2022 Legal Trends Report

Introduction

A need for balance

- Introduction. A need for balance

- Part 1. State of the industry

- Part 2. The location of work has shifted

- Part 3. The blurring of work and life

- Part 4. Prioritizing client needs

- Part 5. Building an antifragile law firm

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

The legal industry has struggled to find its balance after a tumultuous few years. With demand for legal services reaching record highs in 2022, the added pressure on lawyers has blurred the lines between work and life. The spread of remote work has brought new opportunities for flexibility, but has also contributed to the breakdown of work-life balance. Lawyers now face a difficult challenge as they search for the right way to balance their own needs with those of their clients.

Finding better balance between work and personal responsibilities is key to the future success of law firms. Lawyers who can achieve this will not only be happier and healthier, but will also be able to offer the legal service experiences that clients are looking for.

This year’s Legal Trends Report explores how lawyers are adapting to the spread of remote work, how the way that legal professionals work is fundamentally changing, and what this means for their well-being. With this data, legal professionals will be able to chart a course that is both flexible and balanced.

Client-centered legal services, or legal services that are tailored to a client’s needs, should be the foundation of any successful law firm. To meet the looming challenges of the coming years, firms will need to develop more dynamic capabilities to deliver on these client-centered experiences and expectations. However, as the past two years have shown us, firms are capable of adapting to adversity and developing new resiliencies, which will be foundational in dealing with future challenges.

The spread of remote work has brought new opportunities for flexibility, but has also contributed to the breakdown of work-life balance.

The antifragile law firm

Author Nassim Nicholas Taleb described the concept of being “antifragile” in his book Antifragile: Things That Gain from Disorder, where he wrote that antifragile organizations thrive under stressors and gain from chaos. In the rapidly-evolving legal environment of today, law firms need to be antifragile if they are going to not just survive, but also thrive amidst this uncertainty.

At the center of this concept is balance: Antifragile law firms build resiliency into their operations by finding balance between the needs of their clients, the industry, and their people. Finding this balance requires being open to innovation, finding creative solutions to challenges, and making data-driven decisions to find a better way forward.

Being antifragile also means balancing flexibility with sustainability. As lawyers work more, they risk undermining their own success by burning themselves out, which also affects the success of their firm. To eliminate this potential failure point, antifragile firms recognize the need to foster a work culture that prioritizes well-being to set lawyers up for success.

Antifragile law firms build resiliency into their operations by finding balance between the needs of their clients, the industry, and their people.

Thriving in adversity

The past year’s high demand for legal services has meant significant financial opportunity for many firms. But with sustained inflation and increasingly grim forecasts of a recession on the horizon, there are clear warning signs that the industry needs to prepare for a challenging year ahead.

As the global economy shows signs of increasing strain, legal professionals will be competing for a smaller slice of the market as fewer consumers find themselves with the resources to access legal services. These are the circumstances in which antifragile firms will thrive. Throughout this report we’ll examine what clients are really looking for and explore how firms can become more competitive by balancing the many factors that contribute to firm success in the most difficult times.

Clio is committed to providing timely, informative intelligence to drive success across the industry and help firm leaders to make data-driven decisions. Our research team continues to monitor trends across the industry so that we can equip legal professionals with the tools they need to become not just resilient, but truly antifragile.

There are clear warning signs that the industry needs to prepare for a challenging year ahead.

New this year

Location analysis

We’ve used aggregated and anonymized location data based on IP address information to analyze where lawyers are working—and to understand how patterns in office use and remote work have changed.

Legal professional schedules

We’ve investigated not just how much lawyers are working, but when they are working. This includes a comparative analysis of when lawyers want to be working, and when they actually work.

What matters most in hiring

Using data from a hypothetical “lawyer shop,” we used statistical analysis to determine which attributes were most likely to drive client hiring decisions. Based on recent trends in remote work and virtual communication, the study provides valuable insight into how lawyers can win clients without compromising their own needs.

This year’s report investigates not just how much lawyers are working, but when they are working.

Data sources

The Legal Trends Report uses a range of methodological approaches and data sources to deliver the best insights about the state of legal practice and strategies for future improvement.

Clio data

We’ve analyzed aggregated and anonymized data from tens of thousands of legal professionals in the United States. This data provides important insights about how technology is being used by legal professionals and the impact it has on firm performance.

Legal professional and consumer surveys

We surveyed 1,134 legal professionals, 458 professionals from other industries, and 1,168 consumers in April and May 2022. The consumers included in this survey are representative of the US population by age, gender, region, income, and race/ethnicity based on the most recent US census statistics. The answers to these surveys offer insights into how legal professionals can become more aligned with consumer preferences in 2022 and beyond.

Location data

We used aggregated and anonymized IP address data to analyze where lawyers are working from and how this has changed over time.

We’ve analyzed aggregated and anonymized data from tens of thousands of legal professionals.

2022 Legal Trends Report

Part 1

State of the industry

- Introduction. A need for balance

- Part 1. State of the industry

- Part 2. The location of work has shifted

- Part 3. The blurring of work and life

- Part 4. Prioritizing client needs

- Part 5. Building an antifragile law firm

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

2021 was a rebound year for the legal industry as demand for legal services increased and the disruptions of the early pandemic began to recede. Lawyers across the country saw increases in their workload as pent-up demand surged, with reports of some firms even turning down work or raising rates (or both) as a result.1

Rising demand and strong financial performance across the industry drove a corresponding increase in both firm headcounts and attorney compensation. Headlines announcing record-breaking associate compensation packages have appeared alongside a legal “talent war” as firms compete to recruit.2 Amidst these developments, lawyers have participated in the so-called “Great Resignation” as they sought new opportunities not just for more pay, but for improved well-being.

While many of these developments were beneficial, the legal industry still faces a rapidly-changing landscape that is difficult to predict and plan for. Past gains do not guarantee future success, and with the threat of a recession on the horizon, the time to prepare for coming changes is now. To successfully navigate this environment and lay the foundation for future success, lawyers need to understand not just what is happening in the industry, but why it is happening.

Past gains do not guarantee future success.

Increased casework indicates higher demand for legal services

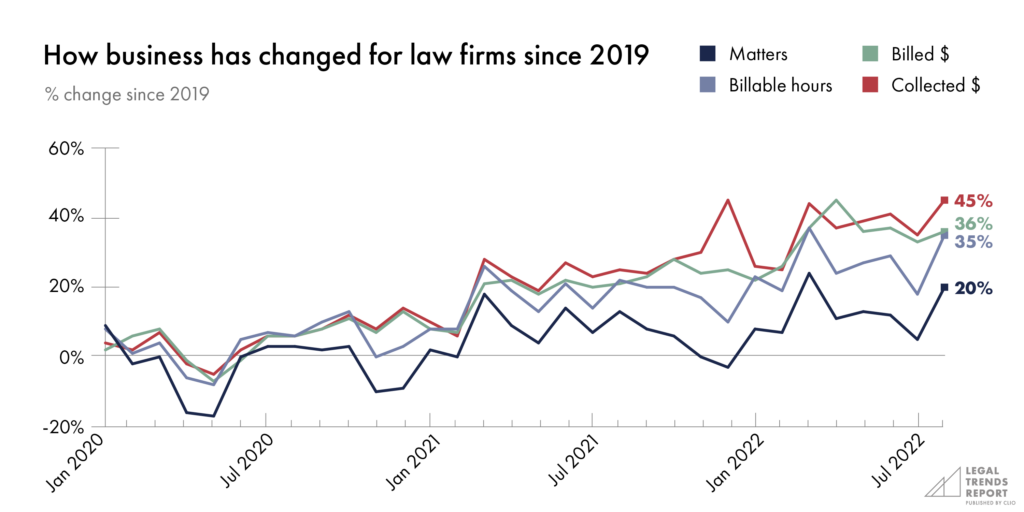

To better understand trends in market demand for legal services, we’ve used aggregated and anonymized Clio data to look at how casework has increased since early 2021.

The number of people in the United States seeking legal assistance over the last two years has risen above the level seen in 2019, which we use as a baseline for comparison. March 2021 saw the first jump in casework (18%). Since then, lawyers have been opening new cases at a rate averaging 10% higher than the 2019 baseline. In March 2022, new casework spiked to 24%—the highest we’ve seen since 2019.

Lawyers have converted the increase in new matters to even more billable hours, which in turn has resulted in even stronger gains in collected revenue. Compared to the 2019 baseline, the average caseload was up 10% during March 2021 to August 2022, while average billable hours were 22% higher during the same time. This means that, on average, lawyers are capturing more billable time for every case they take. The increase in billable hours indicates lawyers are capturing more billable time, taking on larger cases that require more work, or that the average case requires more time to complete (discussed further with respect to utilization rate below).

Over the same period of time, the number of hours billed to clients was up by an average of 28% compared to 2019 and average collected revenue was up by 31%, meaning that every hour of legal work has become more valuable to firms overall.

Along with more potential revenue, higher demand also brings more communications to manage, documents to organize, deadlines to meet, and bills and payments to track. As firms work to keep up with these increased workloads, it’s important to consider whether this tempo can be sustained beyond 2022. As the demand for legal services has proven extremely volatile over the last two years—and shows signs of remaining so over the short-to-medium term—firms will need to think about how to manage staffing and resourcing effectively in such a challenging business environment.

Every hour of legal work has become more valuable to firms.

Key performance indicators for business

Clio’s key performance indicators provide benchmark insights into how firms are performing, giving firms an important tool to measure their own performance as they navigate challenging market forces.

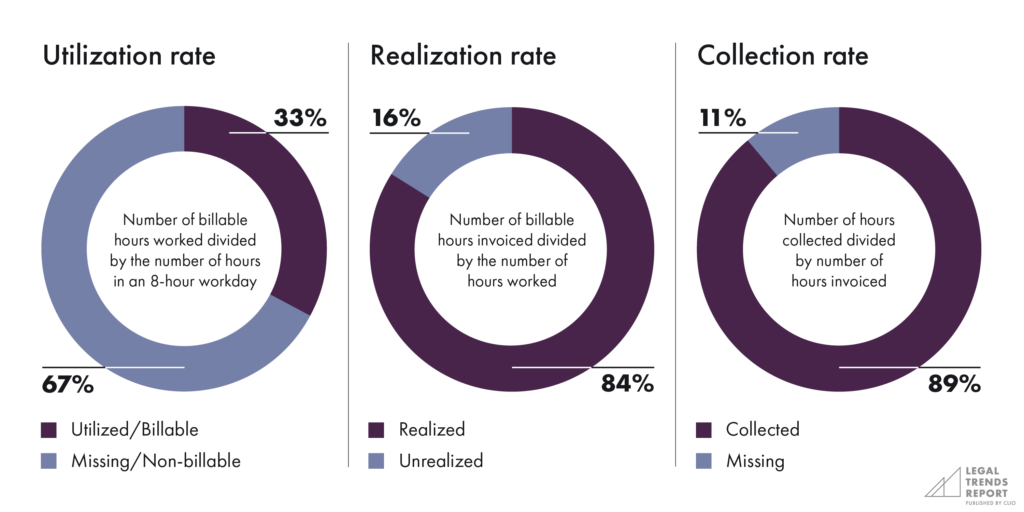

On the business side, the major KPIs we track are utilization, realization, and collection rates. These offer a clear indication of what is driving firm performance.

Utilization rate

Utilization rate is a measure of how much of a typical eight-hour work day is spent on billable hours for clients.

