2023 Legal Trends Report

Introduction

Unlocking the potential to succeed

- Introduction. Unlocking the potential to succeed

- Part 1. The thriving business of legal

- Part 2. Lockup—a new indicator of cash flow

- Part 3. Getting paid faster

- Part 4. Business levers to improve firm performance

- Part 5. The promise of AI

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

In our fast-paced world, efficiency and effectiveness are of the utmost importance. In the practice of law, this has been never more true since Clio first started publishing the Legal Trends Report in 2016.

With rapid advancements in new systems and technologies, today’s legal professionals have more tools and opportunities for innovation than ever before, and they are driving never-seen-before productivity as a result.

But the landscape for success continues to evolve. What defined innovation in the last decade has since become foundational. With radical advancements in artificial intelligence, law firms are once again finding themselves at the cusp of transformative change.

This is where a client-centered approach is more important than ever. In the midst of uncertainty, certain values still—and always will—hold up. The lawyers and practices that continue to adapt and evolve in the interests of their clients are the ones that will ultimately succeed in the long run.

What defined innovation in the last decade has since become foundational.

Legal productivity is higher than ever before

Today, legal professionals work heavier caseloads—and earn over two and a half times more for their firms than in years past. This is an unprecedented achievement in the legal industry. It means that lawyers and their firms are doing a lot more of what they set out to do—provide legal services to clients. And they’re earning substantially more for themselves in the process. This growth in productivity also means that the capacity of the legal profession as a whole has, in turn, increased the scale of services available to clients. This growth couldn’t be more timely.

Over the last three years, businesses have dealt with inflation rates that have reached their highest levels in decades. Rising costs put law firms in a challenging position—on the one hand, looking for ways to reduce costs, while on the other, having to find new ways to increase revenues.

Lawyers may be hesitant to raise their hourly rates—since clients are also dealing with the effects of inflation—and many are instead turning to technology to improve efficiency and productivity. Technology is a powerful lever that businesses use to get more done while also improving client experiences. Certain capabilities can have a revolutionary impact on business. However, finding the right tool for the job at hand is critical.

Technology is a powerful lever that businesses use to get more done while also improving client experiences.

The power of leverage

A lever is a mechanism that amplifies the impact and outcomes of our work efforts. When using a lever, a small amount of effort can be multiplied several times over to apply a substantially larger force. When used strategically in the practice of law, certain business levers can transform a firm’s operations to make them incredibly more efficient, productive, and capable of delivering the best client experiences possible.

When applying the principles of leverage to business, knowing where to apply them is just as important as knowing what tools to use. We’ve seen the massive impact that technology can have in improving the success of law firms. Throughout this report, we look at key leverage points that include utilization, realization, and collection rates—and discuss cash flow with the introduction of our new lockup metric.

We also look at key technologies as business levers that have had the most impact on firm success. Billing and payment systems in particular continue to be a crucial point of focus for any law firm. As simple as it might seem to bill work to clients, the undertaking grows more complex with scale. Even small inefficiencies can result in delayed cash flow and lost earnings.

Electronic billing and payments are powerful business levers that allow law firms to find new efficiencies, create better client experiences, and open the door for more advanced automation. Even simple workflow improvements see law firms billing 18% more of their work to clients over other firms, resulting in substantial revenue gains.

Throughout this report, we look at key leverage points that include utilization, realization, and collection rates—and discuss cash flow with the introduction of our new lockup metric.

The advent of generative artificial intelligence

By far, the most impactful technological advancement made in the last decade has been the public launch of generative artificial intelligence (AI) with the release of ChatGPT. For the first time, law firms have access to technology that doesn’t just help manage and process information. With generative AI, legal professionals have new tools that simulate cognitive functions for interpreting, summarizing, and creating new content based on large language models (LLMs) trained on enormous datasets.

AI has the potential to transform so many facets of everyday business operations, and we’ve only just scratched the surface in terms of what it will be capable of in the years and decades to come. As more legal professionals adopt AI in their practices, the benefits are becoming increasingly apparent. Already, AI has given firms the ability to summarize key information, assist in drafting documents, identify high-risk clauses in a contract, and automatically generate demand letters for personal injury cases.

The early days of generative AI have also highlighted the risks inherent in this technology. A New York lawyer learned this the hard way when he used ChatGPT to cite court decisions relevant to an airline lawsuit. Unfortunately, Chat GPT invented—or “hallucinated,” the term used when AI software creates incorrect information presented as fact—precedent cases, which was only revealed during court proceedings. Such episodes highlight that, like any new technology, lawyers must ensure they understand both the benefits and the risks of the technologies used in their law practices.

Remarkably, the evolution of legal through AI has already begun, and it’s more important than ever that legal professionals stay abreast of these developments as they evolve. In this report, we look at how legal professionals—and their clients—are equipped to embrace these changes, both in their firms and in the wider justice system.

AI has the potential to transform so many facets of everyday business operations.

New this year

Expanded analysis of the state of legal practice

We’ve broadened our analysis of business performance to include data as far back as 2016. This expanded historical view allows us to identify longer-term trends that provide a more robust picture of how far the industry has come—and puts in perspective more recent changes relative to past performance.

A new metric for firm performance: lockup

This year, we’ve introduced the concept of “lockup” as a measure of law firm cash flow. This metric includes both realization lockup, which looks at how much of a firm’s revenue sits in an unbilled state, and collection lockup, which measures how much of a firm’s revenue has been billed but remains unpaid. Reducing total lockup increases cash flow and is key to better business management.

Comparative impact of KPI levers

In analyzing several capabilities within the Clio platform, we’ve identified some of the most impactful features that see law firms earn consistently more revenue. In turn, they help illustrate some of the significant productivity gains we’ve seen industry-wide.

Perceptions on AI in legal practice

In our surveys of legal professionals and the general population, we’ve undertaken an extensive study that looks at new important perspectives on the use of AI for legal practice. With its rapid public adoption, this data gives insight into where the industry is at in the earliest stages of AI adoption, and where the greatest opportunities lie for future innovation.

Reducing total lockup increases cash flow and is key to better business management.

Data sources

The Legal Trends Report uses a range of methodological approaches and data sources to deliver the best insights about the state of legal practice and strategies for future growth.

Clio data

We’ve analyzed aggregated and anonymized data from tens of thousands of legal professionals in the US. This data provides important insights about how technology is currently being used by legal professionals, as well as its impact on firm performance.

Survey of legal professionals

We surveyed 1,446 U.S. legal professionals from May 31 to July 20, 2023. The legal professionals we surveyed included lawyers as well as support staff—such as paralegals and administrators—who are engaged in the management side of their practice.

Survey of the general population

We surveyed 1,012 adults in the U.S. general population from June 13 to June 22, 2023. This survey was designed to gauge attitudes, opinions, preferences, and behaviors regarding the legal profession among individuals who have hired lawyers in the past or who may become potential legal clients in the future. This sample is representative of the U.S. population by age, gender, region, income, and race/ethnicity based on the most recent U.S. census statistics.

We’ve analyzed aggregated and anonymized data from tens of thousands of legal professionals in the US.

2023 Legal Trends Report

Part 1

The thriving business of legal

- Introduction. Unlocking the potential to succeed

- Part 1. The thriving business of legal

- Part 2. Lockup—a new indicator of cash flow

- Part 3. Getting paid faster

- Part 4. Business levers to improve firm performance

- Part 5. The promise of AI

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

Since 2016, Clio’s Legal Trends Report has provided data and analyses fundamental to the success of law firms—and deep insights into trends across the wider legal profession.

Featuring data from tens of thousands of legal professionals, no other system of record provides the scale or reliability of analysis that we feature in this report. That’s why countless legal professionals—both those who have been in the business for decades and those just starting their careers—rely on the Legal Trends Report to uncover insights and strategies to improve their practices.

The data in this section shows exactly how firms have achieved substantial success to date and why further growth is not just possible but achievable by legal professionals who have the knowledge and tools to build a better future for their firms.

No other system of record provides the scale or reliability of analysis that we feature in this report.

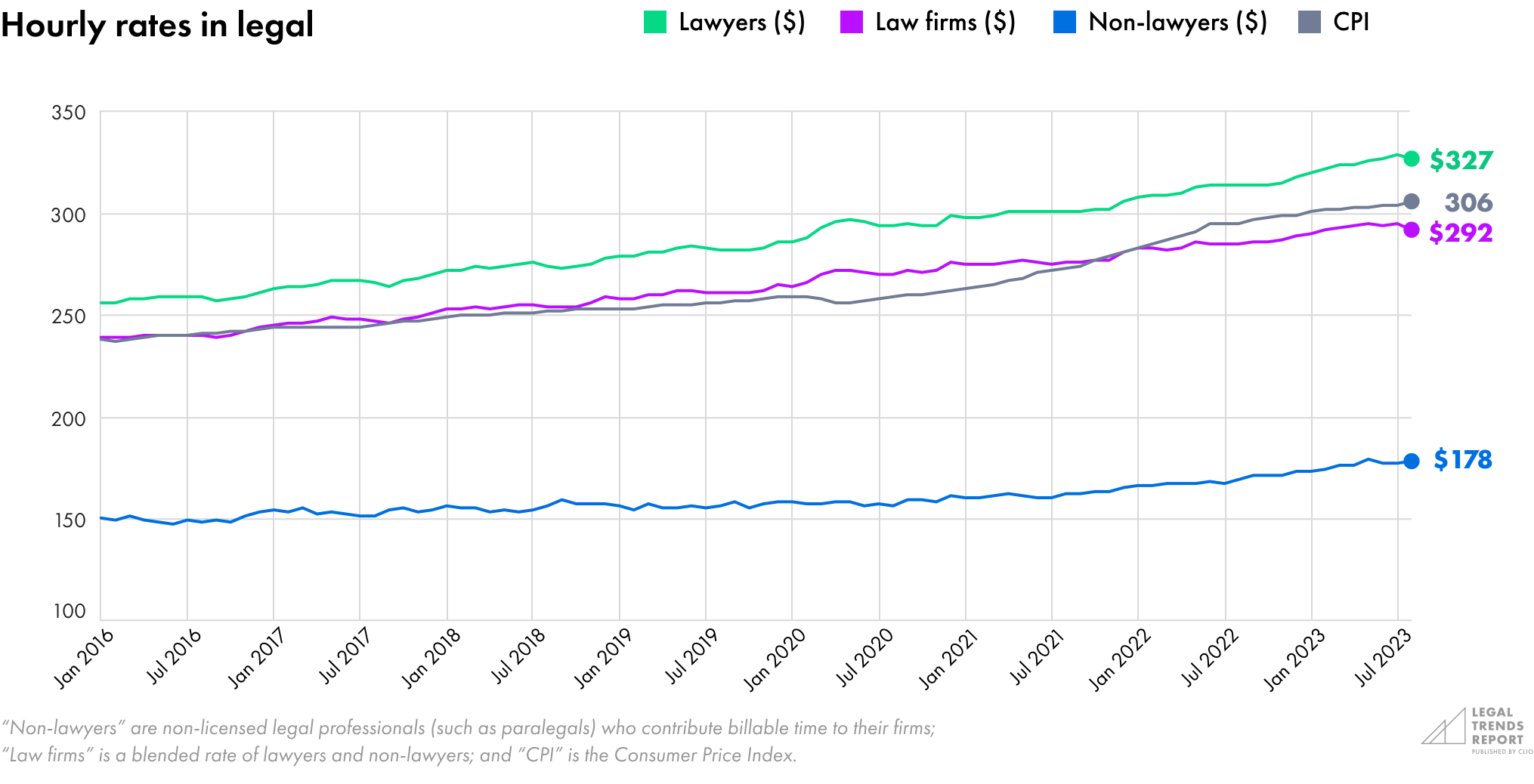

Lawyers have matched rates with inflation, but non-lawyers are way behind

A major concern for law firms—and any business—in the last few years has been the steady increase in both inflation and lending rates. Looking back to 2016, we see that the cost of legal services has also increased for clients.

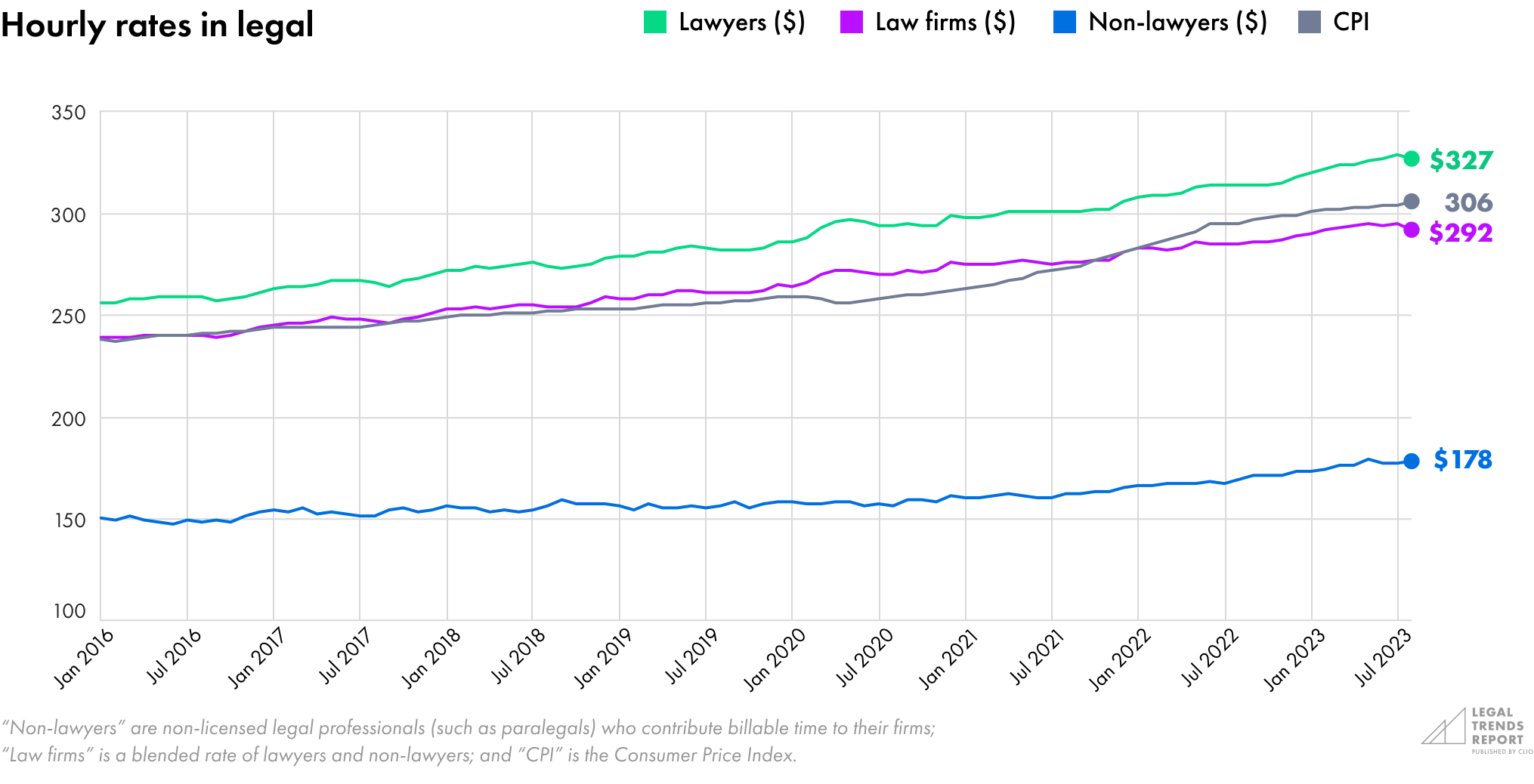

Lawyer hourly rates have risen steadily since 2016, increasing by 28% from $256 to $327 in August 2023. For comparison, rates for non-lawyers (e.g., non-licensed legal professionals, such as paralegals, who bill for their work) have only increased by 19%, rising from $150 to $178 since January 2016.1

By looking at the average of what both lawyers and non-lawyers have been charging over this period, we get a blended law firm rate, giving an approximation of what an hour of legal service costs the average client in the US. Overall, the blended law firm rate has increased by 22%, from $239 to $292, over the same period.

Inflation used to be a nominal factor in running a business, but in recent years it’s become something that business owners need to pay more attention to. When comparing to the Consumer Price Index (CPI)—which is used to measure annual inflation rates—we can see how well hourly rates have (or have not) kept pace with inflation. Overall, the CPI has increased by 29%, from 238 to 306, since the start of 2016.

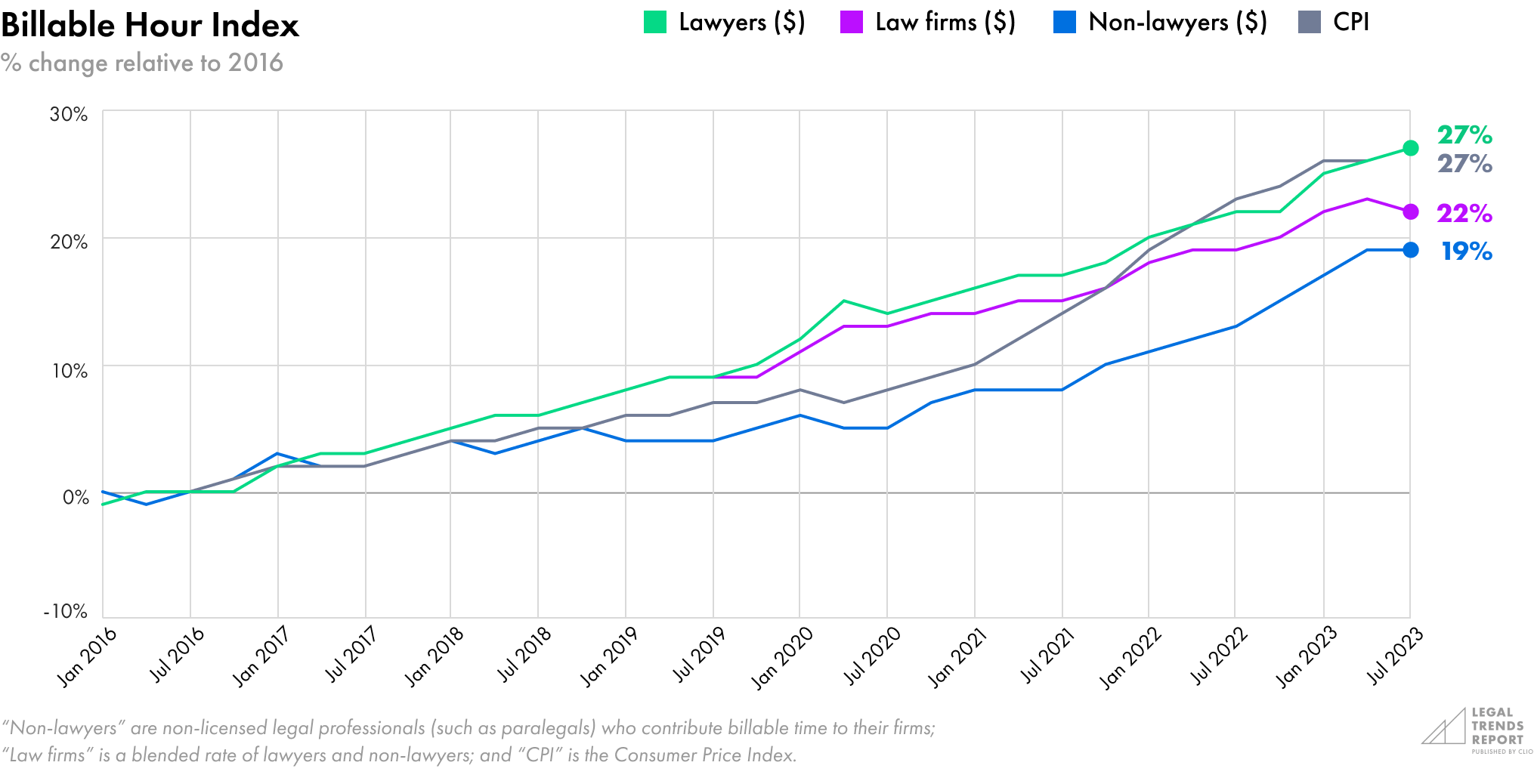

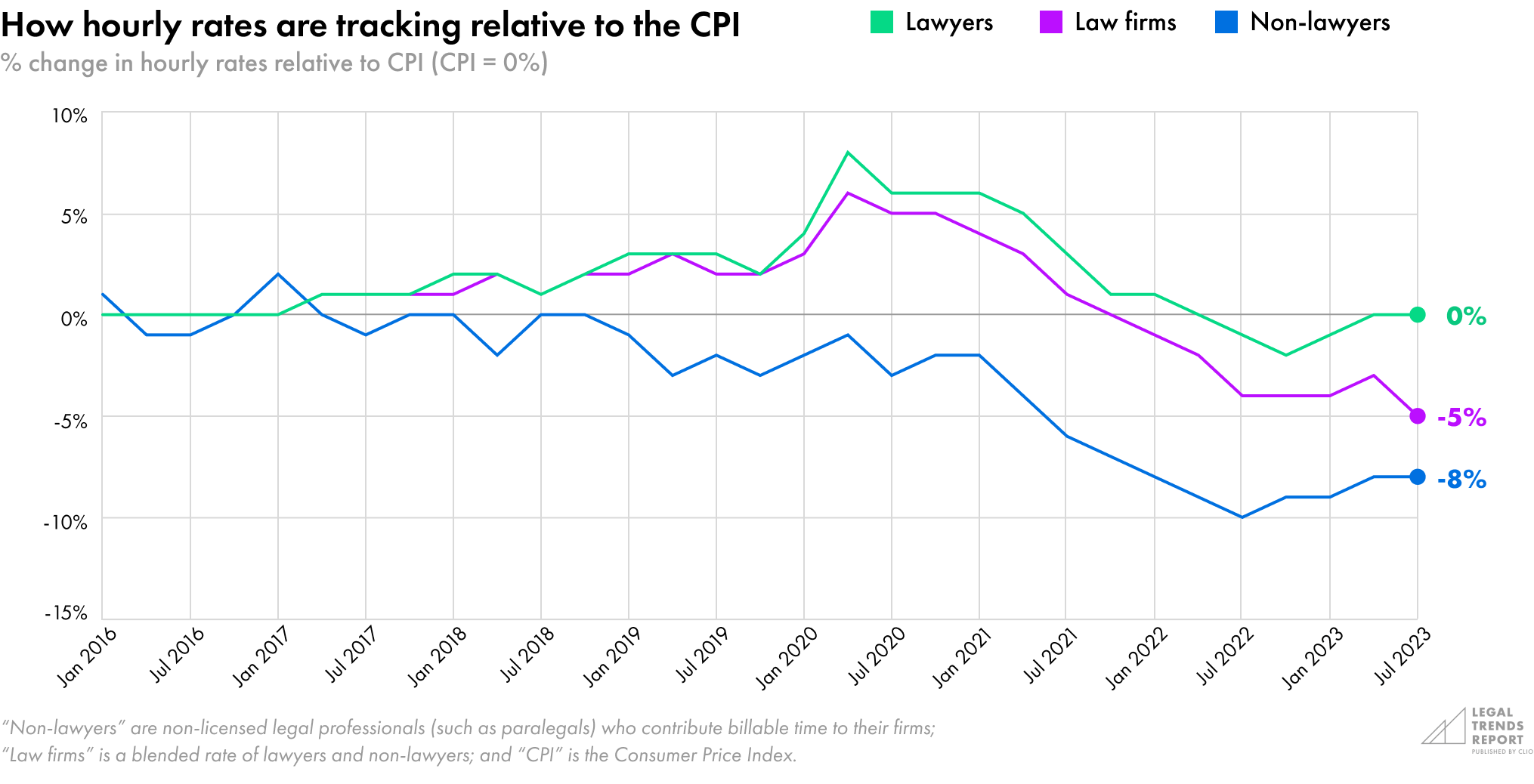

In our analysis last year, we found that consumer prices increased at a rate that exceeded hourly rates for lawyers (illustrated in the charts below). Lawyer rates fell behind consumer prices by as much as 2%. This decrease followed a period when lawyer rates were increasing at a much faster pace than the CPI, likely in response to the COVID-19 pandemic. During this time, lawyer rates actually increased by as much as 8% more than the CPI.

This year, lawyer rates have recovered relative to inflation and remained steady throughout 2023. As of Q3 (July to September), when compared to the rate of change since 2016, lawyer rates are on par with increases in consumer prices.

While non-lawyer rates have also recovered slightly in the last year, they remain far below the trend in consumer price increases. Historically, increases in non-lawyer rates have fallen below those of lawyers and the CPI since 2019. Between 2021 and 2022, increases in non-lawyer rates trailed behind the CPI by as much as 10%.

As for blended firm rates, the average cost for legal services has not kept pace with inflation, falling 5% behind the CPI. Compared to the other goods and services that clients pay for, legal services may be slightly more affordable compared to 2016.

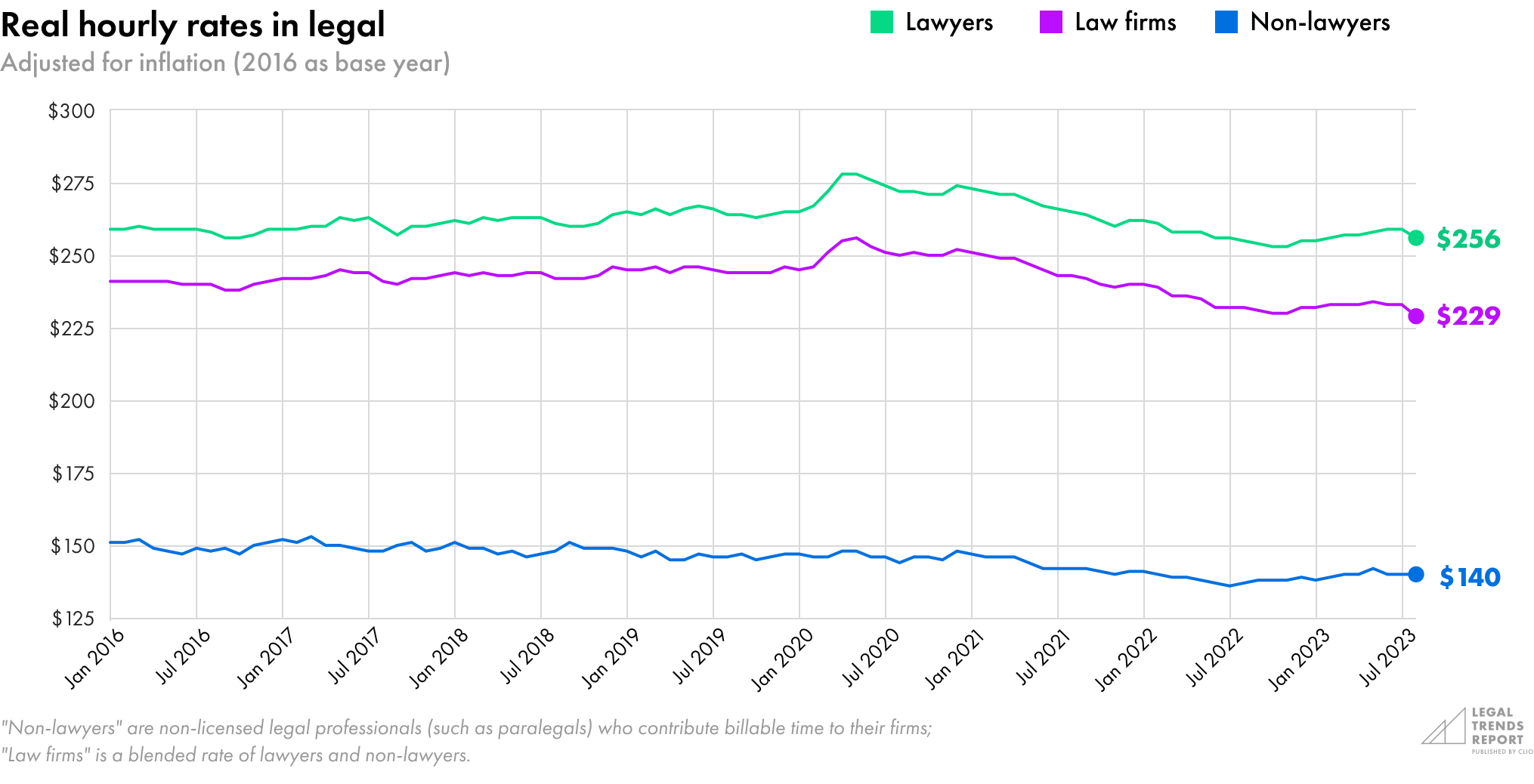

The chart below shows hourly rates in real dollars (adjusted for inflation).

When comparing to the Consumer Price Index, we can see how well hourly rates have (or have not) kept pace with inflation.

A new era of legal productivity

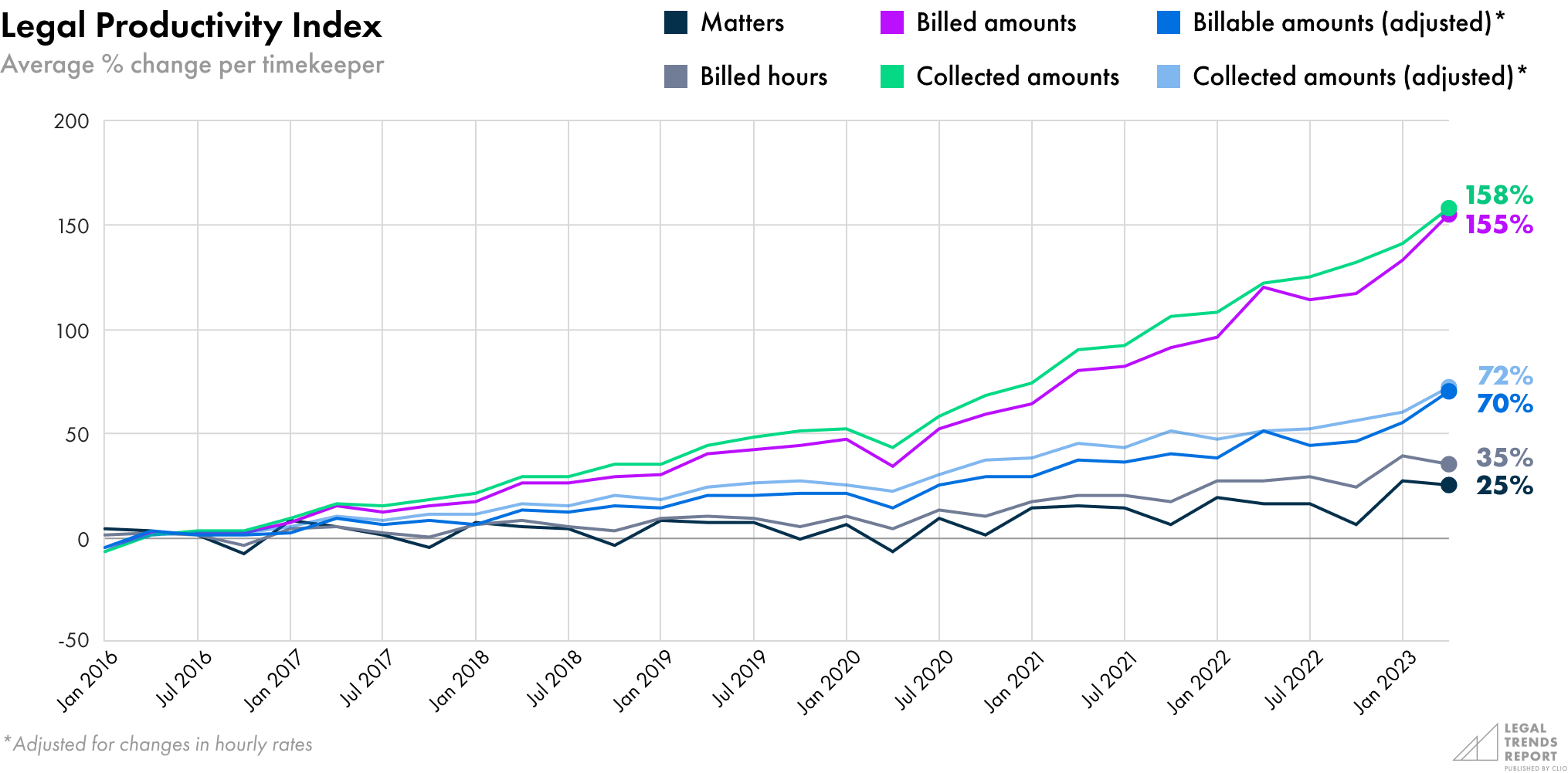

Compared to 2016, we’ve seen a staggering increase in workforce productivity within the legal industry.

