Legal Trends for Solo Law Firms

Introduction

Solo law firms confronted with new challenges

- Introduction. Solo law firms confronted with new challenges

- Metrics. Key metrics for success in the wake of COVID-19

- Technology. Technology adoption improves revenues at solo law firms

- The Future. Creating a vision for the future of solo legal practice

- Appendix A. Additional data visualizations

- Appendix B. Detailed methodology

Solo law firms face unique challenges when it comes to running a legal practice. This couldn’t be more clear than in Clio’s research, which looks at both how law firms have been affected by the COVID-19 pandemic, and where lawyers have seen the most success in adapting to these difficulties.

As a whole, solo law firms struggled more significantly in adapting to remote work throughout the pandemic. However, many solo lawyers were also quick to recover, to the point of seeing substantial business growth compared to the previous year, showing that, in fact, it is possible to operate a thriving legal practice in the face of challenges posed by COVID-19.

The data in this report is based on research conducted for the annual Legal Trends Report, published in the fall of 2020. The report highlighted the fact that many of the long-standing challenges legal professionals have endured over the years were magnified due to the constraints of the pandemic, with law firms and the legal system itself not being set up to operate or serve clients remotely. These constraints were felt to an even greater degree by solo law firms.

Solo law firms struggled more significantly in adapting to remote work.

Client expectations of solo law firms have changed

While solo lawyers are typically more agile—burdened less with organizational bureaucracy and coordination between staff and decision makers typical of a larger firm environment—solo lawyers often struggle with fewer resources to determine what actions to take and how to implement changes. As a result, while many solo lawyers have been able to operate more nimbly, offering more attentive and responsive service, many struggled to keep up with the rapidly evolving client needs throughout 2020.

As the world continues its effort to eradicate the coronavirus in 2021, the situation has created a competitive opportunity for law firms that are able to adapt to the circumstances of the present.

As the behaviors—and expectations—of clients continue to shift, we’ve reached a tipping point in technology adoption, a point that we’ll likely never return from. Many of the advantages to remote work will continue to be advantages beyond the pandemic, and are therefore likely to remain in place. However, as we’ve seen in the research, solo law firms as a whole have not been leaders in innovation—instead they have been about average in terms of technology adoption, if not lagging slightly behind larger firms.

As client expectations continue to evolve with the possibilities that technology present, firms that are able to meet these expectations will be the ones to see growing success throughout 2021 and in the years to come.

Solo lawyers often struggle with fewer resources to determine what actions to take and how to implement changes.

Solo lawyers can benefit greatly from small adaptations

Recent studies show: 77% of legal problems don’t receive legal help1, and 86% of civil legal problems faced by low-income individuals receive either inadequate or no legal help at all2. This indicates that there is a massive gap between those who need legal help and those who provide legal services. In business terms, this is known as a latent market, one that presents a significantly large opportunity for law firms, and solo practices in particular, since the lawyers that determine the means for servicing this market are the ones that will see the rewards of a more profitable business.

How should solo lawyers look to adapt? Small, incremental changes are key. Over time, the aggregation of marginal gains will ultimately compound to achieving the type of transformational change that lawyers should be seeking, for the benefit of their firms, and their clients.

While COVID-19 has presented an overwhelming amount of challenges, it has also presented a unique opportunity to reimagine the future of the legal service experience. The data in this report aims to help solo law firms better understand the challenges of 2020, and what they will mean for the future of legal practice. Similarly, in reviewing data from tens of thousands of law firms who continued to provide legal service during the pandemic, we help uncover where lie some of the greatest opportunities for solo law firms to improve.

[1] World Justice Project, Global Insights on Access to Justice, 2018.

[2] Legal Services Corporation, Justice Gap Report, 2017

How should solo lawyers look to adapt? Small, incremental changes are key.

In this report

Understanding the impact and opportunities for solo law firms. Clio’s analysis of aggregated and anonymized data from tens of thousands of legal professionals provides unique insight how solo law firms have been affected, and how they can adapt to these difficulties, as well as the new expectations of clients.

Reimagining client experience in a post-pandemic world. As the rise of cloud-based technologies has helped the world adapt to everyday social restrictions, it has also created new opportunities to redefine the delivery of legal services to the benefit of both lawyers and their clients. The analyses in this report look at what the future of legal service could look like, and how the foundation for this evolution has already been set.

Data Sources

Each year we use a range of methodologies and data sources to better understand the state of legal practice and what opportunities exist for improvement.

Clio Data

The Legal Trends Report uses aggregated and anonymized data from tens of thousands of legal professionals in the United States. This year, we’ve adapted and expanded our analysis to provide more up-to-date data on law firms to better identify the challenges faced during the global pandemic in 2020.

Surveys of Legal Professionals and Consumers

We conducted ongoing surveys of thousands of legal professionals and consumers since the start of the COVID-19 pandemic. The data uncovered in these studies provides unique insight into the challenges and opportunities of 2020.

Longitudinal Research

We conducted a longitudinal study following 16 lawyers as they navigated the impact of COVID-19 on their businesses through April and May. Several snippets of these interviews are featured throughout this report to help describe the experience of working at a law firm in 2020, from lawyers themselves.

We’ve reached a tipping point in technology adoption, a point that we’ll likely never return from.

Legal Trends for Solo Law Firms

Metrics

Key metrics for success in the wake of COVID-19

- Introduction. Solo law firms confronted with new challenges

- Metrics. Key metrics for success in the wake of COVID-19

- Technology. Technology adoption improves revenues at solo law firms

- The Future. Creating a vision for the future of solo legal practice

- Appendix A. Additional data visualizations

- Appendix B. Detailed methodology

Key metrics for success in the wake of COVID-19

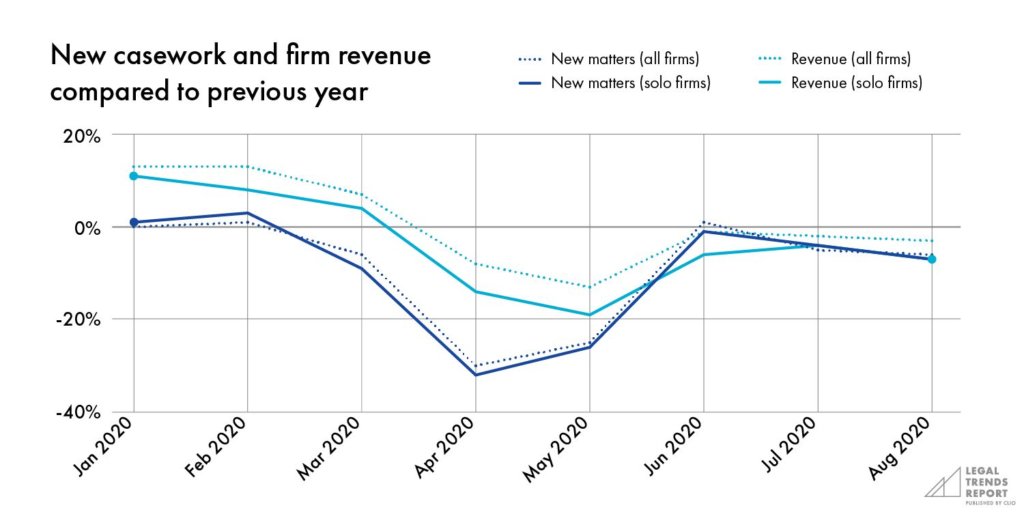

The outbreak of COVID-19 had a drastic impact on virtually everyone in the spring of 2020, with law firms seeing the impact as early as March. Two key metrics—new casework and firm revenue—help demonstrate just how law firms were affected initially during the pandemic, what recovery looked like throughout the summer, and how solo law firms should focus on building their business as the impact of COVID-19 continues to subside in 2021.

