t have to take off a half day of work to drive over here to meet with the attorney or to sign paperwork or whatever.

While we’ve seen significant mass adoption of cloud technologies, we still see a high degree of preference for traditional forms of communication as well. It will be up to law firms to determine the right format for communicating and sharing information for a particular client at any given moment in their case—while recognizing that the situation may vary from client to client.

Being able to incorporate these technologies into their firms, and being able to do it well, may also pose significant challenges that legal professionals should prepare for. In 2019, we conducted an investigative study, which involved email and phone outreach to 1,000 randomly selected law firms, in which 60% didn’t respond to email, and 27% were unreachable by phone.4 The implication of this study is that many law firms already struggle with traditional forms of communication. Adding new means of communication will only increase the complexity of managing conversations and the information provided within them—which could make it even more difficult for firms to maintain a high standard of responsiveness and client service. When incorporating new communications tools, firms should ensure they also put systems in place that will help provide a consistent, reliable experience.

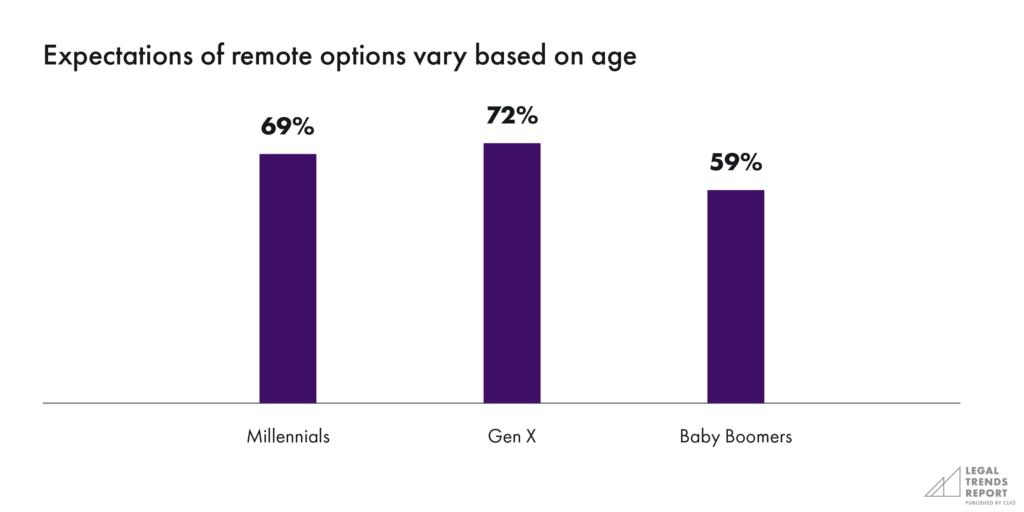

When looking at the future prospects for any law firm, lawyers should consider that these shifts in preference are likely to continue, as younger—often more tech-enabled—consumers tend to exhibit greater preference for remote options compared to older generations. Gen X haas the highest preference (72%) for working remotely with a lawyer. Millennials, many of whom may have not worked with a lawyer previously, still have a high preference (69%) for remote options. Baby Boomers are the least likely to expect remote options, yet still we see 59% wanting to be able to work remotely with their lawyer.

Key takeaways for future planning

Given the recent shifts in consumer attitudes and behaviors, legal professionals will need to adjust their mindset on how to develop effective communication and client services at their firms. There are three key areas that lawyers should focus on when planning the future of their practice:

- Be prepared to offer the means to work and communicate based on what clients are looking for. This requires that law firms equip themselves with the tools to communicate in ways that align with how clients wish to interact.

- Be proficient in using multiple formats for communication. It will not be enough for law firms to merely offer multiple communication options to clients. Adding new methods of communication will increase the complexity and scope of conversations and the information being shared. Law firms will need to demonstrate the type of informative, responsive communications—often across multiple communications channels—that clients expect.

- Be prepared to communicate the value of remote options to clients. Many clients, especially those not familiar with legal processes, will look to their legal advisors to design and recommend the ideal method for working together. Being able to demonstrate the advantages of more efficient means for communication—where clients are comfortable and where they will be most effective—will create time-saving opportunities and the types of flexibility that clients will appreciate and value in their interactions with their lawyer.

This last point is especially important for legal professionals as we emerge from the pandemic. Similar to our findings in 2018, survey data indicates that the more experience a client has working with a lawyer, the more they prefer to have the option to work remotely. For those who have worked with a lawyer in the past, 79% prefer to have the option for both in-person and remote interaction, compared to 67% among those who have never worked with a lawyer. This suggests that the more a lawyer can introduce a client to the legal process and the options available to them, the more likely they are to find more efficient solutions that will benefit both the client and the firm.

The more a lawyer can introduce a client to the legal process and the options available to them, the more likely they are to find more efficient solutions that will benefit both the client and the firm.

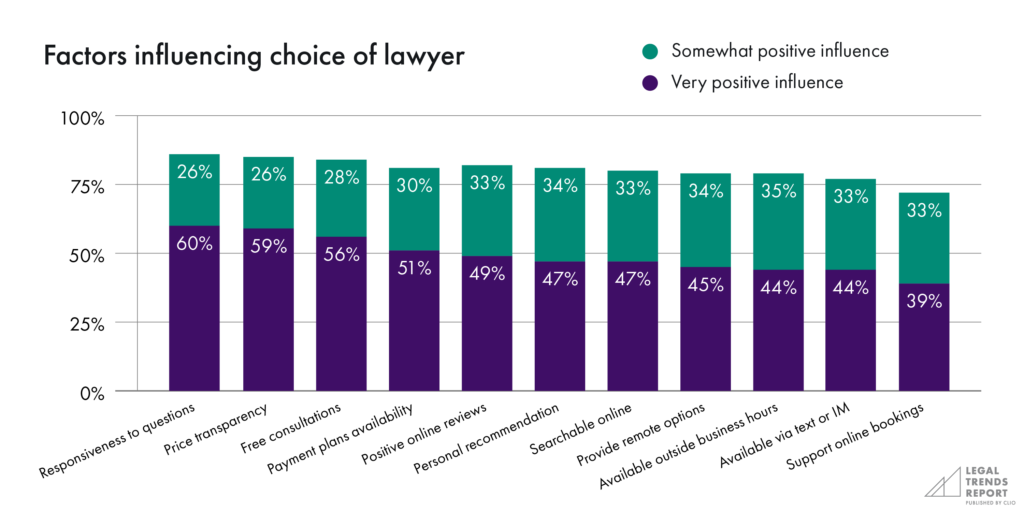

Remote services are only part of the picture

Law firms should also recognize that, ultimately, the most sought-after trait in a lawyer is responsiveness to questions (86% among consumers), which should be the ultimate goal when making decisions about how to design a firm’s client-centered services. The better prepared a lawyer is to provide—or ensure clients have access to—the necessary information they are looking for, the more they will be able to positively influence the client experience.

Technology can also influence a firm’s ability to deliver across other aspects of the client experience. Payment plans (sought by 81% of consumers) come enabled with many online payment platforms. Reviews and referrals (sought by 82% and 81% of consumers, respectively) will also be influenced by the positive experiences that firms provide. To see where firms have the most to benefit, we can also look at how some of the most successful law firms have built their success.

Endnotes

[1] McLuhan, Marshall. Understanding Media: The Extensions of Man. Edited by Terrence Gordon. 2nd ed. Berkeley: Gingko Press Inc., 2013, 14.

[2] “Legal Trends Report 2018.” Burnaby: Clio, October 2018, 37-39.

[3] Ibid.

[4] “Legal Trends Report 2019.” Burnaby: Clio, October 2019, 31-34.

2021 Legal Trends Report

Part 2

Technology advantages among growing firms

- Introduction. Adapting to rapid technological change

- Part 1. Client expectations have changed

- Part 2. Technology advantages among growing firms

- Part 3. How lawyers are investing in their firms

- Part 4. Lawyers want to know more about their business

- Part 5. Setting new standards for legal service

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

Beyond the impact that technology adoption has had on client expectations, we can also analyse how technology has contributed to law firm success. From a business perspective, being able to adopt the right technologies can have a substantial impact on firm efficiencies and client service. To better understand what this looks like, we conducted an analysis of aggregated and anonymized data across law firms that have seen varying degrees of growth over the course of several years.

Findings from this research indicate that growing law firms are much more likely to use key business metrics to measure firm performance, and are much more likely to adopt new technologies at a more rapid rate than shrinking law firms. For some technologies like online payments, however, it appears that the advantages in adoption rates that growing firms once had may be declining as all firms adopt these tools at higher rates.

Growing law firms continue to see more revenue

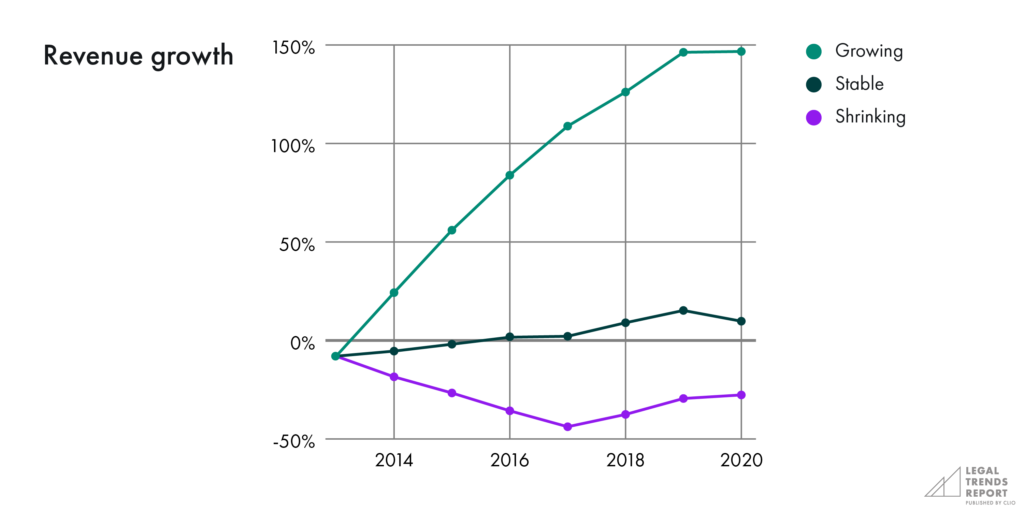

In conducting research for this report, we revisited the cohort analysis included in the 2019 Legal Trends Report. This analysis looked at growing, stable, and shrinking law firms over a five-year period. Each cohort was defined based on total year-over-year revenue growth over the same period. During this time:

- Growing firms saw a minimum of 20% revenue growth

- Stable firms saw no more than 20% growth or decline in revenues

- Shrinking firms saw revenues decline by more than 20%

The initial analysis in 2019 indicated that growing law firms acquired more clients during this period, and that they earned proportionately more casework and revenue for every client, which contributed to significantly higher revenue growth for these firms.