The average legal professional earns much more for their firm by working a heavier caseload and putting in more billable hours. Firms are also collecting an outsized return on that work through better administrative efficiencies and capitalizing on the work of their lawyers and staff.

On average, legal professionals are working over 25% more cases compared to 2016 and recording 35% more billable hours. In addition to increasing billables, law firms are collecting a higher proportion of revenue for every hour worked. In total, legal professionals are billing and collecting over two and a half times more than in 2016.

After controlling for increases in hourly rates, the average legal professional still earns nearly three-quarters more revenue for their firm than they did in 2016.

While these gains may seem unbelievable at first glance, they are explained by the substantial improvements across a set of key performance indicators—each compounding to drive colossal business growth.

The average legal professional earns nearly three-quarters more revenue for their firm than they did in 2016.

Small efficiency gains compound into massive revenue growth

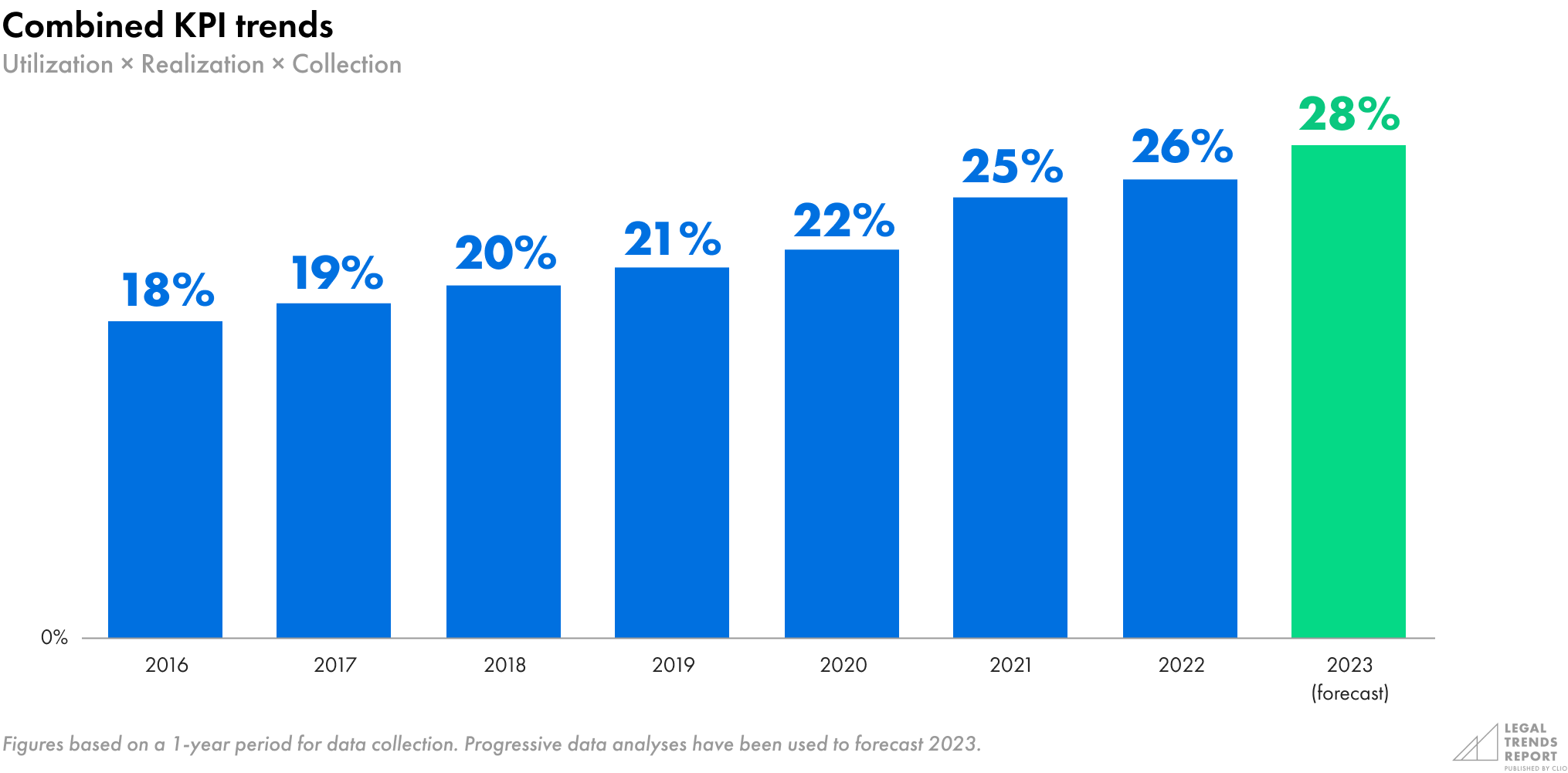

Clio’s key performance indicators (KPIs) provide benchmark insights into how law practices are performing over time, giving firms insight into how to measure and improve their performance.

Law firm KPIs

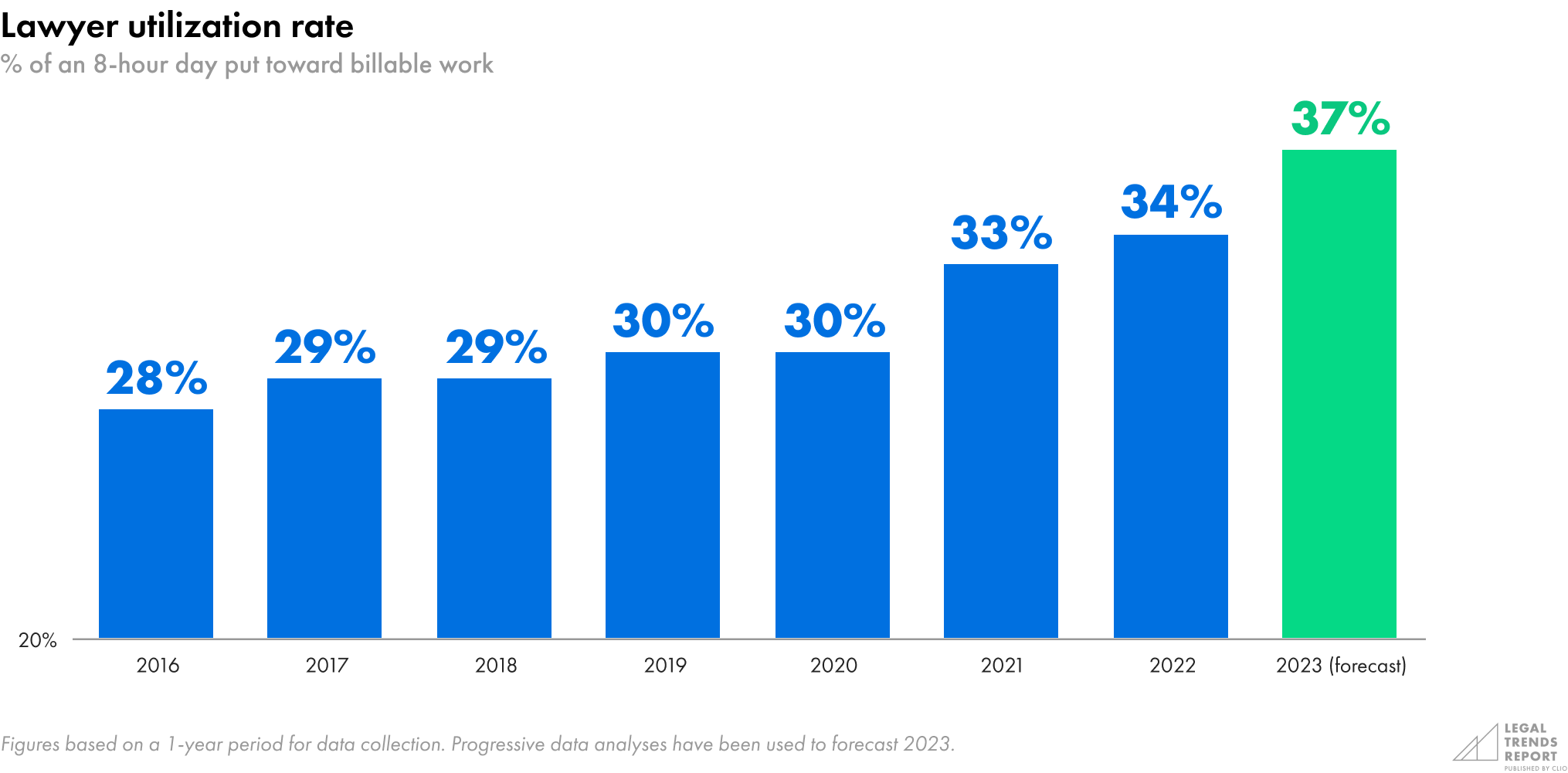

Utilization

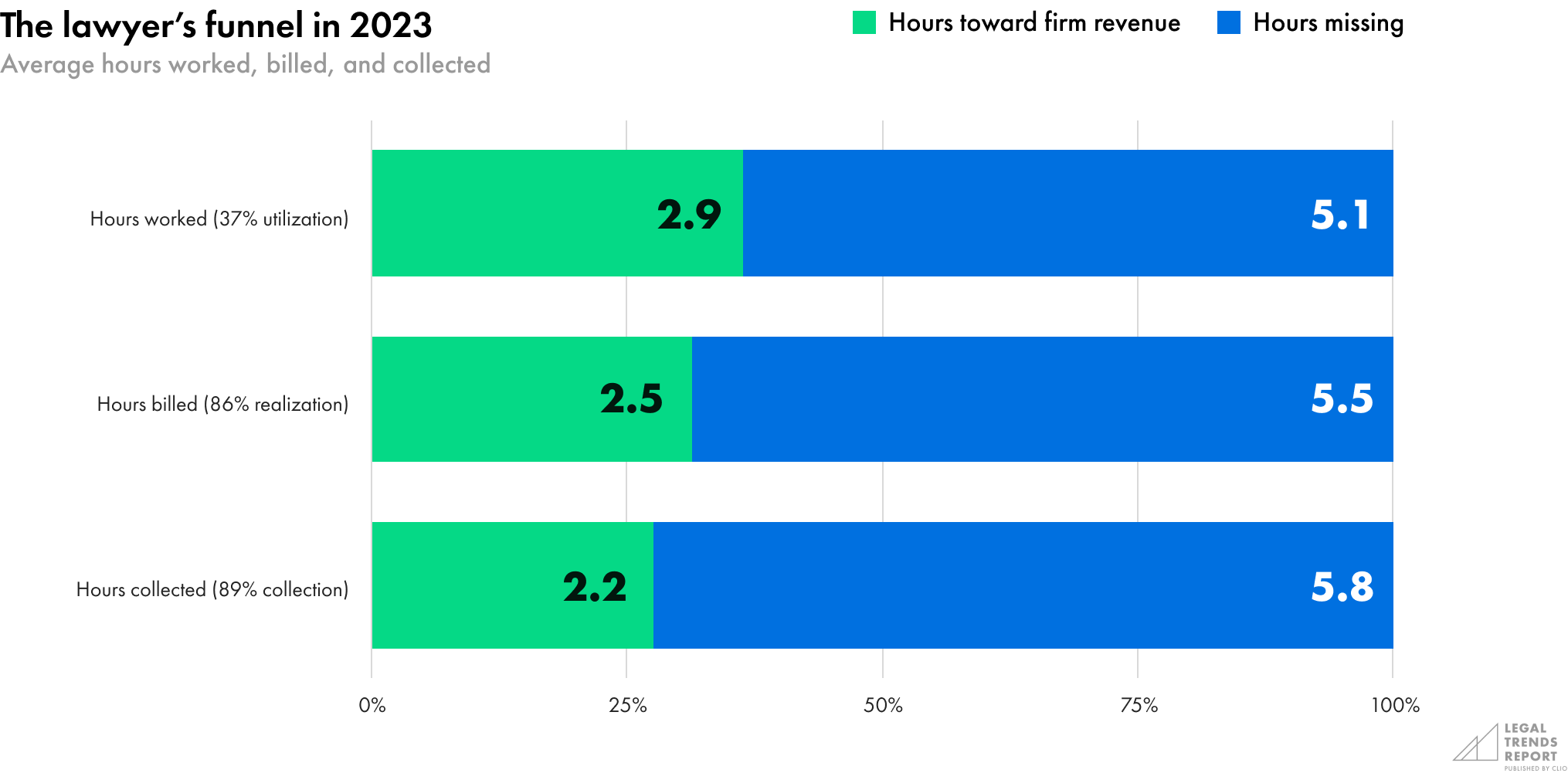

A law firm’s utilization rate measures how much of a lawyer’s eight-hour day gets put towards billable work. Since 2016, lawyer utilization rates have significantly increased from 28% to 37%—an improvement of 32%. This increase represents nearly three-quarters of an hour of billable time added for every day worked.

The fact that legal professionals are—as discussed above—working 25% more cases and putting in 35% more billable hours is a direct reflection of law firms increasing their utilization.

Yet, despite the massive boost in lawyer productivity, nearly two-thirds of the workday still goes underutilized with respect to billable client work, meaning there is still much room for improvement.

Two issues in law firms often contribute to lower utilization rates: (1) lawyers may be overwhelmed with administrative and business development tasks, reducing their ability to spend time on billable work, and (2) law firms may struggle to find enough clients to keep their lawyers busy. Past research shows that 48% of a lawyer’s non-billable time gets put toward administrative tasks like office administration, generating and sending bills, and collections. Another 33% of non-billable time gets put into business development.2

This is where adopting the right systems for organizing and improving access to firm information—and using efficient tools for timekeeping, task management, and collaboration—can keep lawyers focused on their most important, and most billable, work.

Firms that struggle to bring enough clients into the firm can also look at increasing word-of-mouth referrals, marketing their services, building reputation with past clients, and putting proficient systems in place to intake clients in an effective, timely, and convenient way.

Since 2016, lawyer utilization rates have significantly increased from 28% to 37%—an improvement of 32%.

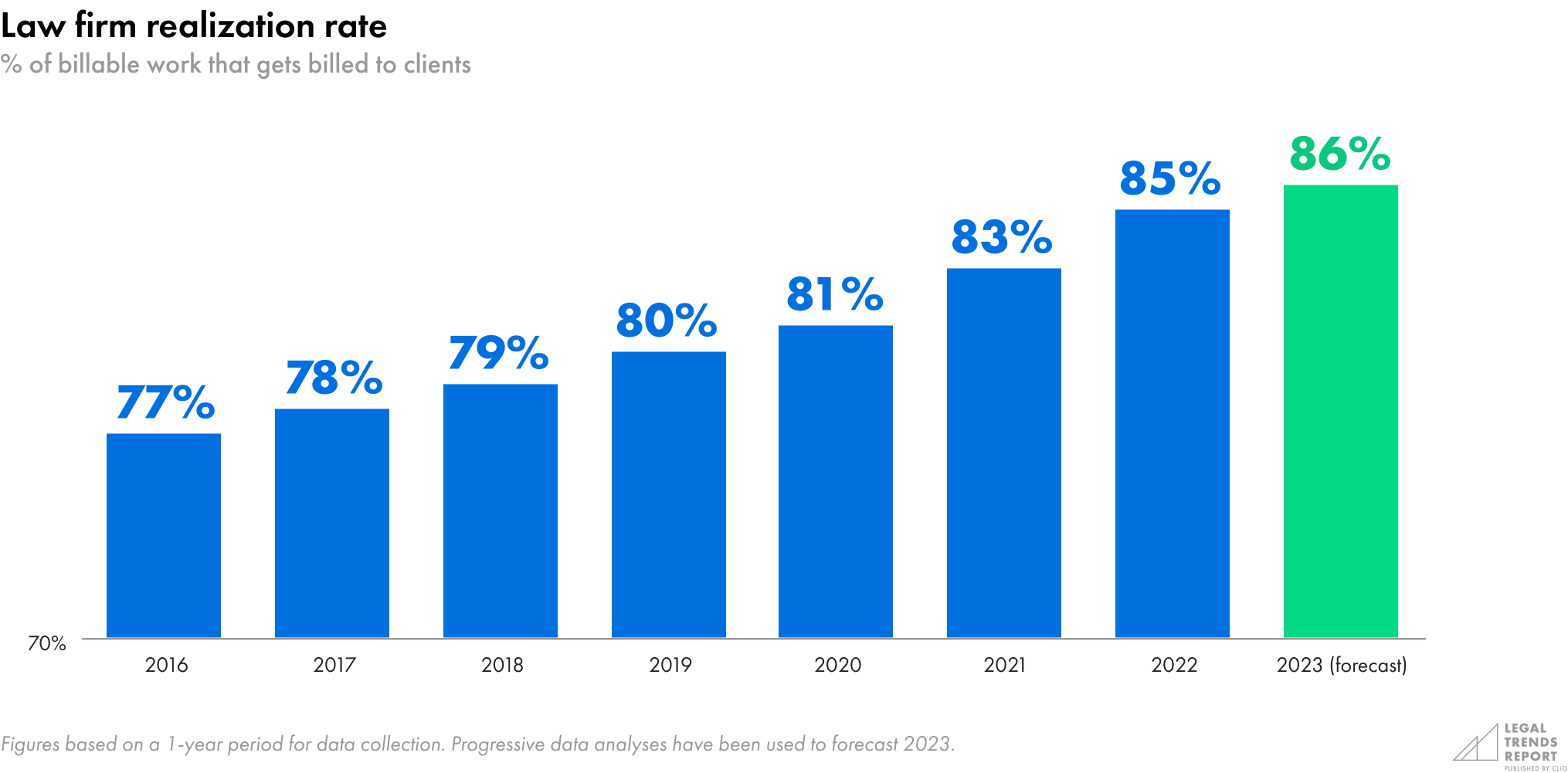

Realization

Realization rates measure how much of a law firm’s billable work actually gets included in client bills. Since 2016, realization rates have increased from 77% to 86%. This means that law firms are invoicing 12% more of their billable hours—adding a significant amount of revenue potential for every hour of billable time worked.

There are a number of reasons why the remaining 14% of billable hours might not get billed to clients. Some firms offer discounts. Others worry that clients may perceive their lawyers to be spending more time than necessary on their case, resulting in write-downs when sending out bills. Unresolved or dropped cases can also account for work that doesn’t get billed.

Additionally, firms may feel pressured by clients to invoice fewer hours than actually worked when their terms are unclear or aren’t communicated well in their engagement letters. Issues can also arise when attorneys don’t establish reasonable billing expectations with clients or when cases haven’t been appropriately vetted during the intake phase.

More efficient billing systems can help law practices accurately communicate to clients how much time they actually spend on casework while accelerating the process for invoicing and getting paid. Conversely, firms that don’t use efficient billing and payment collection systems put themselves at significant risk of losing revenue that has been earned but ends up lost.

Law firms are invoicing 12% more of their billable hours—adding a significant amount of revenue potential for every hour of billable time worked.

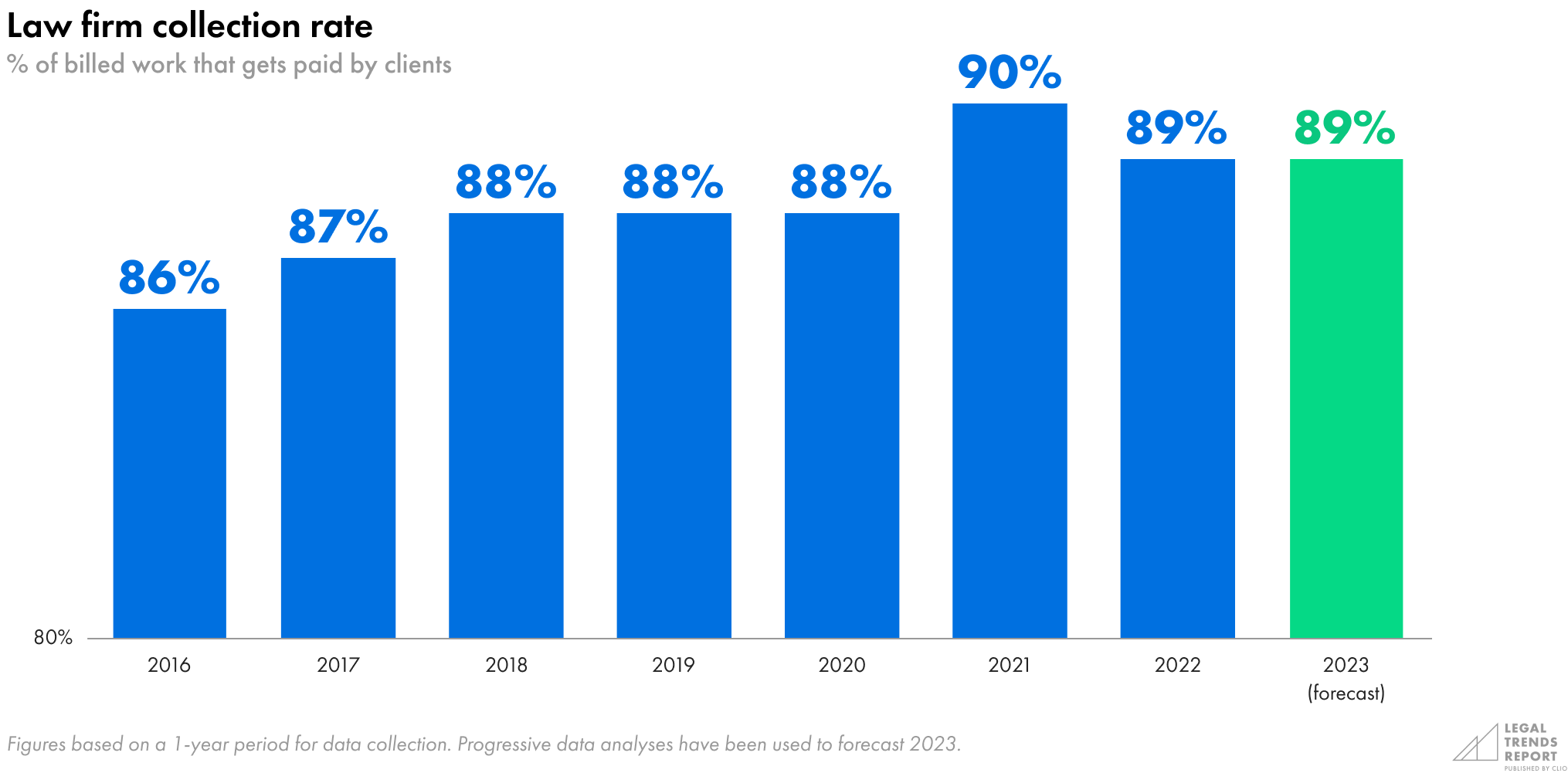

Collection

Collection rates measure how much of a law firm’s bills get paid by clients. Once billable work is successfully tracked (utilization) and invoiced (realization), it finally becomes revenue to the firm when it is collected. Without collection, there is no revenue.

Since 2016, collection rates rose from 86% to a high of 90% in 2021, but fell slightly to 89% in 2022. Collection rates are expected to remain at this level through the end of 2023, amounting to a total net increase of only 3% compared to 2016. While firms have made modest gains, payment collection remains a critical point of friction between law firms and their clients.

The fact that collection rates haven’t increased as much as utilization and realization rates over the past several years shows that getting paid is a crucial area in which most firms can improve.

Not collecting on bills in a timely fashion has an impact beyond simply foregoing revenue—it often inflicts other incremental costs on a law firm, including staff time to chase after unpaid bills, fees paid to collection firms for bad debts, and carrying costs of any loans that may be necessary to provide interim operating capital.

Part 3 of this report looks more in-depth into some of the challenges that firms have in collecting payments from clients and how they can improve.

While firms have been able to make modest gains, payment collection remains a critical point of friction between law firms and their clients.

The lawyer’s funnel shows narrowing earning potential

Utilization, realization, and collection rates are powerful measures of a firm’s performance. Alone, they each tell us a lot about the state of the industry. Examined as a group, they tell us even more about the health and dynamics at play.

Utilization doesn’t just tell us how much time a lawyer puts towards billable work; it also impacts how much work can be billed (realized) and collected. In effect, low utilization rates limit realization and collection. Similarly, if firms suffer from low realization and collection rates, it limits how well law firms capitalize on the work performed by their staff.

When looking at utilization, realization, and collection rates together, we get a broader view of how much of an average lawyer’s day actually goes to earning revenue.

In 2023, when applying realization and collection rates to overall utilization, 28% of the average lawyer’s workday contributed to firm revenues—which amounts to just over two hours per day. In other words, while firms have made significant gains in utilization (with still more opportunity to improve), any continuing inefficiencies in realization or collection only dampens the benefit of those productivity gains.

Compare this to 2016: lawyers had a utilization rate of 29%, but they were only able to realize 77% of that work to bills, and of the bills they sent out, only 86% got paid. As a result, only 18% of the average lawyer’s workday ended up getting invoiced and paid. In terms of hours, this amounts to just under 1.5 hours of paid—utilized, realized and collected—work per day.

If firms suffer from low realization and collection rates, it limits how well law firms capitalize on the work performed by their staff.

A need to measure performance over time…

In addition to how much law firms are getting paid, lawyers need to pay close attention to how quickly and consistently they are getting paid. While realization and collection rates give insight into how much revenue firms earn overall, they don’t give any insight into the period—or latency—in which they collect that revenue.

A law firm could bill and collect a significant amount of revenue. However, if they aren’t able to do this in a timely and efficient manner, their business could actually be suffering in terms of its net cash flow and, as a result, performing very poorly at a given point in time. In the next section, we introduce a new KPI called “lockup” to help firms assess their cash flow.

Lawyers need to pay close attention to how quickly and consistently they are getting paid.

[1] See Appendix A for detailed breakdowns of hourly rates by state and practice area.

[2] Clio, 2017 Legal Trends Report, 2017.

2023 Legal Trends Report

Part 2

Lockup—a new indicator of cash flow

- Introduction. Unlocking the potential to succeed

- Part 1. The thriving business of legal

- Part 2. Lockup—a new indicator of cash flow

- Part 3. Getting paid faster

- Part 4. Business levers to improve firm performance

- Part 5. The promise of AI

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

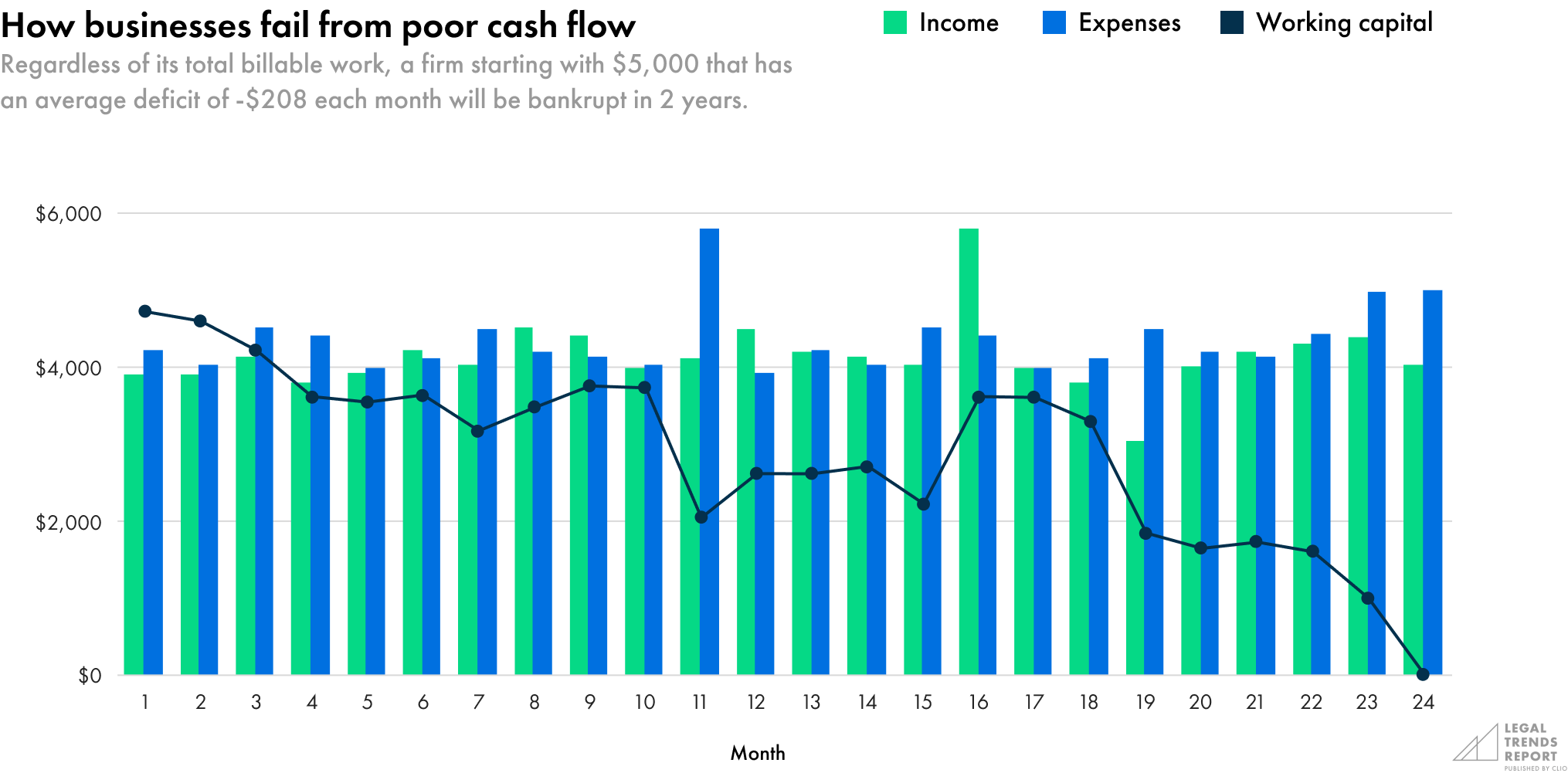

A healthy business brings in more money than it spends. This is what creates positive cash flow, which ensures that money is on hand when it’s needed.

Cash flow is about more than just doing the work for clients—it requires being able to collect money on that work in a timely manner. By generating positive cash flow, law firms create the type of financial environment that will be both sustainable and fruitful in the long term.

Cash flow is about more than just doing the work for clients.

Introducing “lockup”—a crucial measure for healthy businesses

“Lockup” is a term used in accounting to assess cash flow in businesses. For law firms, it shows how much revenue—measured in days of work—is unbilled and uncollected at any given time.

Knowing how many days worth of work are held in lockup gives us an understanding of what cash flow looks like in a law firm. Firms with a high amount of their revenue stuck in lockup—relative to their expected annual earnings—have slower cash flow. Whereas, firms that can bill out and collect on their work more efficiently will have less of their revenue in lockup, which will see them achieve higher cash flow.

Lockup consists of three measures within the billing process and is measured in days:

- Realization lockup. This is the amount of revenue that is unbilled at any given time (also known as “work-in-progress lockup”).

- Collection lockup. This is the amount of revenue that is uncollected at any given time (also known as “debtor lockup”).

- Total lockup. This is a combination of revenue held in both realization and collection lockup.

How to measure lockup in terms of days of work

Realization and collection lockup can be looked at on their own, and each has its own challenges and opportunities within a business. Each of these measures also influences total lockup, which is the bottom-line evaluation that determines how well a law firm is set up to succeed—or how it will struggle—with its cash flow over time.