Overall, while solo law firms were affected similarly to firms of other sizes with regards to new casework, the impact on overall revenue was more severe. When compared to the previous year, solo law firms saw casework fall 32% in April, slightly below the average for all law firms. While caseloads began to recover in May and through summer, revenue continued to decline for solo law firms, falling by 19% compared to the previous year. From April to June, solo law firms saw a drop of between 5% and 7% more than firms with more lawyers, indicating that solo lawyers were affected significantly more by the pandemic.

While solo law firms were affected similarly to firms of other sizes with regards to new casework, the impact on overall revenue was more severe.

Lawyers continue to see lasting impacts

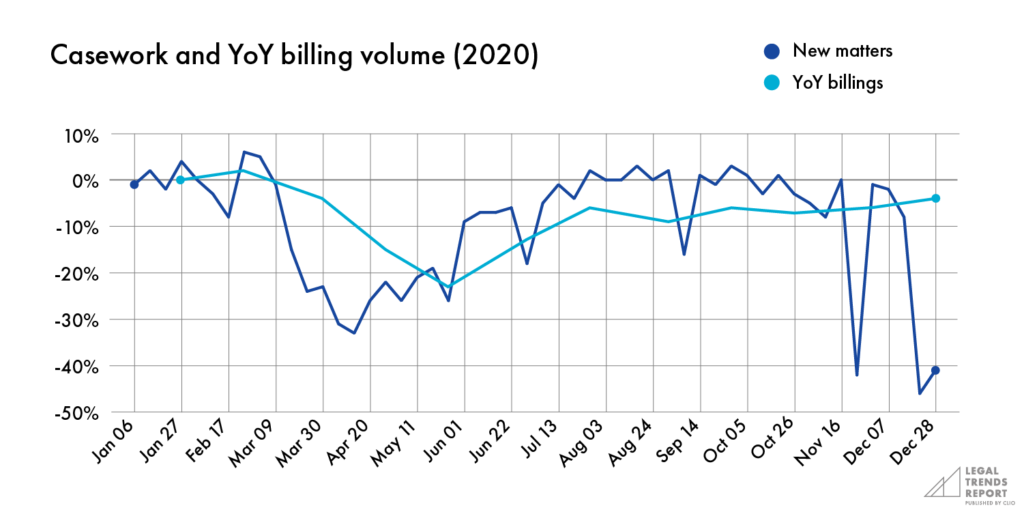

In addition to the impact analysis to firm growth during the first months of the pandemic, Clio has been conducting an ongoing assessment of casework and firm billables since the start of 2020.

- New matters. Clio’s baseline analysis shows that casework among law firms has largely recovered since the initial months of the pandemic compared to the first months of 2020. While March, April, and May saw a significant slowdown, seeing as much as a 33% drop in new cases, on average, firms saw caseloads return close to baseline by June.

- Monthly billings. Looked at on a monthly basis, compared to revenue from the previous year, monthly billings never fully recovered in the summer months, and beyond, as law firms continued to see billing shortfalls of 6% or more.

The ongoing analysis of new matter volume and monthly billing looks at the impact on all law firms, but if we use the impact analysis at the beginning of this section as an indicator of how solo law firms fared in 2020, the data suggests that they were affected just as much, if not more.

At first I felt like it was the end of the world. But I think that mindset contributed to the revenue loss because I wasn’t diligent about marketing, being proactive, following up, and reaching out. But then I read something and it was like, ‘listen, you just pivot, you don’t stop.

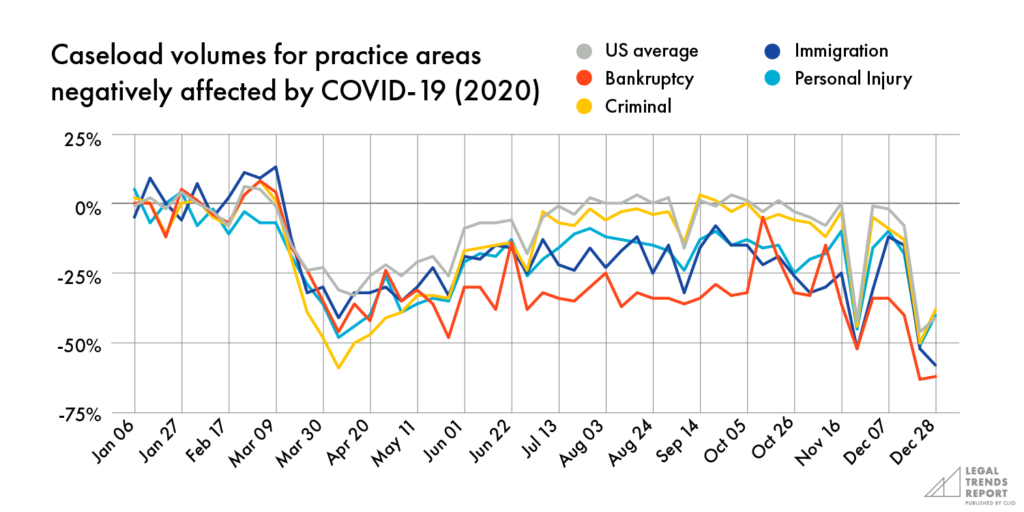

Practice areas most affected during COVID-19

Some practice areas were affected more than others, especially during the initial onset of the coronavirus pandemic. Criminal law casework, which is a common practice area among solo law firms, saw a drop of 59% in the spring. Other practice areas such as personal injury, immigration, and bankruptcy have seen lasting negative impact on casework relative to national averages throughout the fall and winter.

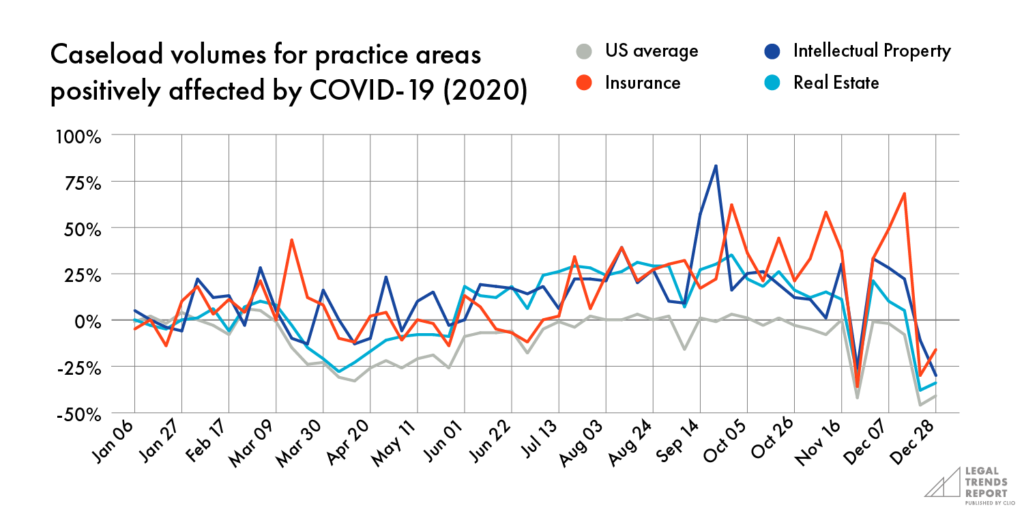

Intellectual property, insurance, and real estate, on the other hand, have seen substantial increases in casework relative to baseline levels throughout the summer and into the fall.

While COVID-19 has affected the demand for legal services in different areas of legal practice, the use of technology to adapt to remote working conditions also correlates strongly to business performance, regardless of practice area, which is discussed in Part 2 of this report.