When assessing new data from all three cohorts, we can see that each cohort’s performance has continued along a similar trend since 2013, with the growing cohort significantly outperforming the other groups in total revenue growth. While it appears that gains among growing firms stagnated in 2020, likely as a consequence of the pandemic and the resultant economic contraction, firms in this cohort have nonetheless seen consistent year-over-year increases amounting to 135% since 2013. In fact, on average, this group more than doubled their revenues within a five-year period.

Stable firms continued to see modest growth overall, with only a slight contraction in 2020. Surprisingly, shrinking law firms appear to have seen slight gains since 2017, including the year that COVID-19 hit.

Technology adoption rates among growing and shrinking law firms

This year, to better understand what differentiates growing firms from others, we looked at technology adoption rates between each cohort. This allows us to assess what types of capabilities these firms have compared to others when it comes to internal firm processes and how they are able to translate these to the services they provide clients.

The technologies included in this analysis stand to benefit law firms in two major ways:

- Firm efficiency. These technologies enable better internal processes that ensure improved organization for specific areas of a firm’s business, while also enabling enhanced efficiencies among staff—whether it be through automated processes or increased access to important information.

- Improved client service. These technologies also create new opportunities to improve client services. For one, they open up new ways for firms to engage with their clients. For another, they can free up time amongst staff, allowing them to be more responsive to clients when they reach out.

Each of the technologies assessed here offer benefits in both these areas, which correlate with improved business performance.

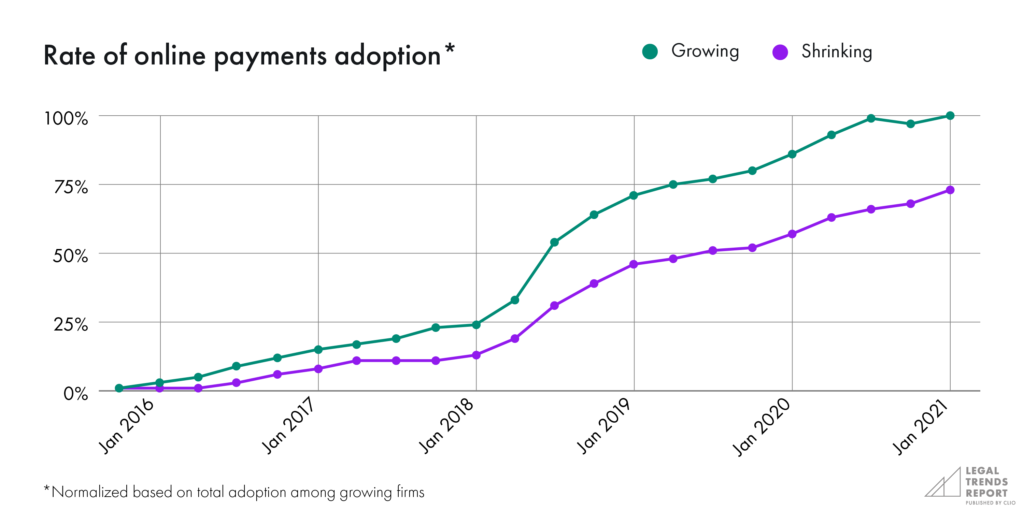

Online payments see fast adoption across all cohorts

Growing firms are 37% more likely to use online payments

Online payment solutions streamline the payment process for both in-person and remote clients, offering several quick payment methods. Flexible payment plans also help make legal services more affordable for clients who may not be able to pay a legal fee all at once—while also having the benefit of increasing collection rates for law firms. Online payment solutions also offer clients the ability to pay their bills quickly and easily from anywhere and on their own time. For law firms, online payment solutions help reduce administrative tasks by automatically updating outstanding balances and ensuring law firms know which clients still require follow up.

When analyzing the adoption trends among both growing and shrinking cohorts, we can see that growing firms have adopted online payments at a much quicker rate. However, it is important to recognize that even shrinking firms see a steep adoption rate. The fact that both groups have adopted these technologies at a rapid rate, largely since 2018, may be due to the high client demand for these types of solutions, as discussed in part 1 of this report. This data also suggests that, while offering online payments may have been a competitive advantage for law firms in the past, it’s become more a standard feature that clients have come to expect when working with a law firm today.

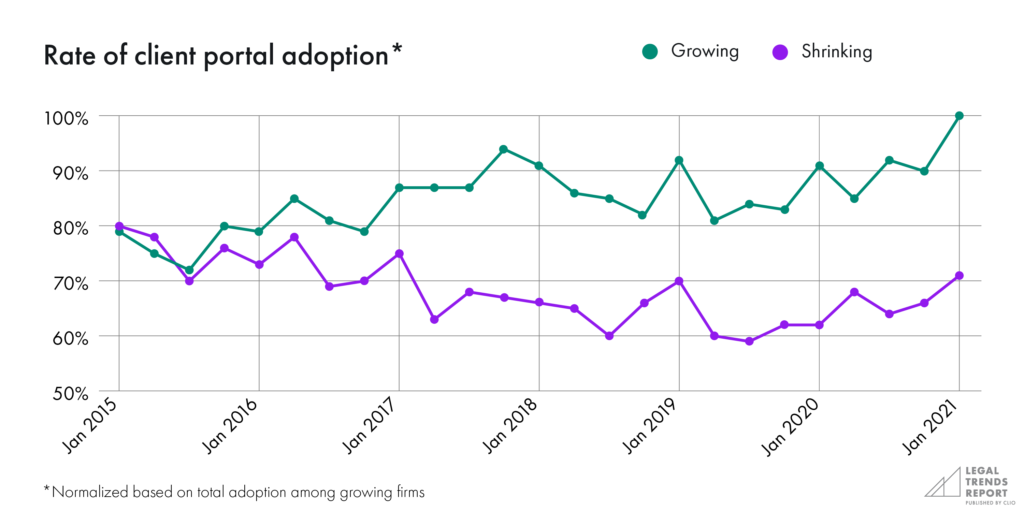

Client portals have seen fluctuating increases

Growing firms are 41% more likely to use client portals

Client portals offer a convenient, centralized means of communication for lawyers and their clients, giving both parties the ability to consolidate all information relevant to a client’s case in one secure location that remains accessible online at all times. This helps clients avoid losing information and gives them the benefit of always knowing the status of their case, resulting in a more communicative and transparent client experience.

Over time, both growing and shrinking firms have seen fluctuating rates of client portal adoption. While growing firms have seen a gradual adoption rate, with a sharp spike in the past two years, shrinking law firms saw a gradual decrease in the use of client portals until two years ago, when their uptake also began to rise. This has resulted in a significant gap in client portal adoption between these two groups and may suggest that, while growing firms have seen greater benefit from these tools, shrinking firms are struggling to effectively implement these tools within their firms. More training and familiarity among staff may be needed among firms that struggle with these solutions to ensure that lawyers and their clients are able to derive the maximum benefit from these tools.

Growing firms are early adopters of client intake and CRM solutions

Growing firms are 46% more likely to use client intake and CRM solutions

Client intake and client relationship management (CRM) software help law firms deliver enhanced client experiences, especially during the crucial intake phase of a legal matter. These solutions make it easier for law firms to keep track of potential clients who reach out to the firm, ensuring streamlined operations at each step of the intake process. Online forms make it easier and more convenient for potential clients to share basic information related to their matter, and online booking systems make connecting for an initial consultation simple. On the firm side, client intake software ensures all the staff know what stage each client is in within their intake workflow, and allows staff to automate reminders and follow-ups.

Growing firms have largely been early adopters of client intake and CRM software compared to shrinking firms, resulting in a fairly consistent adoption gap developing between the two groups. While shrinking firms continue to see steady adoption of these solutions, they appear to be lagging behind that of growing firms.