Lockup is a term used in accounting to assess cash flow in businesses.

Prolonged lockup periods ruin businesses

Having cash on hand means that a business has the working capital to cover all of its short and long-term costs and can pay them out on time. These costs include staff salaries, office leases, utility fees, and any other administrative costs that firms may incur.

Not having cash on hand has the opposite effect on a business. In fact, poor cash flow is a primary reason that businesses fail. The phrase “cash is king” couldn’t be more accurate in managing a business—making cash flow is an existential issue for law firms.

Businesses that don’t have a steady or predictable cash flow need to make up for it with a sizable operating account to pay expenses when collections are slow. And even if a firm has plenty of earned revenue in its accounts receivable, if it can’t collect on that revenue, it can become insolvent—and eventually bankrupt—if it can’t afford to pay its bills at any given time.

Businesses with poor cash flow may have the option to borrow money to make up for shortfalls in the near term, but this only leaves them on the hook to pay that money back—while also incurring additional costs in the form of interest. Finally, there are also opportunity costs to consider; unpaid bills require staff hours to monitor and follow up with clients when they could be taking on other work instead.

The impact of lockup can be seen at the macro level as well. According to a report by Citi Law Firm Group and Hildebrandt Consulting, large law firms in the US saw significant increases in their unbilled time and accounts receivable, which amounted to a 3.7% increase in lockup in 2022. Researchers of the study attributed the increased collection cycle to a slowdown in revenue earnings for the industry, which saw growth fall from a high of 14.7% in 2021 to 4.1% in 2022.34

The benefit of minimizing lockup is that it supports a healthy cash flow, giving law firms more cash on hand, ensuring peace of mind in paying expenses, and having more revenue available to invest in future growth.

Even if a firm has plenty of earned revenue in its accounts receivable, it can become insolvent—and eventually bankrupt—if it can’t afford to pay its bills at any given time.

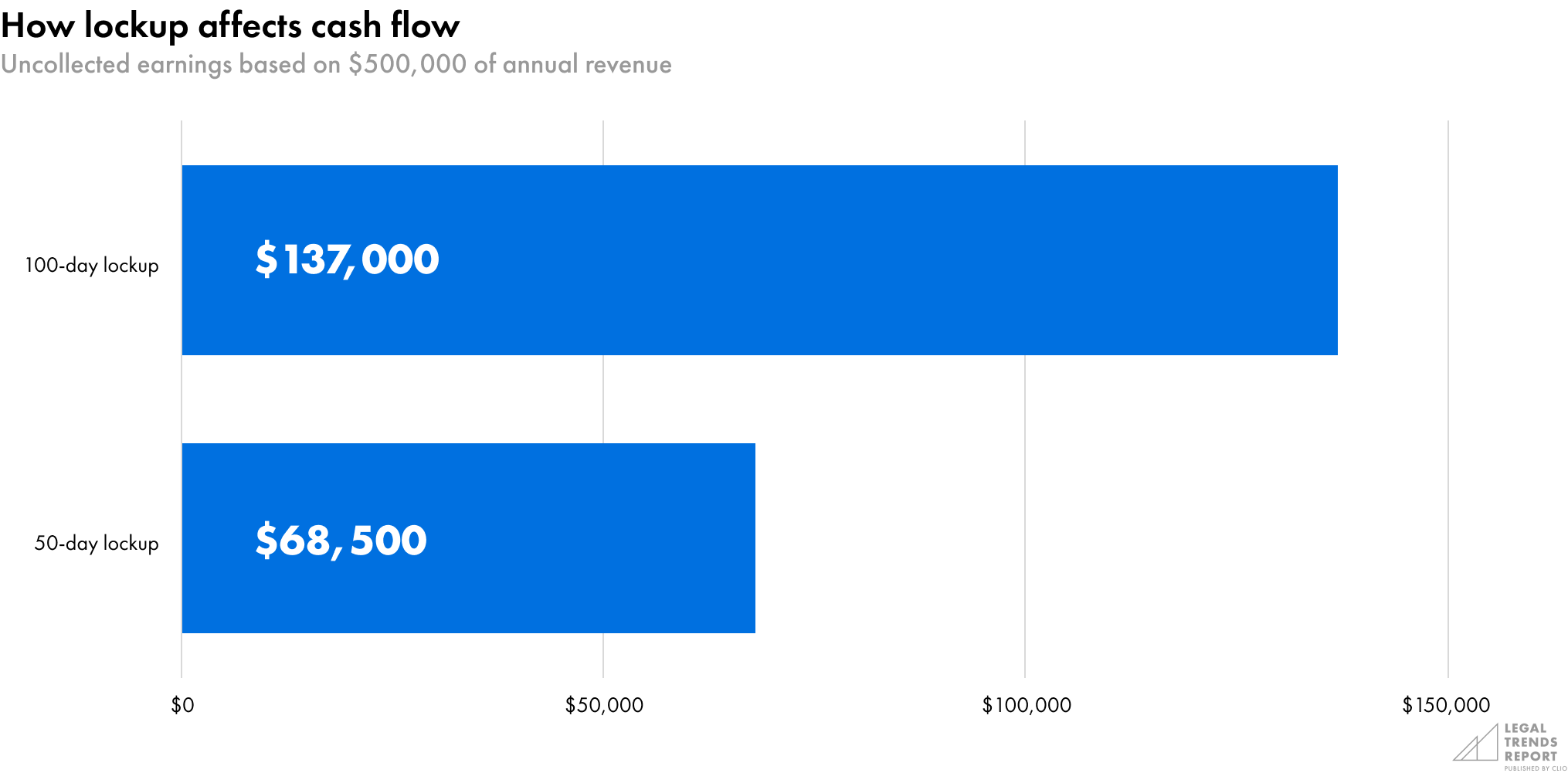

Reducing lockup puts more cash in hand

Lockup provides an indication of cash flow. Decreases in lockup mean firms have more annual revenue on hand to better cover expenses or fund expansion. However, increases in lockup trap revenue in unbilled or uncollected states, leaving firms vulnerable to liquidity problems and stalled growth.

If a firm that expects to collect $500,000 in annual revenue has 100 days of total lockup, then there is, on average, $137,000 in potential revenue sitting unbilled or uncollected at any point in time. This would amount to just over one-quarter of the firm’s annual earnings.

Compare this to a firm that expects the same revenue but has a total lockup of 50 days. This firm would have, on average $68,500—14% of its annual earnings—in unbilled and uncollected revenue. Compared to the firm with 100 days of revenue in lockup, this firm would have $68,500 more cash on hand at any given time.

Compared to the firm with 100 days of revenue in lockup, this firm would have $68,500 more cash on hand at any given time.

Realization lockup

Realization lockup is calculated by taking the value of a firm’s unbilled work (also known as “work in progress”), dividing it by the value of total collections from the previous fiscal year, and multiplying that value by 365 days. This data tells us how many days worth of a law firm’s expected annual revenue currently sits in an unbilled state.

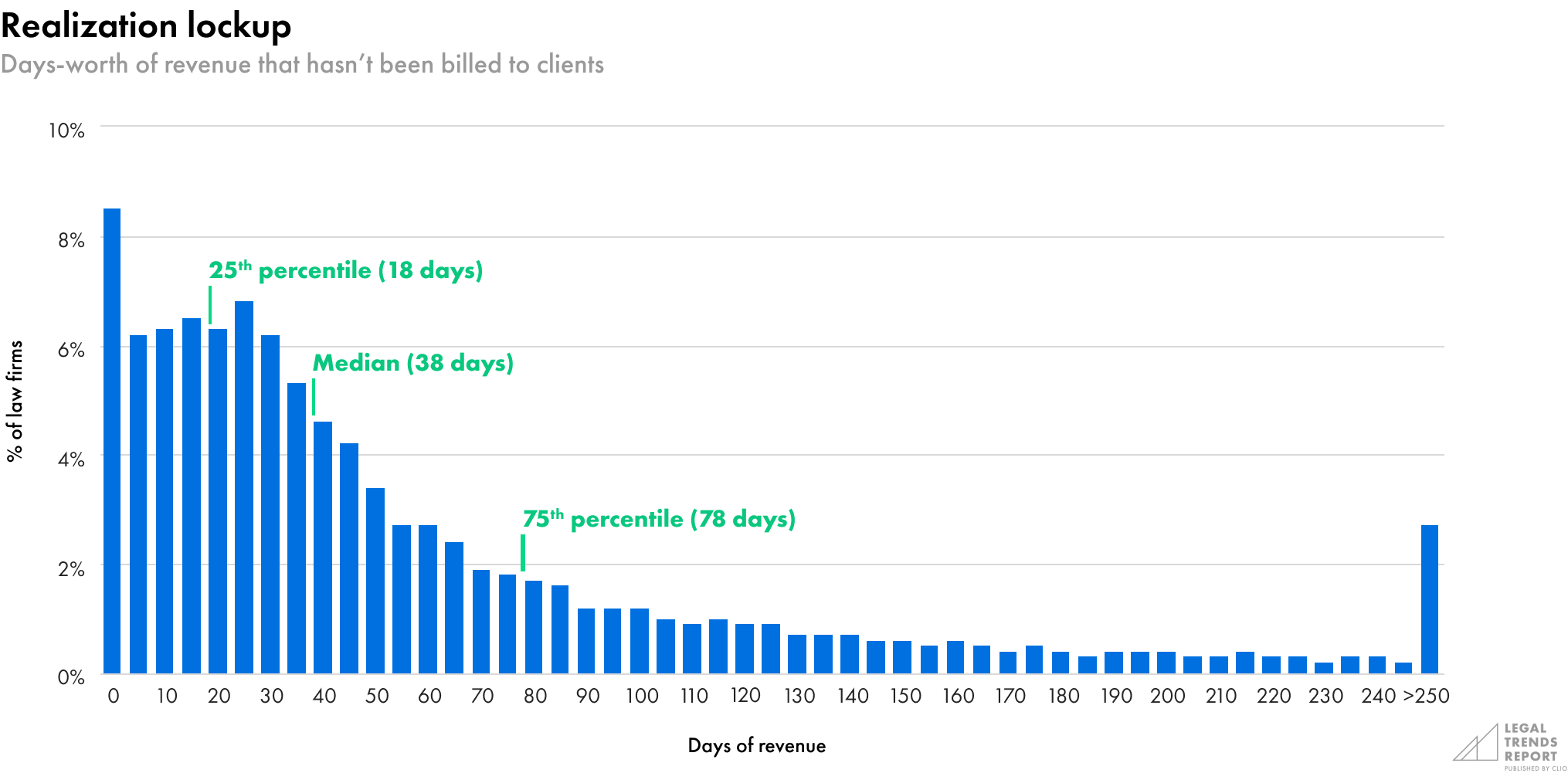

Our analysis indicates that the median amount of realization lockup that firms carry is 38 days—or just over five weeks worth of annual revenue. For comparison, the top 25% of law firms have realization lockup of 18 or fewer days (approximately 2.5 weeks) and the bottom 25% have more than 78 days worth (over 2.5 months) of their annual revenue in an unbilled state.

Greater realization lockup indicates that firms have a large portion of their work that has yet to be billed to clients. The longer a law firm waits to bill a client, the greater the risk of clients being unable to pay, since any number of misfortunes could befall them before they get their bill. For example, they could lose their job, lose money in a bad investment, or be negatively impacted by a struggling economy or natural disaster. Waiting too long to issue bills leaves law firms vulnerable to these types of situations beyond their control.

The longer a law firm waits to bill a client, the greater the risk of clients not being able to pay.

Collection lockup

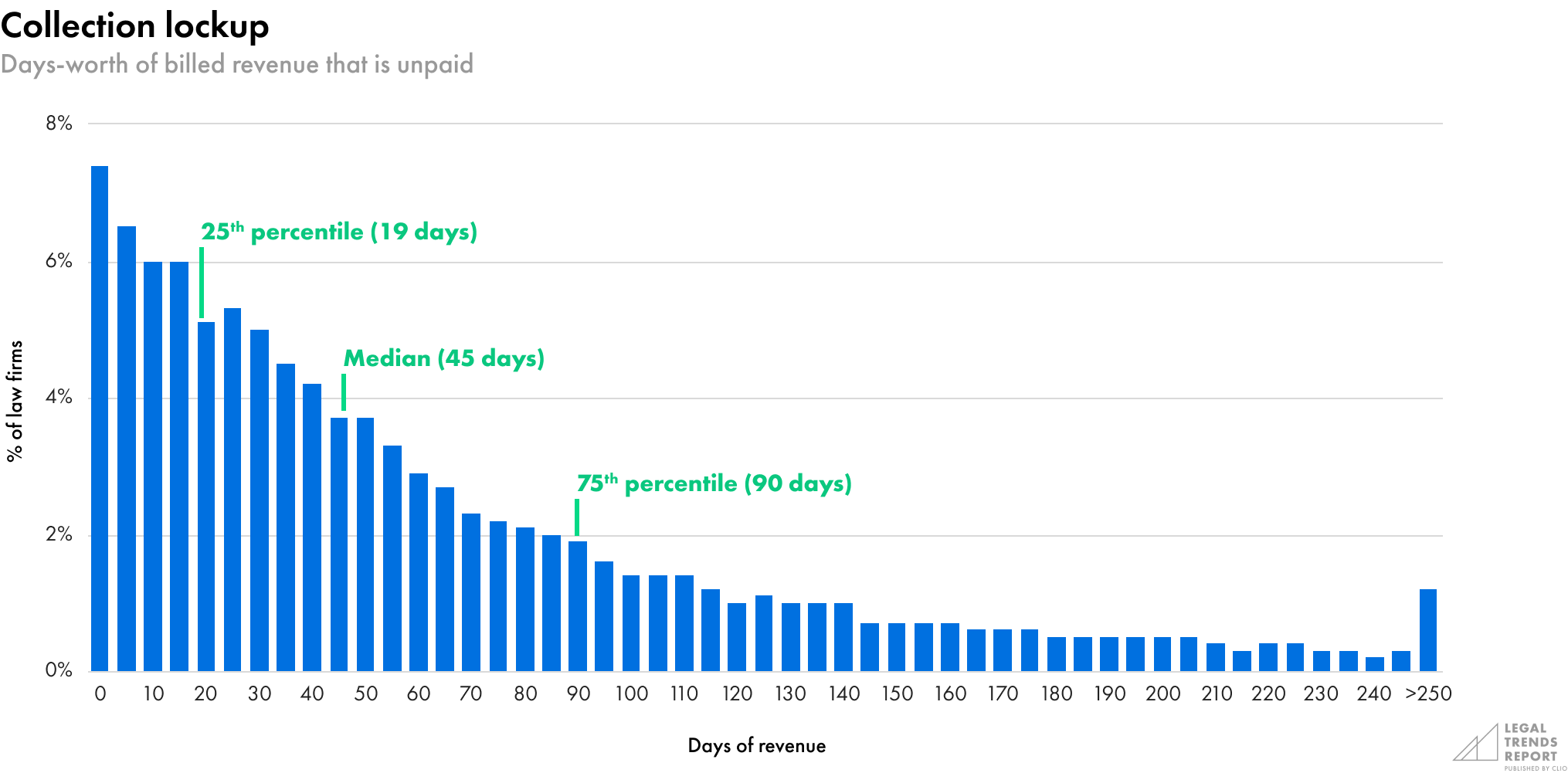

Collection lockup is calculated by taking the value of a firm’s total outstanding accounts receivable, dividing it by the value of total collections from the previous year’s fiscal collections, and then multiplying that value by 365 days. This data tells us how many days worth of a law firm’s expected annual revenue is unpaid within a firm’s accounts receivable.

Our data indicates that the median collection lockup among law firms is 45 days—about 1.5 months worth of annual revenue. For comparison, the top 25% of law firms have collection lockup of 19 or fewer days (just under three weeks), and the bottom 25% have more than 90 days worth (three months) of their annual revenue in their accounts receivable.

Collection lockup is vulnerable to the same risks as realization lockup but with an additional component. Many of a law firm’s expenses operate on fixed schedules. Rent, salaries, professional liability insurance, telephone utilities, and more must be paid on fixed, recurring schedules. As a result, high collection lockup puts fiscal pressure on a law firm. While firms need to pay bills every month, they may have to deal with clients who pay on a different schedule. Firms that carry a large amount of collection lockup may be more willing to accept decreased payments to keep the lights on, or they are forced to take out loans to manage cash flow due to protracted payment dates.

While firms need to pay bills on a monthly basis, they may have to deal with clients who pay on a different schedule.

Total lockup

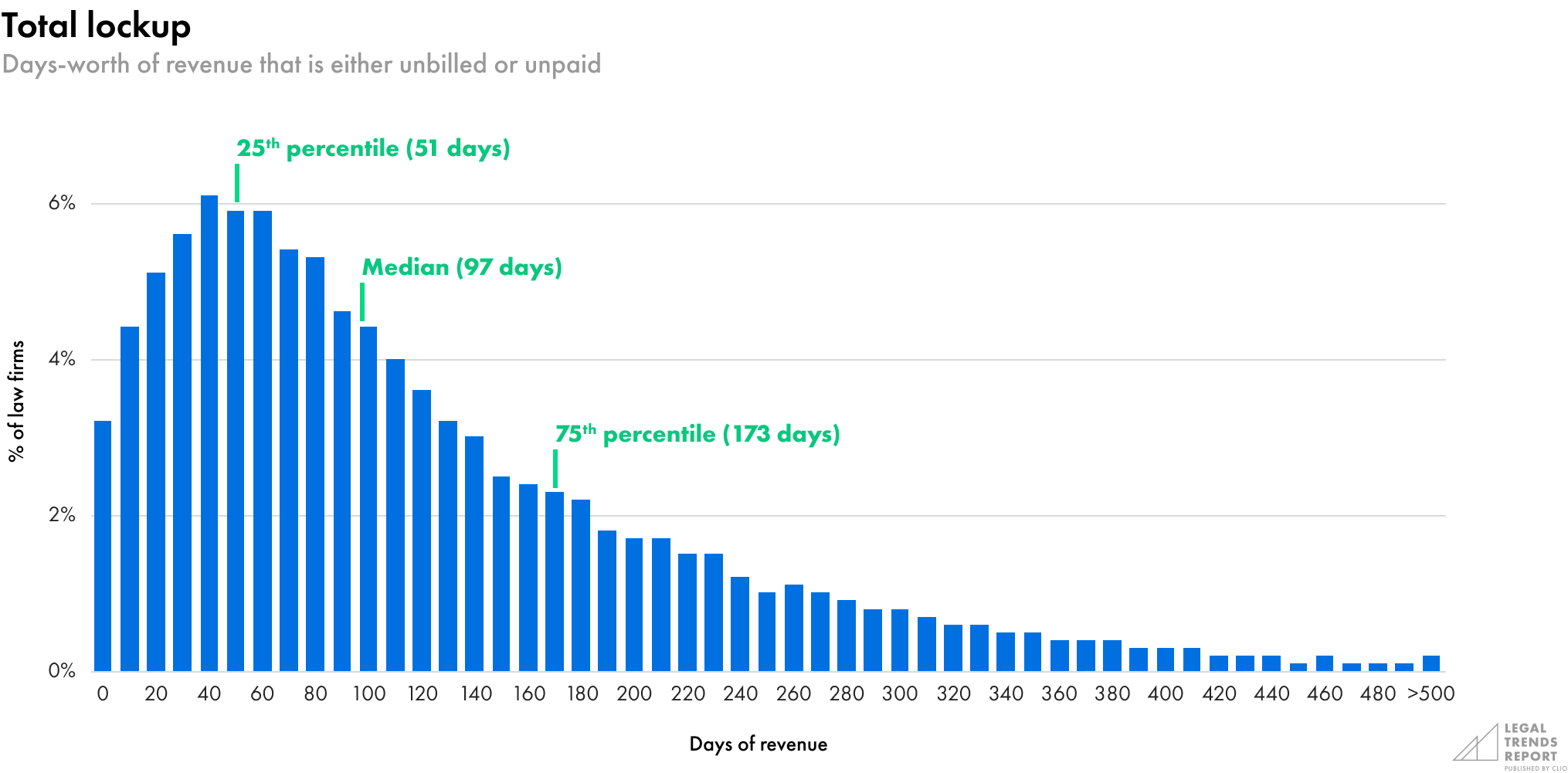

Total lockup is calculated by adding a firm’s realization and collection lockup days. This data tells us how many days worth of a law firm’s expected annual revenue sits in an unbilled or unpaid state, and it gives us an indication of a law firm’s overall cash flow.

The median total lockup among law firms is 97 days—or 3.2 months worth of its annual revenue. For comparison, the top 25% of law firms have total lockup of 51 days (over seven weeks), and the bottom 25% have 173 days (almost six months) worth of annual revenue in either an unbilled or unpaid state at any given time.

Clio users enjoy shorter total lockup periods

When compared to other reports on lockup, law firms using Clio have much less of their revenue tied up in unbilled or uncollected states and likely have much higher cash flows.

For comparison, The Law Society of England and Wales reports median lockup values in 2022 at 140 days, down from 150 days in 2021.5 In 2022, law firms using Clio had lockup amounts that were smaller by 43 days (over six weeks) worth of annual revenue compared to the firms studied by The Law Society.

Law firms using Clio have much less of their revenue tied up in unbilled or uncollected states.

Levers for reducing lockup

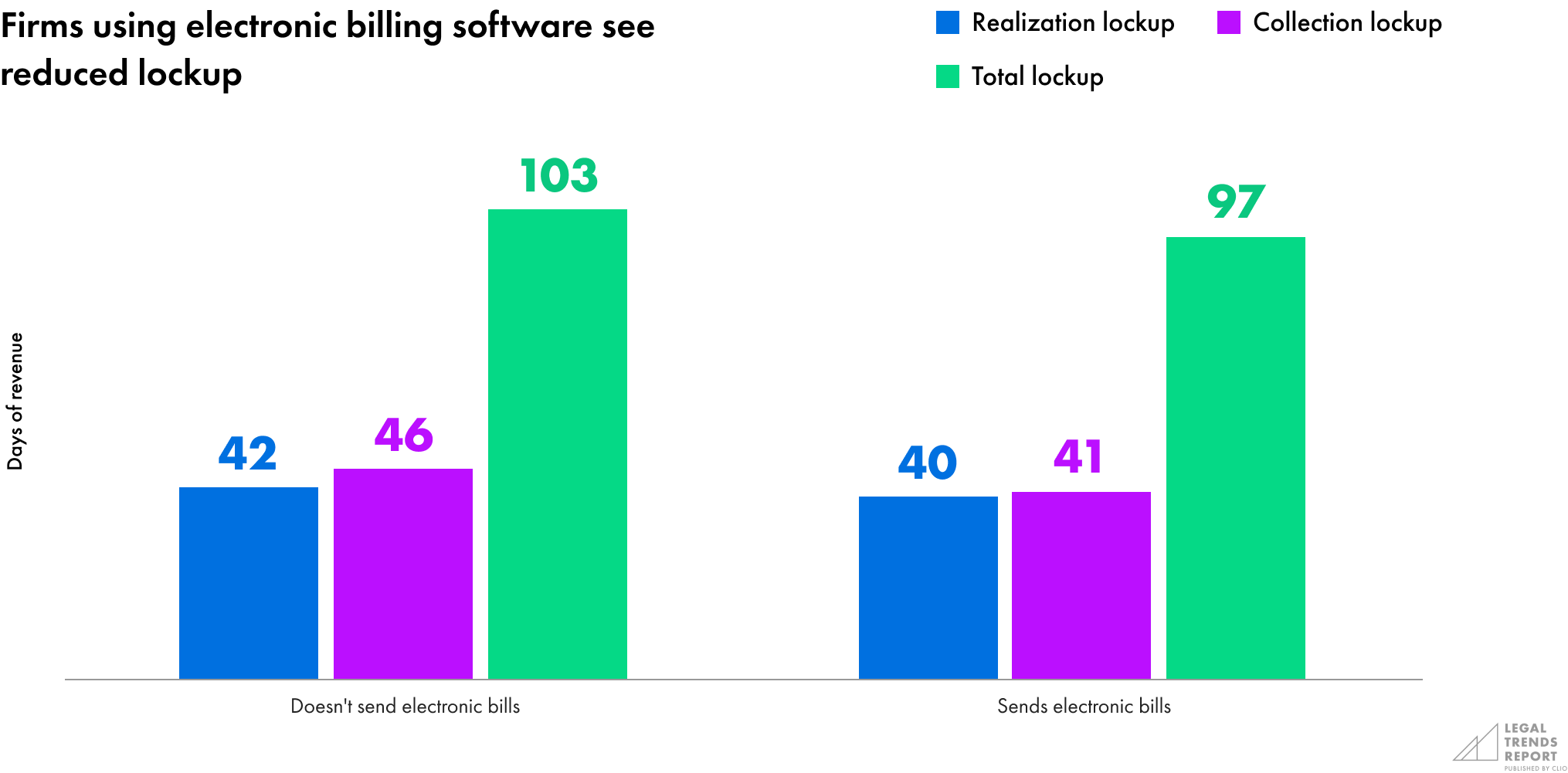

When looking at how law firms can reduce their lockup, the ability to bill clients in a timely manner is critical. Timely billing requires accurately capturing client work in a bill that can be shared quickly and efficiently. In fact, we see that certain billing capabilities correlate with lower lockup.

Electronic billing solutions

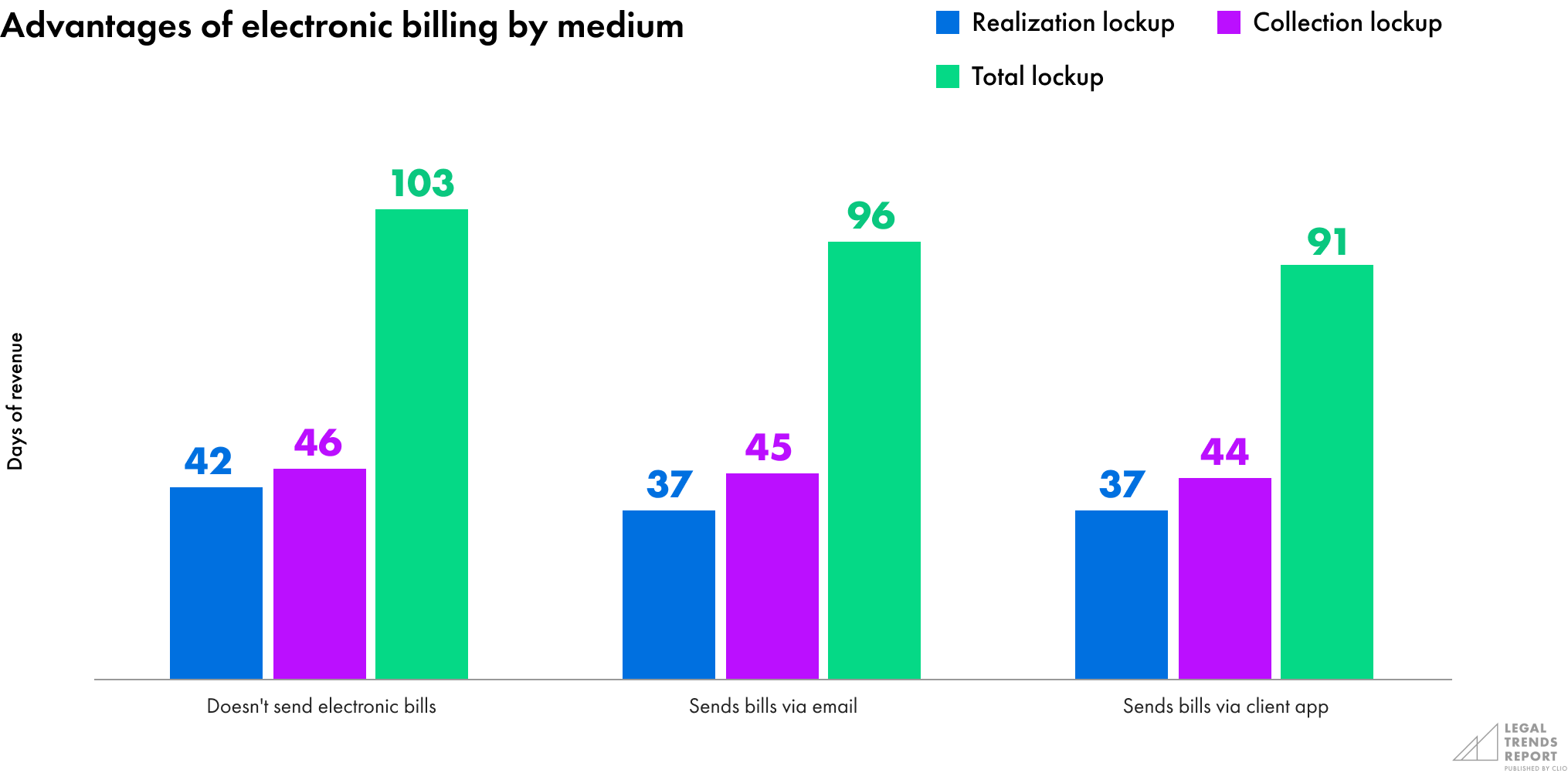

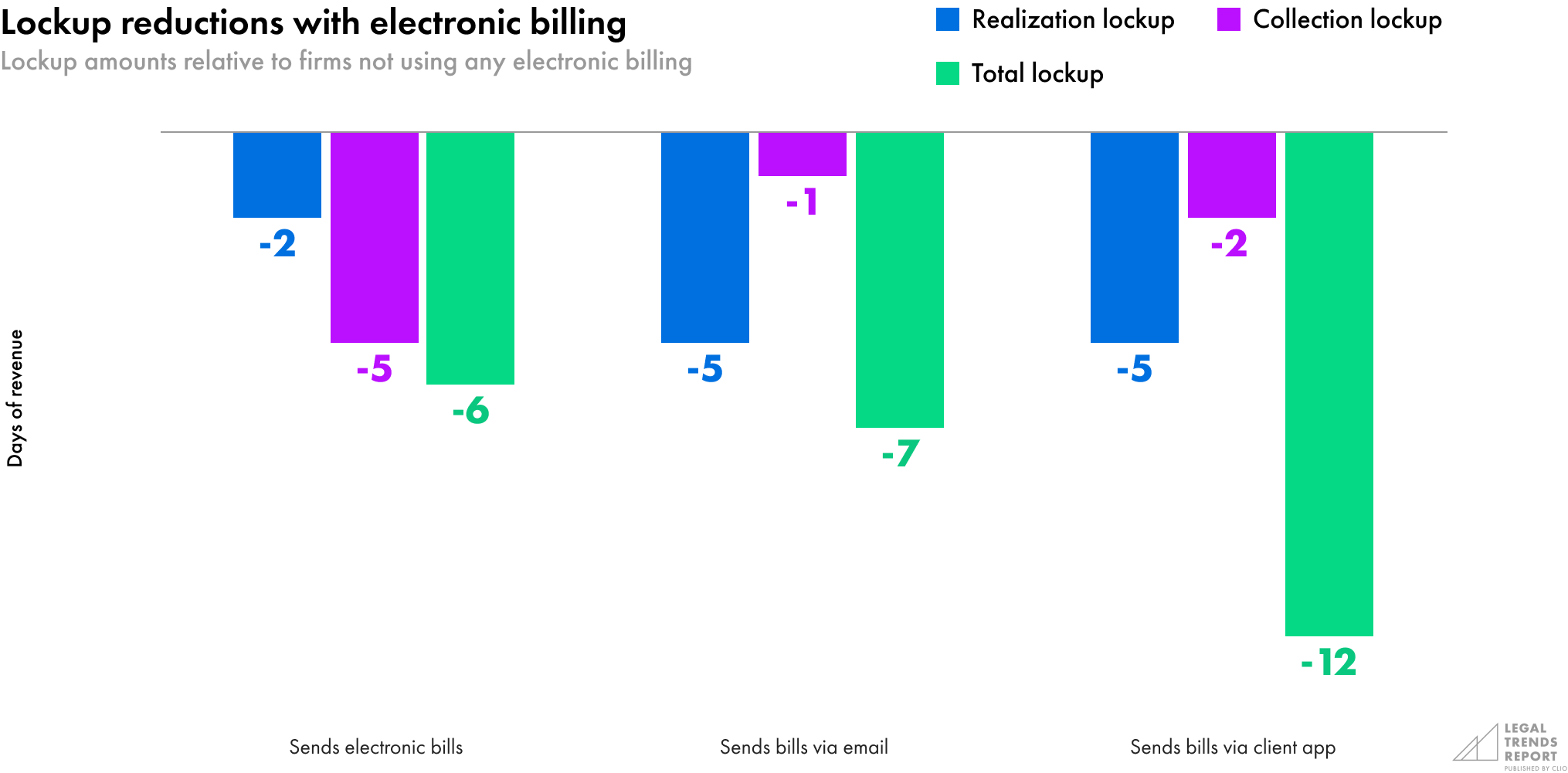

Firms that use electronic billing systems to draft and send bills to clients have realization lockup that is smaller by two days worth of revenue (40 days instead of 42 days), collection lockup that’s smaller by five days worth of revenue (41 days instead of 46 days), and total lockup that’s smaller by six days worth of revenue. In other words, firms sharing bills through Clio have nearly a week’s worth of their annual revenue on hand at any given time.