Solo law firms remain concerned about future revenue

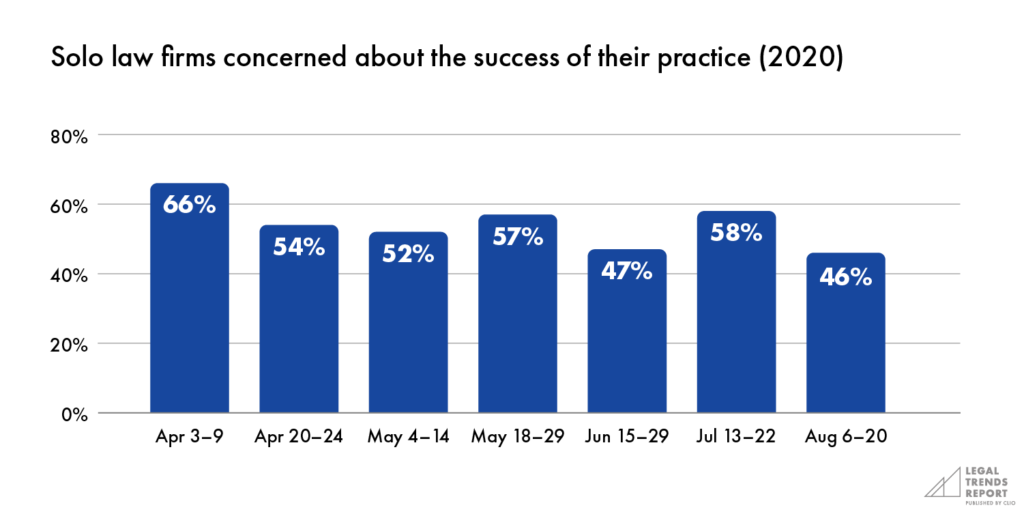

While the range of casework has varied across firms in different practice areas, many solo lawyers have indicated concern about the future of their legal practice. In conducting an ongoing series of surveys through the spring and fall, as many as 66% of solo lawyers were concerned about the success of their legal practice, and 47% were worried about making a living. As many as 60% reported seeing a decrease in the number of clients reaching out to their law firms.

Solo law firms were especially concerned about their clients’ ability to pay the legal bills, and many have had to forfeit revenue. 72% of solo law firms expressed concern about their clients’ ability to pay, and 24% reported having to forfeit revenue by June 2020, which may have an impact on annual earnings for solo law firms. By July 2020, 15% of solo law firms reported having to lay off staff.

66% of solo lawyers were concerned about the success of their legal practice.

As law firms continue to be impacted by the COVID-19 pandemic, lawyers should look for strategies to (1) support clients and maintain their business through 2021, and (2) ensure they are building a strong foundation for meeting the needs of clients beyond the impact of the pandemic.

As discussed in the next section of this report, solo law firms using electronic payments, client portals, and client intake and CRM solutions have achieved substantial gains in both these areas compared to others. Despite 2020 being one of the most challenging years for legal practice, these law firms managed to defy the odds to see more success than the year prior.

Despite 2020 being one of the most challenging years for legal practice, these law firms managed to defy the odds

Legal Trends for Solo Law Firms

Technology

Technology adoption improves revenues at solo law firms

- Introduction. Solo law firms confronted with new challenges

- Metrics. Key metrics for success in the wake of COVID-19

- Technology. Technology adoption improves revenues at solo law firms

- The Future. Creating a vision for the future of solo legal practice

- Appendix A. Additional data visualizations

- Appendix B. Detailed methodology

Technology adoption improves revenues at solo law firms

While it may be tempting for law firms to hope for a return back to a pre-pandemic normal, the reality is that COVID-19 has fundamentally transformed consumer behaviors—and client expectations for the long term. (The next section in this report will go into more detail as to how these expectations have shifted.)

This section looks at how the use of key technologies—specifically electronic payments, client portals, and client intake and CRM solutions—has helped solo lawyers mitigate the initial impact of the coronavirus pandemic. These technologies have also accelerated recovery, resulting in solo lawyers earning over $50,000 more revenue than others.

In fact, solo law firms benefited to an even greater degree than firms of other sizes. As solo law firms continue to adapt to the changing needs of clients, the success of firms using these technologies should serve as a model for how other solo law firms should look to invest in their own innovation.

The pandemic is pushing people to be more technologically savvy. It’s going to hurt people that are resistant. For the lawyer who is able to adapt, I think they’re really going to thrive.

Tech solutions earn solo law firms $50,000 more in revenue

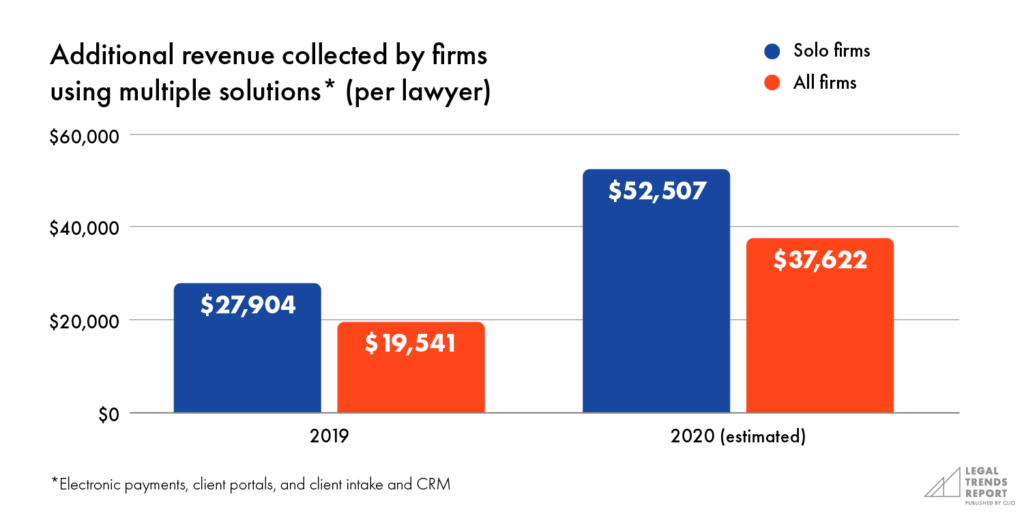

In 2020, solo law firms using these technologies collected $52,507 more revenue than other solo firms—and $14,885 more than firms with more lawyers using these technologies. This revenue advantage represents a massive sum for any solo law firm, or any law firm on a per-lawyer basis.

While the revenue advantages to these technologies have grown more substantial since the start of the pandemic, when remote work has become the norm, law firms have seen significant benefits even prior to 2020.

In 2019, solo law firms using electronic payments, client portals, and client intake and CRM solutions collected $27,904 more revenue than firms that weren’t using these technologies—which was also $8,363 more on a per-lawyer basis than firms with more lawyers who were also using these technologies. This shows that while these technologies have created value for law firms operating under remote-working conditions, they also create the types of efficiencies and client satisfaction that build positive business returns in more traditional business contexts.

This revenue advantage represents a massive sum for any solo law firm, or any law firm on a per-lawyer basis.