The past year has seen the biggest jump in utilization rate—from 31% to 33%, a 6% relative increase—since Clio began publishing utilization rate data in the 2016 Legal Trends Report. In the years prior to the sudden surge, utilization increased incrementally from 2016 to 2019, then plateaued from 2019 to 2021. Notably, utilization rate has increased 18% over the six years we’ve been publishing data.

For context, this improvement in utilization rate represents an additional 40 hours of billable time over the course of a year. Put another way, for a lawyer with an hourly rate of $300, this change represents an additional $12,000 in annual revenue—all from completing just a few more minutes of billable work each day. With small increases like this accumulating into significant gains, utilization rate is a key metric that firms should measure and improve to drive firm success.

As noted above, utilization rate is calculated based on the number of hours put toward billable work as a portion of an assumed eight-hour day. A utilization rate of 33% indicates that a lawyer completes 2.6 hours of billable work each day. For lawyers that work more than eight hours a day, that 2.6 hours would amount to a smaller percentage of the work day. In other words, some firms may be seeing this rate increase as a side effect of working more hours in absolute terms, and not necessarily as a result of becoming more productive.

As lawyers strive to both run successful firms and achieve healthier work-life balance, the goal should be to raise this rate not by working more hours, but by making better use of existing work time. Parts 2 and 3 will look at the importance of work-life balance and the strain that working outside of business hours can place on lawyers.

Utilization rate has increased 18% over the six years we’ve been publishing data.

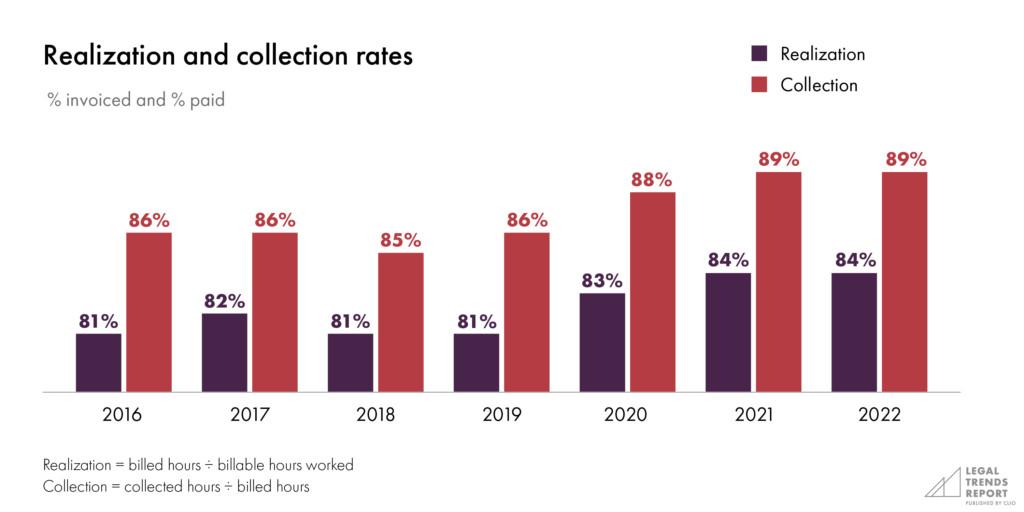

Realization and collection rates

Realization is a measure of the number of billable hours—after discounting and write-offs—that actually make it onto a client’s bill, giving an idea of how well a firm charges for completed work. The collection rate is a measure of how many of these billed hours are actually paid by clients.

Since 2018, realization and collection rates rose dramatically before plateauing in the last year. 2020 saw a substantial jump in realization from 81%, which continued to increase to 84% by 2021. Collection rates increased similarly from 85% in 2018 to 89% in 2021.

The fact the most substantial gains were made during 2020 is both impressive and surprising given the significant disruptions from the pandemic. This indicates that during this time, law firms maximized the value of their work by ensuring they accurately billed clients and collected on those bills.

While the increase in realization and collection rates helped firms weather the difficulties of 2020, sustaining these figures helped to boost revenues as casework rose through 2021 and 2022.

There is still lots of work law firms can do to raise these KPIs. Currently, the average law firm collects only $748 for every $1,000 of billable work. This means these firms could collect up to 34% more revenue by optimizing their realization and collection rates. This is a massive opportunity for law firms to capitalize on.

Since 2018, realization and collection rates rose dramatically before plateauing in the last year.

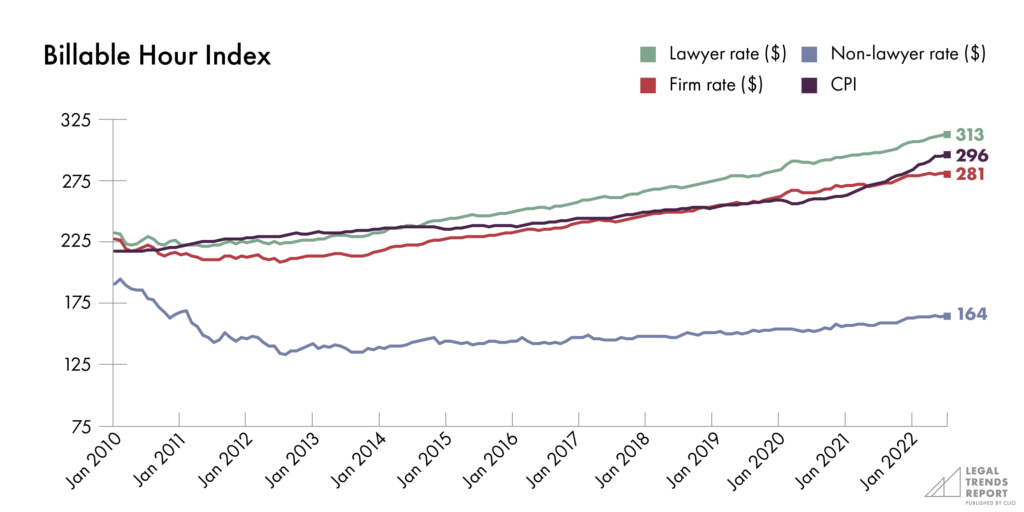

The impact of inflation

Rising inflation, increased payroll costs, and a competitive talent market are all challenges facing law firms today. The situation is complicated by the unique circumstances of the inflationary trends, which have been driven in part by the Russo-Ukrainian War. This conflict dealt a major blow to global energy and agriculture markets just as the world was working to recover from the disruptions of the pandemic.3

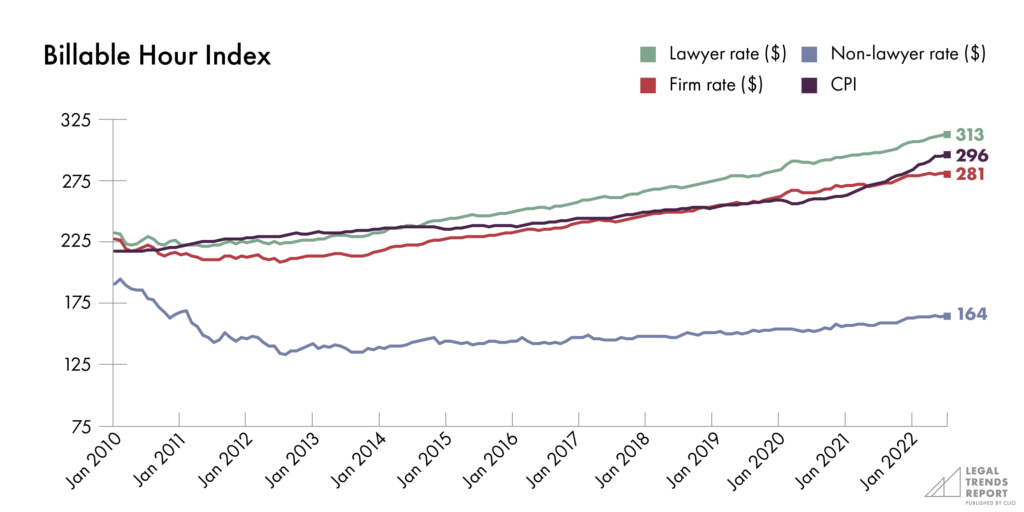

Measured by changes in the Consumer Price Index (CPI), inflation has risen dramatically this year, reaching as high as 9.1% in mid-2022.4 When comparing law firm hourly rates—which include rates for both lawyers and non-lawyers (e.g., paralegals)—the CPI has increased at a faster pace than firm rates since June 2021, which is the first time this has happened since the start of 2019. When looking at lawyer and non-lawyer rates in isolation, both have also increased at a slower pace relative to the CPI. In other words, the rate of inflation is outpacing the Billable Hour Index, which could put significant pressure on law firm economics in the coming years.

The fact that firms haven’t increased rates to match inflation may be due to lawyers successfully capitalizing on increased demand—recording more billable hours and increasing revenues, thereby reducing pressure to increase rates. Firms may also be feeling pressured to remain competitive when it comes to attracting clients—especially if they struggled previously.

As costs increase, most firms are likely seeing increases in overhead, which will create challenges for those that haven’t increased revenue or for anyone that sees demand fall in the coming months and years. One way to address inflation is to adjust rates accordingly. Given the current gap in rates relative to inflation, industry-wide data suggests the average lawyer could increase rates by 3% to keep up with recent changes in the CPI relative to 2019.5

However, increasing costs might come with risk. Potential clients are also struggling with the burdens of inflation, and may find higher lawyer rates unappealing. As a result, they might opt to handle legal issues on their own or hire a more affordable lawyer. Therefore, law practices may also want to consider a range of factors beyond just increasing their rates.

For example, as we discuss in the next sections of this report, the importance of commercial offices has shifted, which could change how much firms need to spend on real estate and property leases. Adopting certain technology solutions can also increase efficiency and profitability while creating better business environments for both lawyers and their clients.

Industry-wide data suggests the average lawyer could increase rates by 3% to keep up with recent changes in the CPI relative to 2019.

Endnotes

[1] James W. Jones and Milton C. Regan, Jr., “2022 Report on the State of the Legal Market: A Challenging Road to Recovery” (Washington, D.C.: Thomson Reuters Institute, January 11, 2022), 6-7.

[2] Staci Zaretsky, “Salary Wars Scorecard: Firms That Have Announced Raises,” Above The Law, January 21, 2022.

[3] Dario Caldara et al., “The Effect of the War in Ukraine on Global Activity and Inflation,” Government Website, Board of Governors of the Federal Reserve System, May 27, 2022.

[4] Rob Wile, “U.S. Inflation Rises 9.1% in June, More than Expected, as Prices Keep Climbing,” NBC News, July 13, 2022, Online edition, sec. Economy.

[5] When comparing average values in the last quarter of 2019—representing a stable period of inflation—to the most recent four months, the CPI increased by 14%. Lawyer rates increased by 11% between these two periods. In comparing these ranges, lawyers on average have a gap of 3% to make up for in keeping up with the average cost of goods and services.

2022 Legal Trends Report

Part 2

The location of work has shifted

- Introduction. A need for balance

- Part 1. State of the industry

- Part 2. The location of work has shifted

- Part 3. The blurring of work and life

- Part 4. Prioritizing client needs

- Part 5. Building an antifragile law firm

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

The pandemic profoundly and permanently transformed where and how lawyers work.

A major reason for this was the shift in mindset during the COVID-19 pandemic, which forced many to work in a distributed environment—most often from home. Another factor is that for the first time, many lawyers realized that cloud-based technology enabled them to work and stay connected to their firm and their clients from anywhere.