Legal billing software is designed to help law firms get their bills out faster. Law firms can instantly generate bills for individual clients and matters, and once the bills have been approved, they can be sent directly to client inboxes, allowing clients to pay them that much faster as well.

Billing software also provides several options for sending bills to clients. Law firms can email bills directly to their clients’ inboxes, or they can use a client portal or app. Clio for Clients is a mobile app that clients can download onto their mobile devices, giving them a place to manage all of their firm communications, documents, billing and payments, and more.

When looking at specific methods for sending bills, we can see that certain types of workflows correlate with reductions in lockup:

- Email. When law firms email clients directly from their billing software, they carry realization lockup that is smaller by five days worth of revenue. Their collection lockup is also smaller by one day worth of revenue, and total lockup is smaller by seven days worth of revenue.

- Client app. When law firms use a client app to send bills, their realization lockup is smaller by five days worth of realization lockup. Their collection lockup is smaller by two days worth of revenue, and total lockup is smaller by 12 days worth of revenue.

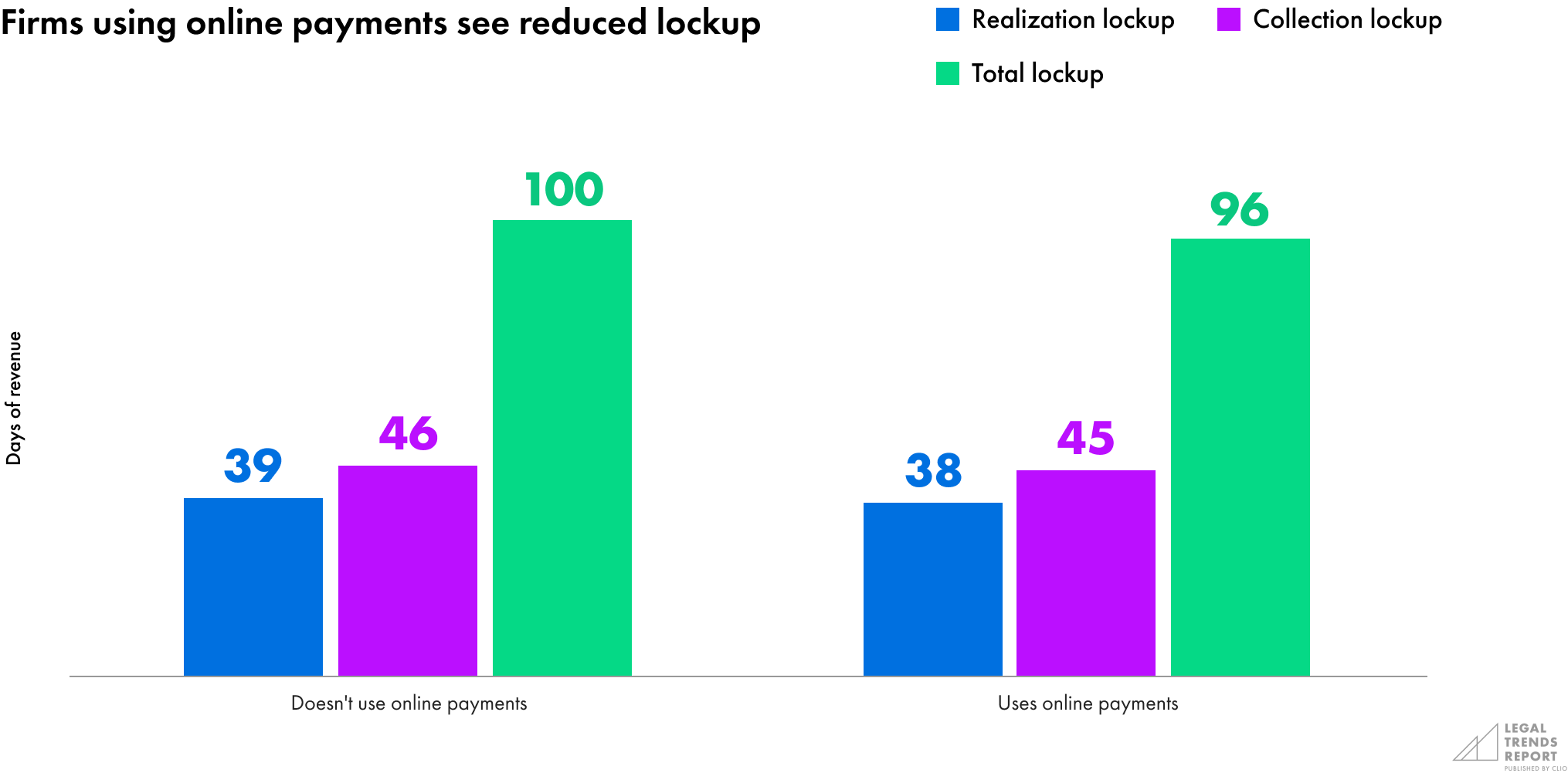

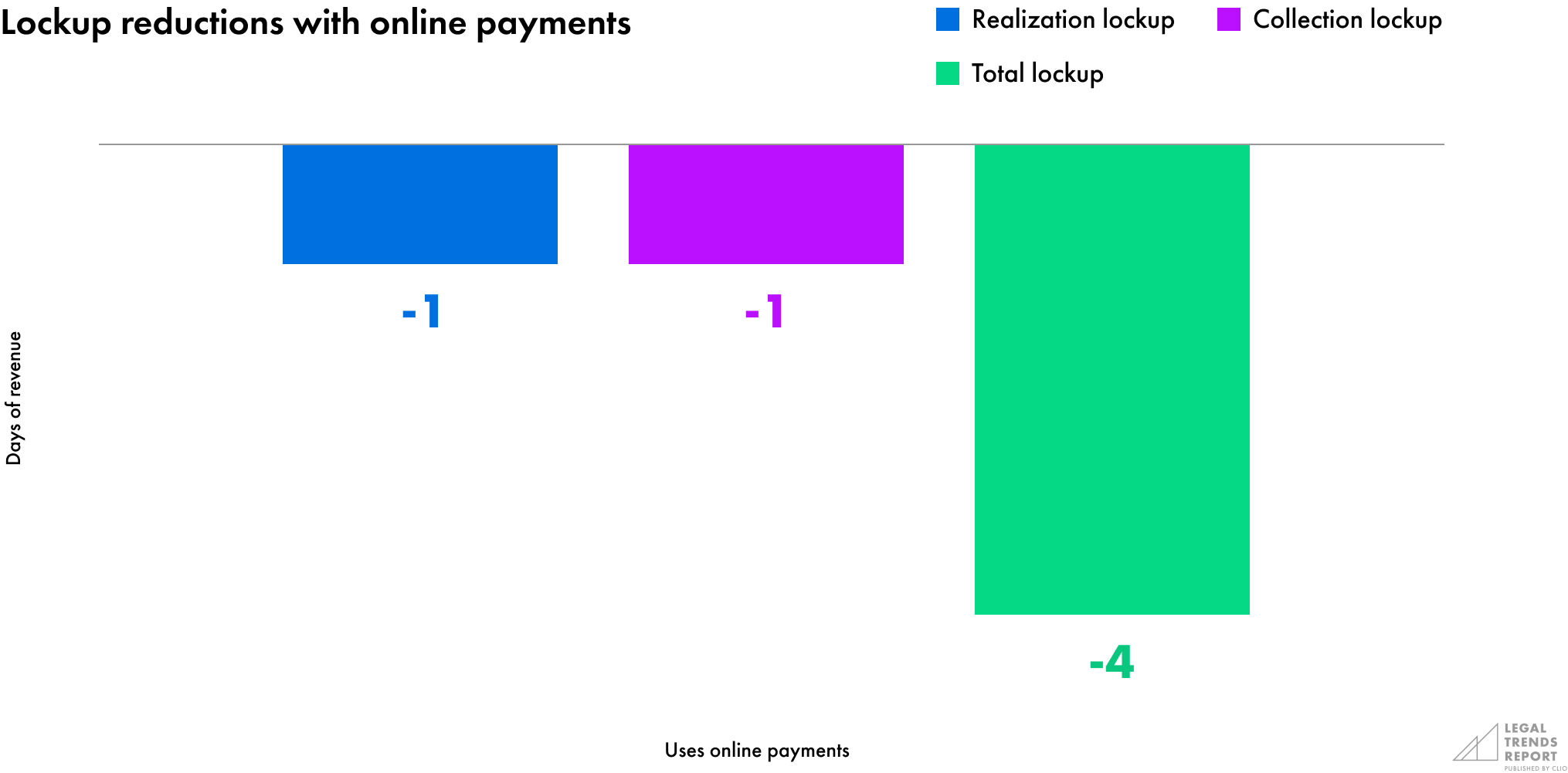

Online payments

Online payments can also significantly reduce lockup periods. When law firms use online payments to collect money from clients, their realization and collection lockup is smaller by two days worth of revenue, and total lockup by four days. To return to the example of a law firm with $500,000 in revenue in the previous year and a total lockup of 140 days, a reduction of 6 days amounts to having over $8,000 in additional funds available at any given time.

When law firms use online payments to collect money from clients, their realization lockup is smaller by two days worth of revenue, collection lockup by five days, and total lockup by six days.

How law firms can reduce lockup

- Bill clients smaller amounts regularly instead of one large lump sum

- Improve processes for getting bills out on time

- Automate bill follow-ups to get paid on time

- Collect advanced fees that can be put toward bills as they are issued (e.g., retainers)

- Explore alternative billing arrangements that provide steadier income

[3] Citi Law Firm Group and Hildebrandt Consulting, 2023 Citi Hildebrandt Client Advisory, 2023.

[4] Citi Law Firm Group and Hildebrandt Consulting, 2022 Citi Hildebrandt Client Advisory, 2022.

[5] The Law Society of England and Wales, Financial Benchmarking Survey 2023, 2023.

2023 Legal Trends Report

Part 3

Getting paid faster

- Introduction. Unlocking the potential to succeed

- Part 1. The thriving business of legal

- Part 2. Lockup—a new indicator of cash flow

- Part 3. Getting paid faster

- Part 4. Business levers to improve firm performance

- Part 5. The promise of AI

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

Billing and getting paid represent some of the most challenging touchpoints law firms have with their clients. In Part 1, industry-wide realization rates showed that 14% of billable hours never get invoiced, and collection rates showed that 11% of bills never get paid by clients. In Part 2, we also saw how poor cash flow can put significant strain on a firm, even when it is billing and getting paid eventually.

This section sheds more light on the nature of the problems inherent to billing and collecting payment from clients and how to implement solutions that improve overall collections while increasing cash flow.

At a certain point, the client’s perception of value reaches its highest point, which is also when they are likely most willing to pay their legal bills.

Foonberg’s Gratitude Curve and the key to getting paid

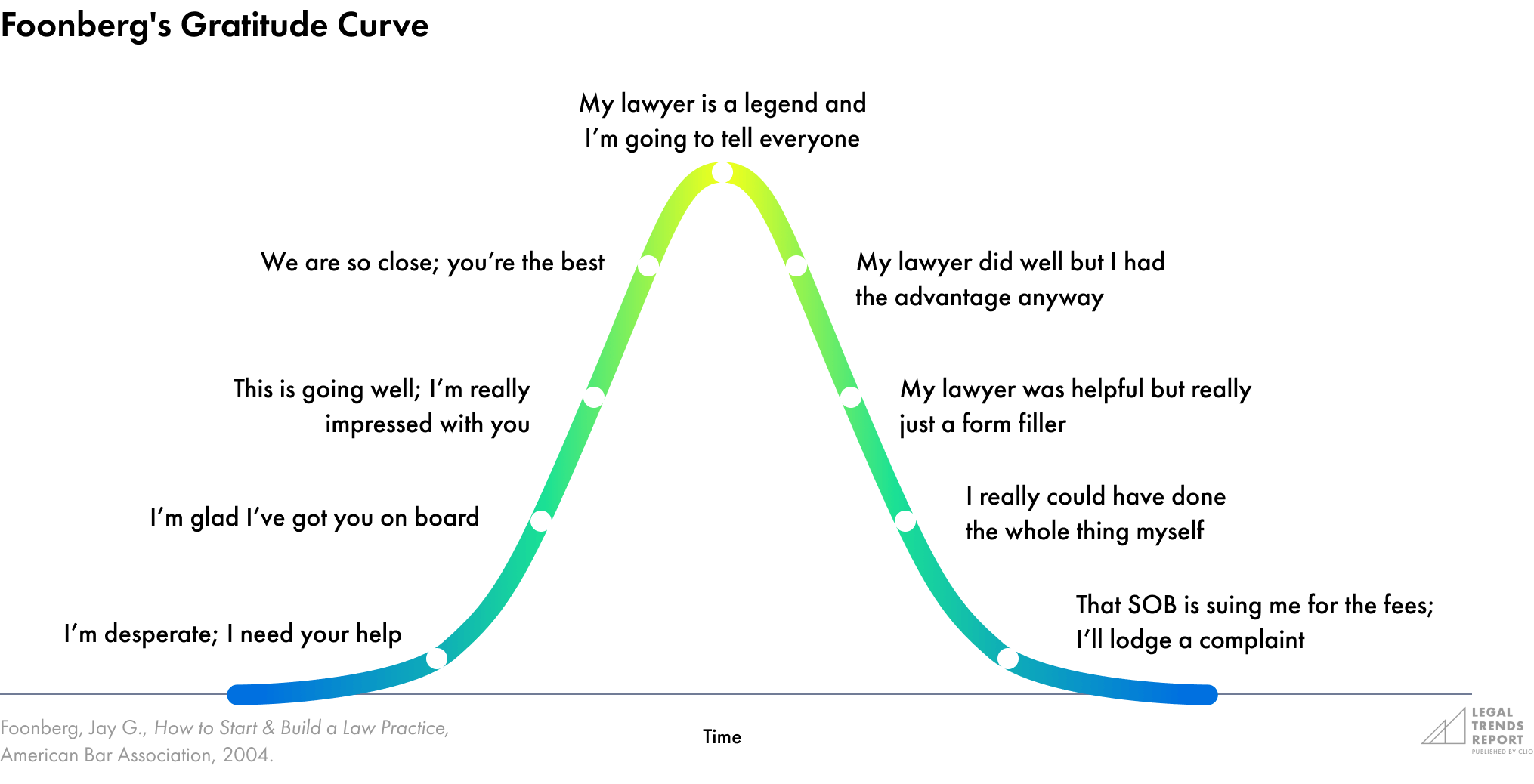

There is an art to sending bills in a timely manner. Jay G. Foonberg, author of How to Start & Build a Law Practice, provides an insightful model that illustrates a hypothetical client perspective on how the perception of a lawyer’s value can change over time. These mindsets can, in turn, influence a client’s willingness to pay their legal bills.

Foonberg’s Gratitude Curve suggests that when clients start working with a lawyer, they are highly invested and often feel a sense of urgency regarding their legal matters. At a certain point, the client’s perception of value reaches its highest point, which is also when they are likely most willing to pay their legal bills.

However, one of the biggest takeaways from Foonberg’s model is that eventually the client’s perception of value begins to diminish. With the urgency of their legal matter in the past, clients may question why they needed a lawyer in the first place. Eventually, when they forget how critical or dire their situation once was, the desire and willingness to pay their legal bills slowly diminishes, putting firms in a place where they need to follow up and remind clients of their duty to pay.

The longer this drags on, the greater risk the client won’t pay at all—and with each passing day, unpaid bills inhibit a firm’s cash flow.

Eventually the client’s perception of value begins to diminish.

A known problem between lawyers and their clients

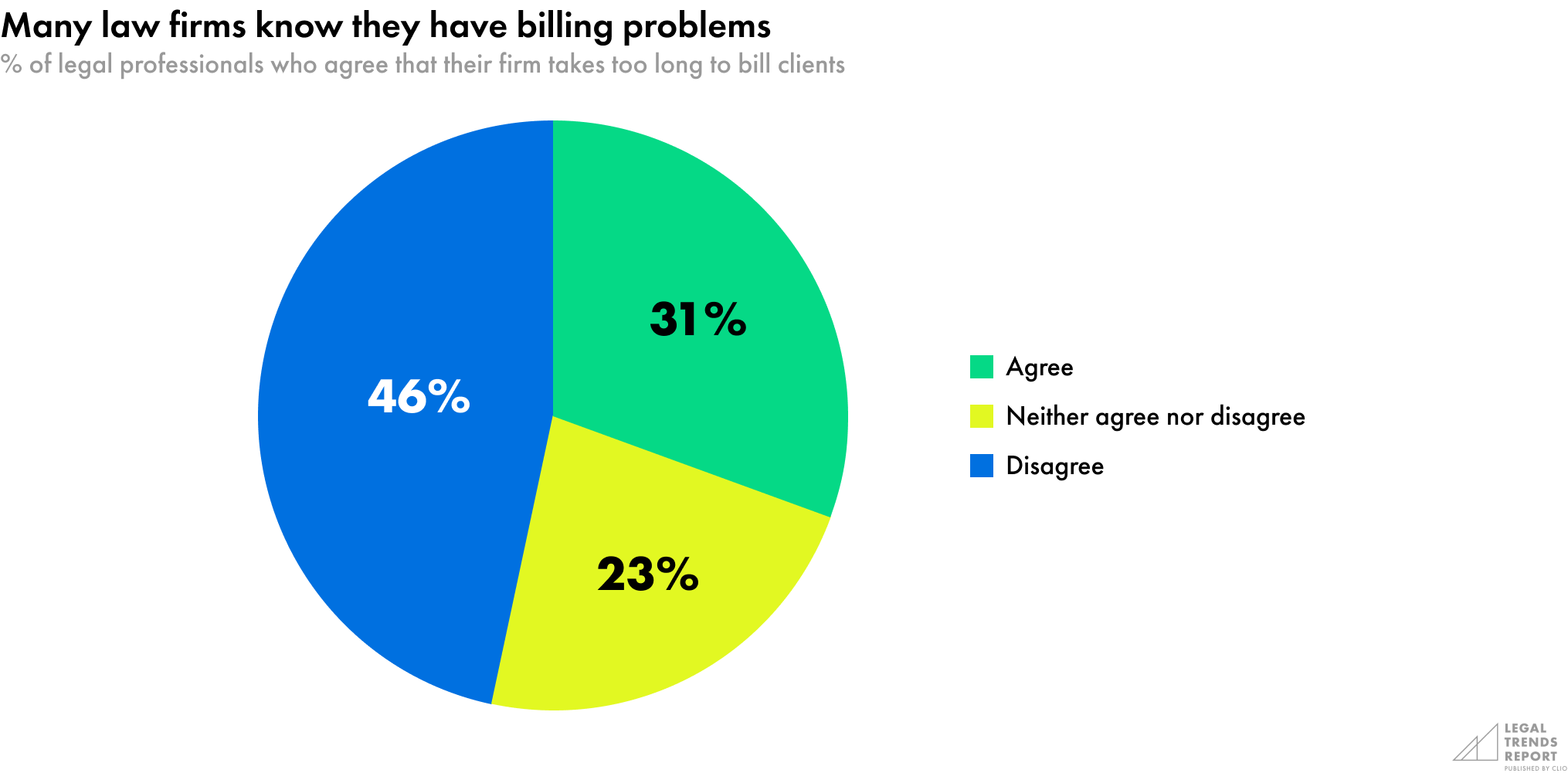

It’s no secret that many law firms struggle to invoice their work and collect payments in a timely manner. Almost one in three legal professionals agree that their firm takes too long to get bills out to clients, and less than half would say they bill in a timely fashion.

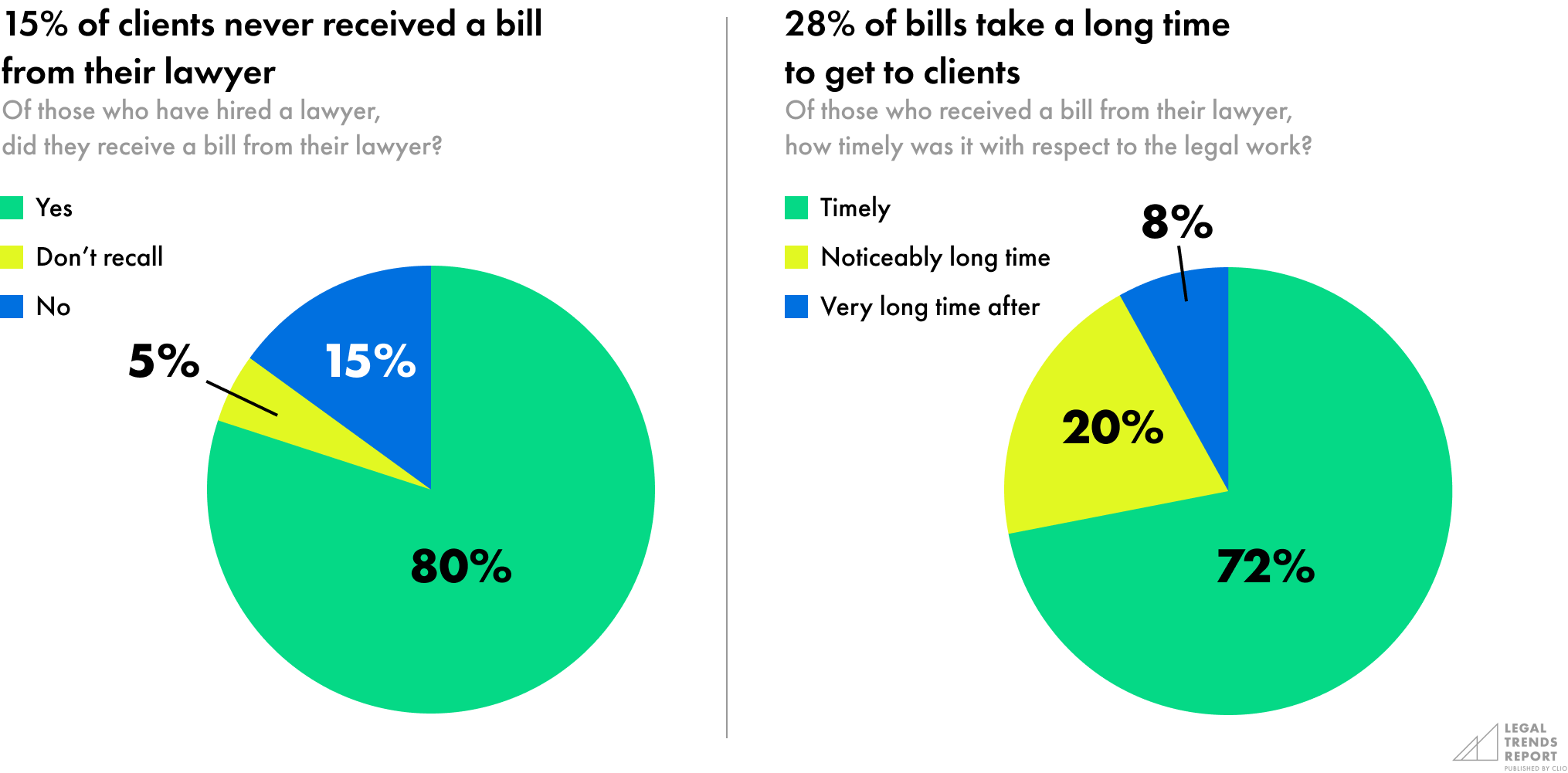

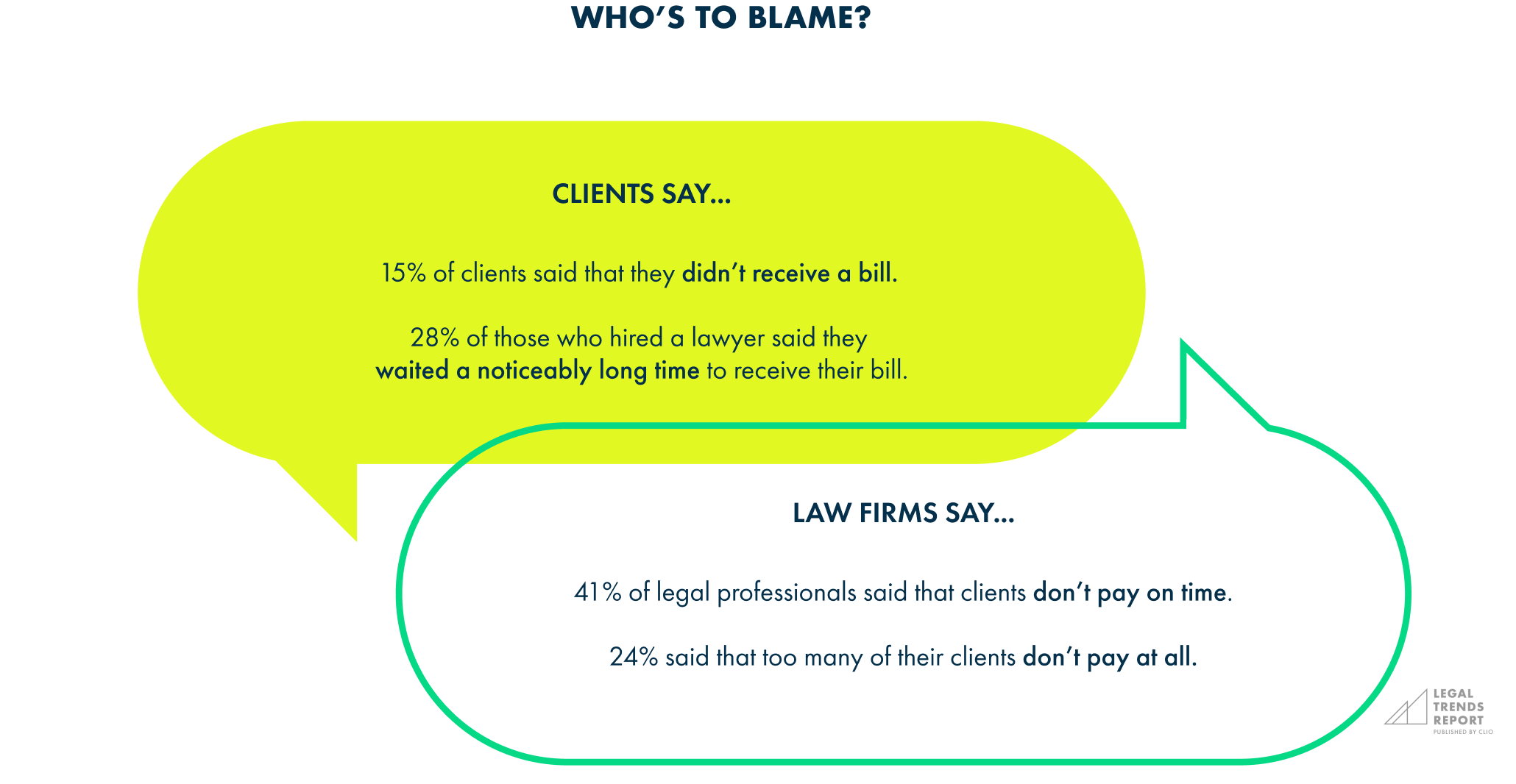

But from the client’s point of view, the problem is even worse. Of those who have hired a lawyer at some point in the past, 15% of clients said they didn’t receive a bill at all.

While it may be hard to believe that firms could fall short on billing 15% of their cases, a couple of factors are likely at play here. On the one hand, clients may either have missed or forgotten about the bills their lawyer sent them; on the other, when firms share bills, there is always the chance that they can get lost in the mail or flagged by spam filters. In either situation, however, the onus is ultimately on lawyers and their firms to stay on top of their bills.

And of the clients that did receive a bill, 28% said that it was at least a noticeably long time—if not a very long time—after their lawyer did the work. Even if firms are getting their bills out to clients, many aren’t doing so in a timely manner.

Of those who have hired a lawyer at some point in the past, 15% of clients said they didn’t receive a bill at all.