The aggregation of marginal gains

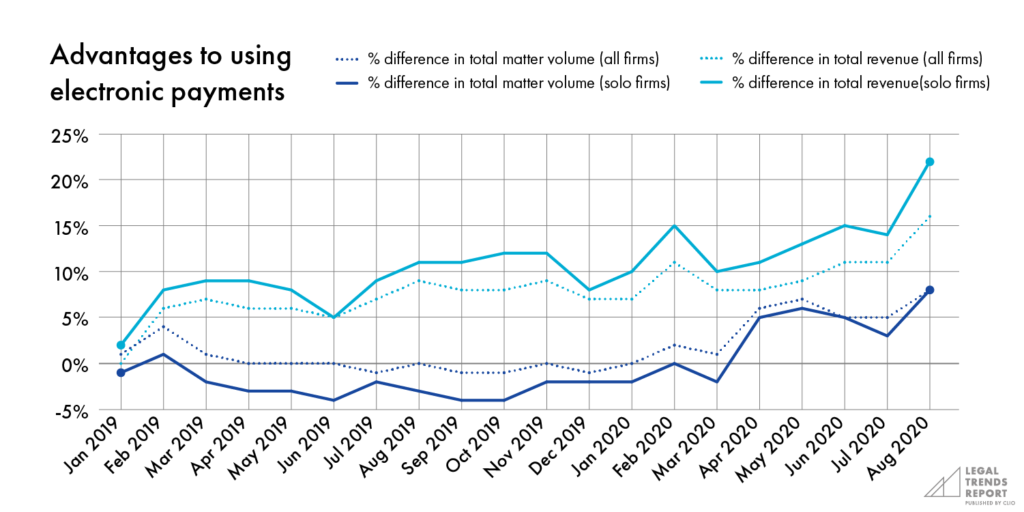

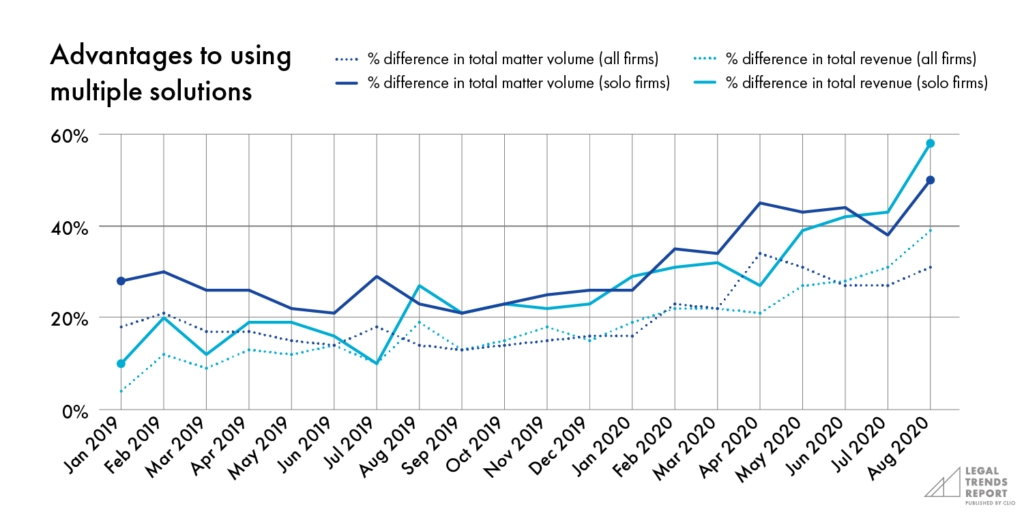

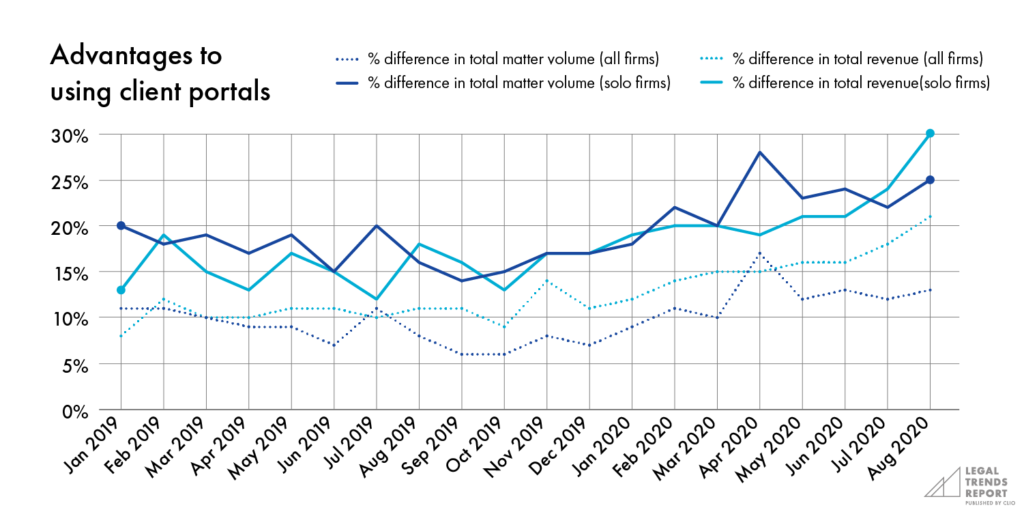

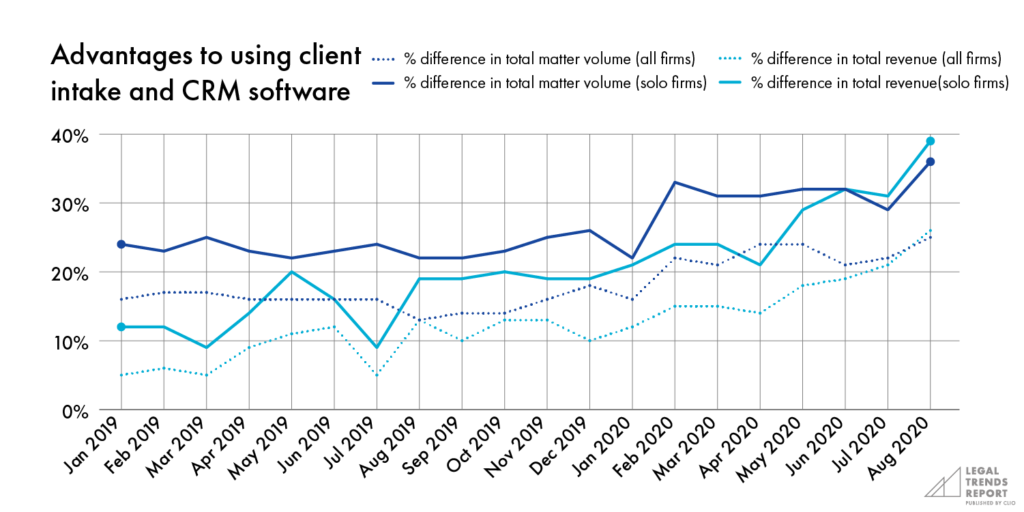

When looking at month-to-month comparisons of how solo law firms performed against industry averages, those using electronic payments, client portals, and client intake and CRM solutions saw significant advantages in terms of both matter volumes and revenue generation.

These advantages can be seen throughout 2019 and early 2020, prior to the onset of the pandemic, but they increase substantially throughout the pandemic, when solo law firms using these technologies saw up to 58% more revenue and 50% more casework than other solo law firms not using these technologies.

When comparing these advantages to firms of other sizes, solo law firms generated up to 18% more revenue and 19% more casework. Again, the most substantial differences emerged throughout 2020.

What’s critical to take away from the comparison of casework and revenue below, for both solo law firms and non-solo law firms, is the fact that we see each of these cohorts achieve substantial advantages—and often grow their advantages incrementally—every month. As this advantage increases, so does the overall benefit from the investment in these technologies, which results in a massive difference in revenue on an annual scale.

We need to not treat this like a patchwork of temporary solutions, let’s really market it for what it is, which is the reality.