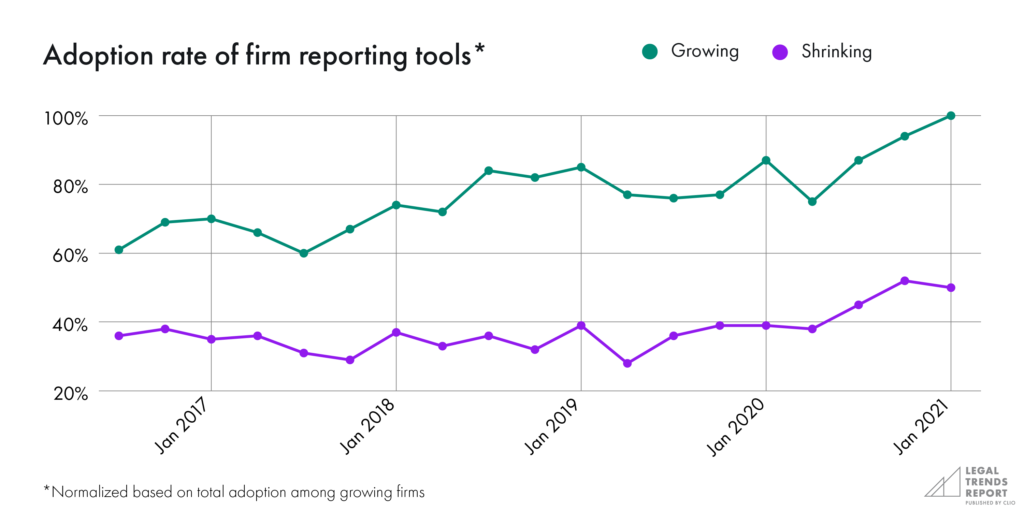

Growing law firms are twice as likely to use firm reporting tools

One of the most striking differences in technology adoption among growing firms is their use of firm reporting tools. The reporting tools analyzed for this report offer insights into key business metrics such as revenue generation, bill collection, and productivity. The takeaway from this data is that growing firms are more likely to increase their revenues because they have access to the information and insights that help them assess how their business is performing, which also allows them to focus more attention on planning for additional, ongoing growth over the long term.

As a whole, growing firms are twice as likely to be using reporting tools than shrinking firms—a difference that reached as high as 175% in 2019.

Since 2016, growing law firms have seen a steady increase in the adoption of firm reporting tools. Shrinking law firms, on the other hand, have seen fairly low adoption that remained mostly unchanged until the past year, when they’ve seen a sharp spike. Similar to the rapid increase in online payment adoption, this spike in the use of reporting tools also correlates with a period of positive revenue growth for this group.

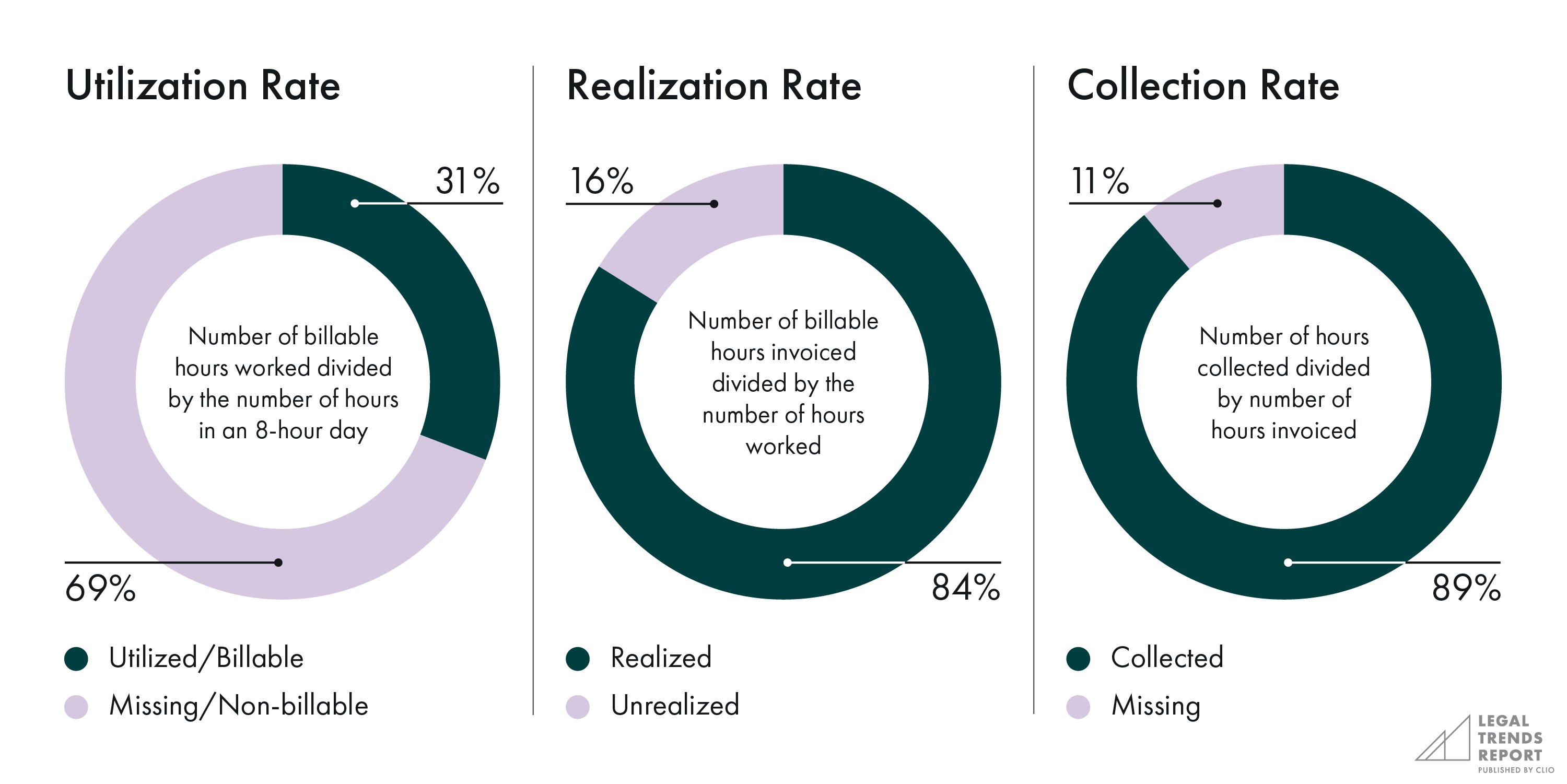

Key performance metrics for law firms

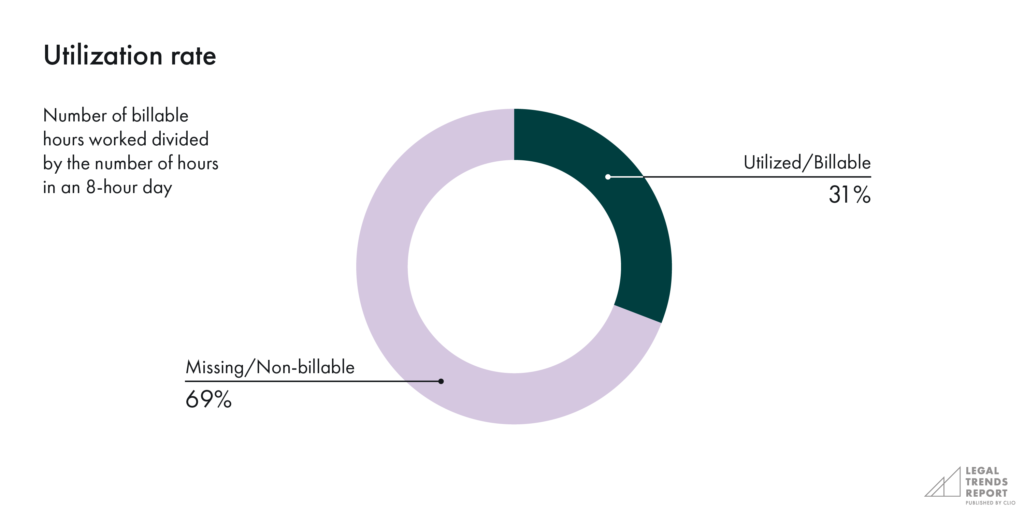

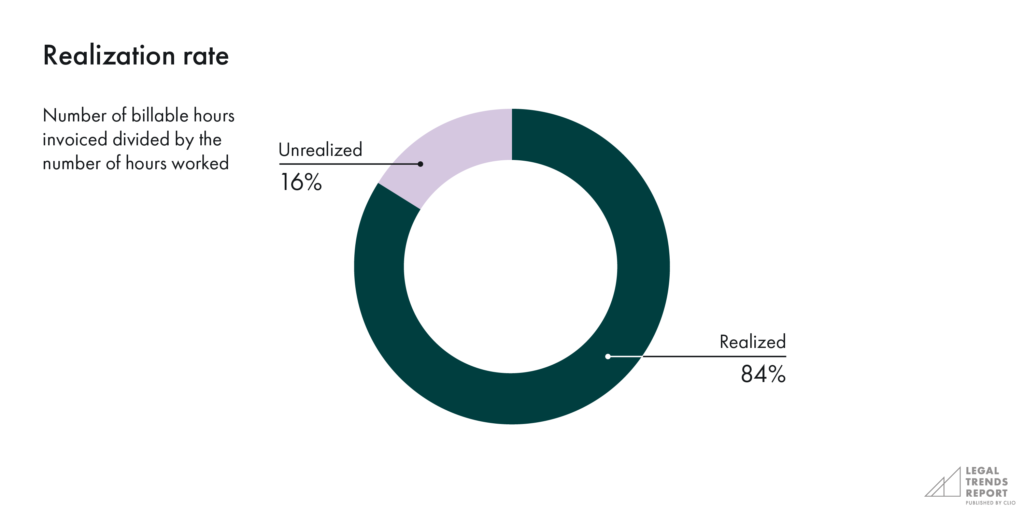

Within Clio Manage, Clio’s legal practice management solution, law firms have the ability to assess specific metrics that impact business performance. These metrics include utilization rates, realization rates, and collection rates:

- Utilization rate measures workload and productivity

- Realization rate measures the potential value of work performed

- Collection rate measures the ability to capitalize on work performed

Each year, we’ve been publishing industry-wide averages based on aggregated and anonymized data from tens of thousands of legal professionals using Clio. At a high level, this data indicates where a typical law firm can focus on improving key aspects of their business to generate greater revenue growth.

Low utilization indicates a need for more clients or more efficiency

Tracking key indicators of the use of my time gives me clarity that helps me better understand the needs of my clients and my practice. This clarity helps me identify areas of focus and opportunities for improvement. Finally, the ability to track progress over time offers motivation and encouragement as I do the work of serving my clients.