The challenge to get paid

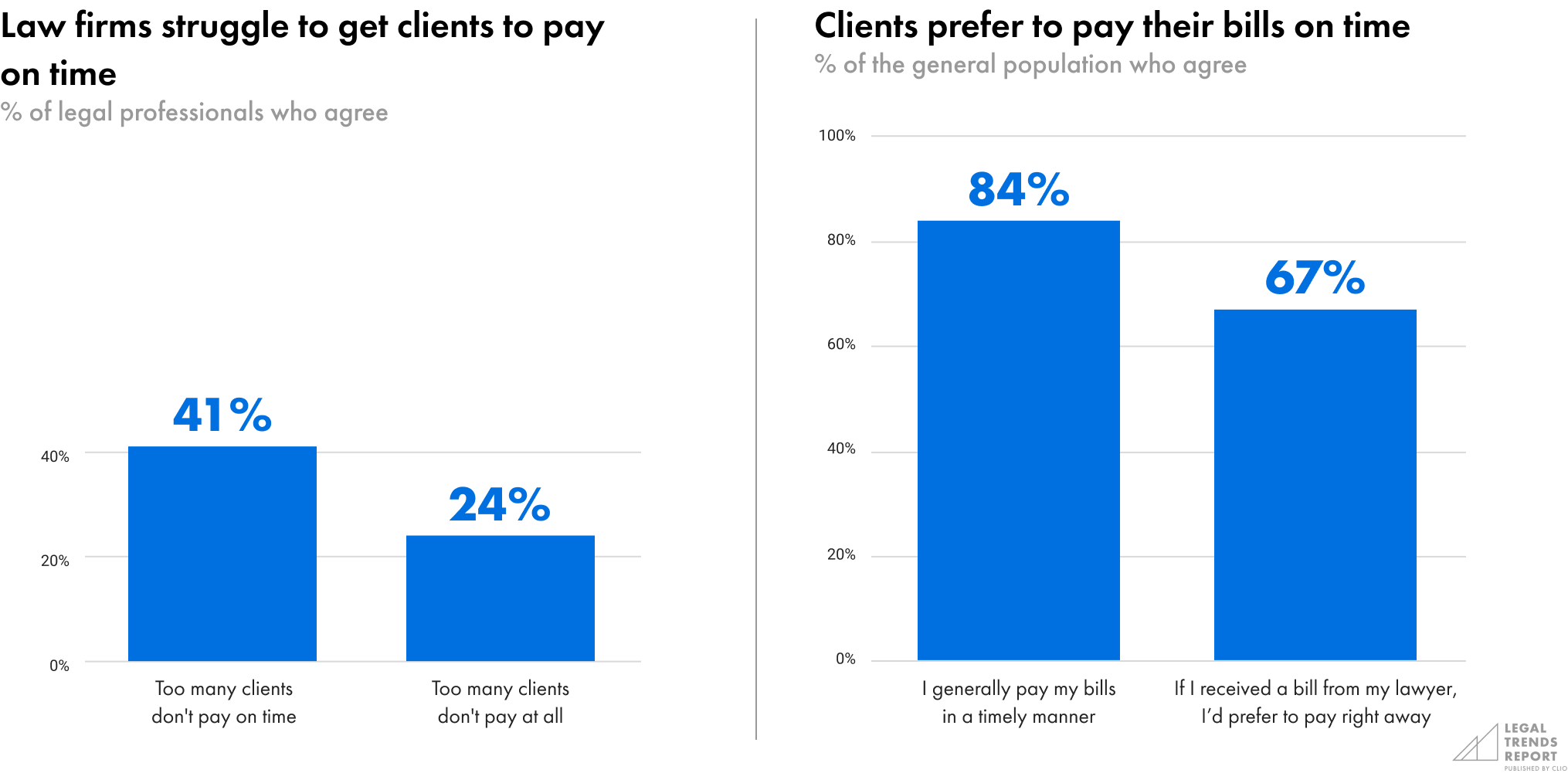

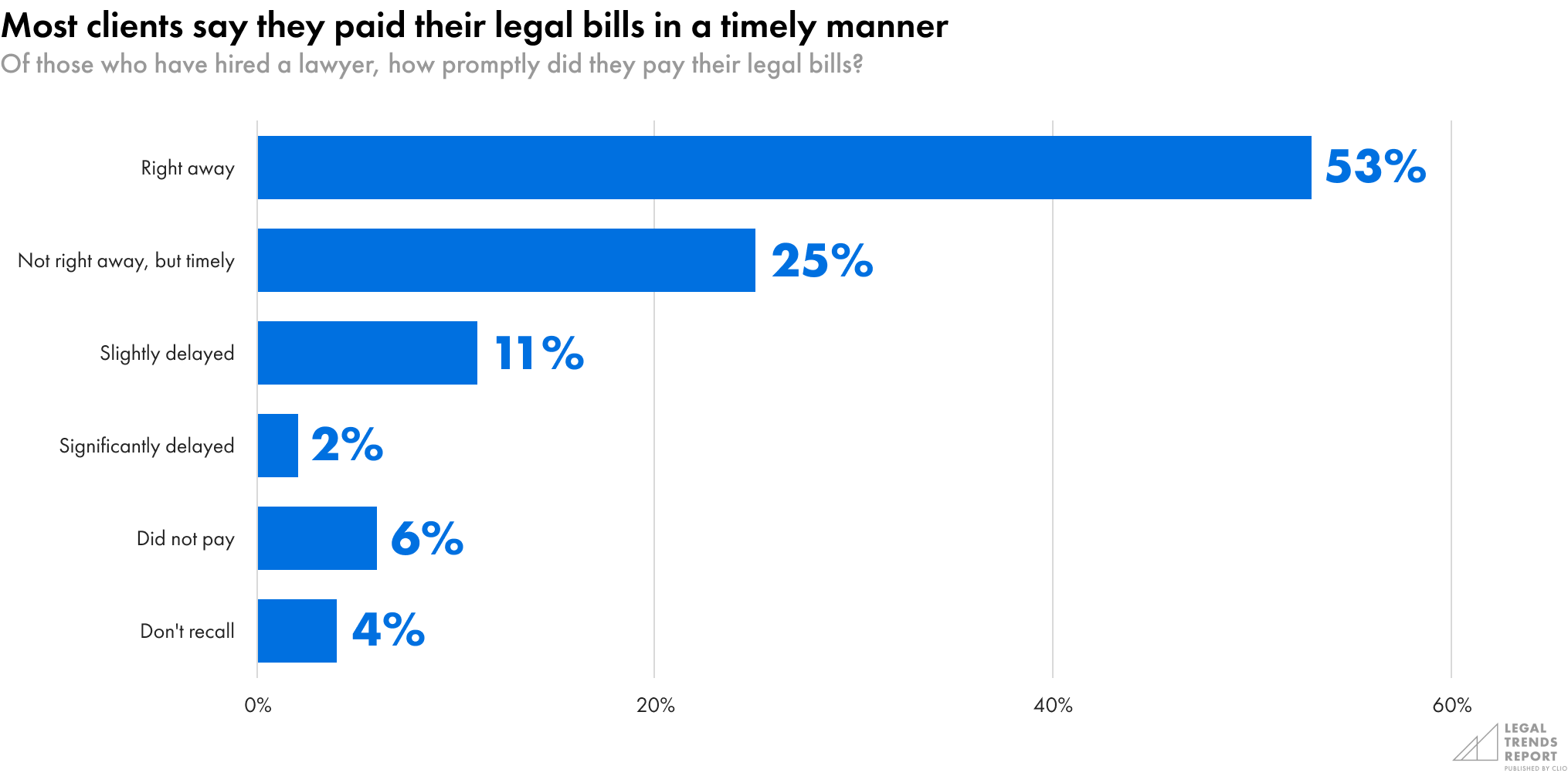

Forty-one percent of legal professionals say that clients don’t pay on time, and almost one in four said that too many of their clients don’t pay them at all. But on the client side, most say that they pay their legal bills on time—and would prefer to pay their lawyer on time if they were to hire one.

Of those who have hired a lawyer in the past, the vast majority say they paid their bills in a timely manner. A small contingent, however, admit that they struggled to pay their bills on time (or at all).

A bill should provide a clear and timely communication of what should be paid, when it should be paid, and how it should be paid. Arguably, a bill should also be easy for clients to pay.

Given the frustrations that both lawyers and their clients express regarding billing, law firms should be hyper-focused on implementing and maintaining the best systems and experiences for their billing and payment collections. At the end of the day, when billing systems are not in order—or at least not optimized to ensure the best-possible results—law firms are the ones that pay the price.

A bill should provide a clear and timely communication of what should be paid, when it should be paid, and how it should be paid.

Many law firms are still committed to “snail mail”

When we look at why many clients wait so long for their legal bills, the mediums firms use to share them have an obvious impact.

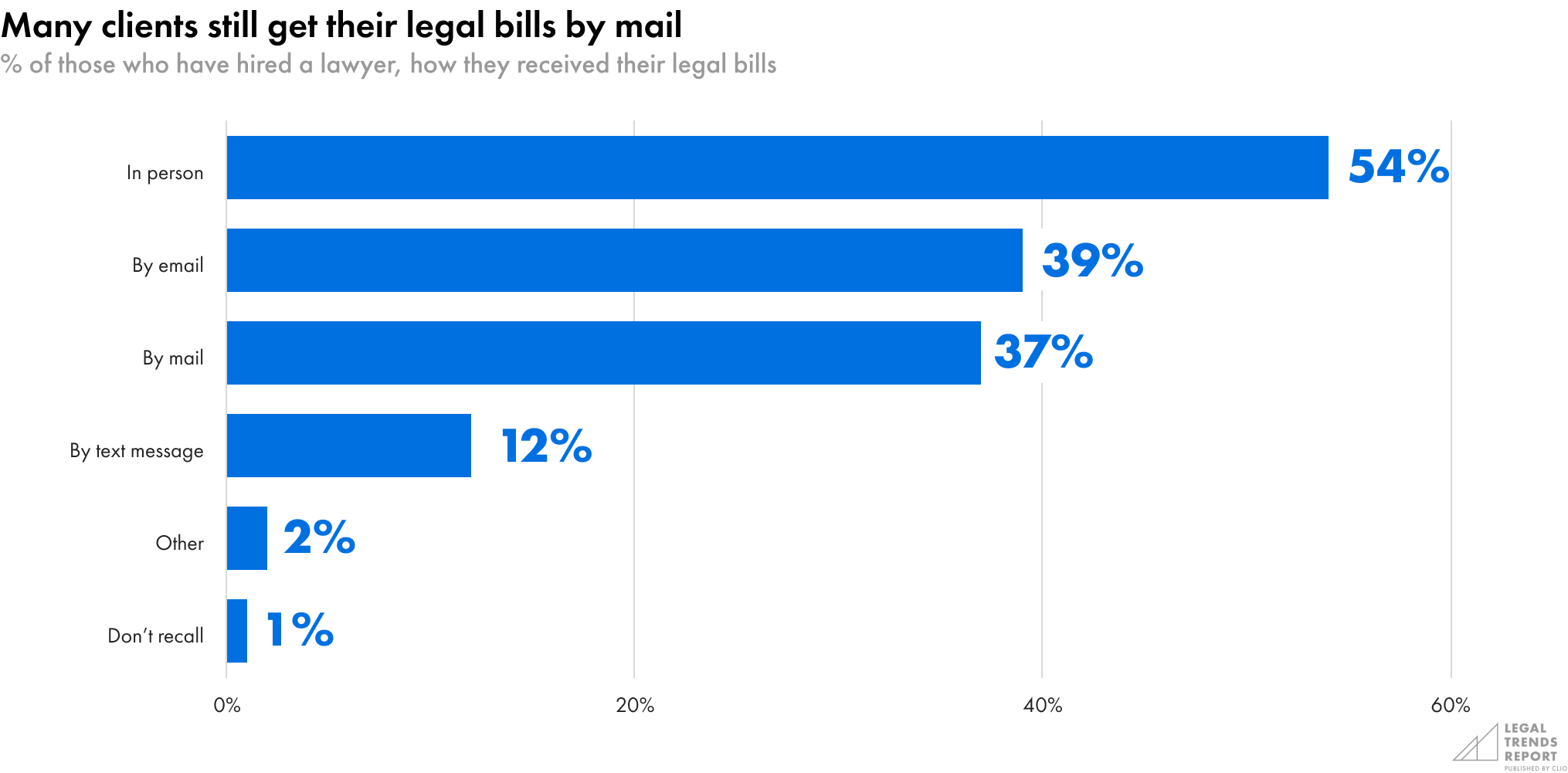

In our survey of those who have worked with a lawyer in the past, 37% of clients said that they received their bills by mail and 39% said they received them by email. By default, firms sending bills by mail add to their collection lockup waiting for bills to get to their clients.

It’s worth noting that 54% of clients say they received their bills in person, likely after an appointment or consultation at their lawyer’s office. Firms may also be using multiple methods to bill clients throughout the duration of their legal matter.

37% of clients said that they received their bills by mail and 39% said they received them by email.

Online payments get firms paid faster

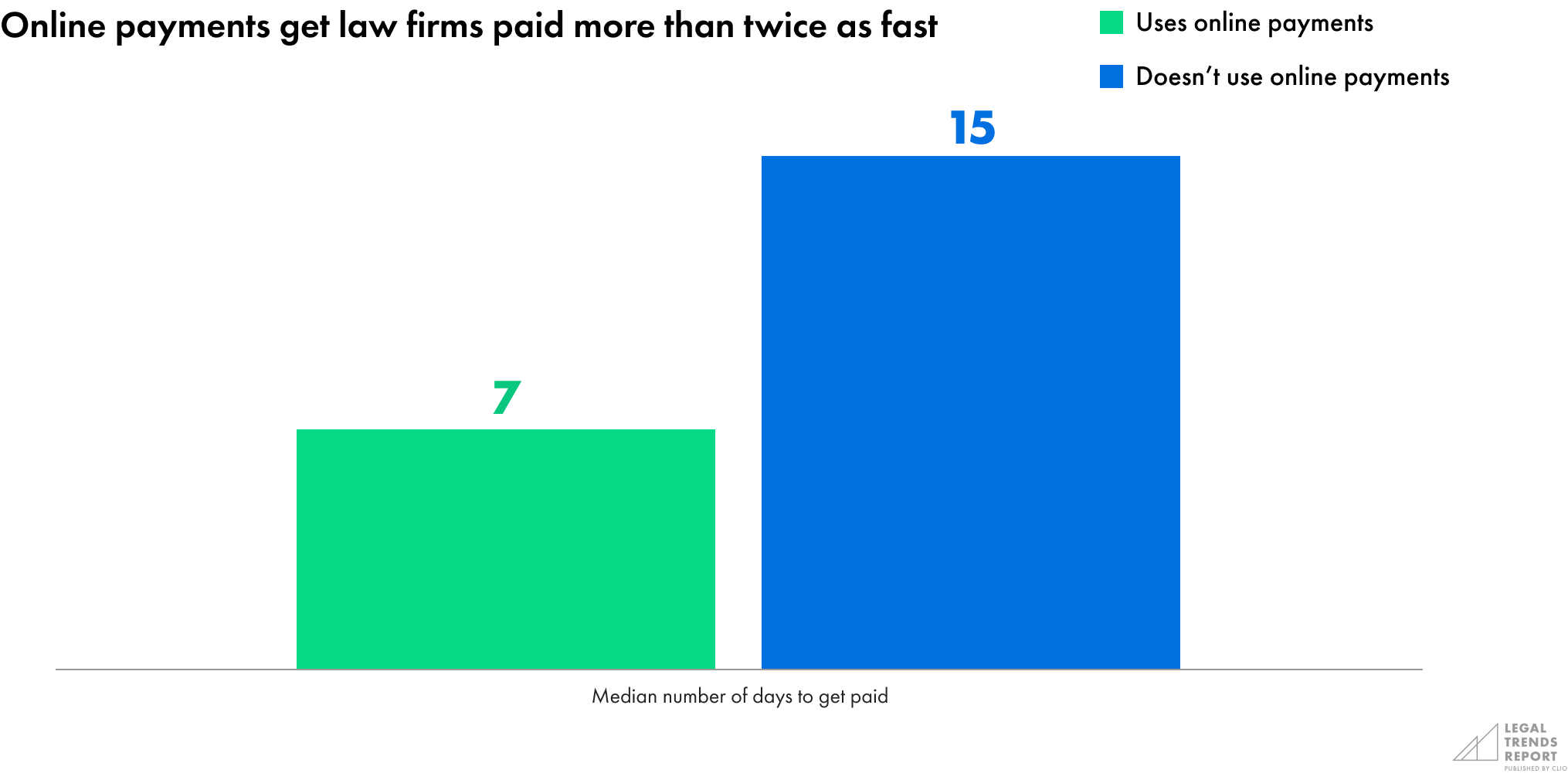

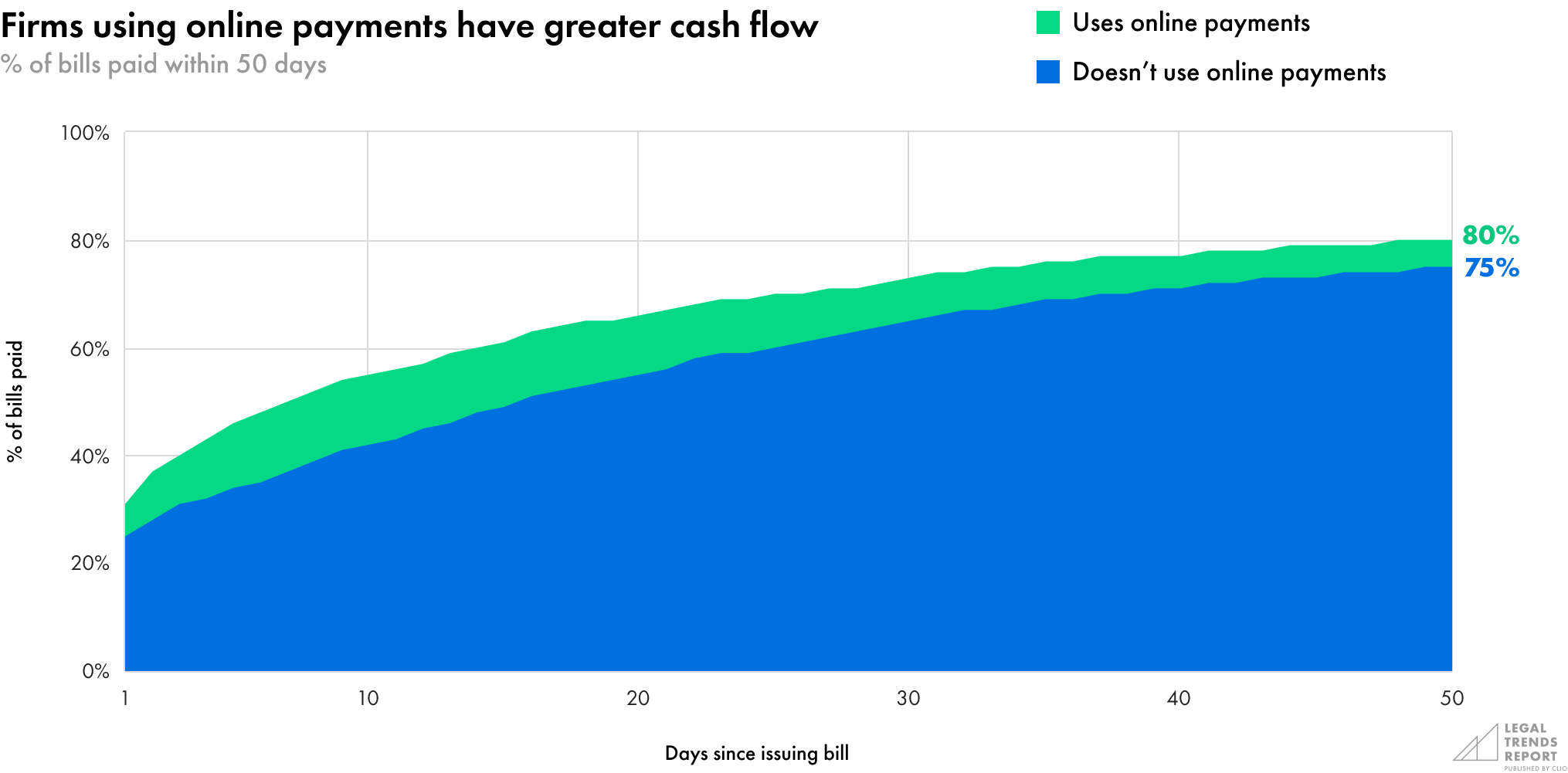

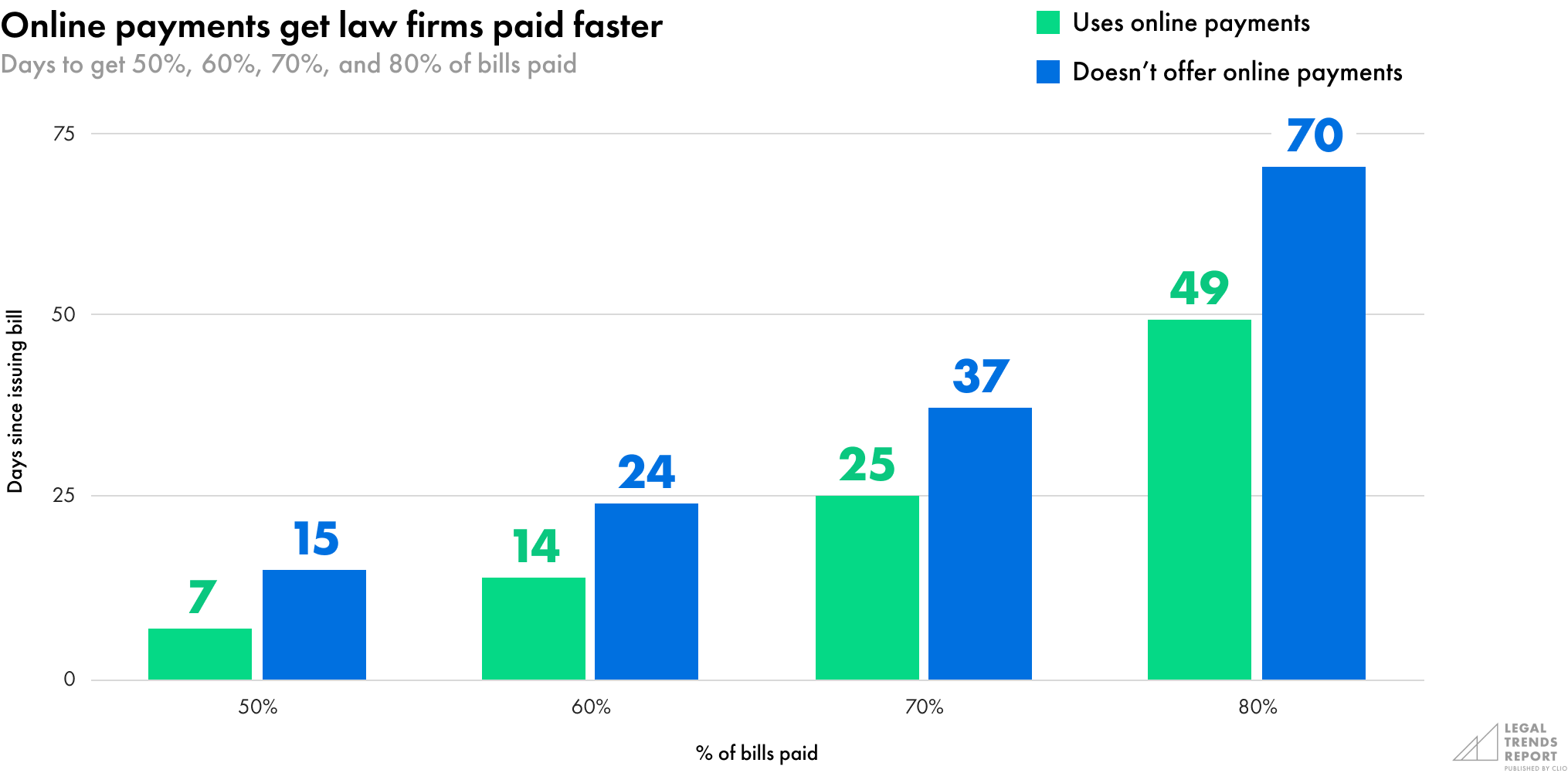

Offering online payments significantly reduces the friction involved for clients in paying their legal bills. In fact, law firms using online payments get paid more than twice as fast. When looking at the number of days it takes to get bills paid, those using online payments have a median waiting period of seven days compared to 15 days for those not using online payments.

Without the ability to pay a law firm electronically, clients typically have to rely on other means, such as paying by check, which slows the entire payment process. It requires that clients have a checkbook on hand and the time to mail or drop off the check in person, both of which only add to a law firm’s collection and total lockup.

When comparing how many bills get paid, the largest difference is in the first 50 days from issuing a bill. Firms using online payments see the greatest benefits within the first several weeks, as this is when bills are likely to get paid the quickest, helping give law firms more cash on hand at any given time.

To put this into greater perspective, law firms using online payments collect, on average, 50% of their bills within seven days of issuing them and 80% of their bills within 49 days (see chart below). Law firms not using online payments take more than twice as long—15 days—to collect 50% of their bills and it takes 70 days—over two months—to collect 80% of bills.

Law firms using online payments on average collect 50% of their bills within 7 days of issuing them, and 80% of their bills within 49 days.

Encouraging clients to pay electronically pays off

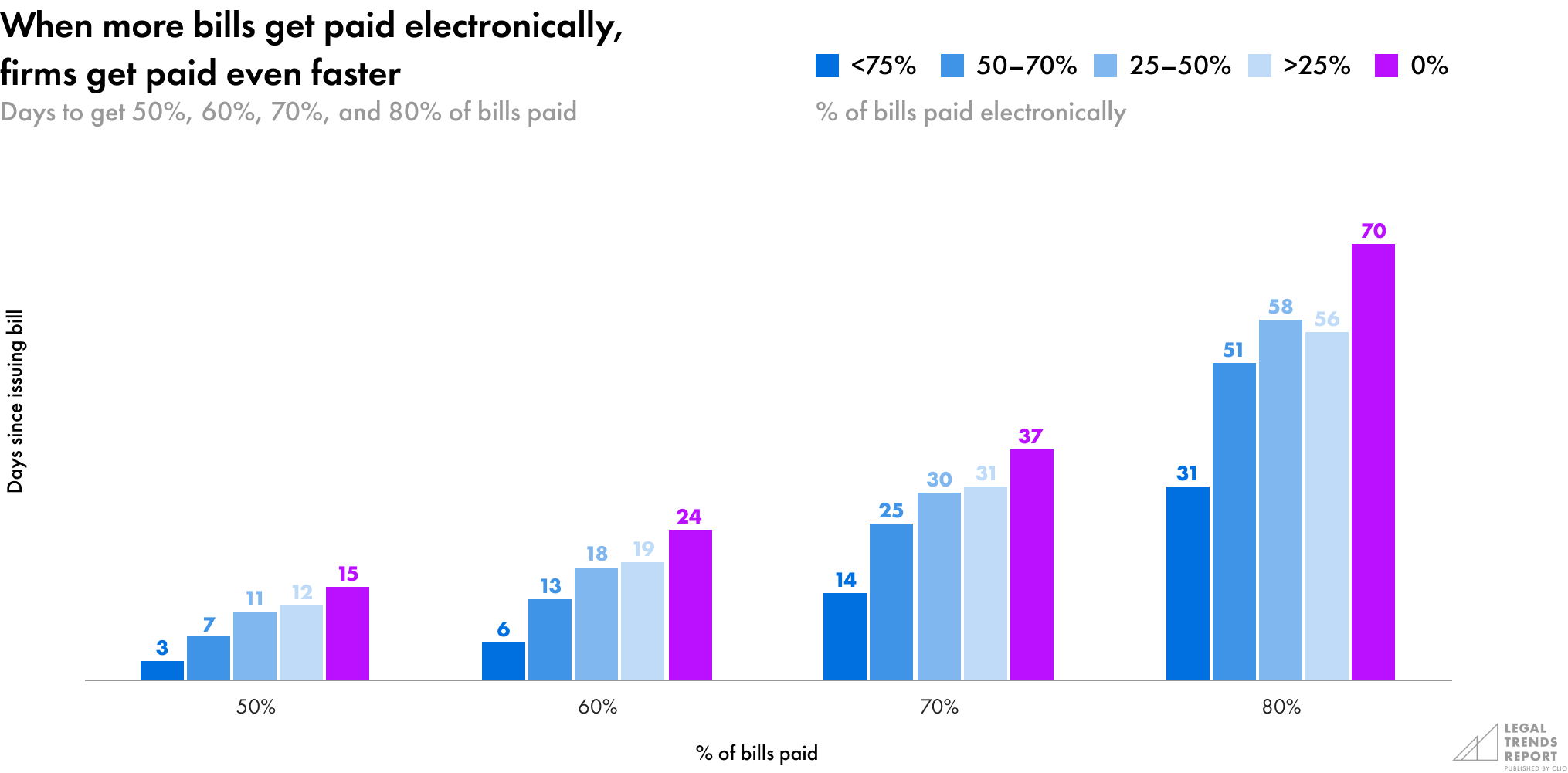

Beyond offering electronic payments, we can look at the extent to which firms are able to get their clients to actually pay electronically and the effect this has on their ability to collect payments from clients.

We see a strong connection between law firms with a high percentage of bills that are paid electronically and how quickly they get paid.

Firms that collect 75% or more of their payments electronically collect half of their bills within three days of issuing them. This is five times faster than a firm that doesn’t collect electronic payments at all.

Firms that collect 75% or more of their payments electronically collect half of their bills within three days of issuing them.

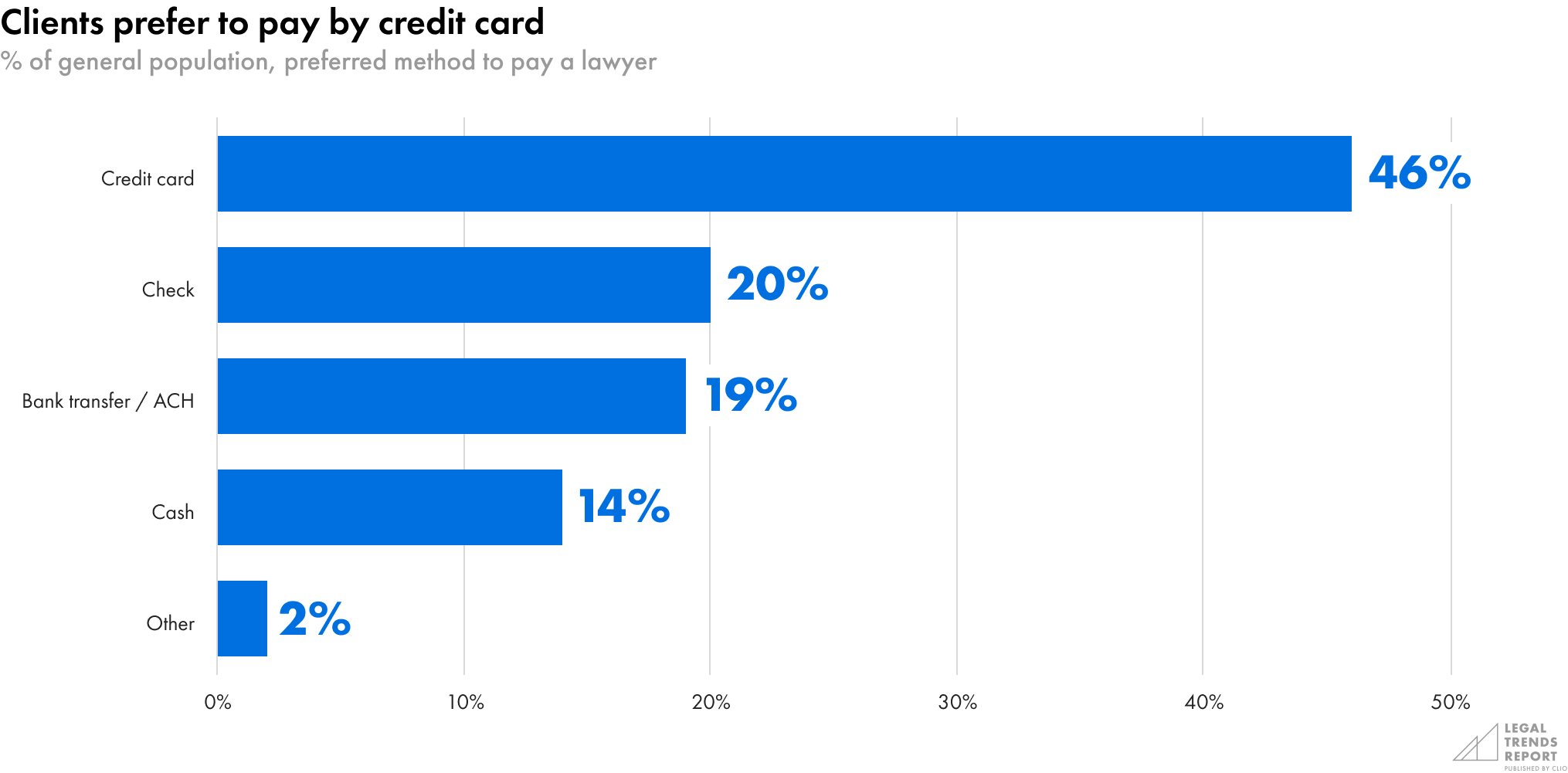

Clients actually want to pay by credit card

As it turns out, what’s good for law firms aligns really well with what clients are looking for when it comes to payment options. In our survey of consumers, paying by credit card was the most preferred option for paying a lawyer, accounting for almost half of all respondents across all age groups. Only one in five consumers wanted to pay by check, and even fewer by cash.

More 55 year-olds and older (24%) prefer to pay by check compared to 18-to-34 year-olds (18%) and 35-to-54 year-olds (17%). Interestingly, more 18-to-34 year-olds prefer to pay in cash (22%) compared to 35-to-54 year-olds (15%) and those 55 years and older (7%).

Since many clients are not just willing, but actually prefer to pay their legal bills with credit cards, law firms should implement strategies to ensure that clients know they have the option to pay electronically and educate clients on the ease and convenience of electronic payments. Doing so could result in getting bills paid exponentially faster, which in turn will result in a drastic increase in cash flow.

Only 1 in 5 consumers wanted to pay by check, and even fewer by cash.

How to make electronic payments more convenient for clients

- Electronic payment links. Including payment links in bills make it easy for clients to pay as soon as they receive their bill.

- QR codes. QR codes can be added to bills or displayed in the office so clients can make quick payments to the firm from their mobile device.

- Saved payment methods. Storing a client’s payment information means they don’t need to look up and enter their payment information every time they make a payment.

- Automated payment plans. Setting up automated payment transactions as a monthly subscription-type fee ensures that money gets paid every month for continuous work or consultation.