Technology adoption creates substantial business growth during COVID-19

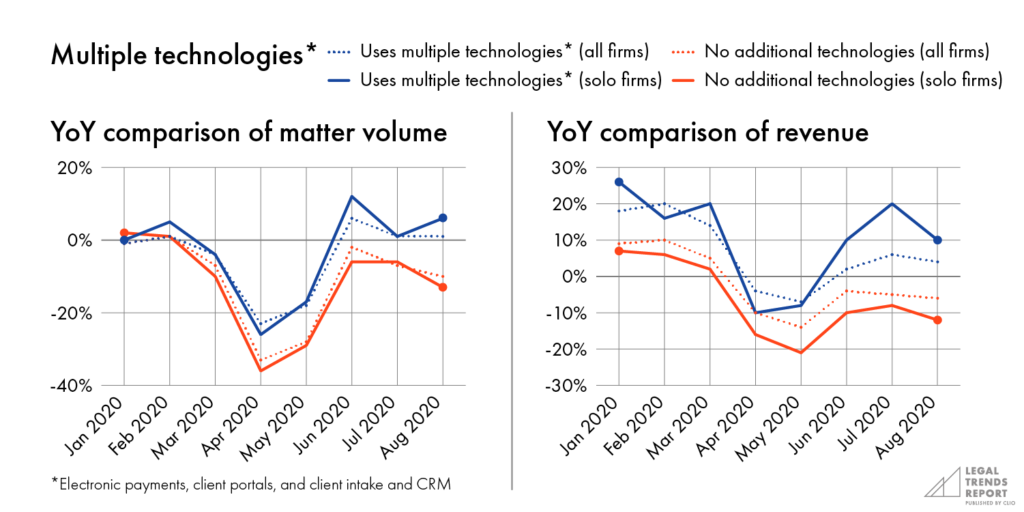

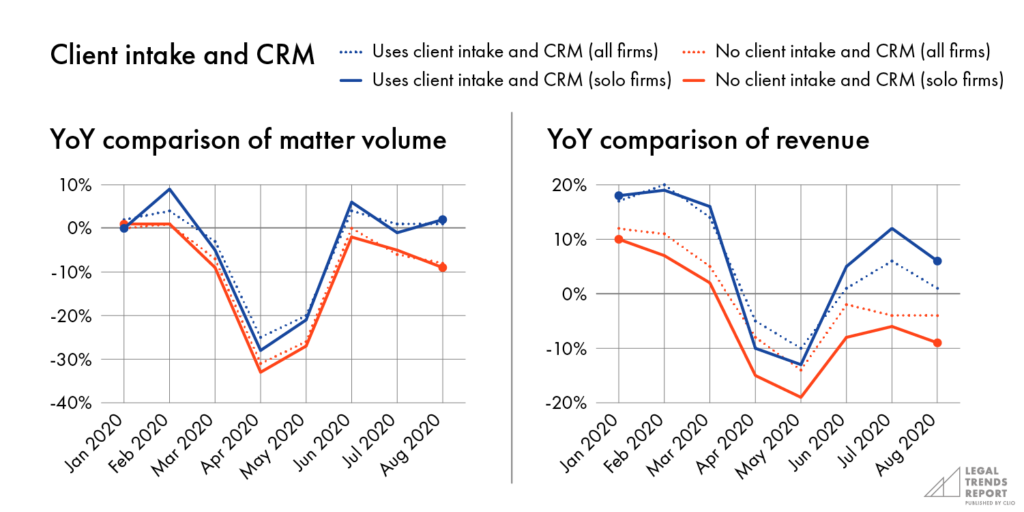

Technology-enabled solo law firms didn’t just see gains in relation to other law firms—they saw growth compared to their own past business performance from the previous year.

Solo law firms saw both greater advantages to using these technologies as well as greater detriments to not using them. In July, solo law firms that had adopted these technologies saw their revenues grow by 20% compared to the previous year, while those not using these technologies collected 8% less the same month, and 12% less in the following month.

For comparison, firms of all sizes using these technologies saw on average 6% and 4% revenue growth in July and August, while during the same time period, those not using these technologies saw reductions in revenue of 5% and 6%. The difference in trends, whether growth or contraction, applied month over month, can have a significant impact on the future prospects for a business.

For matter volume, by June, tech-enabled law firms experienced a spike in casework relative to the year before, taking on more work than would be expected given the ongoing challenges of COVID-19. Law firms, both solo and non-solo, that weren’t using these technologies during this time saw an overall reduction in casework relative to the previous year, and never fully recovered in the summer months. This means these firms opened fewer matters in these months than they did the year before.

My hope is, as I’m pivoting to virtual, I’ll get the younger or middle-aged crowd who are more comfortable with it. And then as they become over the years the folks who need guardianship or estate services, then I’ll already be there.

I don’t want to attract thousands of clients and then drop the ball because the efficiency and the streamlined procedures and processes are not in place.

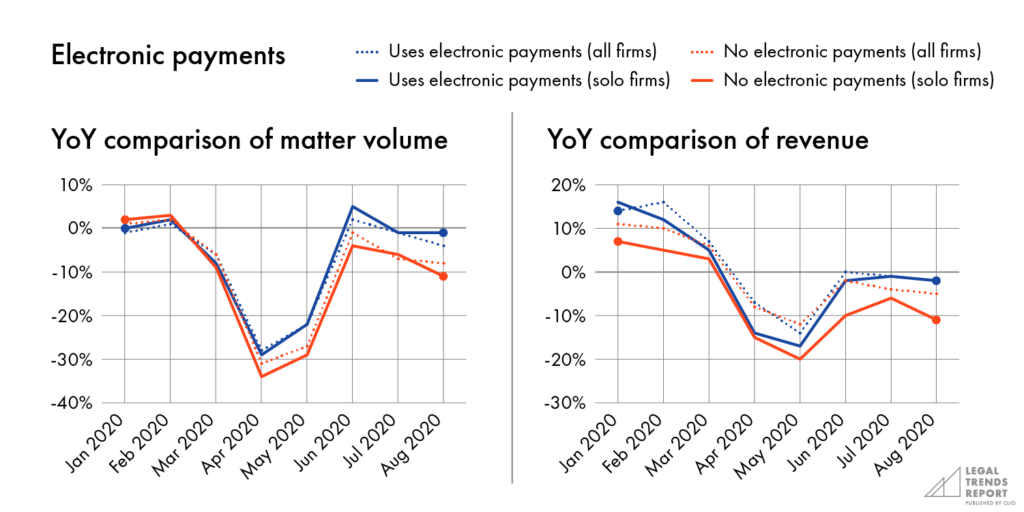

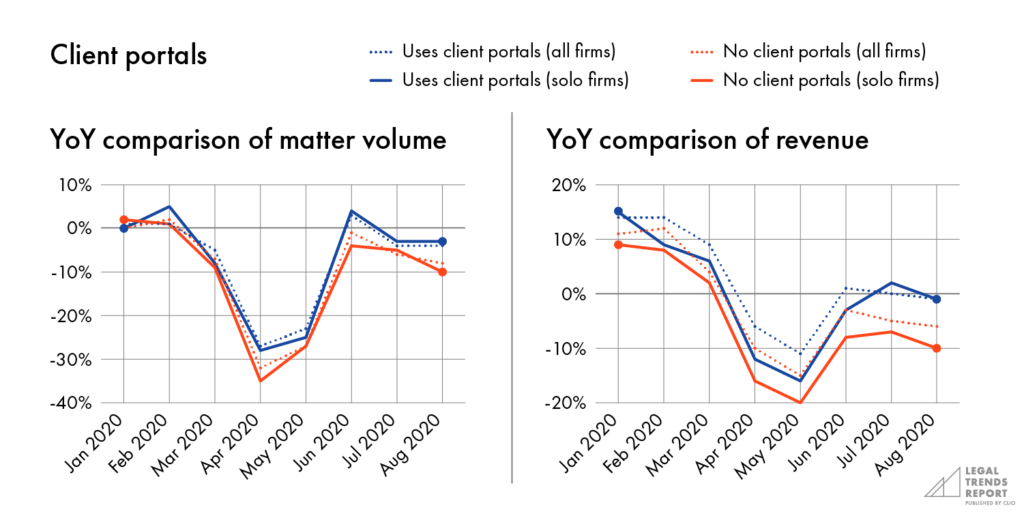

The summary of analysis above looks at the impact of using electronic payments, client portals, and client intake and CRM, but each of these solutions on their own offers substantial advantages to law firms.