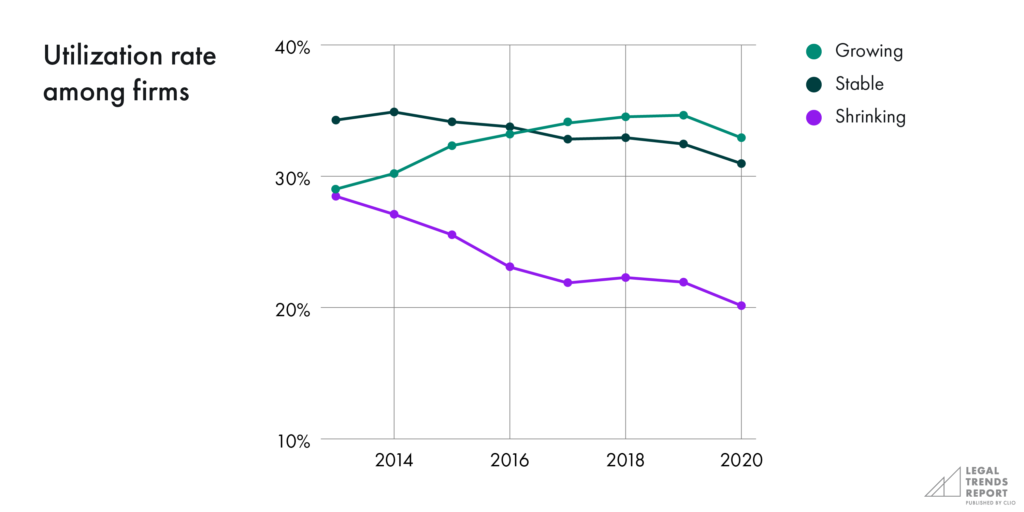

Year after year, the biggest challenge that law firms deal with appears to be the low utilization rates we see on an industry-wide basis. Utilization is the measure of how much of an 8-hour workday is devoted to billable work at a law firm, measured on a per-lawyer basis. In 2020, the average lawyer billed just 2.5 hours (31%) of an 8-hour day, indicating that many lawyers either don’t have enough clients to fill their day or that they struggle with inefficiencies in their firms that distract from billable work.

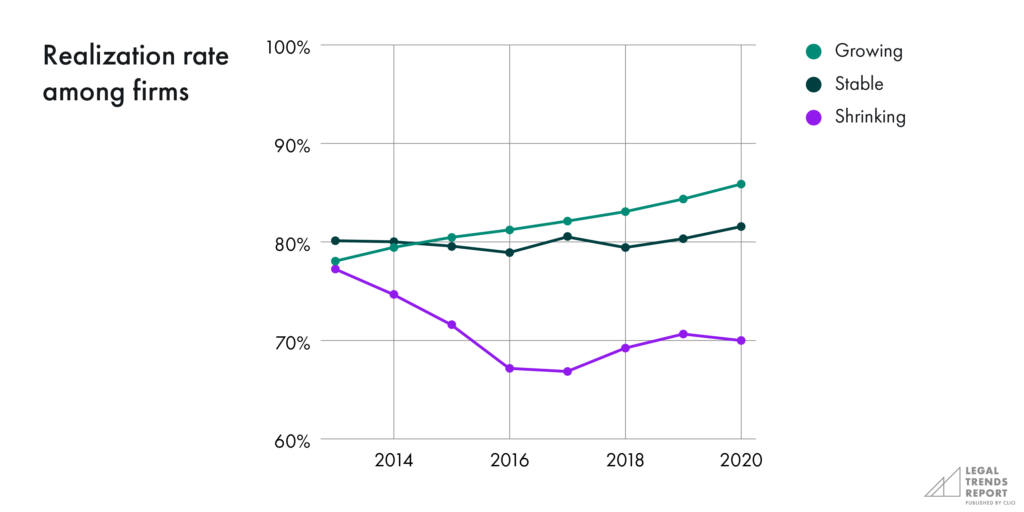

Realization rates continue to hinder earning potential

Realization rates measure how much of a firm’s billable work actually makes it to a client bill. The closer a firm’s realization rate is to 100%, the more billed hours are being converted into potential revenue. Offering services at a discounted rate—or otherwise writing off time—reduces a firm’s realization rate. Like utilization rate, realization rate can help to identify what is impacting a firm’s financial performance. In 2020, the average realization rate was 84%, indicating that many firms have room for improvement.

One potential cause of 16% of billable hours going unbilled at a firm could be that lawyers are underestimating the time legal matters will actually take them to complete, and are then refraining from charging their clients for the additional time they spend on them. These circumstances can result in stagnant or declining revenues, but understanding that these issues exist can give legal professionals the opportunity and insights needed to address the underlying causes and avoid adverse effects on their bottom line.

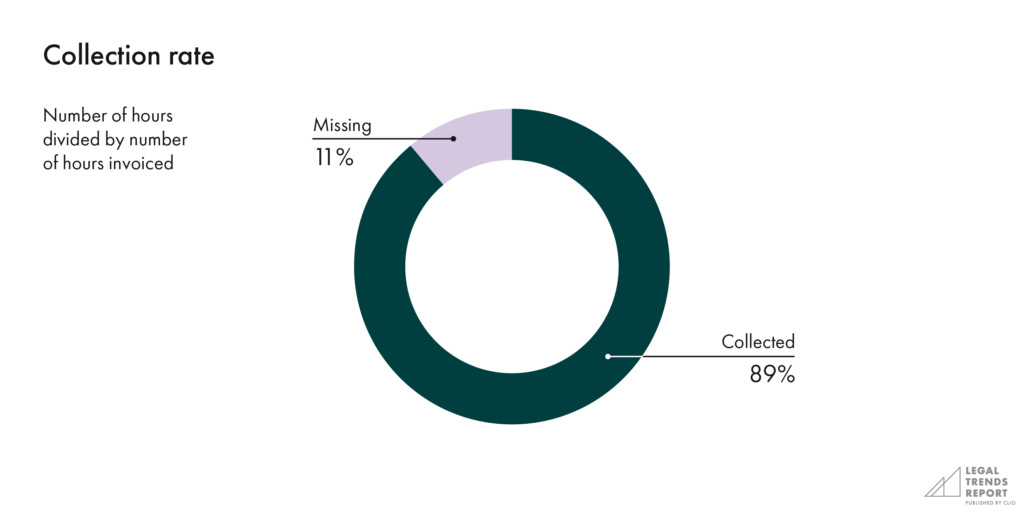

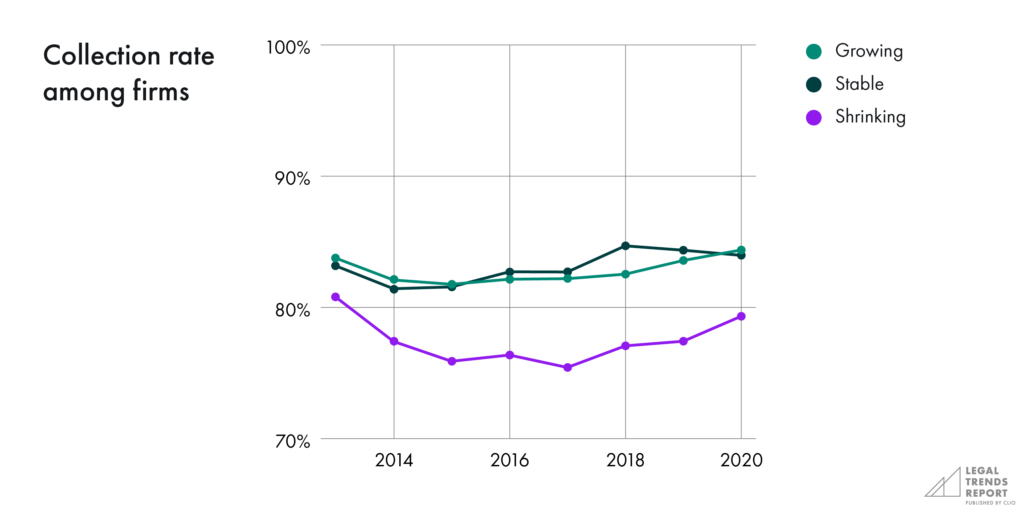

Collection rates reflect the challenges faced in getting clients to pay

A firm’s collection rate is a measure of its ability to capitalize on the billable work it performs—and is an important indicator of whether a lawyer’s hard work is actually generating revenue for their firm. The average collection rate for law firms in 2020 was 89%, which suggests that most law firms struggle to some degree in getting clients to pay their bills.

From a technology standpoint, a key area that is highlighted in consumer data is the preference for online payment solutions when paying their bills. This is another area where growing firms have an advantage in adoption rates compared to their shrinking counterparts. These systems reduce barriers to making payments while introducing greater flexibility and convenience for clients. When using online billing solutions with billing management software, firms also get the benefit of having up-to-date information on outstanding bills, simplifying the process of following up with clients who haven’t paid.

I know a lot of people who spend a lot of time at the end of the month putting in all their hours, and it seems like a waste. It blows my mind that people just don’t do it while they’re working.

Growing law firms continue to outperform rivals across key business metrics

When we look at multi-year cohort analysis data, it’s clear that growing firms have achieved improved performance across each of the key metrics discussed above, contributing to the unmatched year-over-year revenue growth for this group.

I love having these KPIs at my fingertips. It really makes me realize where I need to focus on improving both my billing and my business aspect of the law firm.

With the exception of 2020, growing firms have seen a steady increase in utilization rates, indicating that they are increasingly able to put more legal staff toward more billable work each year. Despite the total amount of billable work decreasing in 2020, this group appears to have increased both realization and collection rates during this time. This data suggests that, while the overall amount of work these firms handled may have decreased in 2020, they were able to realize and collect on more revenue for their business—resulting in stable business performance during that difficult year.