- Evergreen trust requests. Collecting automated trust deposits can be used to collect advanced fees, helping to ensure that funds are available to pay bills as they’re issued.

2023 Legal Trends Report

Part 4

Business levers to improve firm performance

- Introduction. Unlocking the potential to succeed

- Part 1. The thriving business of legal

- Part 2. Lockup—a new indicator of cash flow

- Part 3. Getting paid faster

- Part 4. Business levers to improve firm performance

- Part 5. The promise of AI

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

One of the biggest points of improvement that law firms have seen over the years is in their ability to bill and collect payment for more of their work. As we see below, many of these gains correlate with the use of better billing and collection technology. But while many law firms have increased their capability to bill and collect more, other firms are being left behind.

This section looks at important business levers—technological capabilities that improve billing and payment collections—used by law firms and how these tools can have an outsized impact on revenue.

But while many law firms have increased their capability to bill and collect more, other firms are being left behind.

Business levers for improving realization rates

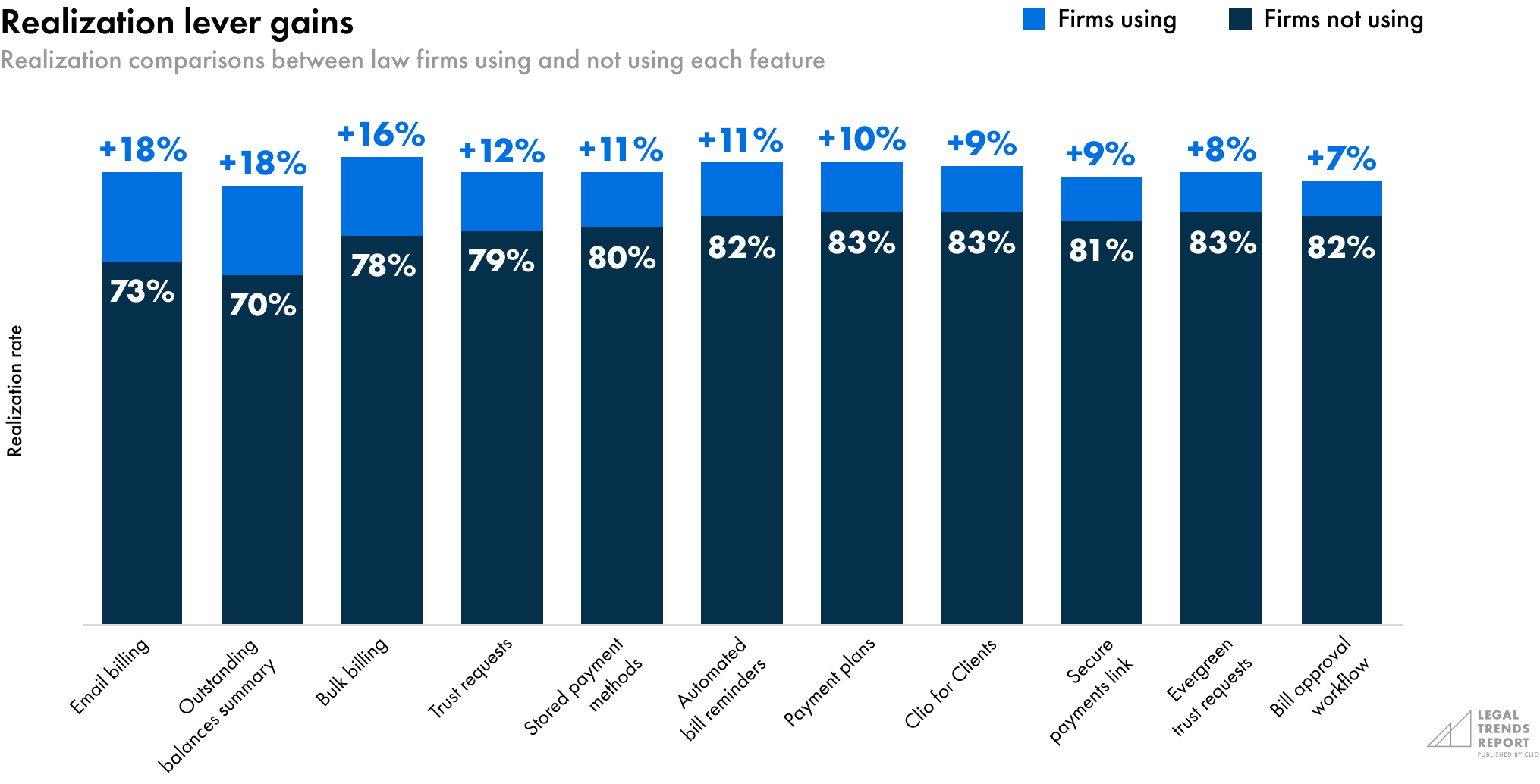

We looked at several business levers in Clio, each of which are designed to improve billing and payment collections in law firms. When comparing firms that use these capabilities to those that don’t, we see a vast difference in how much of a firm’s work actually gets billed to clients.

Top 3 differences in realization

When looking at the business levers that have the most profound impact on realization rates among law firms, the top three are:

- Email billing. When law firms create a bill using the billable hours tracked in Clio, they have the option to email the bill directly to the client. This feature saves having to download the bill to send manually, either through another email platform or physically by mail. Law firms that emailed bills directly from Clio had realization rates 25% higher than firms that did not (91% compared to 73%).

- Outstanding balances summary. When working with a client that has multiple outstanding bills, law firms can summarize a total of what the client owes in an email sent from Clio. The summary itemizes the bills, the amounts unpaid for each, and a total amount owed, which can be paid from an embedded payment link. Firms using this feature to follow up with unpaid bills had realization rates that were 26% higher than firms that did not (88% compared to 70%).

- Bulk billing. Bulk billing is a workflow that allows law firms to instantly draft all of its bills—or a selection of bills—for clients with unbilled activities. The ability to automate an otherwise tedious process saves significant time and can lead to more billable work being invoiced to the client. Law firms using bulk billing have realization rates that are 21% higher than firms not using the feature (94% compared to 78%).

Fee-forward billing ensures client funds are available to pay legal bills

Trust requests and evergreen trust requests are features in Clio that make it easy for law firms to request advance fee deposits and stay on top of requests to keep trust accounts topped up each month. Since firms know that funds are on hand to pay their clients bills, lawyers may be less likely to apply write-downs or discounts. As a result, their realization rates remain high.

Lawyers value their work more with better systems in place

A surprising outcome of our analysis was that Clio’s bill approval workflow correlated with increased realization rates. The bill approval workflow allows someone, usually a non-legal professional like an office manager or bookkeeper, to draft an invoice which is then sent to a lawyer for review and approval. Our initial expectation was that putting more time toward reviewing bills would result in added write-downs or discounts, but instead it had the opposite effect, resulting in realization rates that were 9% (89% compared to 82%) higher than firms not using this feature.

Automated billing and payment collections create smoother experiences for clients

Many of the business levers looked at in this analysis automate important tasks for billing and payment collections that take up a lot of time when done manually. Having better systems in place allows lawyers to include more of their billable work on client invoices and gives them confidence in knowing that follow-ups will be handled automatically for the lawyer.

And, if lawyers are concerned that billing more of their work will make clients less likely to pay, these higher realization rates generally don’t appear to affect collection rates, as we see below.

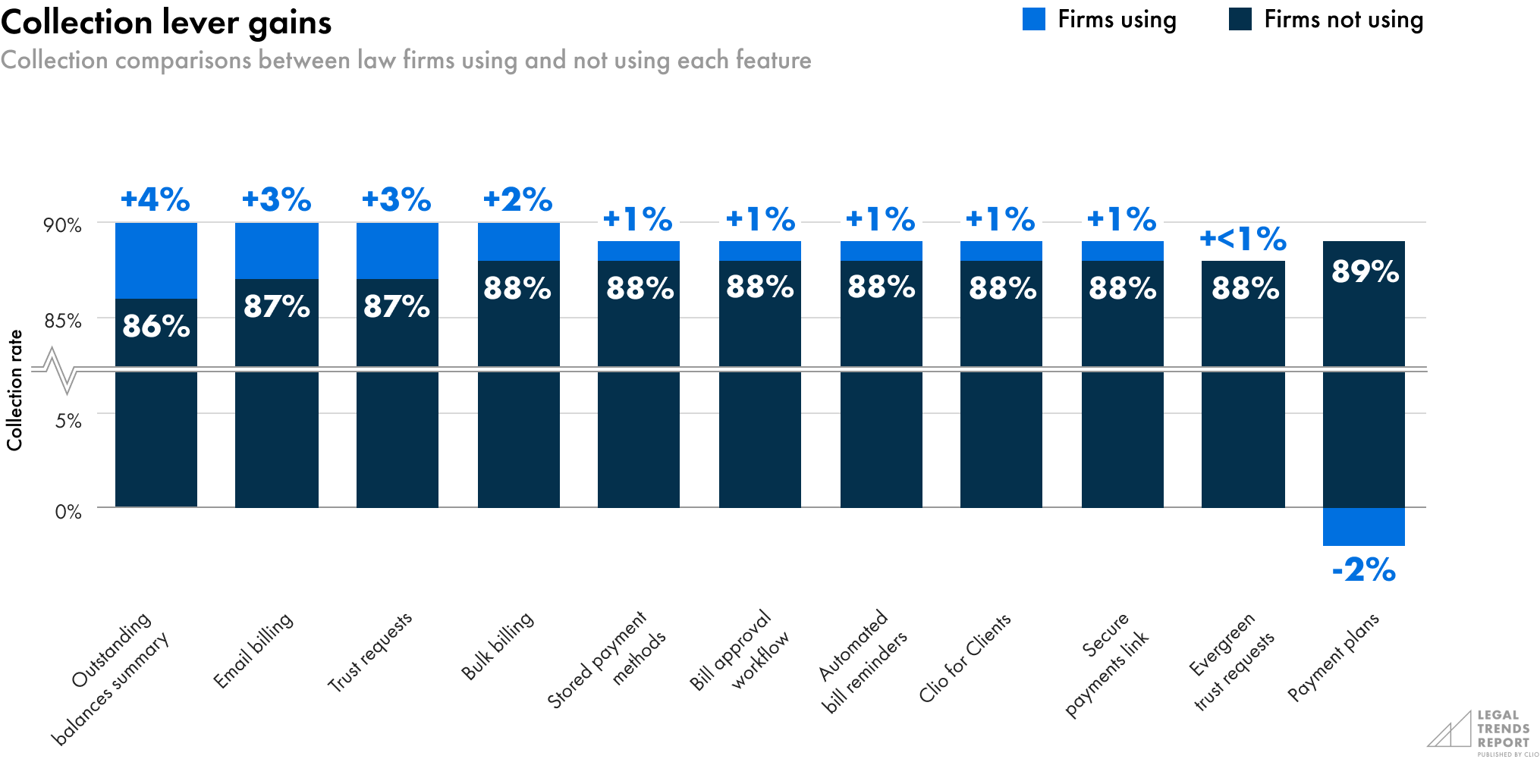

Top business levers for improving collection rates

We also examined collection rates when analyzing business levers associated with increased realization rates. In most cases, firms using these features also saw modest increases in their collection rates. In other words, not only does the average law firm bill more using these levers—they often collect a greater proportion of their bills as well.

Top three differences in collection rates

When looking at the business levers that have the largest difference in collection rates among firms, the top three are:

- Outstanding balances summary. This feature helps law firms stay on top of their clients’ bills if and when they have more than one balance outstanding with the firm. It’s not surprising that the use of this feature was associated with the most significant difference in collection rates. Firms using this feature had collection rates that were 5% higher than firms not using it (90% compared to 86%).

- Email billing. This feature can free up a significant amount of time for lawyers and staff when sending out bills while making it easier for clients to pay, since bills include a link for instant electronic payment. Not only does email billing put invoices directly into a client’s inbox; it also makes it convenient for clients to then click the link to pay immediately, reducing the risk that the bill will get lost or forgotten. Firms using email bill sharing had 3% higher collection rates than firms not using it (90% compared to 87%).

- Trust requests. Similar to how firms saw higher realization rates when they used this feature, the ability to easily collect advanced fee deposits ensures that money is on hand to pay legal bills as they are issued. Firms using this feature had collection rates that were 3% higher than firms not using them (90% compared to 87%).

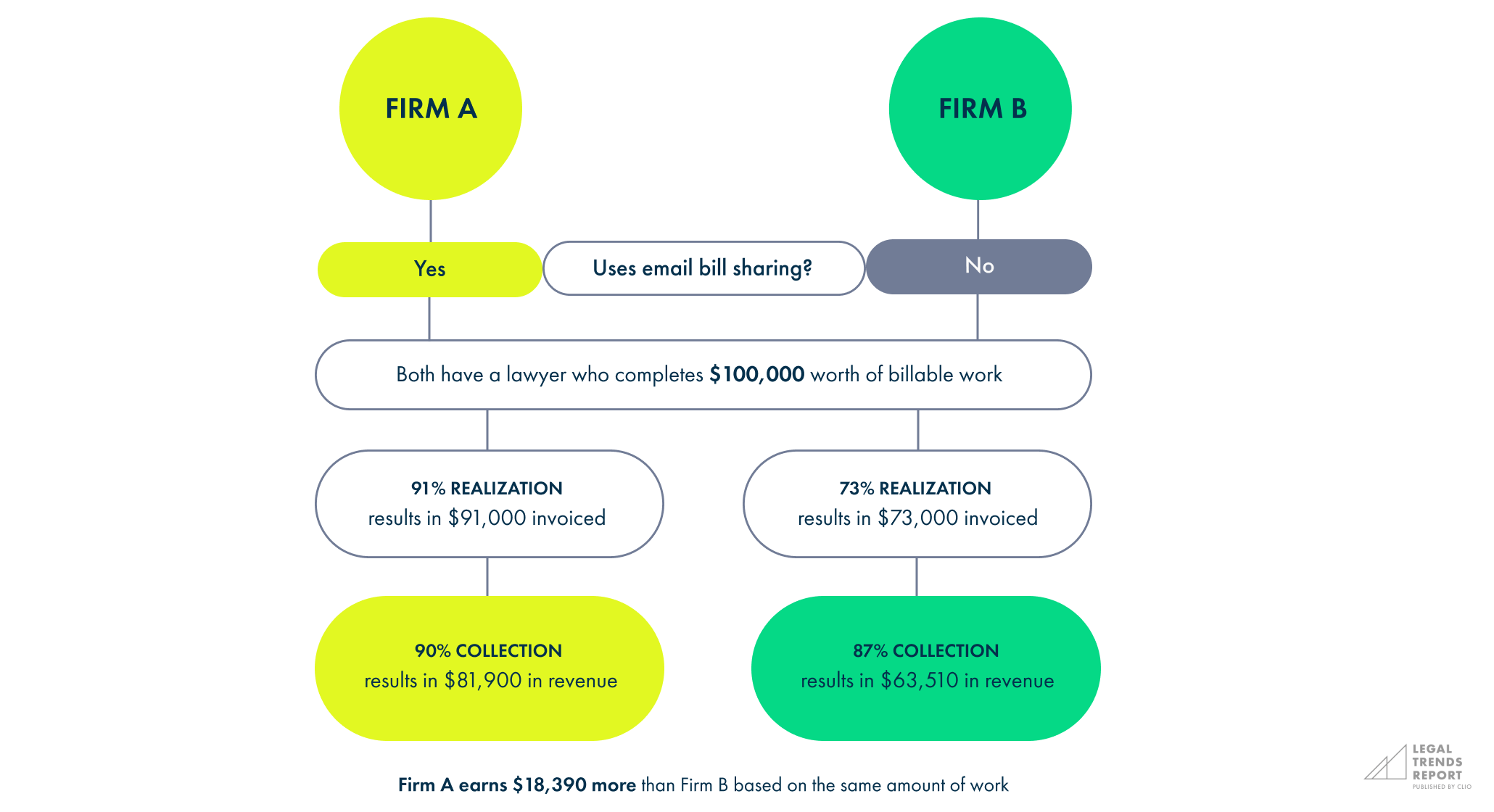

Comparing the impact of realization and collection

Consider a lawyer that completes $100,000 worth of billable work over a period of time. When we compare realization rates between firms using email bill sharing versus those not, those using this capability will bill out 91% of the work on average, compared to 73% for those not using the feature.

Then, when we factor in the difference in collection rates, that same firm using the feature will, on average, collect 90% of the work they bill out compared to only 87% for those not using the feature. Based on the difference in realization and collection rates, the firm using email bill sharing will collect $18,390 more based on the same amount of work.

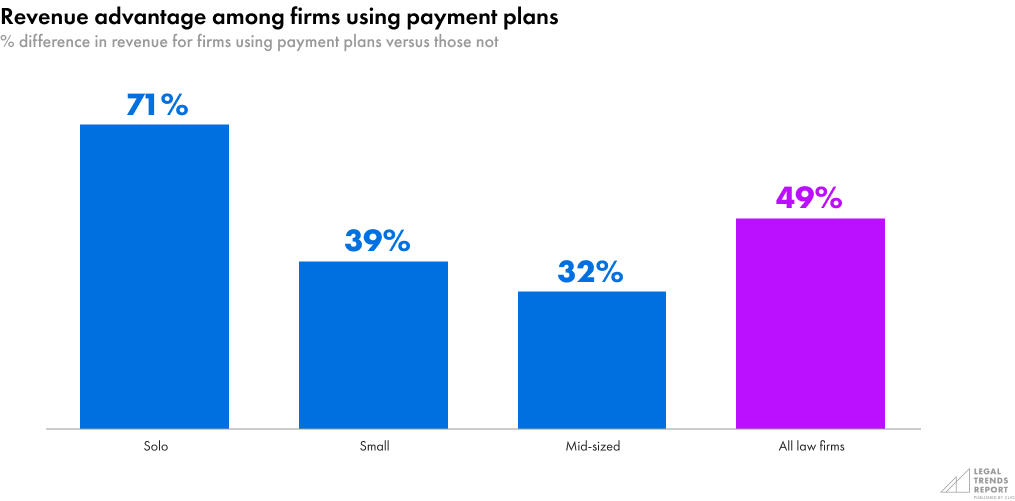

Payment plans

When comparing collection rates above, firms offering payment plans to clients saw collection rates that were 2% lower than firms not offering them. However, while firms offering payment plans had lower collection rates, these firms collected much more revenue overall.

Across firms of all sizes, those using payment plans collected 49% more monthly revenue per lawyer than firms that did not. Solo law firms using payment plans saw the greatest difference: a total of 71% in increased monthly revenue compared to solos that did not offer payment plans to clients. Small and mid-sized law firms saw substantial differences in collection rates as well—39% and 32%, respectively.

However, according to our survey research, almost one in three firms (30%) don’t offer payment plans. This finding provides a major opportunity for many firms to earn more by simply offering this payment option. Not only do payment plans offer law firms more predictability in their revenues, but they also provide transparency and flexibility for clients to pay their legal bills over time, resulting in more clients being able to afford and pay for their legal services overall.

$300 is the average installment amount that clients pay when on a payment plans

Automated bill reminders

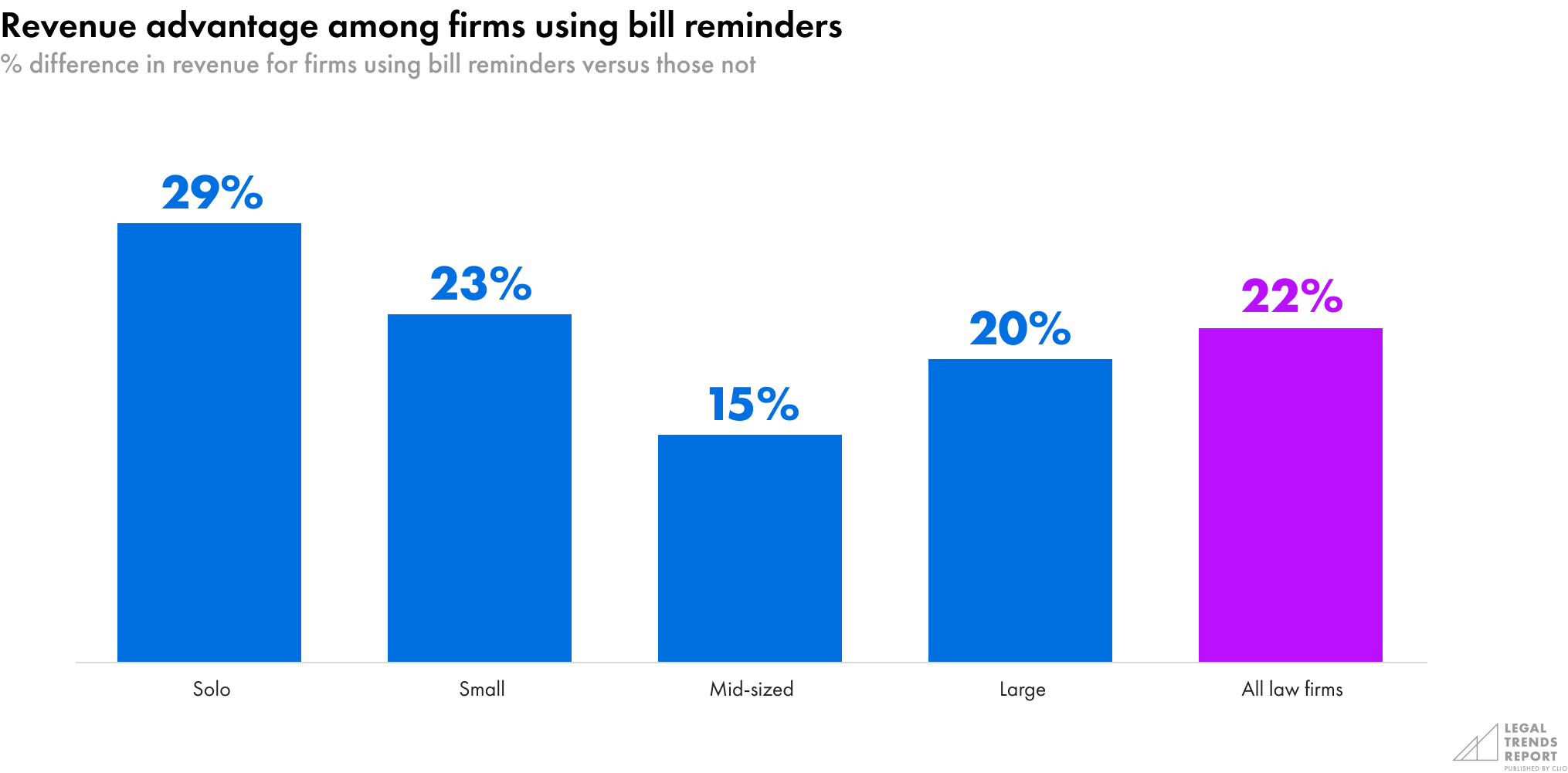

Automated bill reminders are also associated with a substantial difference in revenue collection. Firms that automate bill follow-ups not only free up time among firm staff, but also ensure that clients get timely reminders when their invoices are past due.

Among firms of all sizes, those using automated bill reminders collected, on average, 49% more monthly revenue per lawyer than firms that did not. Solo law firms saw the greatest difference: those using this feature collected 29% more monthly revenue compared to solos not using it. Small and mid-sized firms saw substantially more revenue collection as well—15% and 20% respectively.

Guide to business levers that improve billing and payment collection workflows

- Bill approval workflow. Review bills for accuracy and completeness prior to sending them to clients.

- Automated bill reminders. Send outstanding balance reminders to clients and bill recipients on a cadence that you select.

- Bulk billing. Send all approved, unsent bills to bill recipients in a single action.

- Clio for Clients. Clients can view and pay bills from their mobile app, in addition to uploading documents, keeping track of case details, and more.

- Email billing. Send bills directly to a bill recipient’s email address with a link to pay immediately online.

- Evergreen trust requests. Get notified when it’s time to replenish a client’s trust fund to pay for the work done on their case.

- Outstanding balance summary. Manually send clients reminders for outstanding bills and balances with a link to pay online.

- Payment plans. Receive payments toward a client’s outstanding balance in specified intervals until the bill is paid.

- Secure payments link. Send clients secure payment links that route payments directly to your specified bank accounts.

- Stored payment methods. Clients can store payment methods for future bill payments.

- Trust requests. Send trust requests to clients that will deposit funds directly into your specified Clio trust account.

Leverage points that firms struggle with most

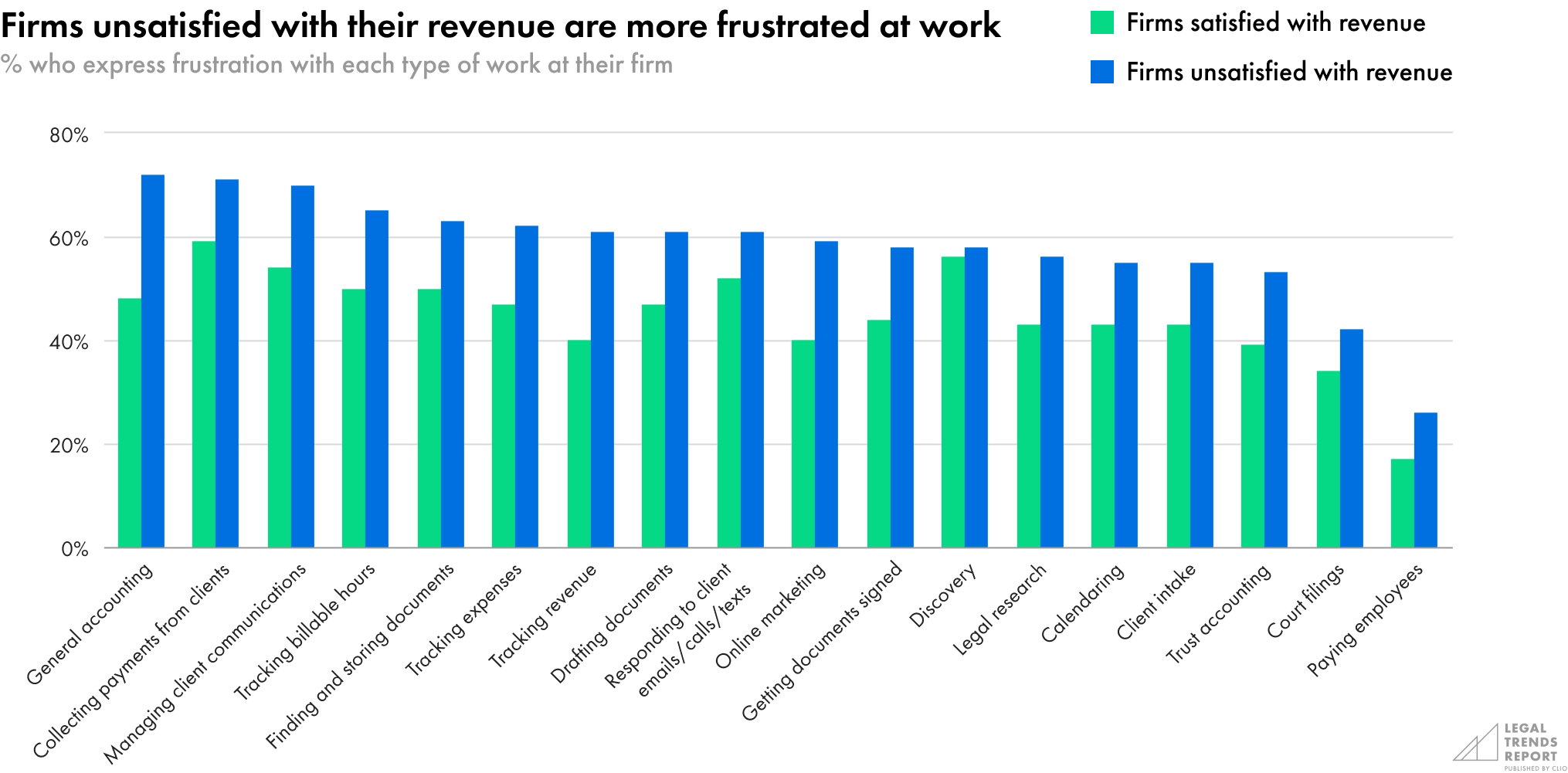

When comparing firms that were satisfied with their revenue to those that were not, we looked at the differences in where they experience frustrations in their day-to-day operations. In all cases, firms that were not satisfied with their revenue were more likely to experience frustration across every type of work.

The most frustration experienced by firms that were unsatisfied with their revenue was in general accounting, which saw a 50% difference (72% compared to 48%). Collecting payments from clients, managing client communications, and tracking billable hours were also frustrating to many firms that were unsatisfied with their revenue.

Each of these points of frustration represents areas of business that likely see inefficiencies that firms could improve with better systems and processes.

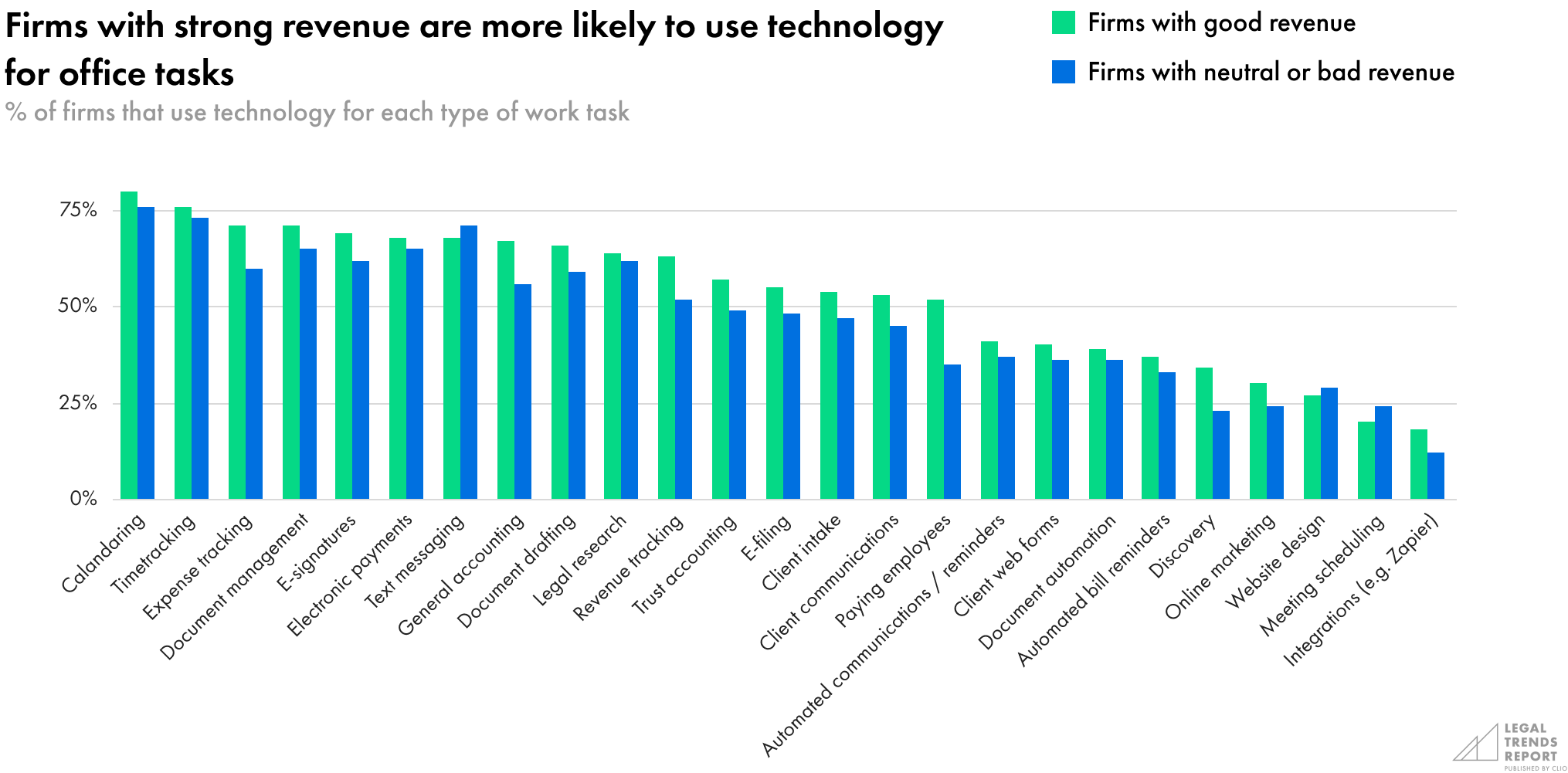

More levers for improving business performance

We also asked survey respondents to tell us which of their practice management-related tasks involve technology. By then comparing firms that were satisfied and unsatisfied with their revenue, we identified what types of features successful firms were more likely to use.