While many lawyers were already accustomed to spending part of their time working out of office—whether at home, at court, or visiting clients—the more complete shift to at-home and virtual settings meant learning new ways to maintain work continuity and collaborate with clients and members of their firm. What the research in this section suggests, however, is that working from home has become more viable for legal professionals regardless of pandemic restrictions.

On a deeper level, this shift also signals potential friction between lawyers and their firms regarding the ideal balance between office and in-home work, which could have implications for attracting and retaining legal talent within a hot employment market.

Many lawyers realized that cloud-based technology enabled them to work and stay connected to their firm and their clients from anywhere.

Office use has declined

To understand how office use evolved among legal professionals, we analyzed aggregated and anonymized IP address data from Clio. For this analysis, we defined an “office” as any location from which three or more users from the same law firm accessed Clio Manage.

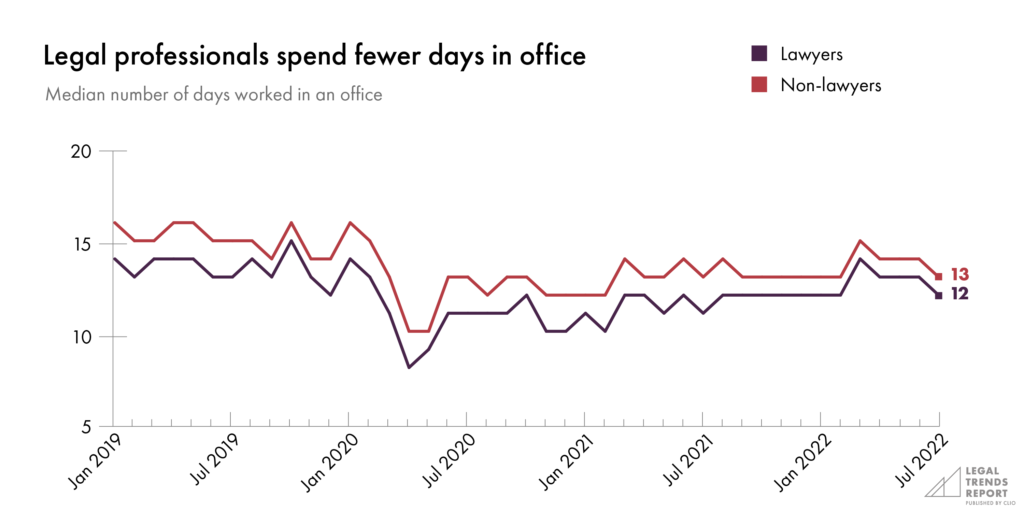

At the highest level of analysis, we can look at the overall number of days that legal professionals spend in the office each month. In doing so, we see a “new normal” that has emerged since 2020 and continues to influence trends in office and remote work.

Before 2020, the median1 number of days that lawyers spent in the office was about 14 days per month, which fell to just eight days at the start of the pandemic. The rest of 2020 saw lawyers spend far fewer days in the office, and 2021 saw only slightly more office use. In 2022, lawyers still spend fewer days in an office overall—about 13 per month—compared to 2019. In comparison, non-lawyers (e.g., paralegals and administrative staff) spend more days in the office, but we still see declines in the relative number of days spent in an office.

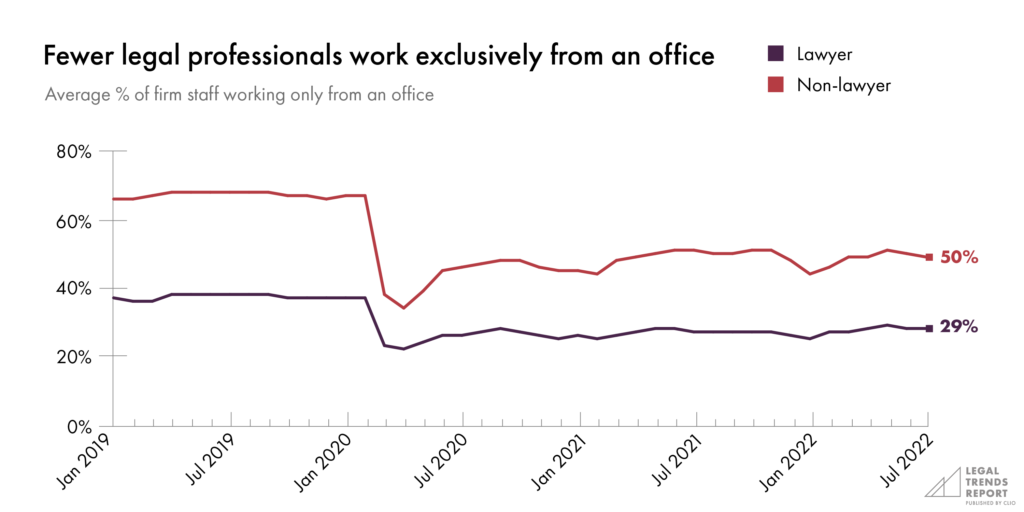

We also see more permanent changes when we look at the drop in how many legal professionals work exclusively from an office. Before 2020, roughly 40% of lawyers—and almost 70% of non-lawyers—worked exclusively from the office. When the pandemic struck, both groups saw sharp declines in exclusive office usage—averaging just 23% for lawyers and 35% for non-non-lawyers through to 2022—meaning that both lawyers and non-lawyers started working outside the office at least some of the time.

Exclusive office use has remained significantly low. Fewer than 30% of lawyers continue to work only from the office, while about 50% of non-lawyers do. This means that overall, more office-based workers—especially non-lawyers—have embraced the flexibility of remote work on a lasting basis.

Fewer than 30% of lawyers continue to work only from the office.

Some firms have moved away from the office more than others

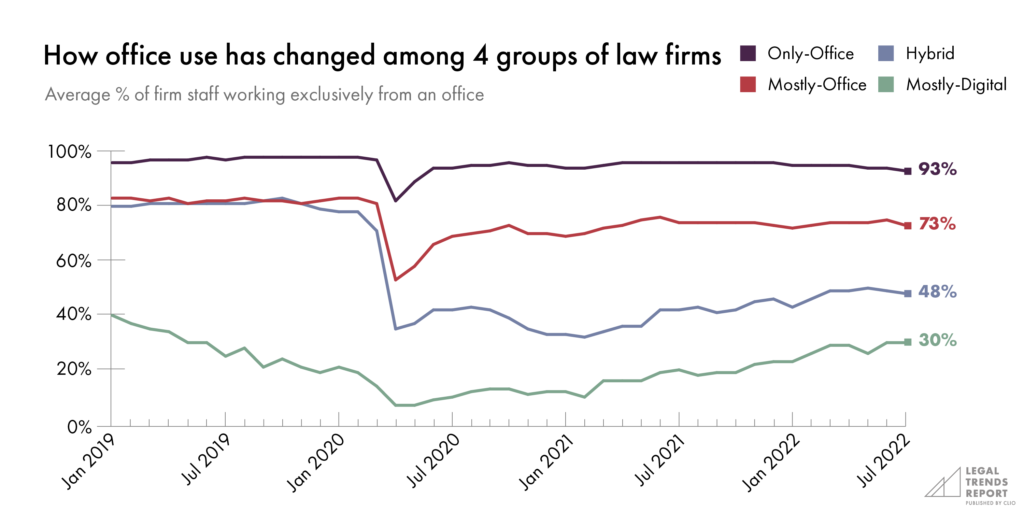

Our analysis also shows that not all lawyers prioritize in-office work and remote work equally. We’ve identified four distinct groups based on the patterns we’ve seen within each:

- Only-Office. Firms that almost exclusively work in an office.

- Mostly-Office. Firms that prioritize in-office work.

- Hybrid. Firms that prioritize remote work.

- Mostly-Digital. Firms that work mostly remote.

The most dramatic shift in office use appears in the Hybrid group, which comprises 10% of all firms. Before 2020, more than 80% of all firm members in this group worked exclusively from the office. By April 2020, this number dropped to just 35%. Not only did this group see the most significant drop in office use during the pandemic, but it also saw fewer firm members return to office in the months and years that followed. By mid-2022, fewer than 50% of firm members were working from an office.

The Mostly-Digital (7% of firms) group provides another example of firms oriented around remote-enabled work. This group has seen little more than 25% of their firm work from an office prior to and after 2020. As few as 7% of all firm members in this group worked from an office in 2020.

The Only-Office (56% of firms) group includes firms that primarily work in an office. This group saw as much as 98% of their firm work from an office prior to 2020. Since then, 95% of firm members have remained exclusively in the office, though, the latest data in July has seen this group fall to the lowest level of office use (93%) since early 2020.

The Mostly-Office group (26% of firms) has also seen most firm members (over 80%) primarily work from an office before and after 2020. After this group saw as few as 53% of firm members working from an office in 2020, nearly 75% have worked in the office since the middle of 2021. While the office appears to remain a central hub for firm members in this group, about one in four work remotely on a regular basis.

Overall, outside of the Only-Office group, remote work has become a part of daily operations for 44% of firms. This is significant because, as we’ll see below, more legal professionals want to work from home, and they may be willing to leave their current jobs for positions that offer this type of flexibility.

The most dramatic shift in office use appears in the Hybrid group.

Lawyers have been leaving jobs for better pay and work-life balance

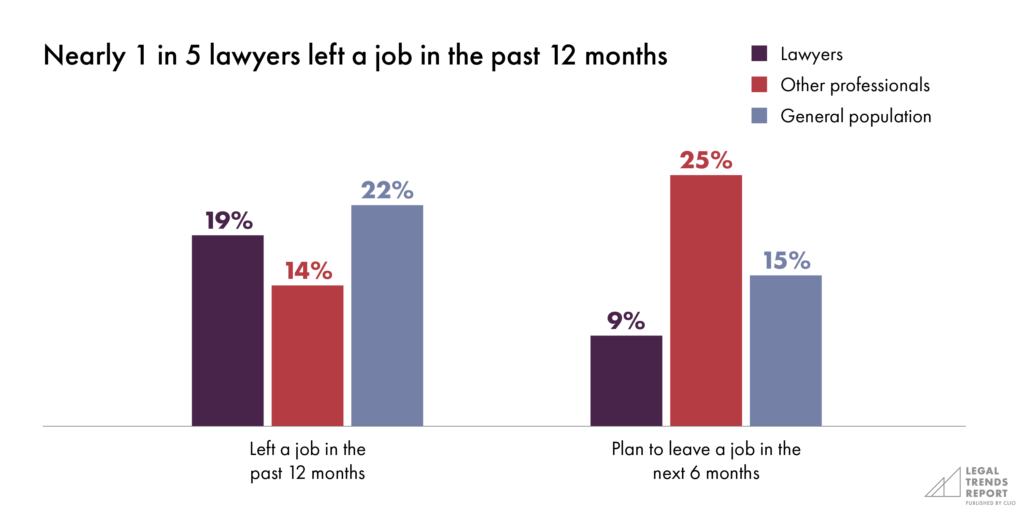

In the 12 months prior to April 2022, nearly one in five lawyers left the law firm they were working for, and 9% reported that they planned to leave a firm in the next six months.

When compared to other types of professionals we surveyed—including finance, insurance, engineering, and real estate professionals, among others2—more lawyers had already left jobs previously but fewer planned to leave in the future, suggesting that the legal industry may have experienced its own Great Resignation earlier than others.