Shrinking firms have generally reported relatively poor performance across most business metrics, but in recent years this cohort has seen an increase in collection rates. This increase also correlates with a rapid adoption of online payments for both groups, which may explain the improved collection rates during this time.

2021 Legal Trends Report

Part 3

How lawyers are investing in their firms

- Introduction. Adapting to rapid technological change

- Part 1. Client expectations have changed

- Part 2. Technology advantages among growing firms

- Part 3. How lawyers are investing in their firms

- Part 4. Lawyers want to know more about their business

- Part 5. Setting new standards for legal service

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

When thinking about the future of any business, the reality is that resources will always be limited, and it’s up to decision-makers to do the best they can with what they have at any given moment. At the same time, making the right decisions today can have a substantial influence on the capabilities and opportunities for success tomorrow.

Basically it’s the client objectives, demands, or requests that drive our spending.

To better understand how law firms are focusing their resources, we conducted a survey to identify how they are prioritizing their spending now, and how they plan to prioritize it in the immediate future. Results show that staff remain a significant investment for law firms, while spending on practice management software has been and looks to remain a key area for spending. While law firms continue to spend significantly on office space, there are also indications that some lawyers are not interested in investing more in commercial office space in the immediate future.

Spending on practice management software reflects growth in technology adoption

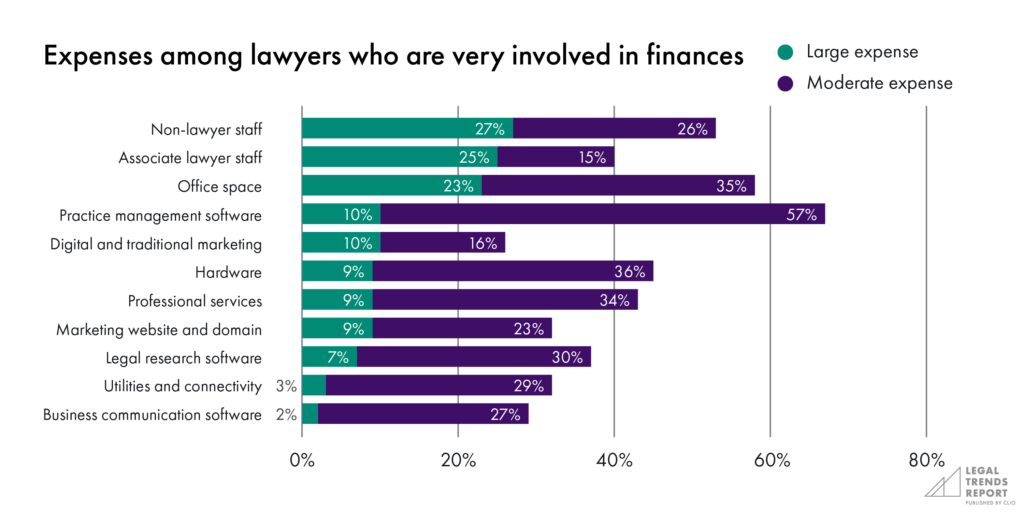

Many legal professionals see practice management software as a key area for investment, which accounted for a moderate or large expense in 67% of survey respondents—more than any other category.

It’s important as we analyze these findings to recognize that the survey data collected for this report is not an indication of overall spending as it relates to each category. Instead, these data points indicate a general sentiment related to spending within each category. For example, firms likely spend a greater amount on office space, legal staff, and non-legal staff due to the high-cost nature of these expenses. In fact, respondents were more likely to indicate these as “large” expenses compared to others they considered “moderate.” While spending on legal practice management software is typically reported as a moderate expense, most firms still indicate that this is a significant amount—moderate or large—of their total spending.

High spending on software may be a reflection of the increase in technology adoption that we’ve seen since the start of 2020, and could also be a result of the significant growth the legal technology industry has seen in recent years. As of September 2021, $1 billion in private equity has been invested in legal technology companies year to date, a significantly higher figure than the $510 million invested in 2020, and exceeding the previous record-breaking $989 million invested in 2019.1 For a profession that has traditionally seen little uptake in terms of technology adoption, this substantial increase in investment is an indicator that the market for legal-specific technologies is heating up, demonstrating both the advancements in technologies available for law firms, and that lawyers are more receptive to bringing them into their practice.

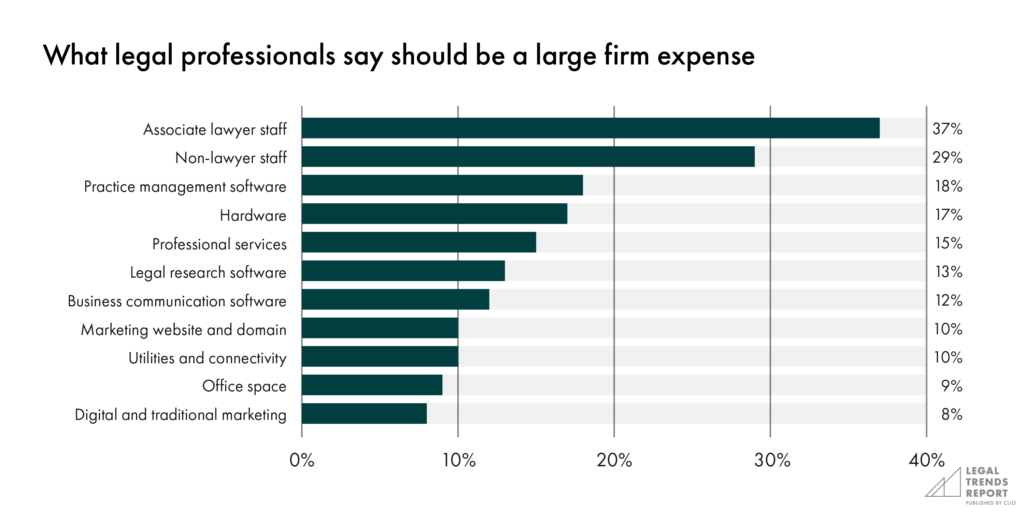

Firms think they should spend more on legal and non-legal staff

We can also look at what legal professionals indicated “should” be large expenses for a firm to get a sense of what they see as most important to their firms. When looking at which categories of spending should amount to a large expenditure, legal (37%) and non-legal (29%) staff rank the highest among respondents.

It may be an obvious statement, but more than anything legal is a people-centered profession, based both on the abilities of attorneys to provide quality outcomes for their clients, and legal staff at the firm to provide the type of service and care that keeps people coming back. Despite the many innovations in legal technology, legal services will remain a people-based service, and investment in technology should be focused on enhancing the legal products and services provided by legal professionals while maximizing their ability to work efficiently. In fact, compared to the data on how much law firms are currently spending as a large expense on legal staff (25%) and non-legal staff (27%), the data suggests law firms believe they should be spending more on people.

Many respondents were also more likely to indicate that practice management software should be a large expense (18%) compared to those that are currently spending a large amount (10%). In other words, this could be interpreted to mean that many firms believe they should be spending more on practice management software than they are currently. Similar comparisons can be made for other types of hardware and software, including software for legal research and business communications.

Office space is one of the few items on the list where fewer firms (9%) indicated it should be a large expense compared to those who currently report it as a large expense (23%), which suggests that many law firms spend more on office space than they feel they should.

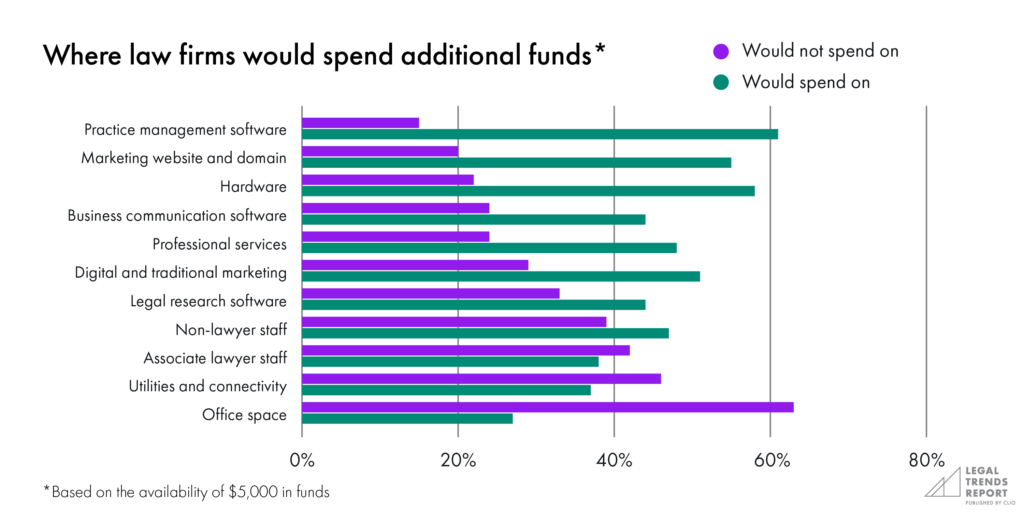

Firms are more likely to spend on software

To get a sense of where law firms are likely to invest their future spending, we asked respondents where they are both least likely and most likely to invest future resources if they are given access to newly available funds. The idea of this exercise is to determine where firms see the most potential for the future benefit of their firm, whether it is to improve their existing situations or to invest in furthering their future growth.

Where firms are least likely to invest any new resources is telling, as office space ranks the highest among 63% of respondents. And even though legal and non-legal staff were most likely to be areas in which respondents thought their firms should be spending, few would actually devote new resources to them.

Where respondents were most likely to spend were hardware and software. Despite being the most common moderate or large expense among law firms, 61% said they would invest more money in these solutions.