- Electronic payments. Solo law firms using electronic payments brought in fewer new matters prior to the pandemic, but brought in more revenue compared to those not using electronic payments. After the initial onset of the pandemic, solo law firms using electronic payments saw more casework and more revenue.

- Client portals and client intake and CRM solutions. Solo law firms had more casework and brought in more revenue when using client portals and client intake and CRM solutions. Overall, firms not using these solutions saw less revenue in comparison. Those using client intake and CRM solutions saw even greater revenue advantages when recovering from the pandemic.

Looking forward to the rest of 2021 and beyond, however, solo law firms should be looking at what client expectations will look like past the COVID-19 pandemic.

The data in this section indicates how tactical changes at a law firm can lead to significant benefits over time. Solo law firms have the advantage of being able to adapt and adopt new business strategies without the significant administrative overhead that can restrict larger firms.

Each of the solutions discussed in this section offers an opportunity for any solo law firm to improve their client services, and more data is provided for each solution in Appendix A.

Looking forward to the rest of 2021 and beyond, however, solo law firms should consider what client expectations will look like past the COVID-19 pandemic. In the last year, consumer behaviors have shifted significantly, and it’s important to examine what added capabilities and efficiencies will benefit lawyers and clients on a more permanent basis.

Solo law firms saw both greater advantages to using these technologies as well as greater detriments to not using them.

Legal Trends for Solo Law Firms

The Future

Creating a vision for the future of solo legal practice

- Introduction. Solo law firms confronted with new challenges

- Metrics. Key metrics for success in the wake of COVID-19

- Technology. Technology adoption improves revenues at solo law firms

- The Future. Creating a vision for the future of solo legal practice

- Appendix A. Additional data visualizations

- Appendix B. Detailed methodology

Creating a vision for the future of solo legal practice

Survey research reported in the 2020 Legal Trends Report indicated a dramatic shift to cloud-based technology in 2020, driven by the needs of both legal professionals and their clients. Social distancing recommendations put in place across the United States had a drastic impact on how people lived their lives on a daily basis, as well as in how they interacted with businesses and professional services.

According to consumer survey data:

- 50% of consumers said they were more comfortable with technology

- 52% said they were using technology more

- 58% said technology was more important to them than before the pandemic

- 53% said cloud technology was a necessity

Meeting the expectations of clients in 2021

In turn, the increase in technology adoption is also reflected in how clients want to work with law firms. Rather than seek out in-person meetings and physical contracts, the data shows that clients are seeking out electronic solutions from lawyers:

- Videoconferencing. 37% of consumers prefer to meet virtually with a lawyer for a consultation or first meeting, and 50% would rather conduct follow-up meetings through video conference. 56% of consumers would prefer videoconferencing over a phone call.

- Electronic payments. The majority of consumers (65%) prefer to pay using electronic forms of payment, such as credit cards, debit cards, or online payment systems such as Clio Payments, PayPal, or Apple Pay over cash or check.

- Electronic document management. The majority of consumers (69%) prefer working with a lawyer who can share documents electronically through a web page, app, or online portal. Many electronic document systems now offer seamless e-signature services as well.

You’d be surprised how many people really get it. I had a 90-year-old sign an engagement agreement on an iPad the other day.

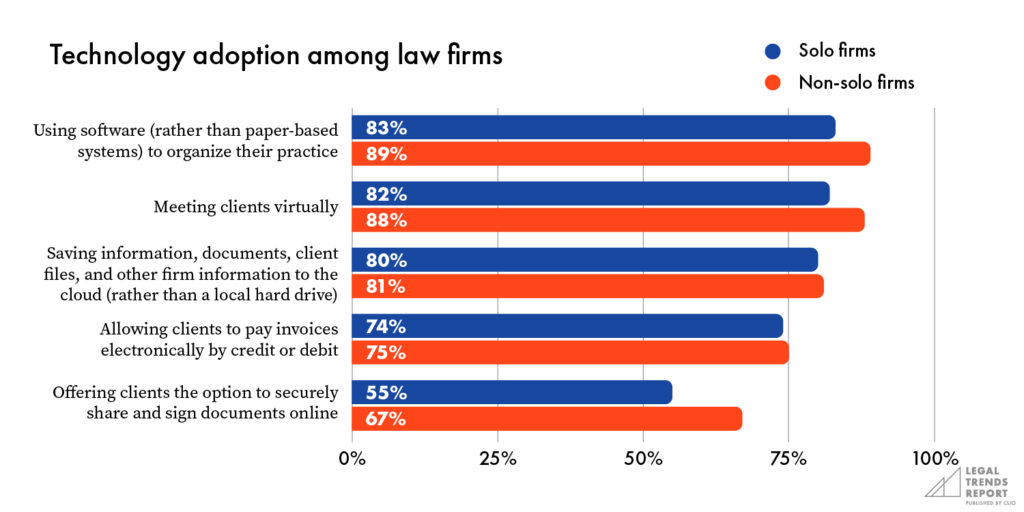

Solo law firms have adopted technology at a pace slightly below average

Solo law firms have also adopted more technology in response to the COVID-19 pandemic. However, while solo law firms are often seen as having a greater ability to adapt, in nearly all cases, technology adoption among solo law firms is only near—if not slightly behind—the average for non-solo law firms.

Overall, the vast majority of solo law firms are running their law firms using software instead of paper-based systems, and they are storing information in the cloud instead of on local hard drives. Additionally, they are meeting clients virtually, allowing clients to pay their invoices electronically, and giving clients the ability to share and sign documents online.

The highest growth areas for tech adoption practices among solo law firms was in meeting with clients virtually (which 59% of them started doing during the pandemic) and offering clients the option to share and sign documents online (which 27% started doing during the pandemic).

With everything that I’m doing, in the back of my mind, I’m thinking how can I make my life easier and how can I make it look more professional?

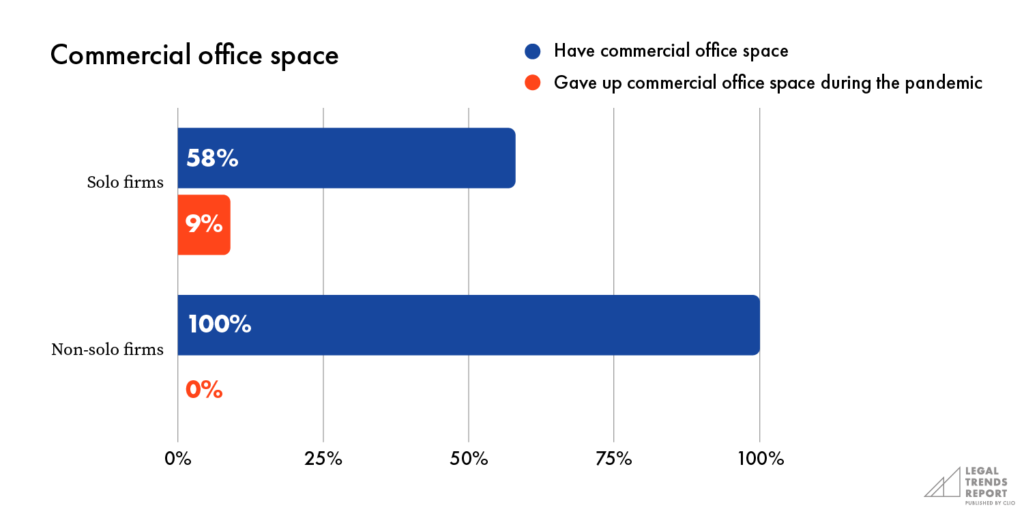

Solo law firms are going virtual

Where solo law firms stand out, however, is in their use of commercial office space. Only 58% of solo law firms indicated that they have commercial office space. Of firms with more than one lawyer, all reported having commercial office space. Based on this data, solo law firms are overwhelmingly more likely to be operating from a home office and offering their services in a fully virtual format, which is a trend we’re likely to see continue.