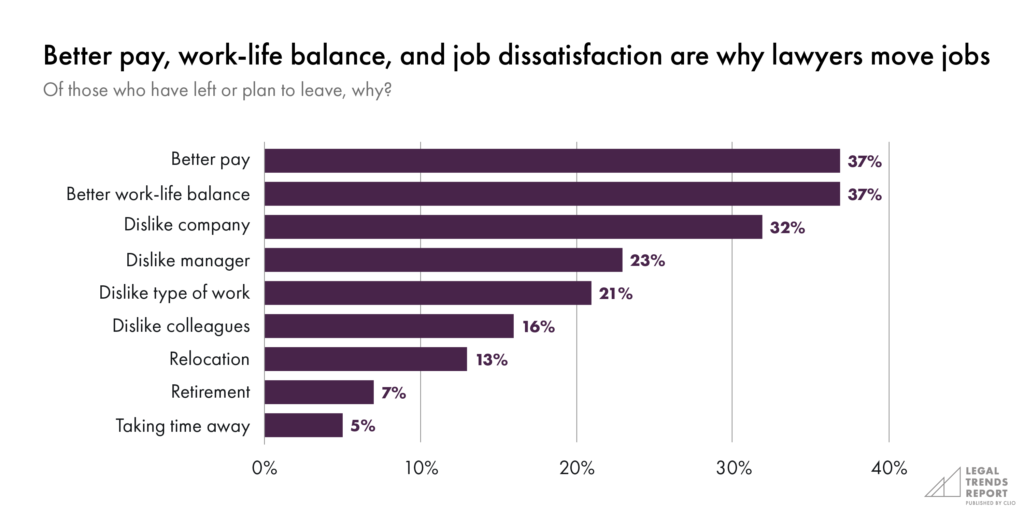

The surge in casework discussed in Part 1 also puts strain on firms to meet demand, resulting in an upward pressure in wages that contributed to a hot job market. Lawyers are aware of this pressure: 37% of lawyers who left or are considering leaving a job are looking for better pay. Reuters reports that associate salaries at large firms were up by 11.3% as of November 2021,3 suggesting that many lawyers are also benefiting from the current state of the industry.

Work-life balance was just as important in terms of job movement, and was cited as a reason for leaving a role more often than disliking their firm, manager, type of work, and colleagues.

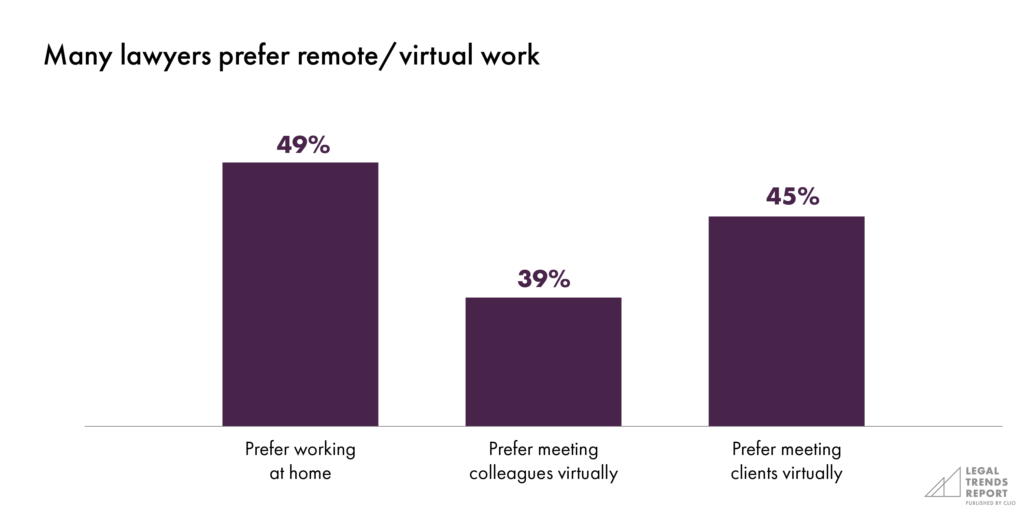

When it comes to balancing work and life, the flexibility of being able to work from home plays a role for many. Forty-nine percent of lawyers say they prefer working from home and 45% prefer meeting with clients virtually. Thirty-nine percent of lawyers also prefer meeting colleagues virtually. This coincides with the fact that fewer legal professionals work exclusively from the office.

For any firm looking to recruit and retain top legal talent, offering high salaries may be an important strategy within the hiring market. However, focusing on building a firm culture that reinforces work-life balance and the flexibility of working from home is an equally strong selling point—and a more affordable one—for many legal professionals.

Nearly 1 in 5 lawyers left the law firm they were working for.

What do clients prefer?

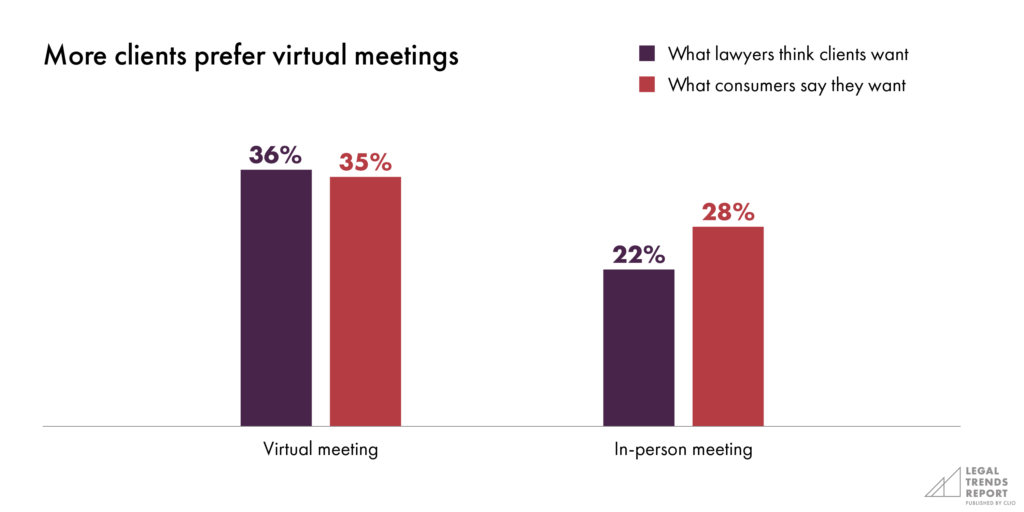

When it comes to remote work, a big question that firms should ask is: how will it affect clients? As it turns out, 25% more clients (35% compared to 28%) prefer virtual meetings over in-person meetings—and the rest indicated no strong preference either way, meaning they’re adaptable. Discussion in Part 5 also illustrates that working from a home office has a negligible influence on clients when hiring a lawyer.

Over one third of lawyers recognize these trends in client preference and are likely adapting their services to make them more friendly to the speed and convenience of remote client communications. At the same time, these capabilities will only enable lawyers to work more flexibly from anywhere—and at any time—as they juggle priorities in both their personal and professional lives.

25% more clients prefer virtual meetings over in-person meetings.

Endnotes

[1] We use median rather than mean in our analyses to mitigate the impact of outliers.

[2] See Appendix B for more details on what types of other professionals were surveyed.

[3] Jones and Regan, Jr., “2022 Report on the State of the Legal Market: A Challenging Road to Recovery,” 14.

2022 Legal Trends Report

Part 3

The blurring of work and life

- Introduction. A need for balance

- Part 1. State of the industry

- Part 2. The location of work has shifted

- Part 3. The blurring of work and life

- Part 4. Prioritizing client needs

- Part 5. Building an antifragile law firm

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

As remote work becomes more common within law firms, it’s important to consider the impact this has on legal professionals on an individual level. With more work taking place within the home, the lines between personal and professional responsibilities have increasingly blurred, creating a state of imbalance for many lawyers.

Coupled with the fact that law firms have been busier throughout 2022, more lawyers are at risk of burnout if they are putting in more hours overall—especially at irregular hours of the day. If lawyers continue to embrace remote work and flexible—or extended—work schedules, many will need to reckon with the potential tradeoffs and work towards finding a better balance overall.

The lines between personal and professional responsibilities have increasingly blurred.

Lawyers work outside of traditional 9-to-5 business hours

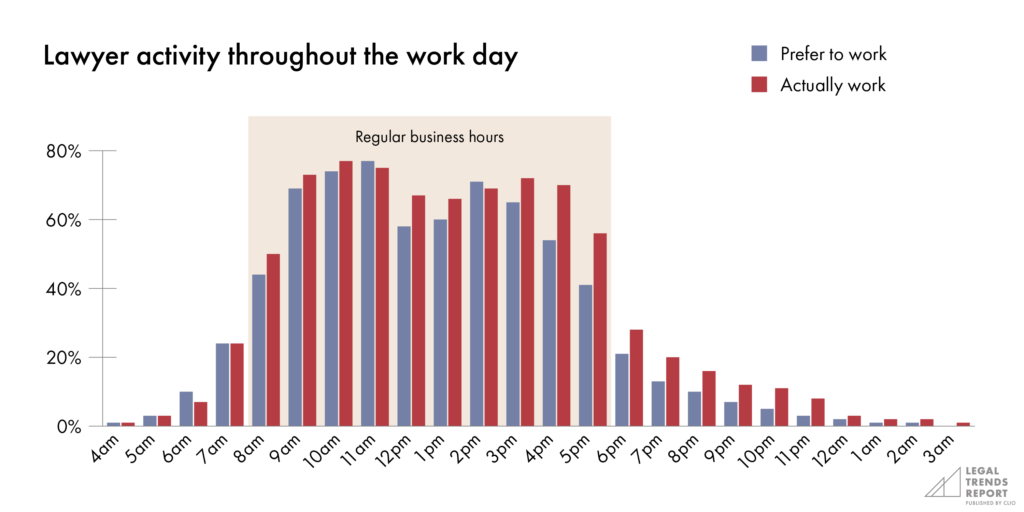

By comparing when lawyers prefer to be working and when they actually work during a typical day, we can see that many lawyers are working outside of their preferred schedules, largely in the evenings and on weekends.

Survey data indicates that most lawyers prefer to work a relatively traditional business day—starting at or before 9 a.m. and finishing by 5 p.m. The reality is that 56% of lawyers work after 5 p.m. and 28% work after 6 p.m. Notably—and perhaps alarmingly—11% of lawyers report working after 10 p.m.

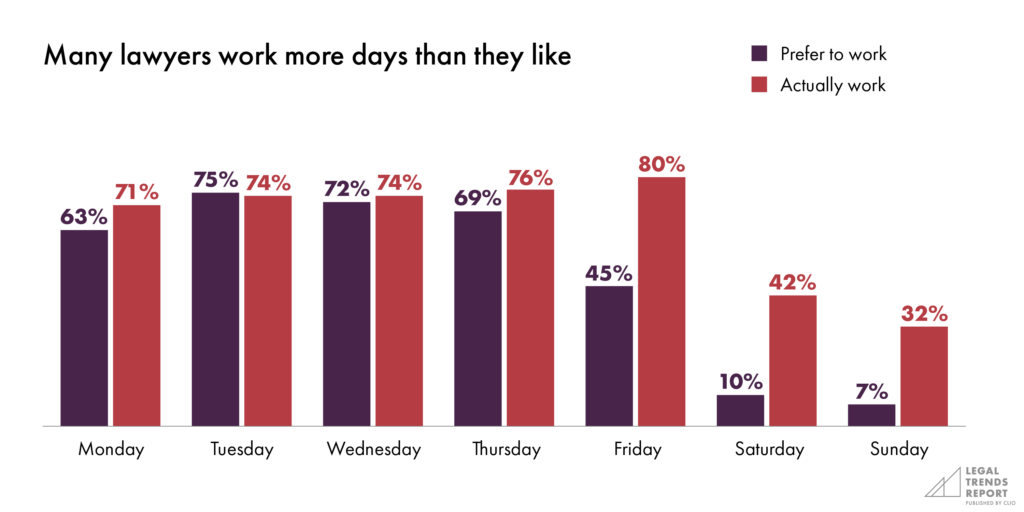

Looking at work habits throughout the week, we see a similar gap between preference and reality. Only 45% of lawyers prefer working on Fridays, while 80% actually work that day. The disparity is almost as large on Saturdays, when only 10% prefer to work, compared to 42% who actually work. This mismatch is even more significant than in the overall hours that lawyers work. Lawyers appear to be working more days—and specifically on weekends—much more than they like.