When looking at the types of workflows in which firms with good revenue are most likely to use technology, there are three that stand out:

- Billing and accounting. Expense tracking, revenue tracking, and trust accounting capabilities

- Client-facing communications. Client communications, client intake, and online marketing

- Document management. Document drafting, e-filing, and e-signatures

In short, by using technology tools for these three workstreams, a firm can increase its revenue significantly.

2023 Legal Trends Report

Part 5

The promise of AI

- Introduction. Unlocking the potential to succeed

- Part 1. The thriving business of legal

- Part 2. Lockup—a new indicator of cash flow

- Part 3. Getting paid faster

- Part 4. Business levers to improve firm performance

- Part 5. The promise of AI

- Appendix A. Hourly rates and KPIs

- Appendix B. Detailed methodology

The advent of generative artificial intelligence (AI) marks the most significant technological development in recent years—if not a generation. Unlike any technology before it, generative AI can perform many of the complex tasks that only the human mind has been capable of.

The growing number of AI solutions available today can perceive, learn, reason, and perform creative tasks. And while the recent developments in AI are altogether new, they are based on a foundational machine learning framework known as the neural network, which simulates how the human brain processes information. Neural networks have been around for decades, and they form the basis for established machine learning solutions like Amazon’s product recommendations, Google Assistant, and Apple’s Siri.

More recently, the breakthrough of a new deep learning architecture, known as a “transformer,” builds on the foundational concept of a neural network and has resulted in the development of large language models (LLMs) that have an unparalleled ability to understand and create text.6 In the six years since the invention of the transformer, coupled with inexorable increases in computing power, we’ve seen an unparalleled explosion in the number of AI startups, with applications being explored in every imaginable facet of the human experience.

What makes LLMs more advanced is that they can not only understand vast amounts of text but also generate new content based on their derived interpretations of human language, which is what many of us have seen firsthand with ChatGPT.

Launched publicly at the end of November 2022, ChatGPT was the first generative AI to achieve widespread use. Within just five days of release, ChatGPT had amassed 1 million users.7 Within two months, it grew to over 100 million users, making ChatGPT the fastest-growing consumer application in history. For comparison, TikTok took nine months to reach the same milestone and Instagram took two-and-a-half years.8

What makes LLMs more advanced is that they can not only understand vast amounts of text but also generate new content based on their derived interpretations of human language, which is what many of us have seen firsthand with ChatGPT.

A future of rapid advancement in legal

What does the rise of AI mean for lawyers? There is no question that we are at the precipice of another massive technological advancement that promises to radically transform the legal profession. We’ve only just seen the first iterations of AI’s capabilities—how technology can take on advanced cognitive processes at a level of quality and speed far beyond anything we’ve seen before.

The situation today parallels the first breakthroughs in cloud-based technologies more than 20 years ago or in modern mobile devices 15 years ago. When these technologies first emerged, it wasn’t clear how they would manifest within our society—yet their future ubiquity was palpable even then. We are at a similar stage with AI. While the advancement in both the capabilities and use of AI is certain, it is not necessarily clear what an AI-assisted world will look like in the future.

With these latest developments, AI has the opportunity to radically transform our society. Many also see extreme risk—the potential for millions of job eliminations, further widening of wealth inequality, and increasing polarization within the global political climate. AI’s potential implications on the world are so profound that some scientists and politicians are calling for temporary—and in some cases, indefinite—moratoriums on AI development. How we deploy AI ethically, safely, and responsibly will be a critical issue for the legal profession to navigate over the coming years.

Both cloud computing and mobile technologies enabled us to create, share, and find information with exponentially greater speed and accessibility. AI will give us even greater capability to not just access but create knowledge and perspective with almost zero effort. For knowledge-based professions like legal—and others that will surely include finance, technology innovation, and creative arts—these capabilities will be revolutionary, giving legal professionals the freedom and opportunity to reimagine how they spend their workdays.

We’ve seen technology disrupt industries in the past. But through these disruptions, we typically see a net positive benefit. For example, prior to 1979, whole floors of accountants used to do the work that can now be done by a single person in a modern spreadsheet. When Don Bricklin invented the first computer spreadsheet with VisiCalc, many feared it would replace the need for accountants—whom, until then, individually performed the work that could now be done within a single cell in Excel.

But since the arrival of spreadsheets, employment in accounting has nearly doubled.9 Far from being replaced, accountants moved up the value chain, shifting from the work of mechanical computation to being strategic partners to their businesses—and delivering more with less.

AI will be no different. It will enable those who embrace it—and those who embrace it will displace those who don’t.

AI will give us even greater capability to not just access but create knowledge and perspective with almost zero effort.

A bigger, smarter lever

The KPI levers we looked at earlier in this report provided insight into some of the most powerful tools that law firms have at their disposal to improve their businesses today. But AI promises to be a different type of lever, one that can get more done faster and take on a much broader set of tasks.

There is no question as to whether AI will categorically transform legal work. Instead, lawyers should be asking how AI will impact their practices and what they are doing to prepare. The answer to these questions will prove critical since it won’t be long before lawyers who use AI will see significant advantages over those who do not.

AI is still in its earliest stages of development, but the rate of advancement has been incredibly rapid. The attitudes, opinions, and behaviors discussed in this section provide a snapshot of the legal profession and its clients’ perspectives on AI, demonstrating ample ground to cover in helping realize its transformative potential.

Clio is a leader in legal technology innovation. Read about our work in AI at www.clio.com/ai

There is no question as to whether AI will categorically transform legal work.

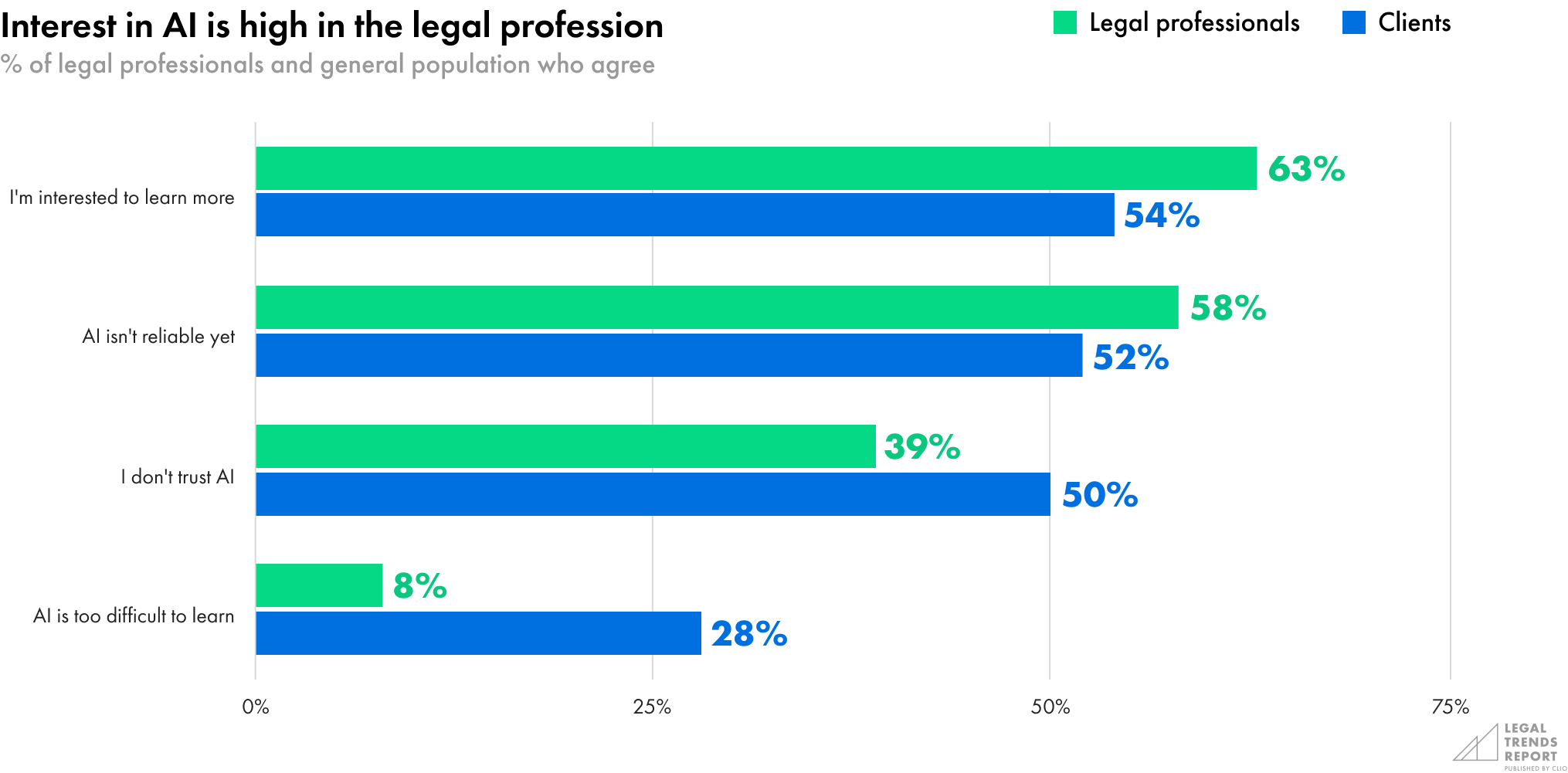

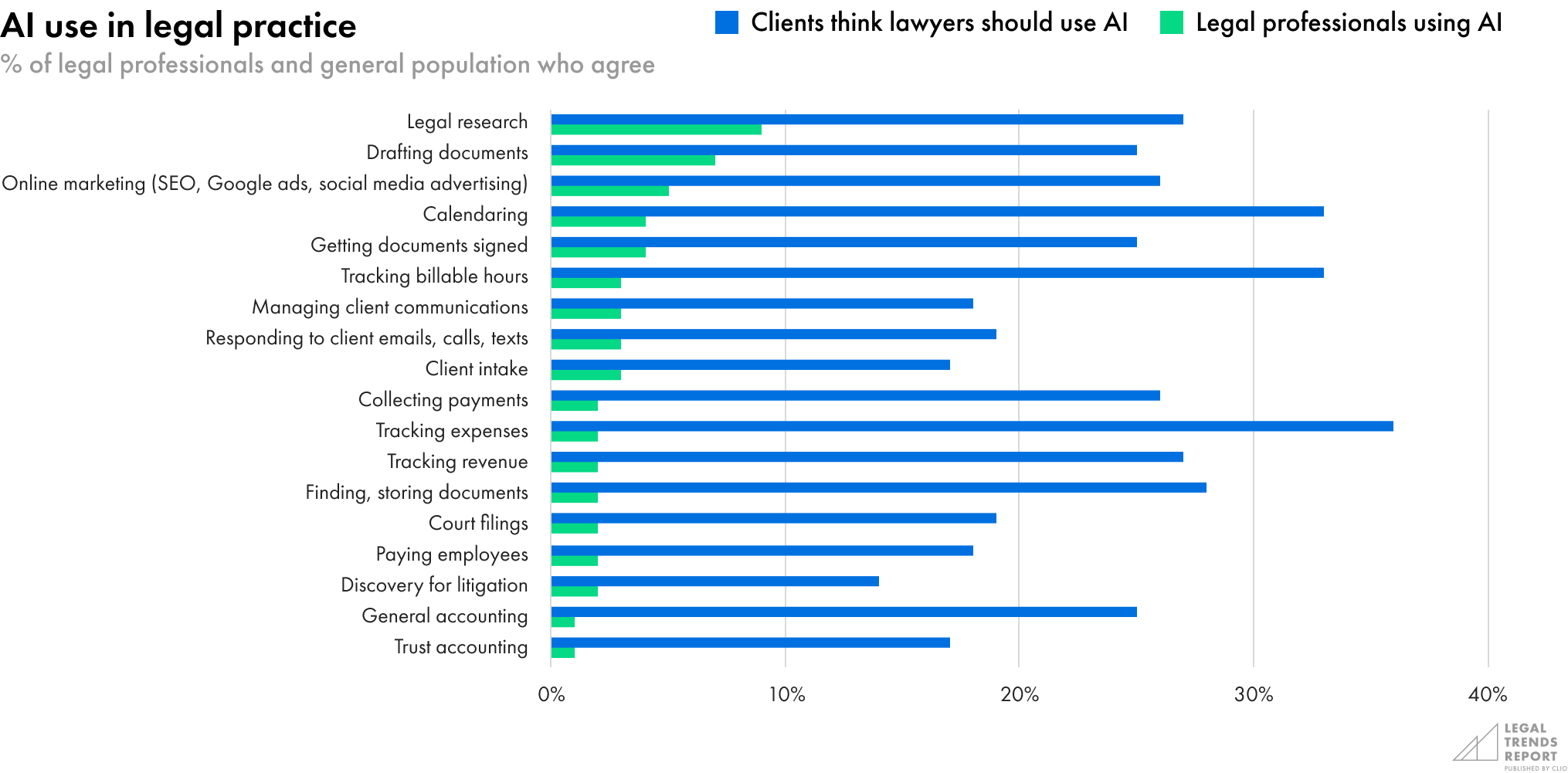

Legal professionals are interested yet cautious of AI

Most lawyers are at least aware of AI, and many see its potential. Sixty-three percent of legal professionals said that they were interested in learning more about AI. This interest is higher than the general population, including both clients and potential clients, of which only 54% showed interest.

Moreover, lawyers are significantly more interested: 68% of lawyers, compared to 54% of paralegals and 48% of administrative staff, want to learn more about AI. With greater interest, lawyers may have an advantage in staying on top of the developments and opportunities available. Rather than falling behind and having to catch up to evolving client expectations, lawyers have the opportunity to be the real leaders and innovators in the space.

At the same time, while both legal professionals and clients are interested in AI, the majority are also cautious. Fifty-eight percent of legal professionals don’t believe AI is advanced enough to be considered reliable, and 39% say they don’t trust it. Clients and potential clients have a similar view regarding AI’s reliability but are even less likely to trust it.

As with any new technology, lawyers especially need to be aware of the risks. To leverage AI to their advantage, lawyers need to know what types of tasks are suitable for an AI to take on, what oversight is required, and what solutions are available in the first place.

At the time of surveying, ChatGPT was the most widely-used form of generative AI, but it was also the first of its kind and designed for general use by the wider public. It was also trained on open datasets that may be unsuitable for certain types of law firm tasks due to the inherent biases and lack of context-specific parameters. As more solutions become available, lawyers should ensure that they use technologies based on secure, reliable data sources managed by reputable businesses. This will help ensure the security of their practices while building trust with clients.

In the meantime, the perceived barriers to adoption are low, as most see AI as easy to use. Only 8% of legal professionals and 28% of clients believe that AI software is too difficult to learn.

Sixty-three percent of legal professionals said that they were interested in learning more about AI.

AI poses both risks and rewards

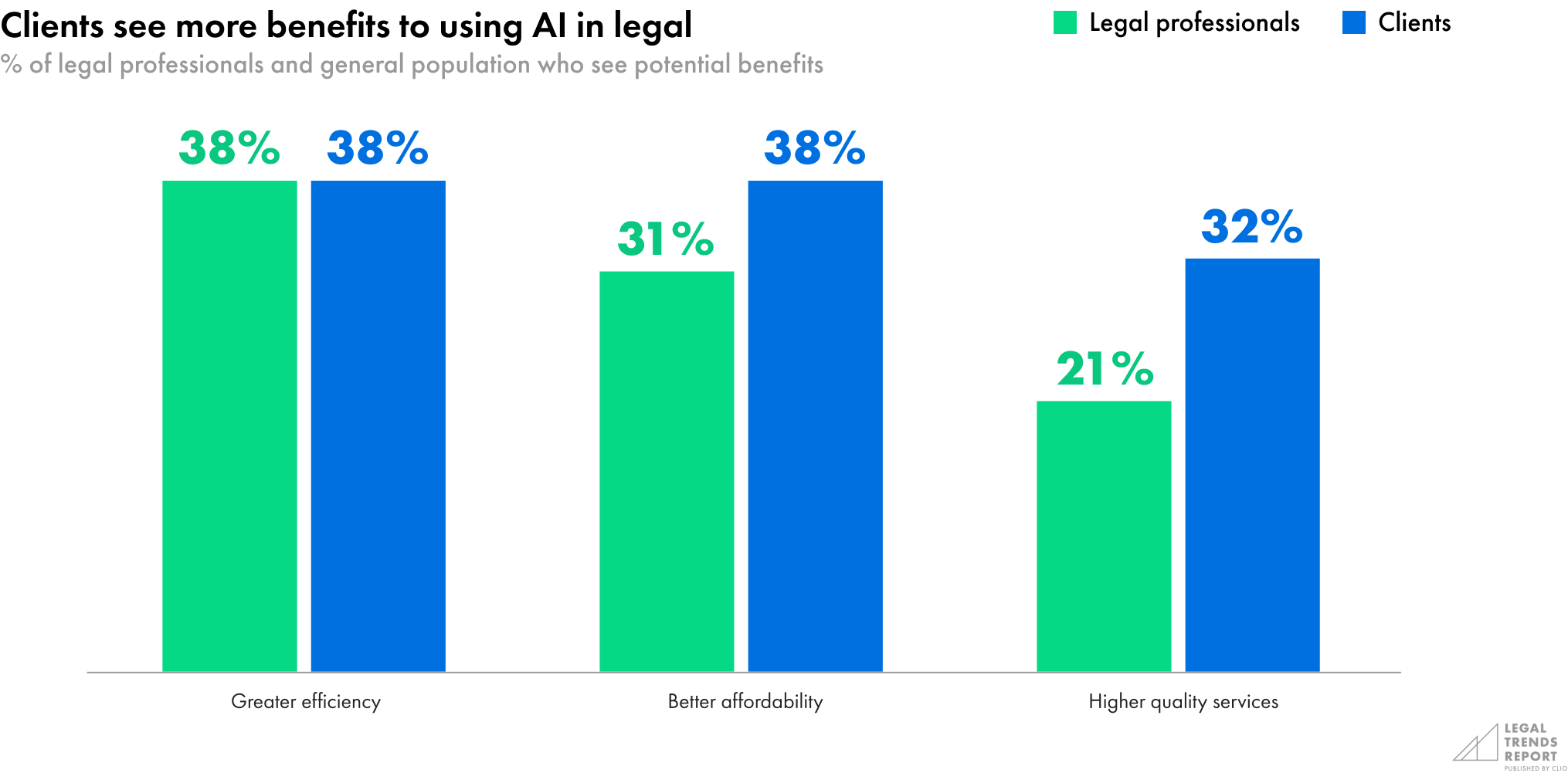

A sizable minority of legal professionals see the potential benefits of AI in legal practice. Twenty-one percent think that AI will improve the quality of legal services, 31% believe it will make them more affordable, and 38% expect AI to improve efficiency.

Lawyers are more likely than others in the firm to see the efficiency benefits of AI: 42% of lawyers, compared to 24% of paralegals and 30% of administrative staff, believe that AI can make law practices more efficient. Clients and potential clients are only slightly more optimistic about the benefits of AI in legal practices.

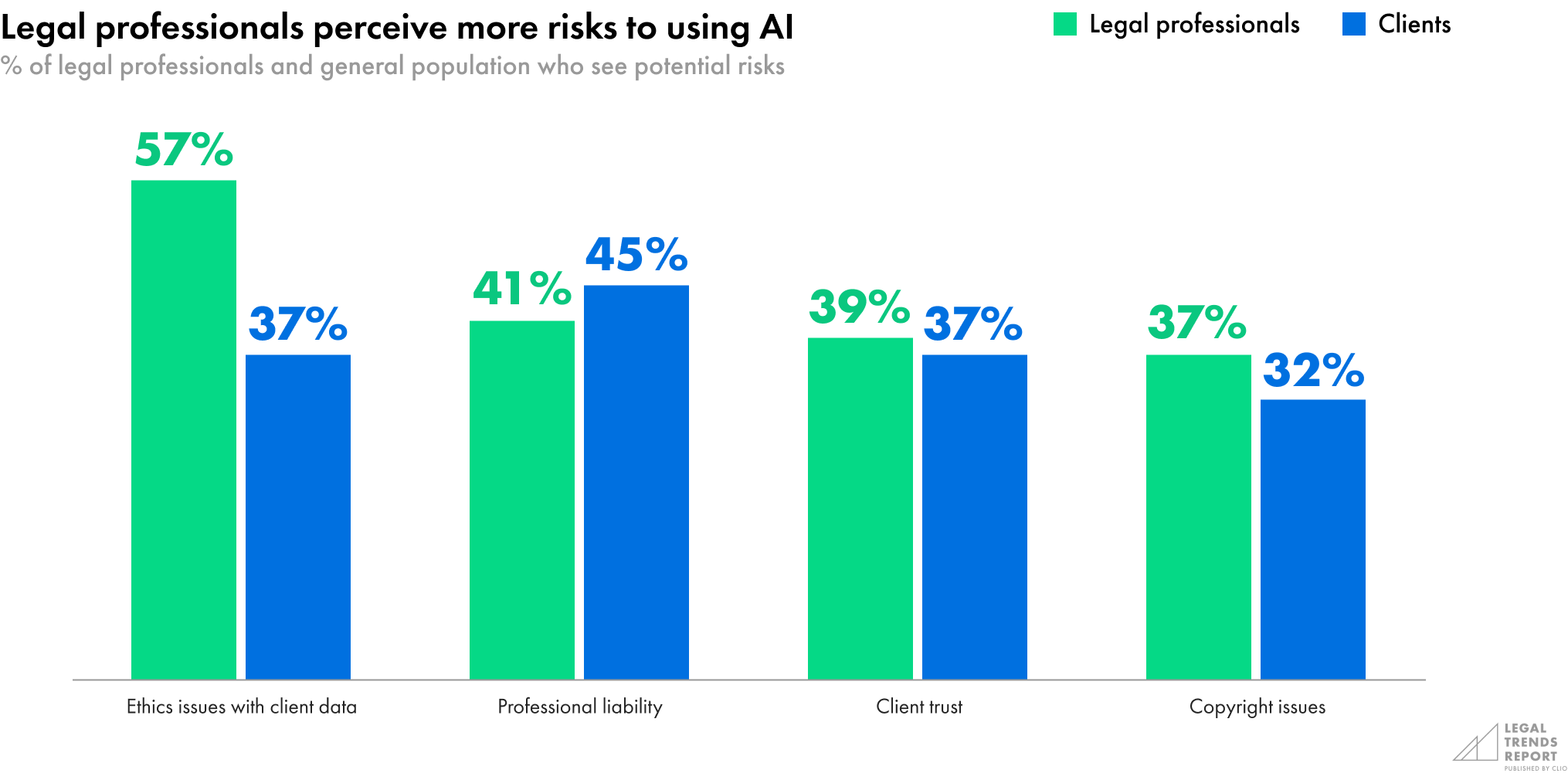

When it comes to the potential risks that AI could pose, many legal professionals express concern. Forty-one percent believe AI would open them up to professional liability, 57% are concerned about client privacy and confidentiality issues, and 37% worry about the risks of copyright issues.

Larger firms are more likely to be concerned about copyright risks: almost half (47%) of firms with 20 or more full-time employees have copyright-related worries regarding AI, compared to 33% of solo firms and 36% of firms with two to 19 employees. Administrative staff are more concerned about copyright than lawyers: of our survey respondents, 46% of law firm administrators, 41% of paralegals, and 34% of lawyers were concerned about this issue.

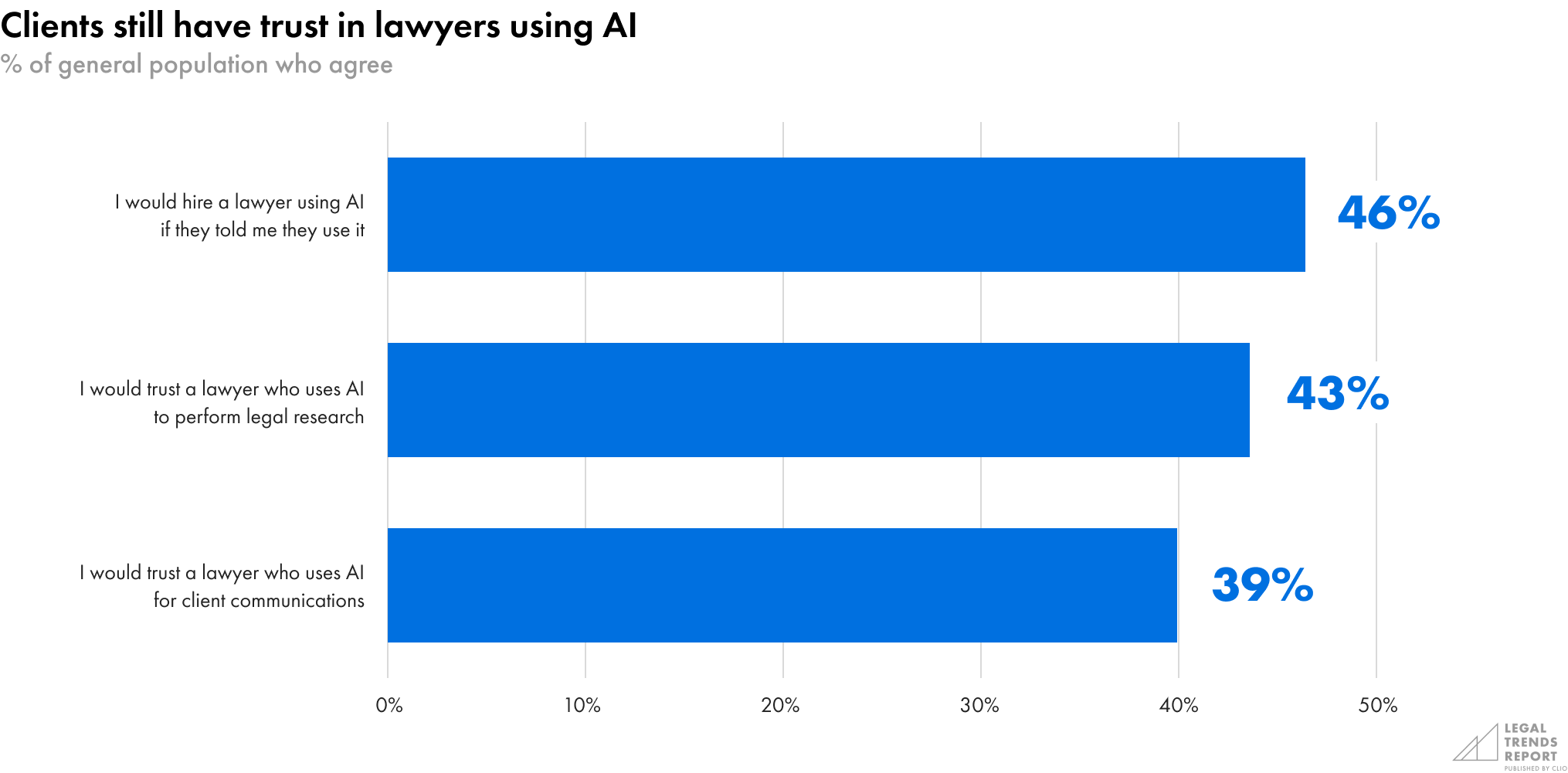

For some, perceived trust may be at the heart of the issue. Thirty-nine percent of legal professionals think clients won’t trust a lawyer who uses AI in their practice. Just over one in three (37%) clients or potential clients say they’d be less likely to trust a lawyer who uses AI.

It will be up to vendors developing AI technologies to stay abreast of these concerns and develop solutions that protect lawyers from all perceived risks.

As AI continues to integrate into our everyday lives, it will become more commonplace, much like other technologies—including spreadsheets, email, and social media—when they were first introduced. Despite being faster, more efficient, and key to unlocking new efficiencies, businesses and clients need time to adapt their perceptions.

Lawyers can play a role in highlighting advantages in conversations with clients and, more importantly, prove the benefits through the quality and responsiveness of their work.

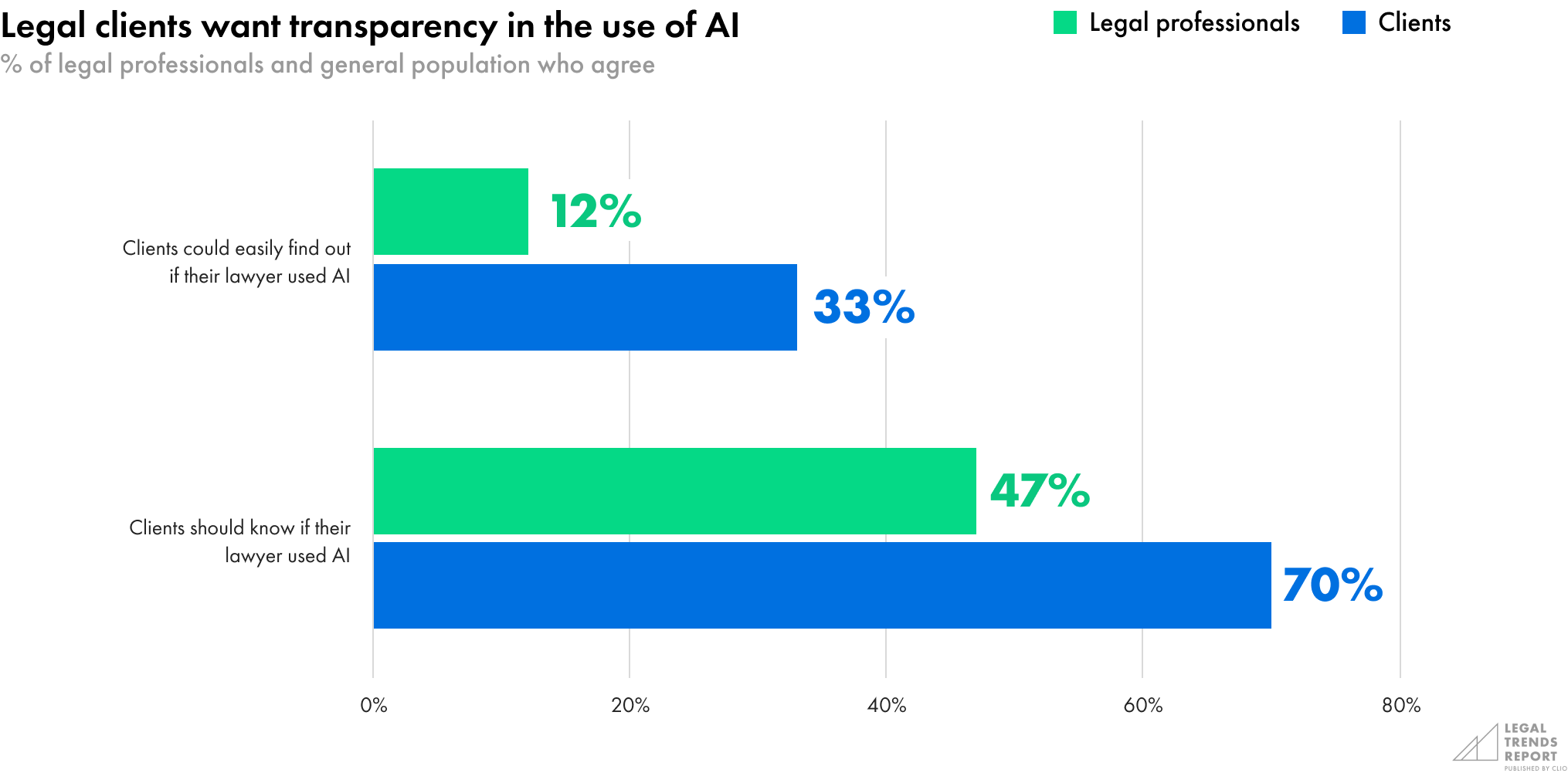

Transparency surrounding the use of AI is top of mind for both lawyers and clients. Seventy percent of clients say they would want lawyers to disclose whether or not they use AI in their practice, and nearly half (47%) of legal professionals say they would want their clients to know if they used it.