In fact, 9% of solo law firms also stopped operating out of a commercial office space since the start of the pandemic, and 9% are unsure whether they will maintain their office space once the impact from COVID-19 subsides, which suggests solo lawyers may continue to shift to virtual formats. While larger law firms have yet to give up their office space, 10% of non-solo law firms are unsure whether they will maintain their office space beyond the pandemic, which indicates this could be a future trend for larger firms as well.

As more law firms establish the ability to work remotely and provide virtual experiences for their clients, firms are likely to continue looking to achieve these benefits even beyond the pandemic.

- 88% of solo practices believe that lawyers could serve their clients much better if more parts of their practice were automated with technology.

- 68% of solo practices said that technology has significantly helped them deliver better client experiences.

- 52% of solo practices said that technology has improved their work-life balance.

- 43% of solo law firms are more focused on streamlining operations than they were before the coronavirus outbreak.

Additionally, as law firms continue to see the benefit from more technology-enabled infrastructure, many may look to reduce how much of their operating costs are dedicated to overhead related to maintaining a commercial office space. This might include reducing the size of commercial office spaces or cancelling their office leases altogether.

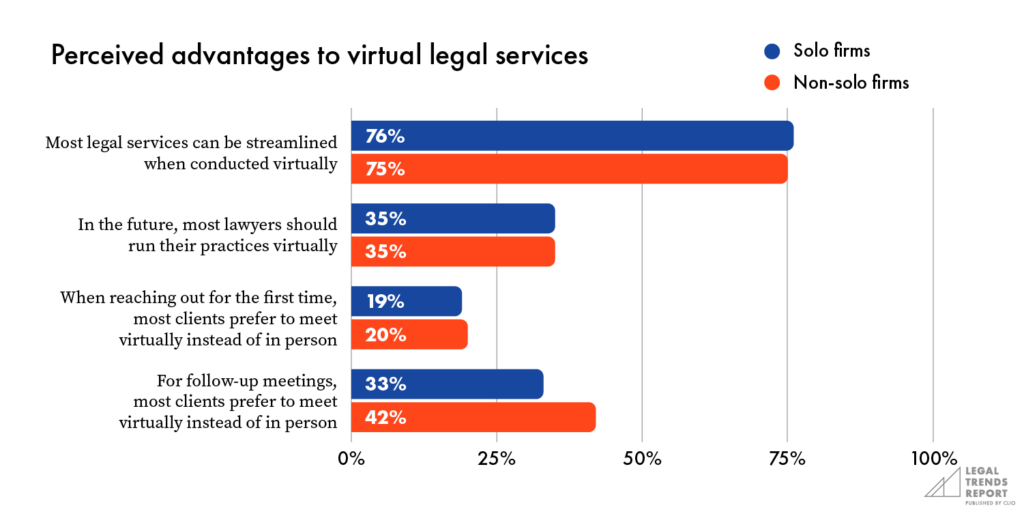

In fact, 76% of solo law firms think that the majority of legal services can be streamlined when conducted virtually, and 35% believe that lawyers should consider operating their firms fully virtually in the future, especially since a significant number of lawyers also believe that clients want to meet virtually instead of in person.

I’m going to try to harness this energy now that everyone knows how to use Zoom. I can advertise, “Meet me on Zoom,” and people are going to do it. I don’t have to explain how a video consult works. Everybody’s doing it.

Reassessing billing and payment structures

32% of solo practices said their law practice or firm is doing more to get new clients than before the coronavirus outbreak (for example, through marketing, networking, or business development). But the effort of finding new clients relies on understanding their needs.

Discussion in the 2020 Legal Trends Report identifies that billing and payment structures can create significant barriers to accessing legal services:

- The affordability of legal services has been a well-researched and documented issue for people living in the US, and it is likely a significant barrier to the 77% of people who don’t pursue their legal problems.3 Recent research indicates that 86% of civil legal problems faced by low-income individuals receive either inadequate or no legal help at all.4

- Prior to the pandemic, according to research conducted by the Federal Reserve on the economic well-being in US households, in 2018, 39% of Americans didn’t have funds available to pay for a $400 emergency expense. In 2013, this number was even higher at 50%.5

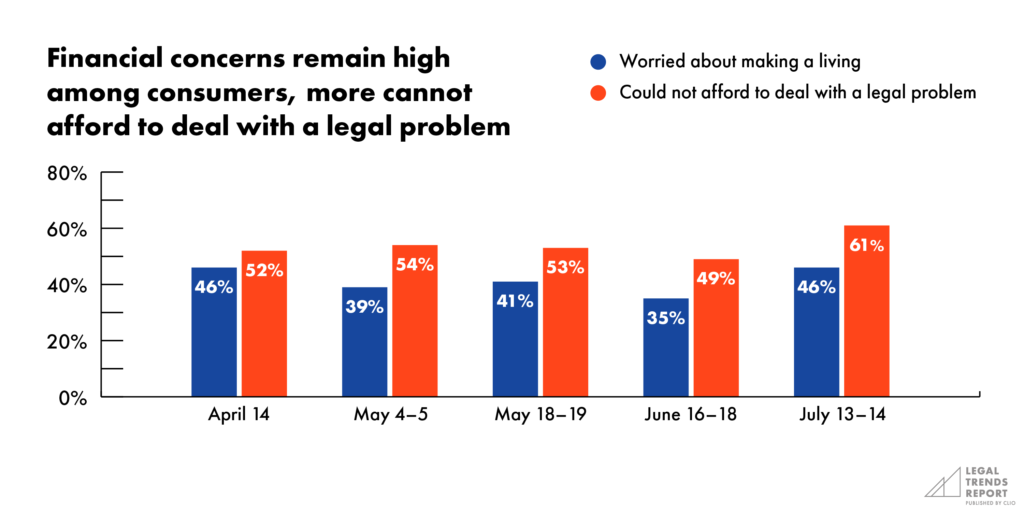

During the pandemic, as many as 61% of consumers reported not being able to afford a legal problem.

For law firms, this may be seen as a critical barrier to securing clients, but there are more dimensions to affordability than the overall cost of dealing with a legal problem.

- Price transparency and predictability. Research shows that 73% of law firms don’t provide information on rates and fees through email, and 43% won’t discuss them over the phone prior to meeting with a potential client.6 Yet, providing either an estimate or fixed fee rate can often help reduce the perception of financial barriers for potential clients who may be concerned about cost.

- Payment flexibility. Aside from the total cost of a legal matter, the option to pay for legal fees in installments over a longer period of time—even with interest—can increase affordability for potential clients who would otherwise be unable to pay all at once. In fact 72% of consumers say they would prefer to pay legal fees on a payment plan, yet only 53% of firms offer them.