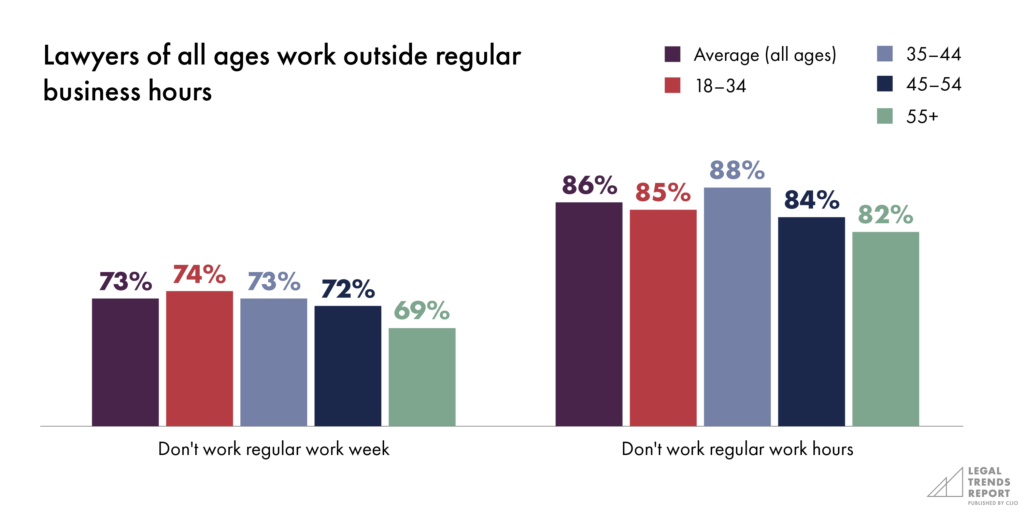

Overall, it is much more common for lawyers to work irregular hours than not: 86% of lawyers work outside of the typical workday (beginning between 8 and 9 a.m. and ending between 5 and 6 p.m.), and 73% work outside of regular business days (Monday to Friday).

These results were not limited to only lawyers of a certain age. With only slight variation, lawyers of all ages work outside of regular business hours, suggesting that there isn’t a generational factor (e.g., being newly graduated, starting a career, or sunsetting a career) driving lawyers to work irregular hours.

86% of lawyers work outside of the typical workday.

Lawyers regularly make themselves available to clients during evenings and weekends

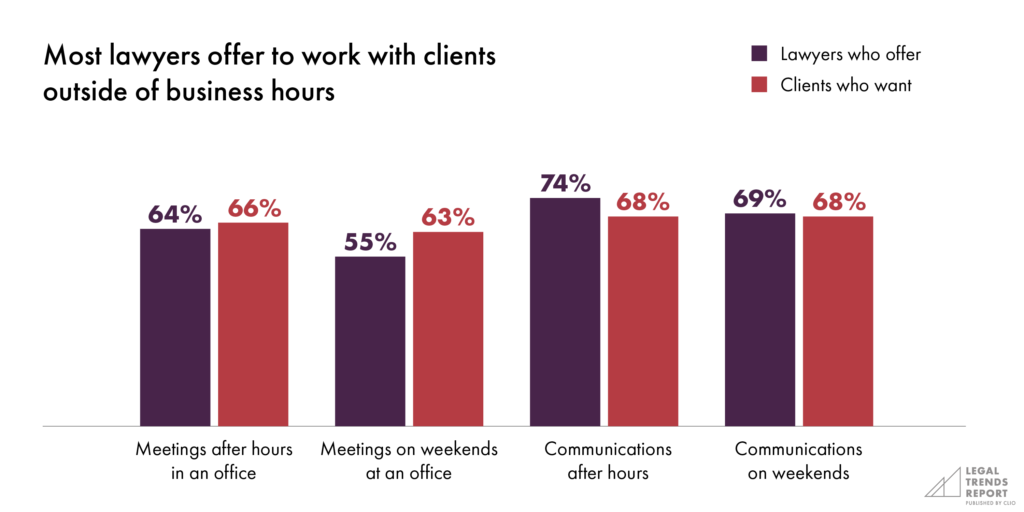

We’ve seen that the majority of lawyers are working outside of or beyond non-traditional business hours. While heavy workloads may be a key factor here, lawyers may also feel significant pressure from clients to be available on evenings and weekends.

Most clients want the option to meet or at least communicate with their lawyer during evenings or weekends. This is likely because meeting during a regular business day can be inconvenient for clients. Some may also appreciate the convenience of being able to speak to their lawyer at any time of any day, especially when faced with an urgent problem.

It’s clear that lawyers recognize this need since most are willing to make themselves available to clients during these times. Seventy-four percent of lawyers offer to communicate with clients on the weekend, while 69% offer to communicate in the evening. As noted earlier, 10% of lawyers prefer to work on Saturday, and only 7% prefer working on Sunday. Most prefer not to work after 5 p.m.

With so many lawyers offering to meet and communicate with clients outside of their preferred working hours, law firms should question how sustainable this working schedule is for lawyers, and what the long-term consequences could be for both legal professionals and their firms.

74% of lawyers offer to communicate with clients on the weekend.

How irregular working hours affect lawyers and their firms

As legal professionals work outside of the office more regularly—many of them from home—we’re seeing work life increasingly blend into personal life.

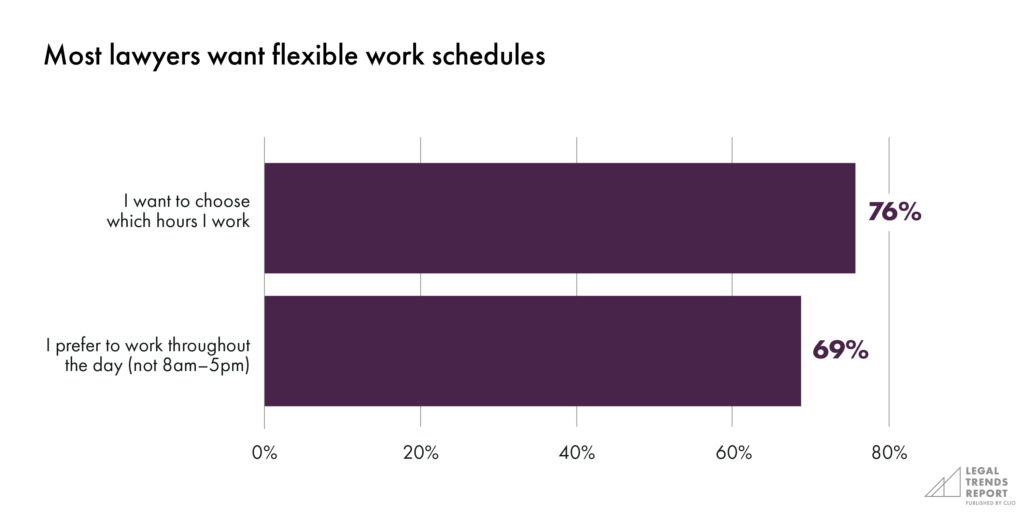

One of the issues here is that even though few want to work beyond the traditional work day, most lawyers still want the flexibility to work evenings and weekends: 76% of legal professionals want to choose which hours of the day they work and 69% prefer to get work done throughout the day, rather than adhering to a rigid 8 a.m. to 5 p.m. work day.

The challenge, however, is that working outside of regular business hours corresponds to poorer outcomes—both personal and professional.

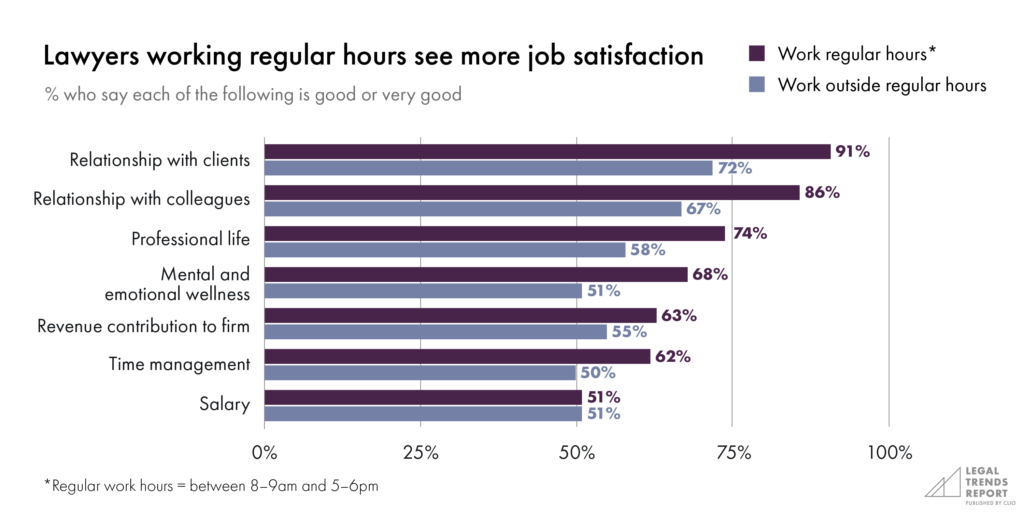

Most significantly, barely half (51%) of lawyers working non-traditional work schedules reported having good or very good mental health, compared to 74% of those who adhere to a regular work schedule. This suggests that lawyers are 45% more likely to report positive mental health and well-being if they stick to working regular business hours.

Working a non-traditional schedule can also be harmful to relationships with clients and colleagues. In terms of work, lawyers who worked regular business hours were 28% more likely (74% compared to 58%) to have a positive professional life than those working irregular hours. Those who stick to working regular business hours are 26% more likely (91% compared to 72%) to have positive relationships with clients, and they are 28% more likely (86% compared to 67%) to have positive relationships with colleagues.

Those who work regular hours were also 13% more likely to be satisfied (63% compared to 55%) with the revenue they contributed to the firm, and were 19% more likely to report better time management (62% compared to 50%).

Lawyers working irregular hours were less likely to report positive personal wellness, yet were no more satisfied with their earnings.

Working outside of regular business hours corresponds to poorer outcomes—both personal and professional.

As the lines blur, work-life balance is more important than ever

As legal professionals embrace more flexible work habits—and possibly more work in general—they run the risk of their work negatively impacting their personal life, and vice versa. The phenomenon of work-from-home burnout is not exclusive to the legal field. A report by the American Psychological Association released earlier this year shows that burnout rates have risen, citing work-related stress among 79% of employees.1 From the same report, 44% reported physical fatigue, while approximately one-third of respondents reported cognitive weariness and emotional exhaustion.