The takeaway here is that while spending on legal and non-legal staff may be seen as the most important areas for a firm to be spending resources on, they also represent high-cost commitments—and few would invest in these areas without the prospect of a steady income to pay for them. Instead, lower-cost investments like legal software and other technologies are seen as a more likely investment to boost existing firm processes and client services. These revenue-driving improvements could be a strategic investment aimed at giving firms the cash flow needed for higher-cost, longer-term investments in staff.

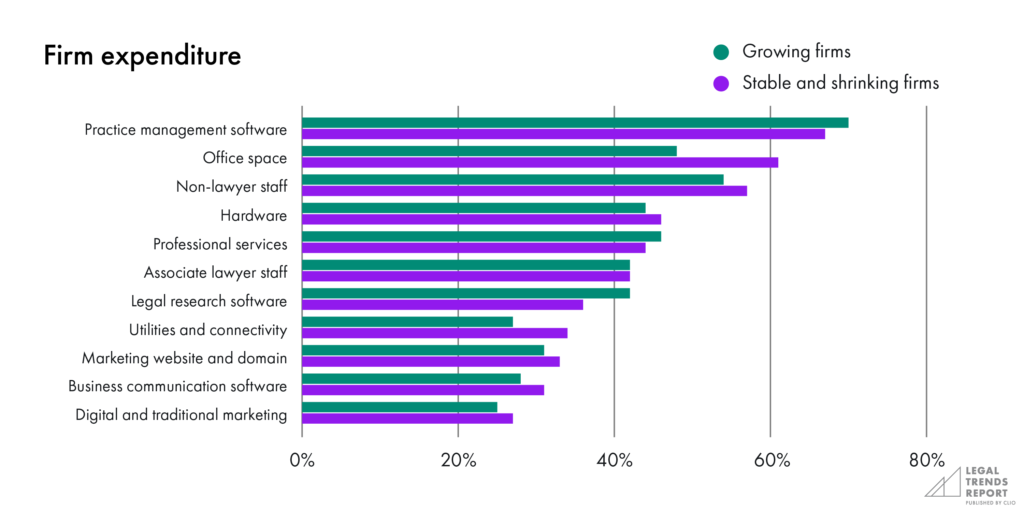

Growing law firms may be less likely to spend on office space

71% of law firms are prioritizing remote interaction over in-person

I don’t need to be spending time traveling and I don’t need to be spending this amount of money. So the office went.

Similar to the cohort analysis discussed in Part 2, we compared survey data between law firms that reported revenue growth of 50% or more and firms that reported less growth. For the most part, spending across each category is nearly identical, falling within a few percentage points between the two groups. The exception to this is in spending on office space and utilities, where growing firms are less likely to be spending a moderate or large amount. Though the margin is small, the difference is statistically significant, indicating that some firms reporting large increases in revenue may be thinking differently about how they design their physical office spaces, and what this means for the services that they deliver to clients.

Within the context of the pandemic, and how it has largely required that many businesses develop capabilities for remote working, this early data may be an indicator that law firms are innovating new means for interaction between staff and clients. In fact, survey data also reveals that 81% of law firms are currently enabling remote working for staff and clients, and 71% are prioritizing remote interaction over in-person.

The shift in mindset to more remote working arrangements could take many forms among legal professionals. Smaller office spaces could be used to prioritize client interactions that require more in-person or private meeting spaces, and could be arranged to operate as more of a shared space, which would be different from traditional law firm arrangements that have mostly been based on lawyers having their own private offices.

Sharing office space with other businesses—such as through coworking office services—could be another model for law firms to explore, as these offer the benefit of only paying for office space when it’s needed. These types of arrangements may be beneficial to law firms that have adopted work-from-home arrangements during the pandemic. Depending on the type of law being practiced—and the clients firms work with—working from home and offering fully virtual legal services may be an option for some.

The potential implications of these office arrangements could have a powerful impact on not just profitability, but also the nature of the legal services that are provided to clients. Reducing spend on office space could open up revenue for better profitability and investment in other areas of the business, such as staffing or technology, further increasing a firm’s growth prospects.

Many businesses outside of legal have reported cutting back significantly on office work arrangements, giving employees the option to work from home permanently while deriving significant cost savings on office amenities. Following similar announcements from Facebook, Twitter, Google, and other technology companies, professional services companies like PwC and its 40,000 employees have also transitioned to remote work arrangements.2 According to reporting in The Wall Street Journal, office occupancy rates have seen little recovery, ranging from between just 20% to 50% of pre-pandemic levels in major cities that include Dallas, Washington, D.C., New York, and San Francisco.3

Shifting the nature of legal service to rely on more remote interactions could also have benefits for certain types of clients that value the convenience and flexibility of these options. Finally, firms that manage to balance the costs and needs of both—creating spaces that are conducive to both the business and their client’s needs—are the ones that are likely to have an advantage over those that fall out of touch with the needs of their clients and the wider market for legal services.

Endnotes

[1] Metinko, Chris. “Legal Tech Makes Its Case With Venture Capitalists, Tops $1B in Funding This Year.” Crunchbase News, September 23, 2021.

[2] Kelly, Jack. “PwC Announces 40,000 U.S. Employees Will Work From Home: How This Can Cause A Chain Reaction Of Companies Offering Competing Remote Options.” Forbes, October 2, 2021.

[3] Broughton, Kristin, and Nina Trentmann. “Companies Cutting Office Space Predict Long-Term Savings.” The Wall Street Journal, Online (July 5, 2021).

2021 Legal Trends Report

Part 4

Lawyers want to know more about their business

- Introduction. Adapting to rapid technological change

- Part 1. Client expectations have changed

- Part 2. Technology advantages among growing firms

- Part 3. How lawyers are investing in their firms

- Part 4. Lawyers want to know more about their business

- Part 5. Setting new standards for legal service

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

I check my accounts at least once a week. As long as I know that more money is coming in than going out, then I’m okay.

It’s clear that lawyers today are faced with making crucial decisions about how they will adapt their firms to remain competitive amidst changing market conditions. Over the course of our research, we’ve discovered that making these decisions is an area where many lawyers are struggling. This could be due to several factors, but it seems that two of the most common challenges law firms face are a lack of business training and the absence of adequate tools to help keep them informed.

When we talk about staying informed, we mean that legal professionals need to be able to easily engage with key metrics so that they can understand what factors are having positive or negative effects on their firm’s financial performance. Lawyers equipped with this business intelligence can make better choices about how they will design client-centered legal services that fit the needs of consumers now and in the future.

Lawyers lack business training

Our 2019 Legal Trends Report found that many lawyers don’t receive the training they need to run the business side of a law firm. Only 7% of lawyers felt that law school prepared them to run a business, and just 23% said that their bar association provided adequate business training. This situation leaves many lawyers ill-equipped to manage and run a business by themselves, a problem which is compounded by the fact that 76% of lawyers feel they are already overworked.1 Without formal business training and little time for further education or self-guided learning, many lawyers may be in need of help to run better businesses.

Another issue—which may also be a direct result of the lack of business training—is that a large portion of firm managers don’t have insight into their business’s revenue and spending, two key areas that determine a firm’s financial performance.

Lawyers need access to revenue and spending information

Lawyers widely agree that revenue is one of the best metrics for tracking firm performance: 84% agreed that this is the metric they focus on and wish to improve in their firms when we asked about this in 2018.2 To make the right decisions when it comes to planning for the future success of their firms, lawyers need to understand their revenue and their spending above all else.

To develop a baseline of how well lawyers understand their revenue, we asked how much they believed it had grown since the same time last year. 56% believe it increased in that period, with one quarter of all respondents reporting that it grew by 50% or more.

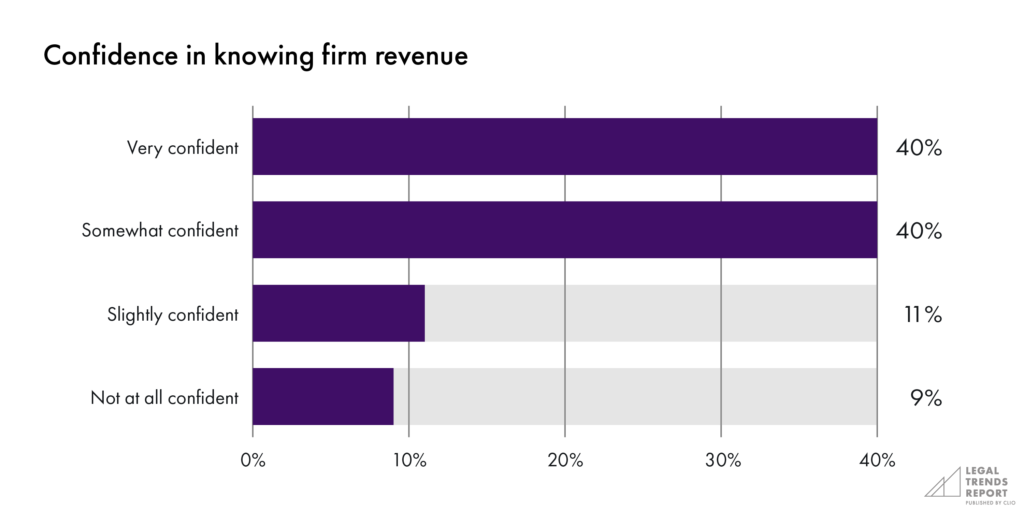

The good news is that these figures indicate that many firms may have adapted to and overcome the challenges of the past two years. The bad news is that these figures might not be entirely accurate: We asked the same lawyers how confident they are about their knowledge of these revenue figures, and 40% reported being only somewhat confident, while a further 20% were slightly or not at all confident. Put simply, while many lawyers may believe that their firms are on the right track financially, some of them don’t truly know whether this impression is accurate.