[3] World Justice Project, Global Insights on Access to Justice, 2018

[4] Legal Services Corporation, Justice Gap Report, 2017

[5] The Federal Reserve, Report on the Economic Well-Being of U.S. Households in 2018 – May 2019, Last Update: May 28, 2019

[6] Clio, 2019 Legal Trends Report

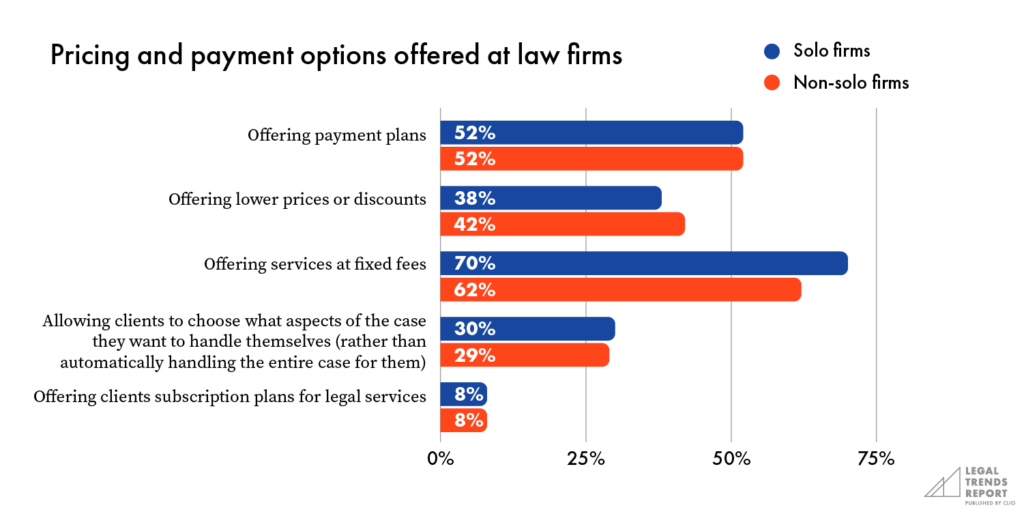

The data shows that while price transparency and flexibility are being adopted by law firms in the form of fixed fees and payment plans, lowering prices or offering discounts is still common practice among many law firms to make their services more affordable. While this may be beneficial to the client, these price reductions also hurt firm revenues, and in a way that adds up over time.

While not as prevalent, alternative billing structures are also seeing more use at law firms.

I think we have to watch for who’s getting left behind. I think as always in America, the middle class is relatively comfortable, but the people in the lower middle class, the elderly, and other vulnerable populations, it’s a struggle to figure out how to serve them properly.

Alternative billing structures

While alternative billing structures have yet to be adopted by the majority of law firms, they offer a model for helping make legal services more affordable by making the costs more transparent and flexible.

- Unbundled legal services. For clients who can’t afford to deal with a legal problem, taking on some of the tasks involved in a legal matter themselves helps reduce the overall cost of dealing with the issue. When combined with the flexibility of a payment plan and the predictability of fixed fees, unbundled services give many consumers the ability to pursue legal problems that they would otherwise not be able to afford.

- Subscriptions-based services. This billing structure blends a number of dimensions to affordability that makes paying legal fees more flexible and transparent. Subscription fees work similarly to an advanced-fee or retainer agreement, where the client pays a number of fee installments throughout the duration of their matter, creating more cost assurance for both the lawyer and the client.

The future of legal practice for solo law firms

The data shows that many solo law firms have suffered disproportionately during the COVID-19 pandemic, but the fact is that not all firms have suffered in the same way. In fact, many solo law firms have seen several months of substantial business growth. Firms that saw accelerated recoveries to achieve year-over-year growth are the ones that have also adopted cloud-based technology solutions to improve the quality of service to clients.

As client expectations continue to shift, and new behaviors become more habituated, it’s clear that firms that continue to adapt and innovate in the interest of their clients are the ones that will reap the benefits both in the immediate future, and in the years to come.

I think courts will start to use technology more often because a lot of the judges and magistrates are now, just like I am, getting a glimpse of what it means to not travel to the courthouse. That’s a game changer.

Firms that continue to adapt and innovate in the interest of their clients are the ones that will reap the benefits.

Legal Trends for Solo Law Firms

Appendix A

Additional data visualizations

- Introduction. Solo law firms confronted with new challenges

- Metrics. Key metrics for success in the wake of COVID-19

- Technology. Technology adoption improves revenues at solo law firms

- The Future. Creating a vision for the future of solo legal practice

- Appendix A. Additional data visualizations

- Appendix B. Detailed methodology

Additional data visualizations

Legal Trends for Solo Law Firms

Appendix B

Detailed methodology

- Introduction. Solo law firms confronted with new challenges

- Metrics. Key metrics for success in the wake of COVID-19

- Technology. Technology adoption improves revenues at solo law firms

- The Future. Creating a vision for the future of solo legal practice

- Appendix A. Additional data visualizations

- Appendix B. Detailed methodology

Detailed methodology

App data collection

Analysis for the Legal Trends for Solo Law Firms uses aggregated and anonymized data collected from the Clio platform. By synthesizing actual usage data, we’re able to identify trends that would be otherwise invisible to most firms.

The Legal Trends for Solo Law Firms has been prepared using data aggregated and anonymized from tens of thousands of legal professionals. These customers were included in our data set using the following criteria:

- They were paid subscribers to Clio. Customers who were evaluating the product via a free trial or were using Clio as part of our Academic Access Program were not included.

- They were located in the contiguous United States. This includes the District of Columbia but excludes Hawaii and Alaska. No customers in other countries were included.

- Any data from customers who opted out of aggregate reporting were excluded.

- Outlier detection measures were implemented to systematically remove statistical anomalies.

Data usage and privacy

The security and privacy of customer data is our top priority at Clio. In preparing the Legal Trends for Solo Law Firms, Clio’s data operations team observed the highest standard of data collection and reporting.

Data collection

- All data insights were obtained in strict accordance with Clio’s Terms of Service (section 2.12).

- All extracted data was aggregated and anonymized.

- No personally identifiable information was used.

- No data belonging to any law firm’s clients was used.

Reporting

Aggregate data has been generalized where necessary to avoid instances where individual firm data could be identified. For example, to avoid reporting data on a small town with only one law firm, which would implicate all of this town’s data to this firm, we only report at country, state, and metropolitan levels.

Additionally, raw data sets will never be shared externally. Clio is effectively a tally counter for user interactions—much like stadiums use turnstiles to count visitors without collecting any personally identifiable information from their customers. Similarly, as users interact with the Clio platform they trigger usage signals we can count and aggregate into data sets. We can identify trends without collecting information that reveals anything specific about individual customers.

Survey design

The Legal Trends for Solo Law Firms report includes survey data collected between April 3 and August 22, 2020.

Surveys of US legal professionals

- April 3 to 9: 485 respondents

- April 20 to 24: 654 respondents

- May 4 to 14: 609 respondents

- May 18 to 29: 783 respondents

- June 15 to 22: 566 respondents

- July 13 to 22: 635 respondents

- August 6 to 22: 1,044 respondents

Surveys of US consumers (general population)

- April 14: 1,042 respondents

- May 4 and 5: 1,019 respondents

- May 18 and 19: 1,055 respondents

- June 16 to 18: 1,004 respondents

- July 13 to 14: 1,003 respondents

- August 4 to 7: 1,002 respondents

Longitudinal study

Clio’s longitudinal study followed 16 lawyers as they navigated the impact of COVID-19 on their business. The study included interviews in April and May, as well as weekly check-in surveys throughout the study.