If lawyers continue to work remotely, choose the hours in which they work, or put more time towards their work, they need to find better ways to balance their work with their own personal goals and commitments. This could mean setting clear boundaries between work time and personal time, even if that work time occurs after hours and on weekends. Blending work and life may be inevitable for many, but it may have a less negative impact if lawyers can avoid being distracted by work when they’re off the clock or distracted by life when they’re working.

Working irregular schedules may also require lawyers to find better ways to maintain relationships with their clients and colleagues. Again, this could also be about creating the space for these relationships, but it could also mean employing better ways of staying connected, regardless of location, and especially through technology. Video conferencing tools and instant messaging systems make it easier and more effective than ever to keep in touch with others, even while managing a breadth of important personal and professional priorities.

While there may be valuable incentives to meeting and communicating with clients outside of business hours, it’s important to recognize the personal tradeoffs. The next section looks at data that informs what’s most likely to influence a client’s decision when hiring a lawyer and how lawyers can prioritize their efforts to meet client needs.

It’s important to recognize the personal tradeoffs.

Endnotes

[1] Ashley Abramson, “Burnout and Stress Are Everywhere,” Monitor on Psychology 53, no. 1 (January 1, 2022): 72.

2022 Legal Trends Report

Part 4

Prioritizing client needs

- Introduction. A need for balance

- Part 1. State of the industry

- Part 2. The location of work has shifted

- Part 3. The blurring of work and life

- Part 4. Prioritizing client needs

- Part 5. Building an antifragile law firm

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

Many lawyers are working irregular hours and working remotely. Technology has played a large part in enabling them to access firm information and maintain communications with clients, increasing a firm’s ability to keep up with client needs, regardless of where a lawyer works from.

At the same time, being available at all times and all places has a negative impact on lawyers’ productivity and overall well-being.

To help firms prioritize what’s most important to clients—and help lawyers establish clearer boundaries between their personal and professional lives—we included a study on lawyer hireability in this year’s survey of US consumers.

To help firms prioritize what’s most important to clients, we included a study on hireability in this year’s survey of US consumers.

What do clients look for when hiring a lawyer?

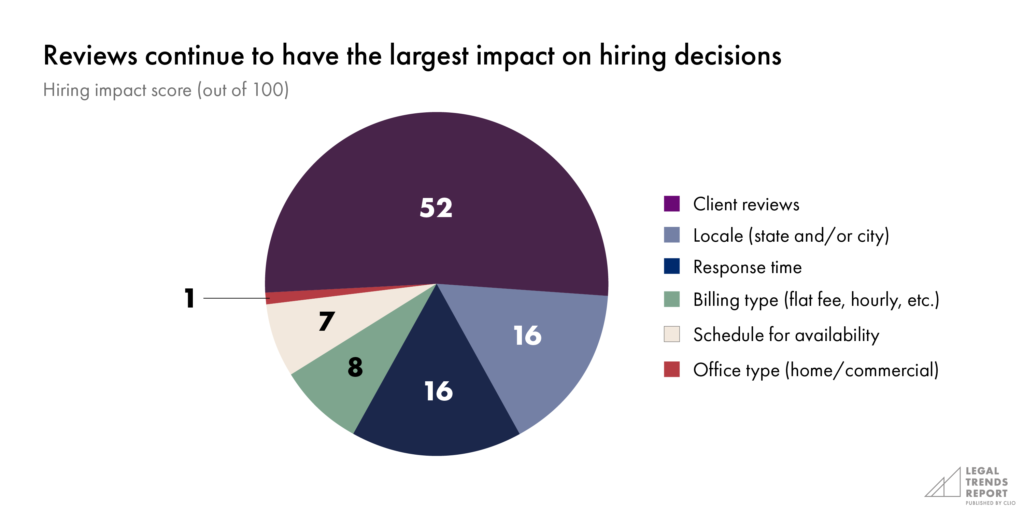

In our survey, we asked over 1,000 people representative of the general population to “lawyer shop.” Participants were asked to compare several pairs of hypothetical lawyers, each with their own randomly-generated set of attributes. Then, using statistical analysis, we determined which attributes were mostly likely to drive hiring decisions.

We tested key hireability factors that relate to remote work and communication, including whether the lawyer has a home office or traditional commercial office, and whether the lawyer was available evenings and weekends. Our previous research also indicates that client reviews and responsiveness to communications have a strong impact on hiring—including these attributes in our study gives us known attributes to benchmark other factors against.1

In total, the hireability factors we looked at included:

- Locale (state and/or city)

- Office type (home/commercial)

- Schedule for availability (after hours and weekends)

- Billing type (flat fee, hourly, etc.)

- Client reviews

- Response time

Using statistical analysis, we determined which attributes were mostly likely to drive hiring decisions.

Reviews are most critical to getting hired

We measured impact on a 0-100 scale, with the sum of scores for all six attributes equaling 100. Similar to our previous research, client reviews surfaced as the most influential factor in hiring decisions with an impact score of 52.

Finding ways to boost and maintain positive client reviews remains one of the most impactful ways lawyers can make themselves more hireable. In some cases, this may mean that firms with strong reviews can work from anywhere, during the times they want, and still be very hireable.

Unlike the other factors we assessed, reviews are an output metric—they are based on the many inputs that influence client experiences. This means that while lawyers should focus on driving positive client reviews, they should also determine what actually influences the reviews they receive. There are a range of factors that will influence reviews for any given firm, and many of the factors included in this study can be used to help lawyers prioritize their work to earn more positive reviews.

Firms should also look at the potential impact of performing well across multiple hireability factors. For example, when firms must compete with others that have several positive reviews, the other factors in this study can provide opportunities to set themselves apart. For firms just starting out or looking to improve their reputation, these other factors are important to prioritize and showcase to prospective clients.

We measured impact on a 0-100 scale, with the sum of scores for all six attributes equaling 100.

Clients still care about location

The location of a lawyer’s office is tied with responsiveness as the second-most important factor in hiring decisions with an impact score of 16 (out of 100). In this context, “location” refers to whether a lawyer works in the same city or state as a potential client.

Despite more clients preferring virtual meetings over in-person meetings (see Part 2), they still want their lawyers to be local. Jurisdictional preference could play a role here, since clients may prefer that the lawyer they hire has familiarity with local laws and court procedures. However, it could also be the case that clients still prefer a degree of proximity to their lawyer, especially if they want the option to meet in-person at some point during their legal matter.

As more firm interactions shift online, clients may care less about the physical location of their lawyers. Firms with a strong online presence that can articulate their familiarity with local judicial law and show attentiveness regardless of location may be able to successfully market their services in surrounding cities and other remote areas.

Despite more clients preferring virtual meetings over in-person meetings, they still want their lawyers to be local.

Being first to respond matters

As noted above, responsiveness ranked just as high as location when it comes to hireability with an impact score of 16 (out of 100). The implication is that firms can dramatically improve their competitive advantage by responding to prospective clients quickly.

In addition to how much clients care about responsiveness in their lawyer, there is likely a real-world reality to consider: firms that are quickest to respond to potential clients—and to make a good impression with relevant and thorough information—are most likely to earn new business.

How quickly should firms aim to respond to potential clients? Research in the 2019 Legal Trends Report says that 79% of clients expect a response within 24 hours—and our data showed most law firms fall far below these expectations. That year, we put lawyers to the test, sending “mystery shop” emails and phone calls from hypothetical clients to measure response times. Shockingly, 60% of law firms didn’t respond to their emails and only 56% answered their phone.

Technology can help firms manage and stay on top of important client communications. For example, the communications features in Clio Manage allow firms to manage email and text messaging in a central location. This helps firms keep track of incoming messages while providing an easy way to respond quickly. Meanwhile, Clio Scheduler can help clients book their consultations instantly, eliminating the need for back-and-forth emails. Technology can help meet the immediate needs of clients and provide a perception of responsiveness, driving a real and sustainable competitive advantage for firms.

Firms can dramatically improve their competitive advantage by responding to prospective clients quickly.

Clients are conscious of what they’ll have to pay

While not as significant as reviews or responsiveness, how a firm bills affects a client’s decision to hire. Specifically, whether a lawyer offers a range of billing options received an impact score of 8 (out of 100) on hireability.

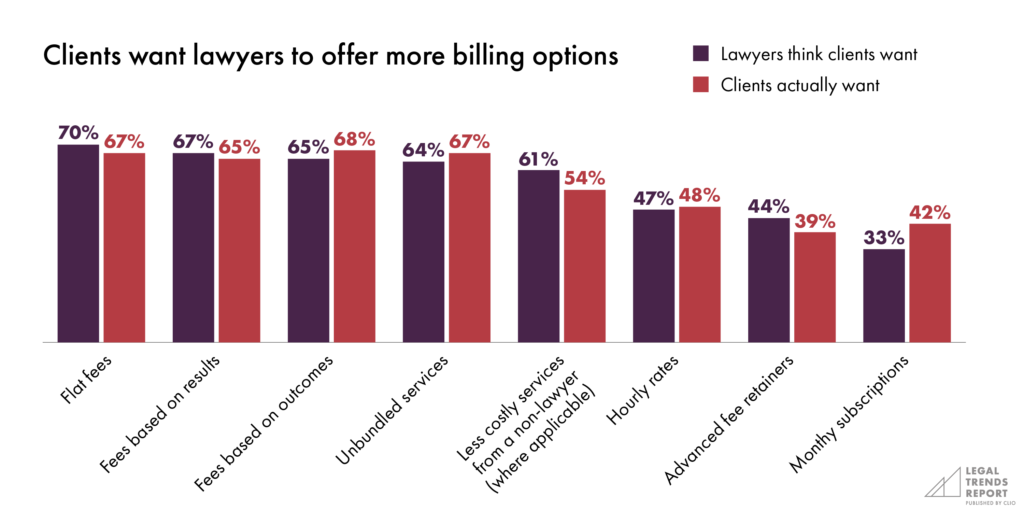

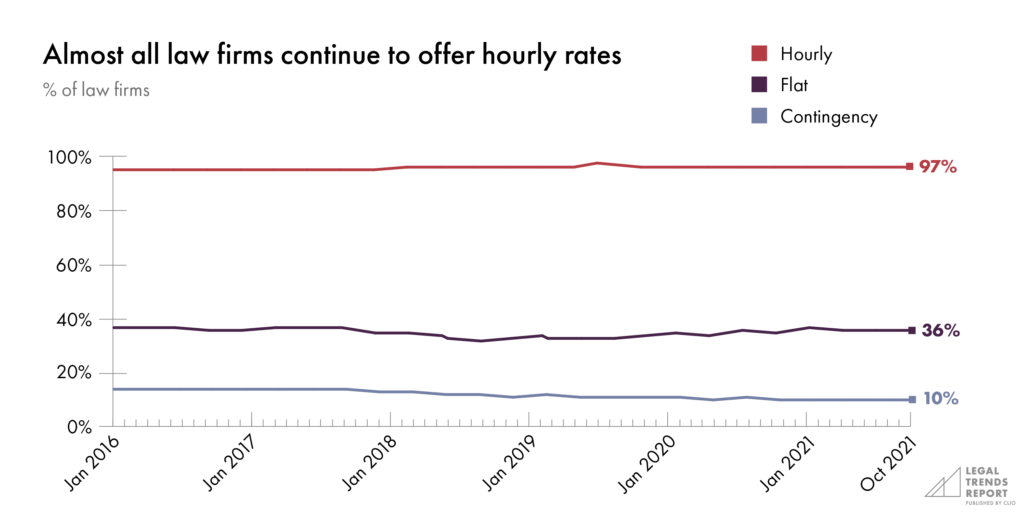

Additional survey data says most consumers (67%) want the option to pay for legal services via flat fees. While 70% of lawyers recognize this preference, based on aggregated and anonymized data from Clio, only 37% of law firms actually offer flat fees for any type of legal matter. Hourly rates remain the most common form, offered by 97% of law firms.