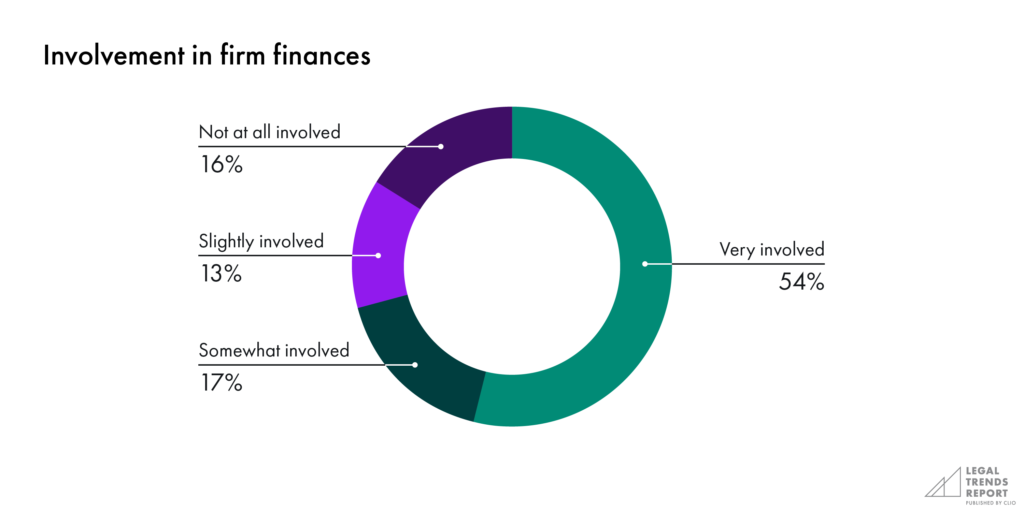

It should be noted that not all legal professionals are expected to be familiar with their firm’s finances. To ensure our analysis reflected this reality, we asked the lawyers we surveyed how involved they are in finances at their firms. Slightly more than half (54%) said they are very involved in their firm’s finances, while the rest reported little or no involvement in this area.

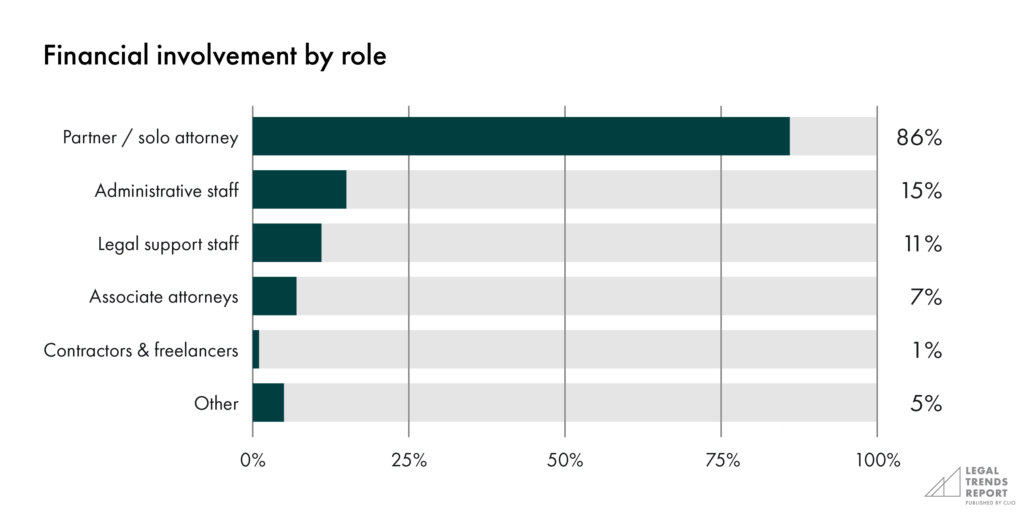

For the lawyers who reported being very involved in finances, we should expect that they are confident in their knowledge of key metrics like revenue and spending. The vast majority (86%) of these lawyers are managing or senior partners, or are solo attorneys. Associate attorneys, legal support staff, and administrative staff reported only low rates of financial involvement.

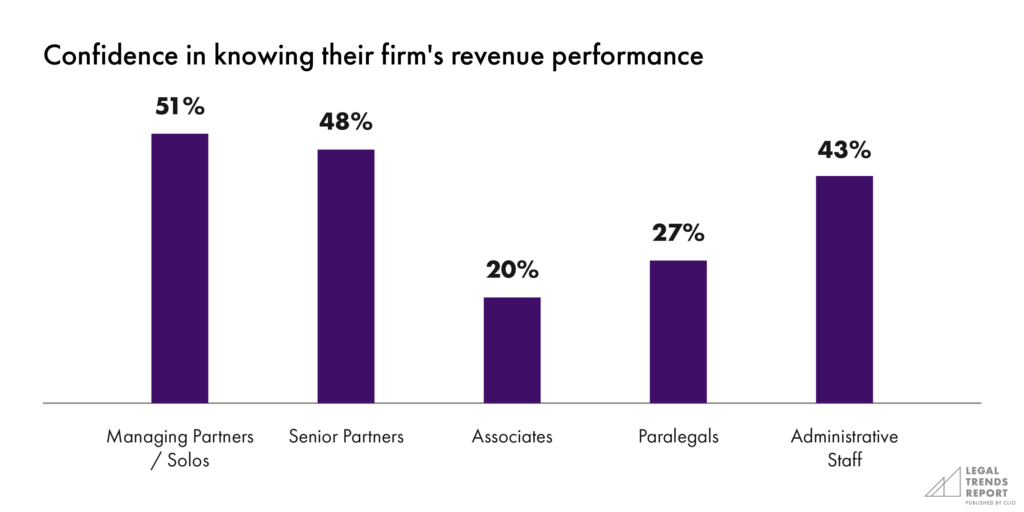

Since most partners and solo attorneys reported involvement in their firm’s finances, we should expect these lawyers to also have high levels of confidence in their knowledge of revenue growth. However, these lawyers still reported relatively low rates of confidence in their knowledge of year-over-year revenue trends: Only 51% of solo attorneys and managing partners say they are very confident, while just 48% of senior partners reported being very confident about their knowledge. While these rates of confidence are higher than those amongst the rest of the legal professionals we surveyed, they are still lower than they should be.

Only around half of solo attorneys, managing partners, and senior partners are very confident about their knowledge of finances in their firms.

These low rates of confidence among lawyers indicate that being involved in finances does not necessarily lead to knowledge of key metrics. This disconnect between involvement and understanding may mean that lawyers don’t have the right tools to keep themselves informed. In the same way that they can illuminate detailed metrics like realization and collection rates, reporting tools can also keep lawyers engaged with bigger-picture metrics like revenue growth.

Spending is the other side of the financial equation, and it is another area where we’ve found lawyers are in need of new, better tools to stay informed. We asked survey respondents how much they know about their firm’s spending. Overall, 25% agreed that they wished they knew more about their firm’s spending, and 16% were unsure if they knew enough. The implications here are that firm managers may be spending in areas of the business that aren’t contributing to the firm’s success, and as a result may be hurting profitability. At the very least, without a strong handle on what a firm is spending on, managers could be missing out on opportunities to invest in other areas of the business that will provide stronger growth.

This problem persisted even when we only asked those lawyers who told us they were very involved in their firm’s finances: 23% of them agreed that they wanted to know about what their firm is spending. Once more, many lawyers who are very involved in firm finances are not confident in their financial knowledge, which suggests that a significant number of law firms need better methods of connecting with important metrics.

Overconfidence leads to missed opportunities

Significantly, we’ve found that the lack of financial awareness among lawyers is not because they are ignoring these metrics: 92% of the lawyers we surveyed agreed that they need to be highly aware of what their practice spends, and 96% stated that they care a great deal about what their practice is spending its money on. This begs the question: If lawyers recognize the importance of this information, why are they not confident in their knowledge of what their firms spend?

Part of the issue may be that many lawyers are overconfident about the quality of their firm’s financial decision-making. We asked lawyers who are very involved in firm finances—42% of whom reported low confidence in their knowledge of firm spending—whether they thought their firm spent its money strategically. Despite the low confidence in financial knowledge among these lawyers, an astonishing 80% told us that they believed their firms did spend strategically.

This level of confidence in their firms’ spending is surprising given lawyers’ relatively low confidence in their own financial knowledge. It also prompts us to ask: If some of these lawyers don’t know what their firm is spending, how can they be sure that those spending choices are being made strategically?

These discrepancies we’ve identified in our survey results between self-reported knowledge and confidence may point to forms of unconscious bias impacting the answers that lawyers are giving. Social desirability bias in particular—the tendency to answer survey questions in a way that will be viewed favorably by others—may be present for some.

For many lawyers—especially those who are involved in their firm’s finances—it’s important that they take an objective look at how much they know about these finances and where their knowledge could be improved. Without accurate information about what resources are available to the firm, or where these resources are being spent, decision-makers can’t be confident about how they are investing in their firm’s future success.

Reporting tools—which, as we described previously, are being adopted more quickly by firms with growing revenues—are one solution for lawyers who need to remain informed of money coming in and money going out at their firms. These tools can help to track bills issued, payments collected, and a wide variety of expenses, centralizing all of this information in easy-to-understand formats. This information helps lawyers stay informed without distracting them from billable work, and ensures that firm managers are prepared to make strategic spending decisions that align with their goals for firm growth and client services.

Endnotes

[1] “Legal Trends Report 2019,” Clio, 39.

[2] “Legal Trends Report 2018,” Clio, 8.