Result and outcome-based fees were also popular among people looking to hire a lawyer (65% and 68% respectively), and many want options for unbundled or less costly services from non-lawyers (e.g. paralegals) (67% and 54% respectively). These types of fee options suggest clients want to pay for results, not hours—and many want to see options to reduce the overall price they pay.

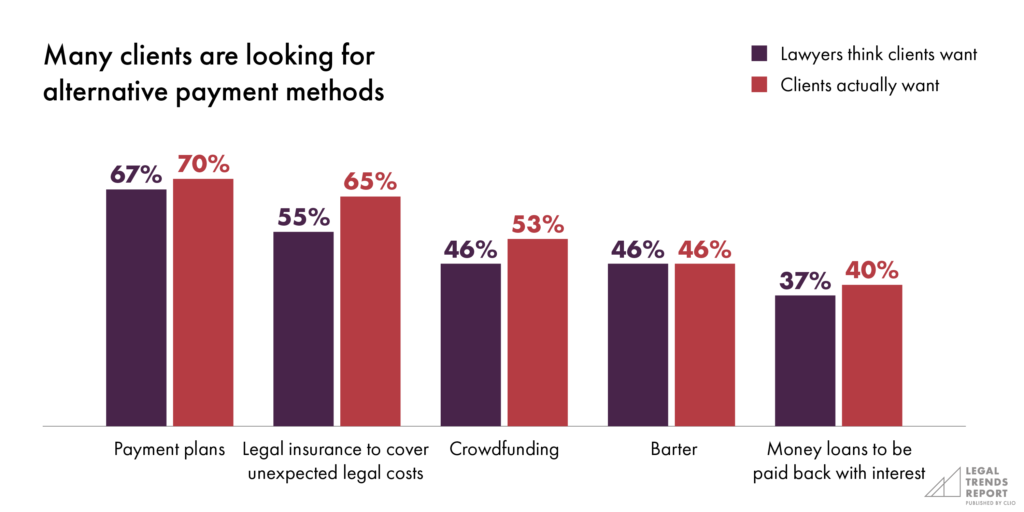

Payment options are closely related to fee structures, since how clients pay ultimately shapes their perception of overall cost. In many cases, payment options can also ease the burden of a large, one-time payment and increase the affordability of legal services. Most clients are open to a range of options: for instance, 70% of consumers want the option to pay a lawyer via a payment plan, 65% want the option of legal insurance, and 53% want the opportunity to crowdfund their legal bills.

A cloud-based practice management solution like Clio Manage enables firms to offer a range of billing options to clients, and makes it easier and more efficient for firms to manage their billing processes from a central location. Online payment solutions like Clio Payments also make it easy to collect payments—and to set up and track automated payment plans for customer bills or retainer deposits and top-ups.

Clients want to pay for results, not hours.

Firms should evaluate the time they spend with clients outside of business hours

Availability outside of traditional business hours scored lower on overall impact with a score of 7 (out of 100). While clients say they care a lot about having lawyers available outside of business hours during evenings and weekends (see Part 3), when forced to balance this against other considerations, the overall impact on hireability is relatively low. This suggests that it may not be worth it for lawyers to prioritize their availability outside of traditional working hours.

Another consideration is the practical advantage to being able to respond during these times—or at least to have systems in place to help meet the immediate needs of clients through some other means. For example, being the first to answer initial questions or schedule a consultation before another lawyer does can help make a good first impression. At the same time, working too many evenings and weekends can have negative personal and professional consequences.

While clients may want access to their lawyer during inconvenient times, this does not require a human being to provide a positive experience for every interaction—technology and automation can dramatically improve how clients perceive responsiveness outside of normal business hours. Lawyers can look at a range of options to help prioritize and respond to certain client needs while also maintaining boundaries that prevent work from negatively affecting their personal life.

For example, cloud-based solutions like Clio Manage and Clio Grow offer several solutions that help automate and enhance client experiences based on their specific needs:

- A secure online portal enables clients to access documents, key information, and case updates themselves.

- An online scheduler lets clients book an appointment without having to call or email the firm.

- Online document sharing and e-signatures allow clients to securely share and sign documents easily and instantly.

- Electronic intake forms help clients share information about their matters when it’s convenient for them.

- An online payment system allows clients to pay bills or deposit money into trust accounts entirely on their own.

In other words, while no lawyer can make themselves available 24-7, there is a range of services that allow firms to automate interactions in ways that extend the overall availability of information and service they provide. This can improve hireability and a client’s overall experience with a firm, and allow for better work-life balance for firm employees.

Technology and automation can dramatically improve how clients perceive responsiveness outside of normal business hours.

Clients don’t care if their lawyer works from home

Whether a lawyer works at home or in an office has a negligible influence on hireability. With an impact score of only 1 (out of 100), whether a lawyer has a commercial office hardly influences the hiring decisions of prospective clients.

This indifference to whether a lawyer works from home or from an office presents a huge opportunity for flexibility without sacrificing hireability—especially since 49% of lawyers prefer to work from home. But as discussed in Part 3, to ensure that working from home doesn’t lead to irregular work schedules that could negatively impact client relationships, work performance, and personal well-being, firms should place clear expectations around work hours and other protocols for lawyers working from home.

When done effectively, working from home can be a means to providing better client service, especially if it means that lawyers can do their best work. Ensuring that they are equipped with the right tools that keep them connected to their work—while helping them stay organized and efficient in managing both personal and professional priorities—is key to helping them succeed.

Whether a lawyer has a commercial office hardly influences the hiring decisions of prospective clients.

Endnotes

[1] In the 2020 Legal Trends Report, we conducted a MaxDiff analysis which indicated positive reviews and recommendations were the most likely to impact a client’s choice when hiring a lawyer. Responsiveness to questions was the most commonly-reported factor influencing a client’s choice in a lawyer in the 2021 Legal Trends Report.

2022 Legal Trends Report

Part 5

Building an antifragile law firm

- Introduction. A need for balance

- Part 1. State of the industry

- Part 2. The location of work has shifted

- Part 3. The blurring of work and life

- Part 4. Prioritizing client needs

- Part 5. Building an antifragile law firm

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

Since 2020, lawyers have dramatically changed the way they work. They work from home and the office, during the day as well as after hours and on weekends.

We’ve also seen the potential negative impact that an irregular work schedule can have on lawyers. As these trends continue, lawyers will need to find better ways to balance their work with their personal lives.

In this respect, we can also see that many lawyers have found ways to thrive in the face of difficult circumstances. As Nassim Nicholas Taleb describes: “Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty.”

In the spirit of antifragility, we’ve seen certain types of firms embrace challenges in recent years and find the means to adapt to new ways of working. In doing so, they’ve developed new capabilities that make them more capable and resilient to the shocks of today, while better preparing them for the potential volatility, randomness, disorder, and stressors of tomorrow.1

In this section, we look at how cloud-based legal practice management (LPM) software has made firms antifragile by helping them run more effective and profitable businesses that are better for both lawyers and their clients.

“Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty.”

Cloud solutions keep lawyers connected

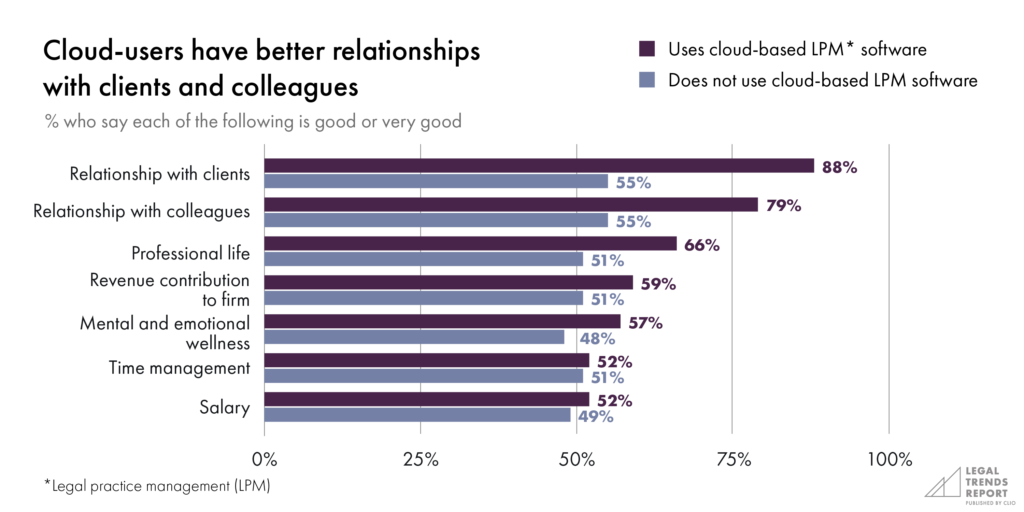

Lawyers working for law firms that use cloud-based LPM software are more likely to see positive outcomes related to their professional and personal lives, especially when it comes to relationships with others.

When comparing how lawyers rate their relationships with clients, those using cloud-based LPM software to manage their practice were 60% more likely (88% compared to 55%) to have positive relationships with their clients. They were also 44% more likely (79% compared to 55%) to have positive relationships with colleagues.

Overall, those using cloud-based LPM software were 29% more likely (66% compared to 51%) to be happy with their professional lives. They were also more likely to report greater satisfaction with firm revenue and mental and emotional wellness.

Those using cloud-based LPM software to manage their practice were 60% more likely to have positive relationships with their clients.

Cloud users are more flexible with their time

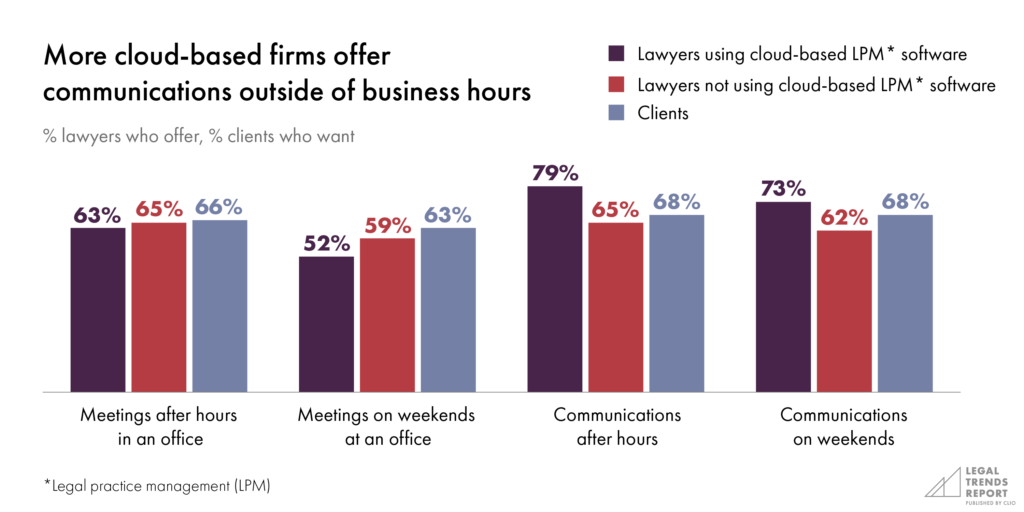

In addition to the benefits that cloud-based LPM software has for relationships with clients, we can also see how these solutions influence the actual delivery of client services.