2021 Legal Trends Report

Part 5

Setting new standards for legal service

- Introduction. Adapting to rapid technological change

- Part 1. Client expectations have changed

- Part 2. Technology advantages among growing firms

- Part 3. How lawyers are investing in their firms

- Part 4. Lawyers want to know more about their business

- Part 5. Setting new standards for legal service

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

[The pandemic] made it better, actually. Now all of my court hearings are on Zoom and any type of appearance is made on Zoom. Some courts have gone back to in-person hearings and trials, but I’m able now to be in more than one place.

The past two years have brought an unprecedented amount of change to all of our lives, and not all of it has been for the better. Naturally, many among us have a strong desire to see a return to what some might call “normal,” but as we discussed in last year’s Legal Trends Report, we should instead be aiming for a better normal. By this we mean using the upheavals of the pandemic as an opportunity to make changes that will benefit how we all live and work.

With this unprecedented change comes an unprecedented opportunity for legal professionals to lay a foundation for long-term success. The pandemic exposed many of the existing inefficiencies of the legal industry, and forced everyone to take note of the solutions that are available to remedy these issues for both lawyers and clients. Traditional modes of operation have been upended, and even the most apprehensive law firms have had to adopt the technological solutions that were previously only available in the most forward-thinking firms.

Where does this leave the legal industry in 2021 and beyond? This is a question we all have, and it’s one that this report has tried to answer.

While the exact long-term impacts of the last two years remain uncertain, we can begin to see a new foundation for the future of legal to be built on. Client expectations have shifted as a result of being exposed to better ways of accessing products and services of all types, including legal services. Traditional formats for communication are not going anywhere, but they can no longer be the only option available to consumers. Remote communication options have not only made legal services more flexible, but they have also recalibrated our sense of distance. Firms have been empowered to expand where they look for clients, and the law office can now be wherever a client wants it to be.

These new formats for engaging with a law firm are becoming a key component for any competitive firm, and it’s simply not possible to operate amidst current consumer demands without these capabilities. As we have seen, technological adoption has been crucial to firm success in the past, and this impact has only grown as these tools have become necessary components of legal services. However, technology adoption alone is not enough: firms must ensure that the way they harness new tools and processes are designed to deliver a client-centered service that will meet the high expectations of the modern consumer.

Lawyers need to recognize this change and be prepared to deliver value not just through their legal advice, but through the flexibility of their services. As technological solutions become the norm, how these solutions are implemented will be more important than simply having them available. Ensuring that implementation is client-centered is key to increasing the value that clients derive from legal services, and in turn is a crucial aspect of driving firm growth.

Nobody can say when we’ll feel that we’re truly past the pandemic, but what is clear is that many things will not return to the way they were. Consumer preferences will inevitably vary as time goes on, but they’re unlikely to return completely to the way they were before 2020. This unpredictable future offers further encouragement for embracing technology now. Flexible technological solutions mean that firms can offer enhanced experiences for all customers, whether they want to connect face-to-face or remotely. An uncertain future will eventually bring with it new challenges to overcome, but firms that have built resiliency into their operations through technology will be better prepared to rise to these challenges.

Being successful now is about adapting to what clients want. Remaining successful in the future depends on being prepared to continuously adapt and lead the way towards better, client-centered ways of delivering and accessing legal services.

2021 Legal Trends Report

Appendix A

Hourly rates and KPIs

- Introduction. Adapting to rapid technological change

- Part 1. Client expectations have changed

- Part 2. Technology advantages among growing firms

- Part 3. How lawyers are investing in their firms

- Part 4. Lawyers want to know more about their business

- Part 5. Setting new standards for legal service

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

Each iteration of the Legal Trends Report includes annual data on average hourly rates and key performance indicators (KPIs) to help analyze lawyer and law firm productivity, efficiency, and revenue generation.

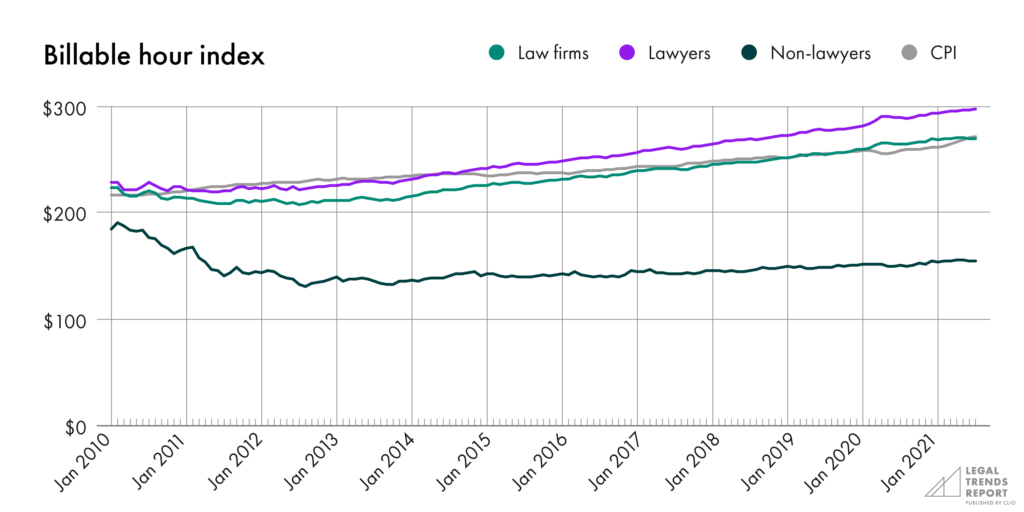

Billable Hour Index

Every year, Clio’s researchers analyze data from tens of thousands of legal professionals to determine the average cost for an hour of legal services in the United States. Changes to the average cost of legal services over time can be observed in the Billable Hour Index. To contextualize changes to the cost of legal services we have also looked at simultaneous changes in the Consumer Price Index to understand how hourly rates have changed in relation to the average cost of goods and services.

Understanding CPI

The Consumer Price Index (CPI) is a measurement of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services.1 CPI is used by the Bureau of Labor Statistics to measure inflation as it is experienced by consumers in their daily living expenses. CPI is fundamentally a measure of price change over time, making it a useful statistic to compare with changes in the cost of legal services across the U.S.

Key Performance Indicators

Several KPIs can be used to gain valuable insights into a law firm’s performance. This information helps lawyers build an understanding of how they and their employees are contributing to revenue generation, and can be instrumental in identifying areas for continuous improvement.

The following charts show three KPIs that every lawyer should be familiar with: utilization rate, realization rate, and collection rate. The figures given here are averages for each of these KPIs in 2020.

Despite the challenges posed by the pandemic, our data indicates that these KPIs saw slight increases between 2019 and 2020.

Hourly rates and KPI data for states and practice areas

The Legal Trends Report features aggregated and anonymized data from tens of thousands of legal professionals across the United States. Download the pdf version to get access to the full report, including appendices that include hourly rates and business metrics based on state, metropolitan area, and practice area.

Endnotes

[1] U.S. Bureau of Labor Statistics. “Consumer Price Index: Overview.” U.S. Government website, November 24, 2020.

2021 Legal Trends Report

Appendix B

Detailed methodology

- Introduction. Adapting to rapid technological change

- Part 1. Client expectations have changed

- Part 2. Technology advantages among growing firms

- Part 3. How lawyers are investing in their firms

- Part 4. Lawyers want to know more about their business

- Part 5. Setting new standards for legal service

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

App data collection

The Legal Trends Report uses aggregated and anonymized data collected from the Clio platform. By synthesizing actual usage data, we’re able to identify trends that would be otherwise invisible to most firms.

The Legal Trends Report has been prepared using data aggregated and anonymized from tens of thousands of legal professionals. These customers were included in our data set using the following criteria:

- They were paid subscribers to Clio. Customers who were evaluating the product via a free trial or were using Clio as part of our Academic Access Program were not included.

- They were located in the contiguous United States. This includes the District of Columbia but excludes Hawaii and Alaska. No customers in other countries were included.

- Any data from customers who opted out of aggregate reporting were excluded.

- Outlier detection measures were implemented to systematically remove statistical anomalies.

Data usage and privacy

The security and privacy of customer data is our top priority at Clio. In preparing the Legal Trends Report, Clio’s data operations team observed the highest standard of data collection and reporting.

Data collection

- All data insights were obtained in strict accordance with Clio’s Terms of Service (section 2.12).

- All extracted data was aggregated and anonymized.

- No personally identifiable information was used.

- No data belonging to any law firm’s clients was used.

Reporting

Aggregate data has been generalized where necessary to avoid instances where individual firm data could be identified. For example, to avoid reporting data on a small town with only one law firm, which would implicate all of this town’s data to this firm, we only report at country, state, and metropolitan levels.

Additionally, raw data sets will never be shared externally. Clio is effectively a tally counter for user interactions—much like stadiums use turnstiles to count visitors without collecting any personally identifiable information from their customers. Similarly, as users interact with the Clio platform they trigger usage signals we can count and aggregate into data sets. We can identify trends without collecting information that reveals anything specific about individual customers.

Survey design

The 2021 Legal Trends Report includes survey data collected between May and June, 2021.

Survey of US legal professionals

- 1,056 respondents

Survey of US consumers (general population)

- 1,002 respondents

- Survey respondents were representative of the US population by age, gender, region, income, and race/ethnicity, according to US census statistics

Cohort analysis

This year’s Legal Trends Report revisited the cohort analysis which was first described in the 2019 Legal Trends Report. This analysis uses aggregated and anonymized data from Clio users collected between January 1, 2013 and December 31, 2020. This data was used to divide Clio users into three cohorts based on annual revenue generation. By analyzing these cohorts and their performance, we were able to identify large-scale trends within each to inform our analysis of the legal industry as a whole.

Legal professional interviews

We conducted interviews with legal professionals to understand how the pandemic affected their firms and how adaptations to these changes might continue in the future. These interviews also provided important perspectives on how the pandemic impacted legal professionals’ work-life balance, their interactions with clients, and their work within the court systems.