Overall, firms using cloud-based LPM software are less likely to offer meetings after hours and on weekends. At the same time, however, they are more likely to offer communications during these times. In this way, being willing to stay in touch remotely could be a form of boundary-setting that allows lawyers to balance work and life. Compared to spending extra hours in the office, communicating through phone, text message, or email is a more efficient and less disruptive way to stay in touch with clients.

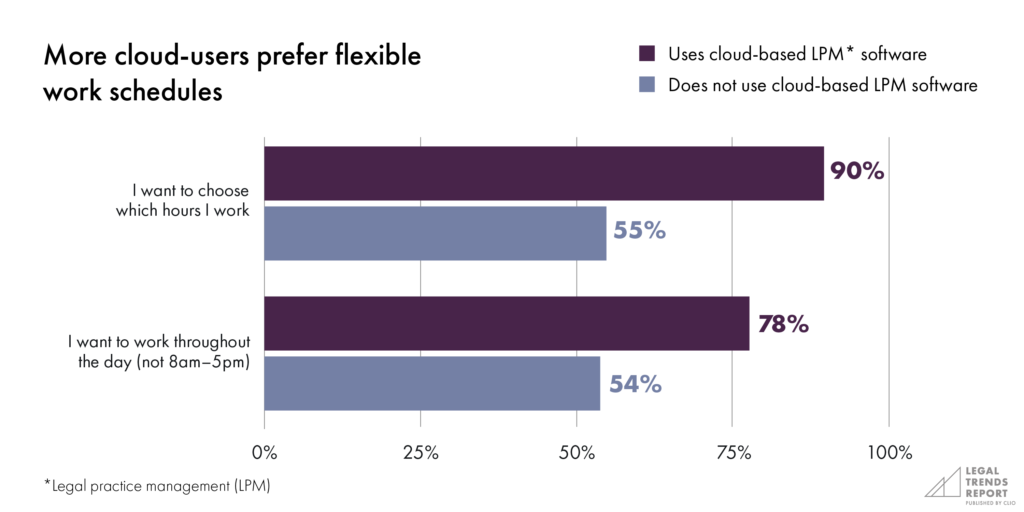

Given that working after hours and on weekends is becoming increasingly hard to avoid, cloud-based LPM software helps mitigate the challenges of off-hours work. In fact, cloud-based LPM software users are 44% more likely (78% compared to 54%) to want to work throughout the day rather than between 8 a.m. and 5 p.m. Overall, 64% more cloud-based LPM users (90% compared to 55%) want to choose which hours they work.

Being willing to stay in touch remotely could be a form of boundary-setting that allows lawyers to balance work and life.

The cloud advantage

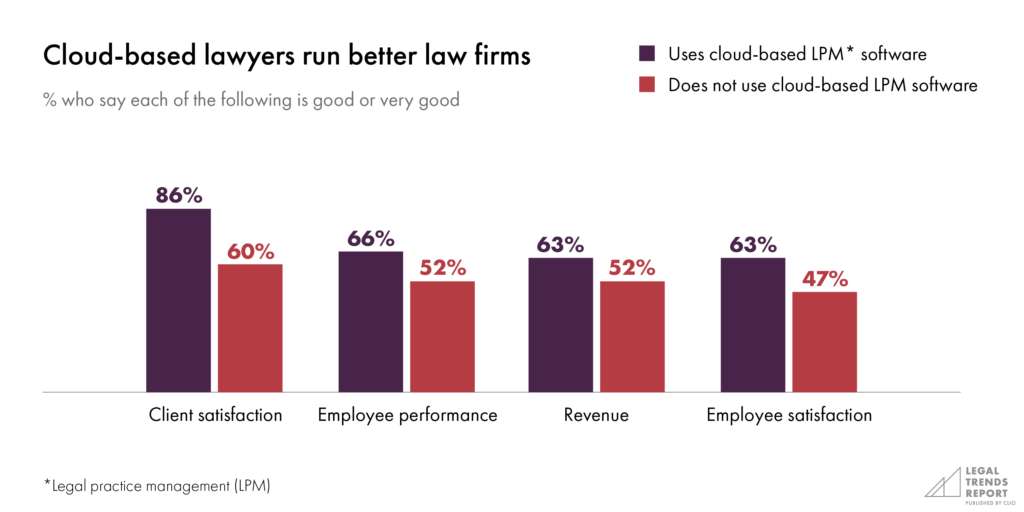

Beyond the ways in which lawyers work and the impact that technology has on daily operations, cloud-based firms also see better performance when looking at key measures of success. Those using cloud-based LPM software are 43% more likely (86% compared to 60%) to have satisfied clients (which is good for positive reviews and hireability).

Cloud-based LPM software is a key factor in employee performance and job satisfaction, which is vital in a competitive talent market. Cloud users are 34% more likely (63% compared to 47%) to be happy working at their firm, and they are 27% more likely (66% compared to 52%) to perform well at their jobs. As many legal professionals still plan to leave their roles in the coming months, firms looking to avoid the disruption of staff turnover should prioritize offering positive working environments that people enjoy.

Overall, firms using cloud-based LPM software were 11% more likely (63% compared to 52%) to have strong revenue streams. Not only do these firms enjoy the profits of a successful business, but they also have more resources to continue investing in new capabilities and adaptations, furthering their competitiveness and innovation. As these firms continue to reap the rewards of running a successful business, they also provide a model for other firms to follow.

As these firms continue to reap the rewards of running a successful business, they also provide a model for other firms to follow.

Cloud technology enables antifragility in law firms

Law firms have relied on the cloud to evolve amidst significant adversity in recent years. In doing so, legal professionals have adopted many capabilities requisite of antifragile businesses—preparing them to not only survive, but to also thrive, amidst the prospect of an increasingly volatile future.

Cloud-based LPMs have transformed the practice of law by enabling lawyers to offer better client experiences and increased flexibility, resulting in better well-being, happiness, and work-life balance. As the market for legal services continues to evolve, the adaptability and resilience gained from cloud technology—in addition to the many other benefits to work and life—indicate that the industry will continue its rapid and permanent shift to the cloud in the years to come. Law firms that embrace both a mindset and technology infrastructure that allows them to be antifragile will be the ones that thrive.

As we enter another downturn, with an increasingly dynamic regulatory and macroeconomic environment, some firms will emerge stronger thanks to these stressors—while others will fail to adapt. As the pandemic and previous recessions have shown, antifragility can be seen at both the individual law firm level and at an industry level. These stressors have better equipped lawyers and their firms to collectively transform how they meet the rapidly evolving needs of the legal consumer.

We’ve seen how the cloud has made firms more antifragile, and in doing so has better prepared them for a future of uncertainty.

Endnotes

[1] Read more about antifragility in our guide, The Building Blocks of an Antifragile Law Firm.

2022 Legal Trends Report

Appendix A

Hourly rates and KPIs

- Introduction. A need for balance

- Part 1. State of the industry

- Part 2. The location of work has shifted

- Part 3. The blurring of work and life

- Part 4. Prioritizing client needs

- Part 5. Building an antifragile law firm

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

Each iteration of the Legal Trends Report includes annual data on average hourly rates and key performance indicators (KPIs) to help analyze lawyer and law firm productivity, efficiency, and revenue generation.

Billable hour index

Every year, Clio’s researchers analyze data from tens of thousands of legal professionals to determine the average cost for an hour of legal services in the United States. Changes to the average cost of legal services over time can be observed in the Billable Hour Index. To contextualize changes to the cost of legal services we have also looked at simultaneous changes in the Consumer Price Index (CPI) to understand how hourly rates have changed in relation to the average cost of goods and services.

Understanding CPI

The CPI is a measurement of the average change over time in the prices paid by urban consumers for a representative basket of consumer goods and services. CPI is used by the Bureau of Labor Statistics to measure inflation as it is experienced by consumers in their daily living expenses. CPI is fundamentally a measure of price change over time, making it a useful statistic to compare with changes in the cost of legal services across the United States.

Key performance indicators

Several KPIs can be used to gain valuable insights into a law firm’s performance. This information helps lawyers understand how they and their employees are contributing to revenue generation, and can be instrumental in identifying areas for continuous improvement.

The following charts show three KPIs that every lawyer should be familiar with: utilization rate, realization rate, and collection rate. To ensure a mature data set representative of our annual benchmarking, the figures show data insights from 2021.

HOURLY RATES AND KPI DATA FOR STATES AND PRACTICE AREAS

The Legal Trends Report features aggregated and anonymized data from tens of thousands of legal professionals across the United States. Download the pdf version to get access to the full report, including appendices that include hourly rates and business metrics based on state and practice area.

2022 Legal Trends Report

Appendix B

Detailed methodology

- Introduction. A need for balance

- Part 1. State of the industry

- Part 2. The location of work has shifted

- Part 3. The blurring of work and life

- Part 4. Prioritizing client needs

- Part 5. Building an antifragile law firm

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

App data collection

By synthesizing actual usage data, we’re able to identify trends that would be otherwise invisible to most firms.

The Legal Trends Report has been prepared using data aggregated and anonymized from tens of thousands of legal professionals. These customers were included in our data set using the following criteria:

- They were paid subscribers to Clio. Customers who were evaluating the product via a free trial or were using Clio as part of our Academic Access Program were not included.

- They were located in the contiguous United States. This includes the District of Columbia but excludes Hawaii and Alaska. No customers in other countries were included.

- Any data from customers who opted out of aggregate reporting were excluded.

- Outlier detection measures were implemented to systematically remove statistical anomalies.

Data usage and privacy

The security and privacy of customer data is our top priority at Clio. In preparing the Legal Trends Report, Clio’s data operations team observed the highest standard of data collection and reporting.

Data collection

- All data insights were obtained in strict accordance with Clio’s Terms of Service (section 2.12).

- All extracted data was aggregated and anonymized.

- No personally-identifiable information was used.

- No data belonging to any law firm’s clients was used.

Reporting

Aggregate data has been generalized where necessary to avoid instances where individual firm data could be identified. For example, to avoid reporting data on a small town with only one law firm, which would implicate all of this town’s data to this firm, we only report at country, state, and metropolitan levels.

Additionally, raw data sets will never be shared externally. Clio is effectively a tally counter for user interactions—much like stadiums use turnstiles to count visitors without collecting any personally-identifiable information from their customers. Similarly, as users interact with the Clio platform they trigger usage signals we can count and aggregate into data sets. We can identify trends without collecting information that reveals anything specific about individual customers.

Survey design

This year’s Legal Trends Report includes survey data collected during April and May 2022.

Survey of US legal professionals

- 1,134 respondents

Survey of US consumers (general population)

- 1,168 respondents

Survey respondents were representative of the US population by age, gender, region, income, and race/ethnicity, according to US census statistics.

Survey of professionals from other industries in the US

- 458 respondents

Survey respondents were representative of the following professions: accounting, architecture, business consulting, data security, engineering, event planning, financial services and investment, insurance, marketing/advertising, public relations, real estate, tax preparation (non-accountant), and transportation/logistics.