And if lawyers weren’t forthcoming about their use of AI, only 12% of legal professionals and 33% of clients believe it would be easy to know whether a lawyer was using AI.

Lawyers are more likely than others in the firm to see the efficiency benefits of AI.

39% of legal professionals think clients won’t trust a lawyer who uses AI in their practice.

Lawyers can play a role in highlighting advantages in conversations with clients and, more importantly, prove the benefits through the quality and responsiveness of their work.

The unseen potential of AI in the justice system

How AI will support the wider justice system is not yet clear to most legal professionals. As a new technology, members of the legal system will need to work with trusted providers to develop solutions that will have a positive impact, and the actual benefits will emerge as more innovations and capabilities become widely available.

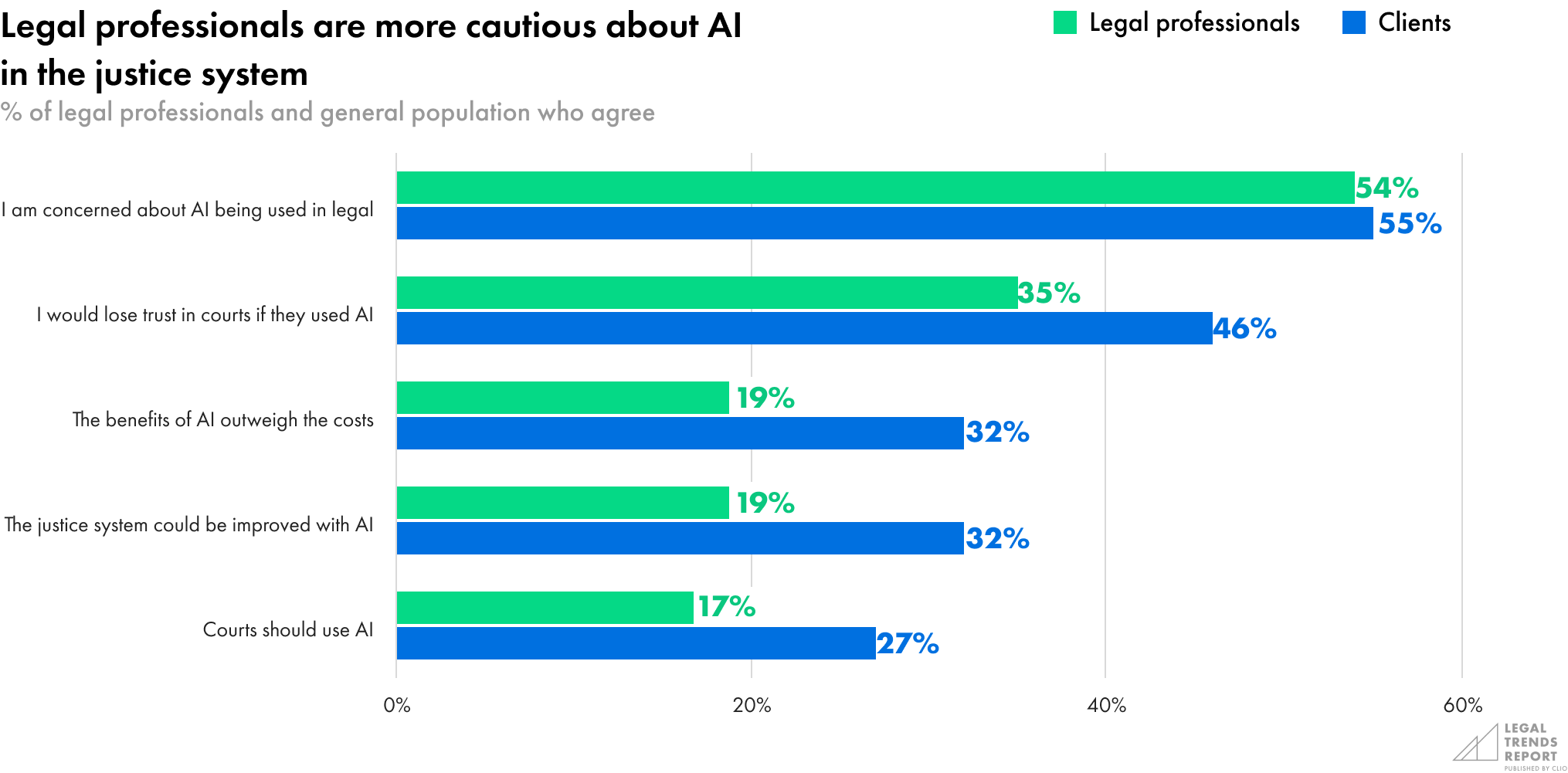

Overall, only 19% of legal professionals believe that the benefits of using AI in a law firm outweigh the costs; 32% of clients and potential clients agree, suggesting that more consumers see the potential advantages of AI to improve efficiencies and reduce the overall cost of legal services.

Among legal professionals, lawyers (22%) are more likely than paralegals (12%) and administrative staff (15%) to see the benefits of AI. Yet, over half of legal professionals (54%) have serious concerns about AI being used in the legal profession, with more lawyers (57%) than administrative staff (43%) feeling this way. Over half of clients and potential clients (55%) have serious concerns about AI being used within the legal profession.

Regarding AI’s use within the justice system, few legal professionals (only 19%) think that AI will help improve it, and 35% say they would lose trust in the legal system if courts started using AI. Only 17% of legal professionals think that courts should use AI.

Clients and potential clients are more polarized on the issue. More think that AI should be used in courts and that AI will help improve the justice system. At the same time, more clients than legal professionals say they would lose their trust in the legal system if it were to use AI.

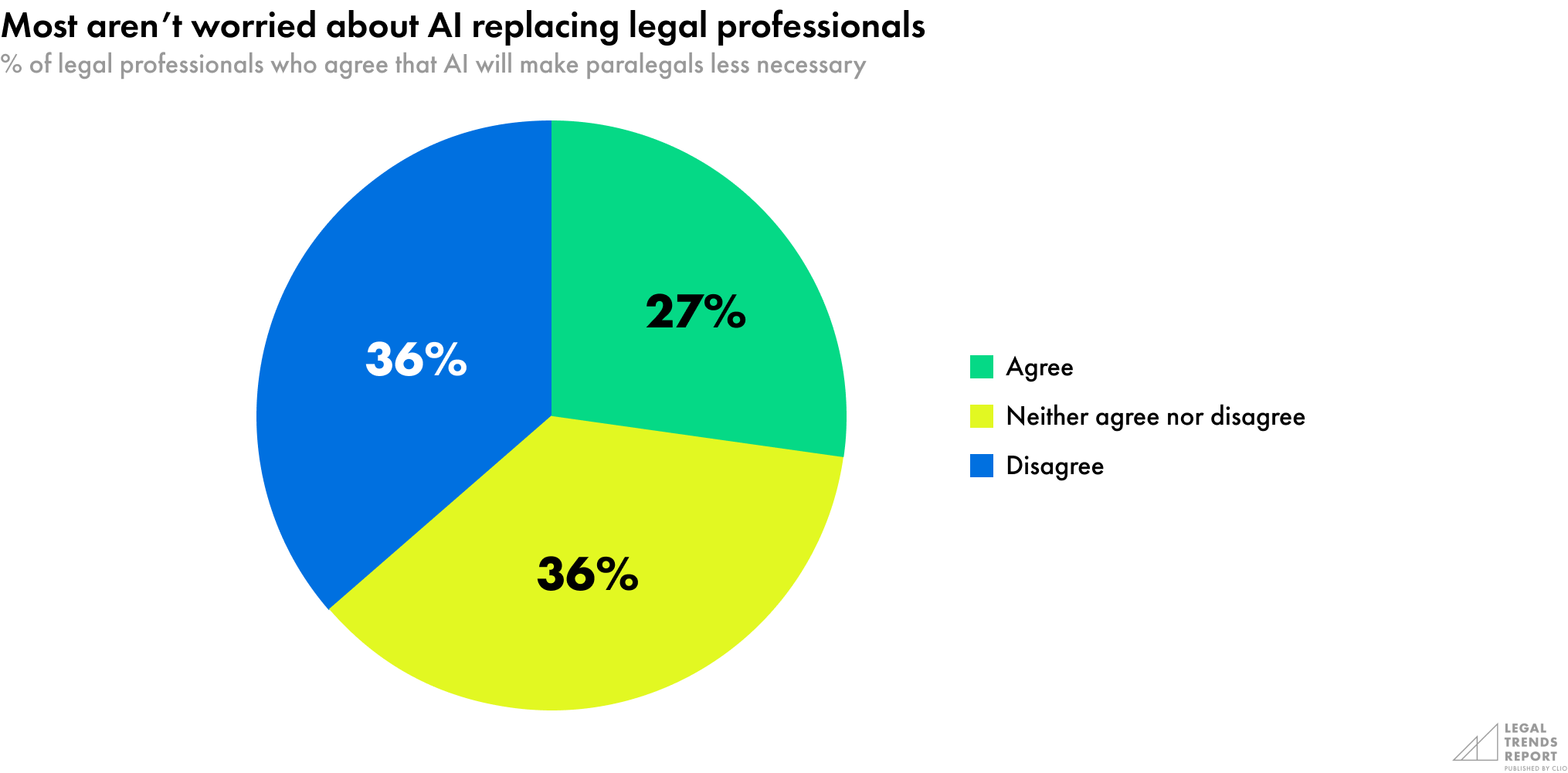

A common fear in any profession is that AI will replace the need for humans in their jobs. In the legal industry, paralegals are considered most at risk. Although one in four (27%) legal professionals believe AI could make paralegals less necessary, most either disagree or are neutral on the issue. And, surprisingly, paralegals are no more likely than lawyers to feel this way.

But firm size seems inversely related to the belief that AI will be a substitute for paralegals: 53% of firms with 20 or more full-time employees do not believe AI would make paralegals less necessary, compared to 31% of solo firms, 35% of firms with two to four employees, and 37% of firms with five to 19 employees.

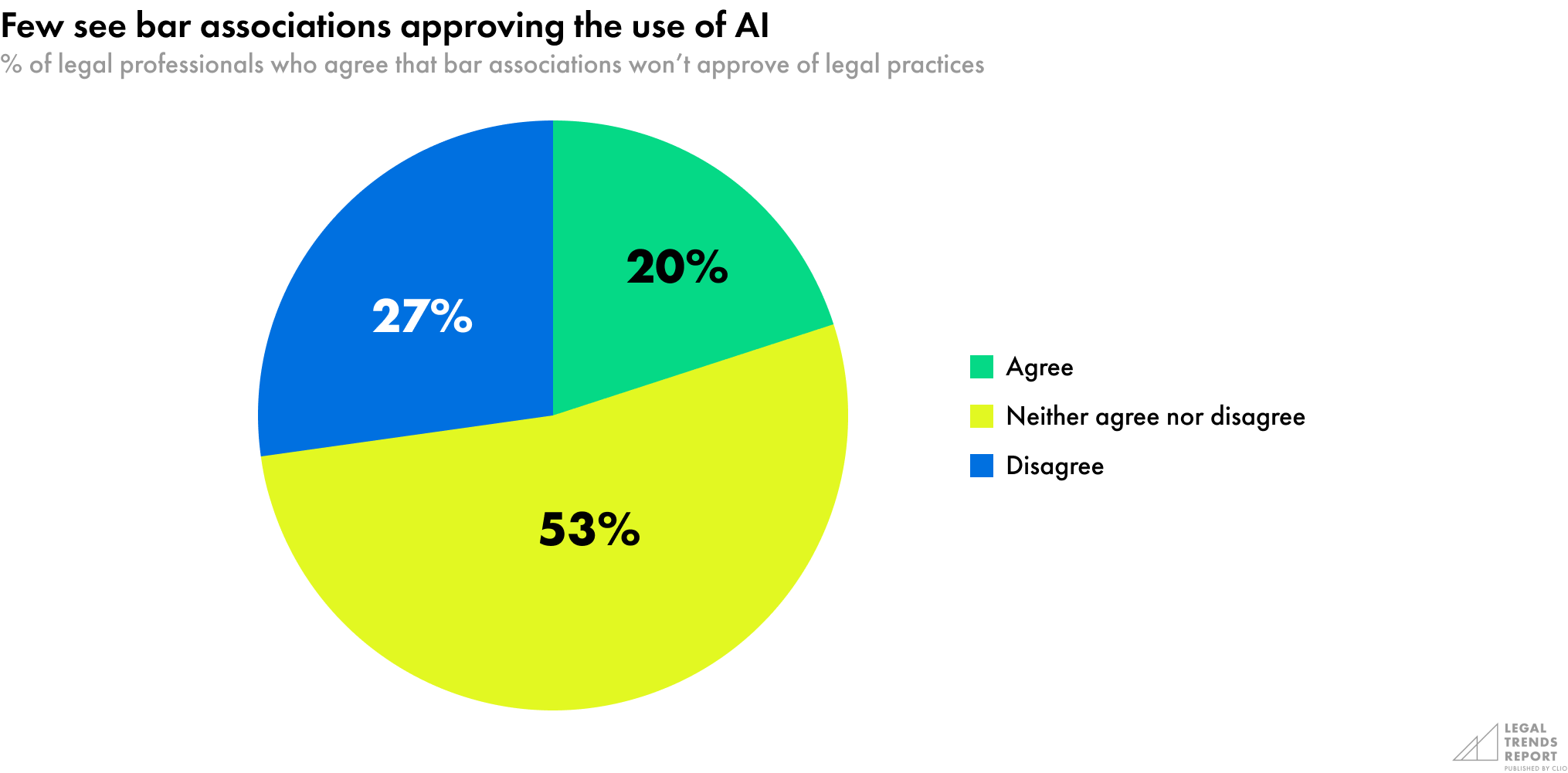

As of publishing this report, no US bar association has issued an opinion about the use of AI among legal professionals. However, the ABA has announced the creation of a task force to study the emerging impact and ethical implications for legal practice.10 Still, 20% of legal professionals believe that bar associations will never approve of practices using AI.

And larger firms—those with 20 or more full-time employees—are more likely to believe that bar associations wouldn’t approve of using AI in the legal profession. Specifically, 31% of these firms, compared to 17% of solo firms, 21% of firms with two to four employees, and 19% of firms with five to 19 employees say that bar associations wouldn’t support the use of AI. Moreover, paralegals are more likely than lawyers to agree: 25% of paralegals, compared to 18% of lawyers, believe their bar would disapprove of AI in the legal profession.

With so many lawyers and clients potentially concerned with the implications of AI being used in legal practice, it will be an issue that professional licensing and regulation bodies will need to stay abreast of—to guide their members through the potential risks and realize the potentially-extensive benefits.

Only 19% of legal professionals believe that the benefits of using AI in a law firm outweigh the costs.

20% of legal professionals believe that bar associations will never approve of practices using AI.

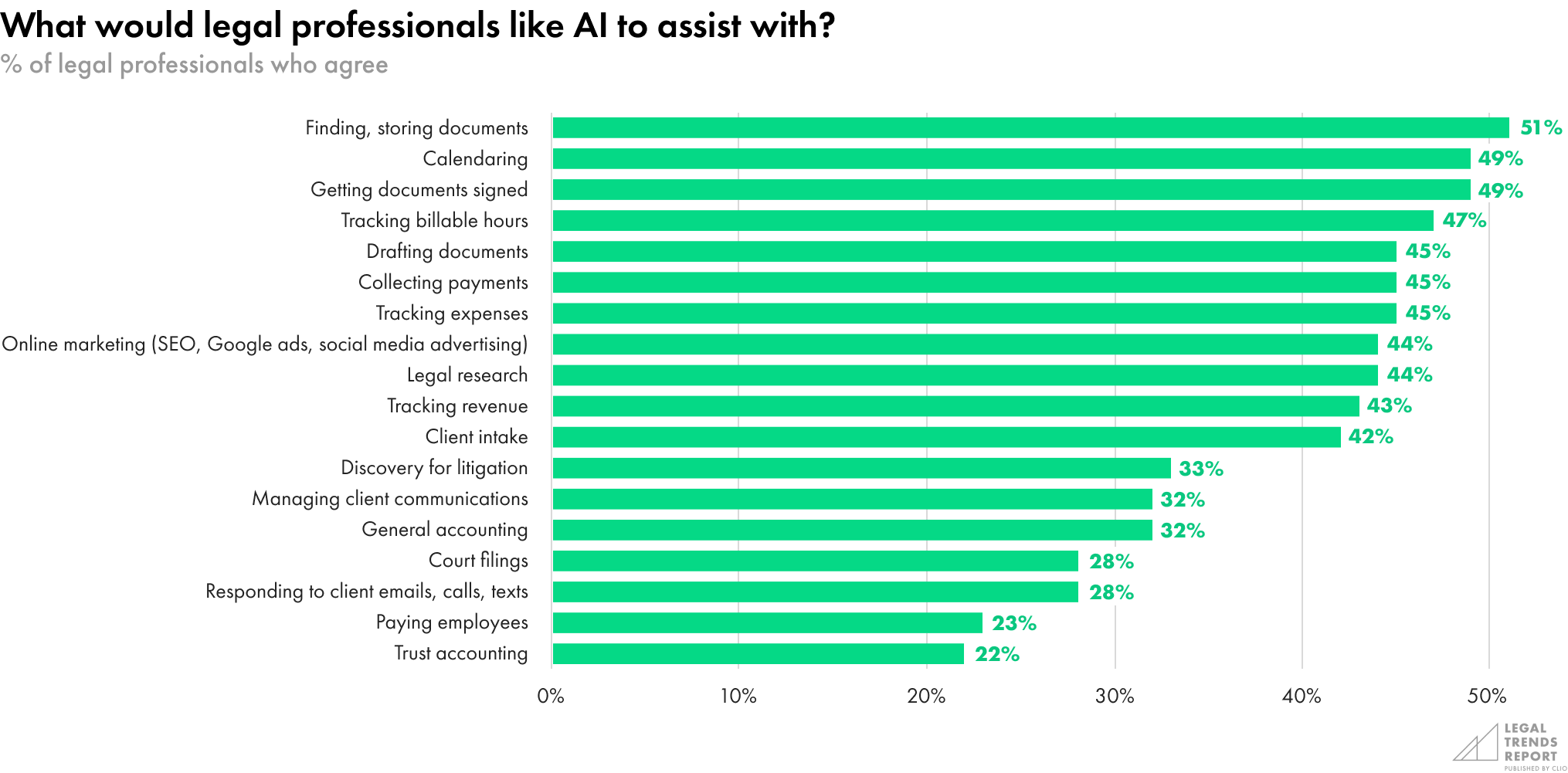

How AI can be used by legal professionals

Even in its earliest iterations, AI offers many applications for legal professionals. Some of these uses include:

- Drafting letters or other legal content based on a set of criteria for a case

- Identifying and summarizing key components from a set of documents or text

- Reviewing a text for grammatical accuracy

- Recommending strategies for legal situations, career advancement, and business development

Lawyers can use most of these applications with a general, out-of-the-box solution like ChatGPT. Still, more solutions are being rapidly developed for specific tasks, providing results tailored to specific use cases.

When it comes to applying AI to certain tasks, again, many lawyers and their clients see both advantages and risks.

AI offers many applications for legal professionals.

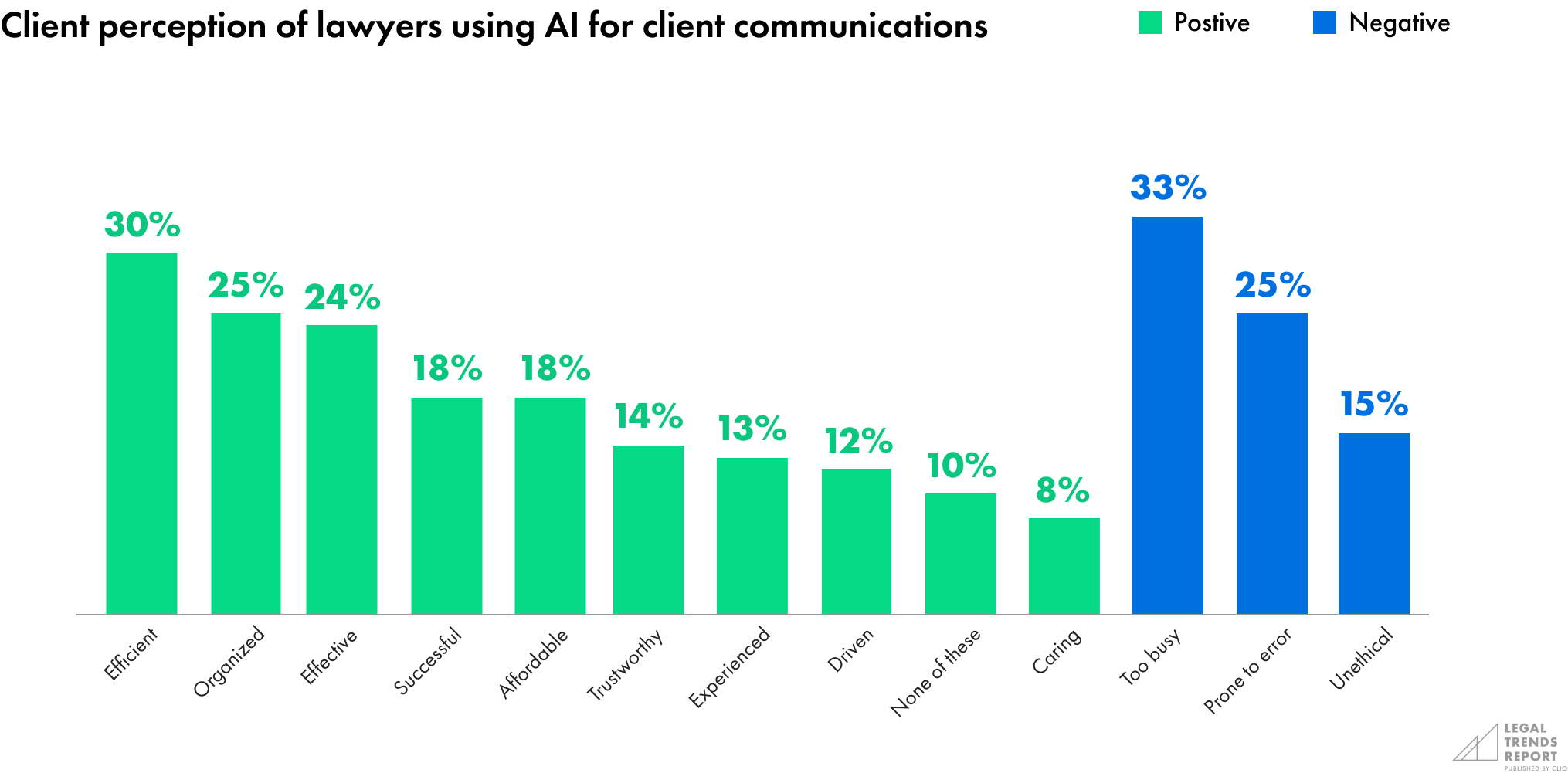

Client communications

Since the most widely-available AI-powered tools today are conversation-based, they have significant potential to improve communications-based tasks. Using AI to draft email responses to clients, for example, can save lawyers a significant amount of time.

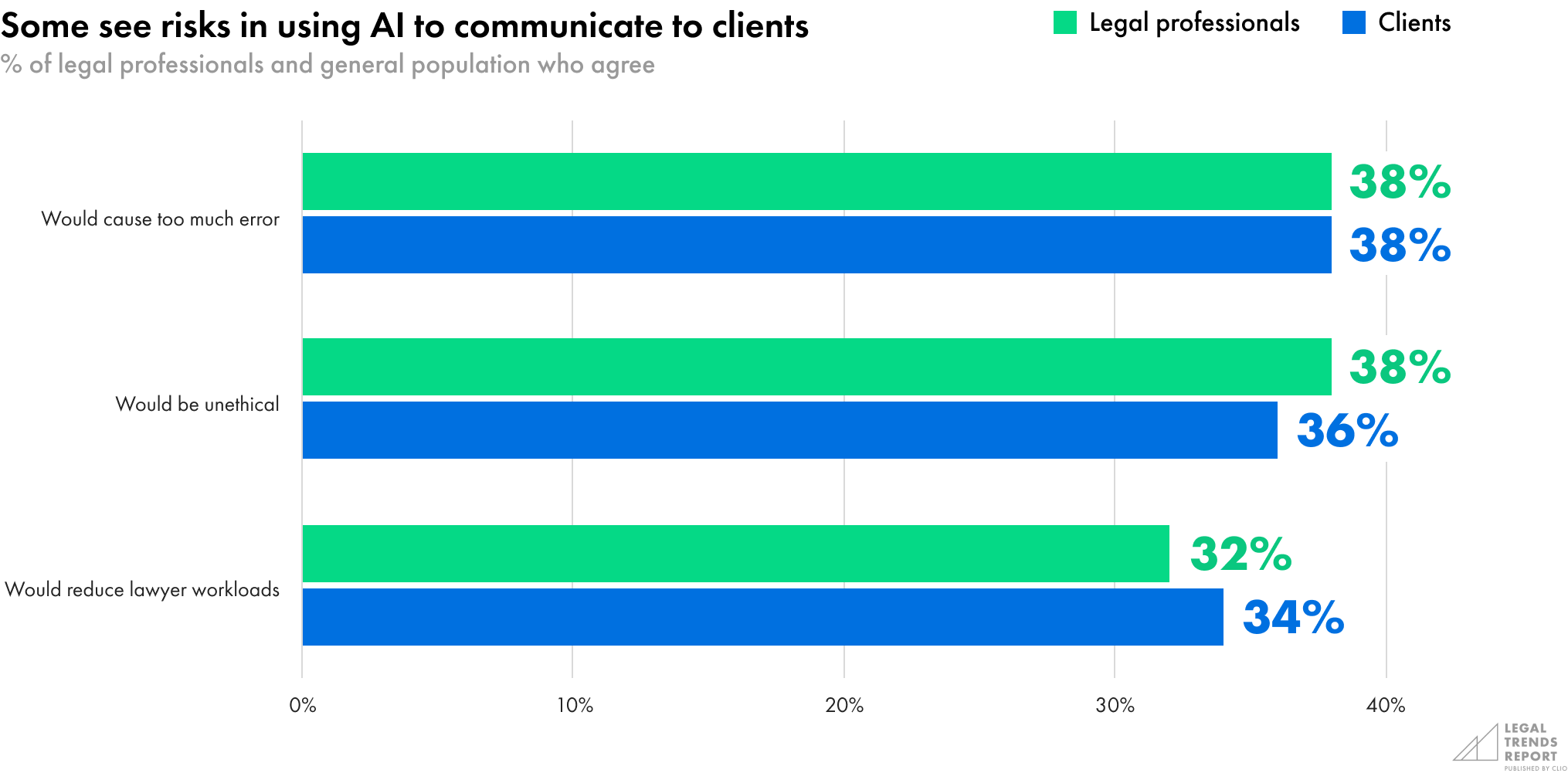

In fact, 32% of lawyers agree that AI can help reduce workloads. But 38% think that generating email responses with AI will lead to too much error and 38% also believe that letting an AI respond entirely on a lawyer’s behalf would be unethical.

Of course, review and oversight of AI-powered communications may be necessary for some time. Given the tendency for AI to “hallucinate,” or provide inaccurate information, any work produced by an AI should be carefully reviewed—similar to how a senior firm member would review the work of an intern. While AI offers the benefit of an overall increase in work capacity, lawyers must still remain accountable for their work product.

32% of lawyers agree that AI can help reduce workloads.

Legal research

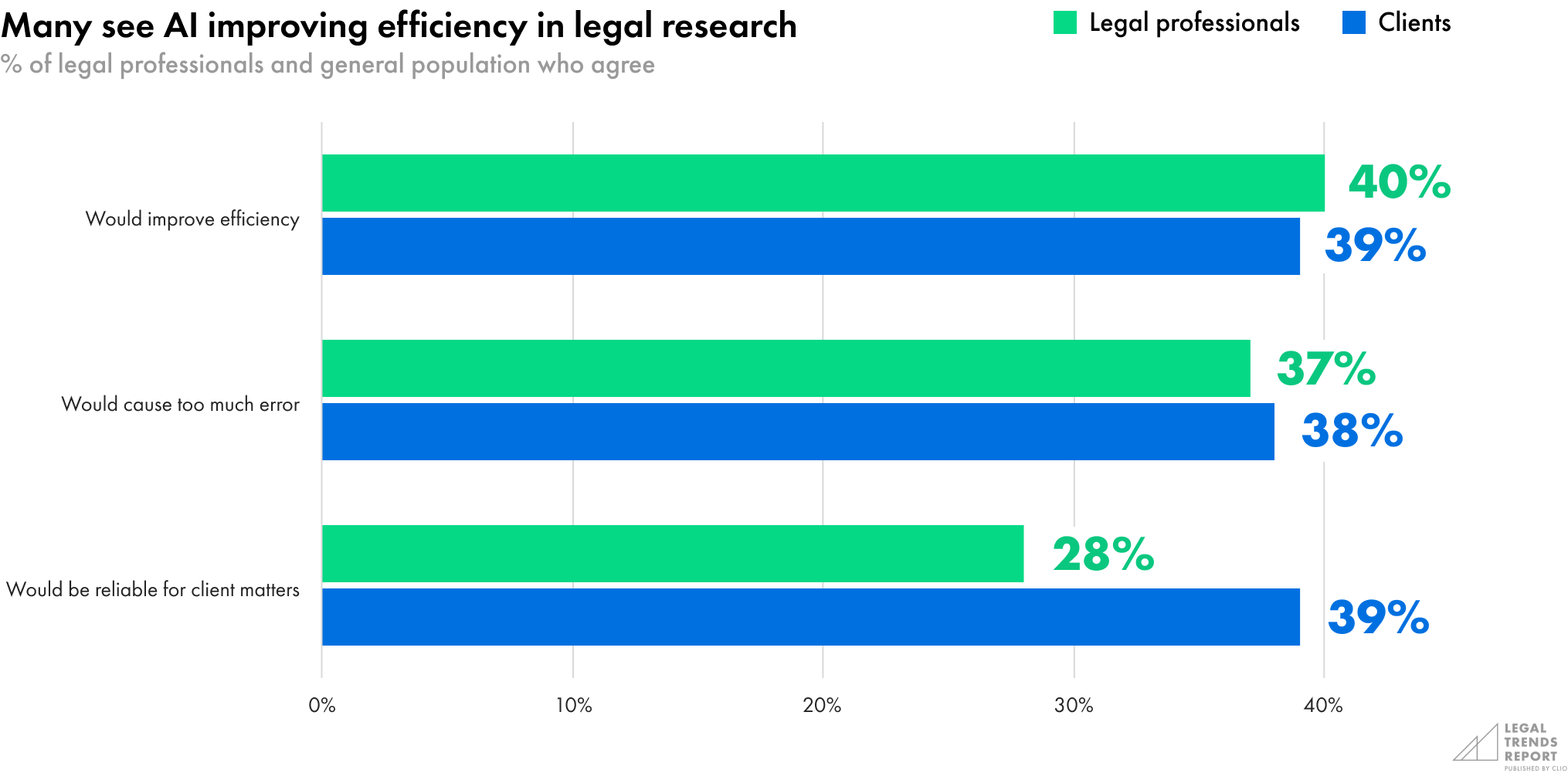

Since AI uses advanced natural language processing, AI-powered tools can review, analyze, and summarize large amounts of text in a very short time.

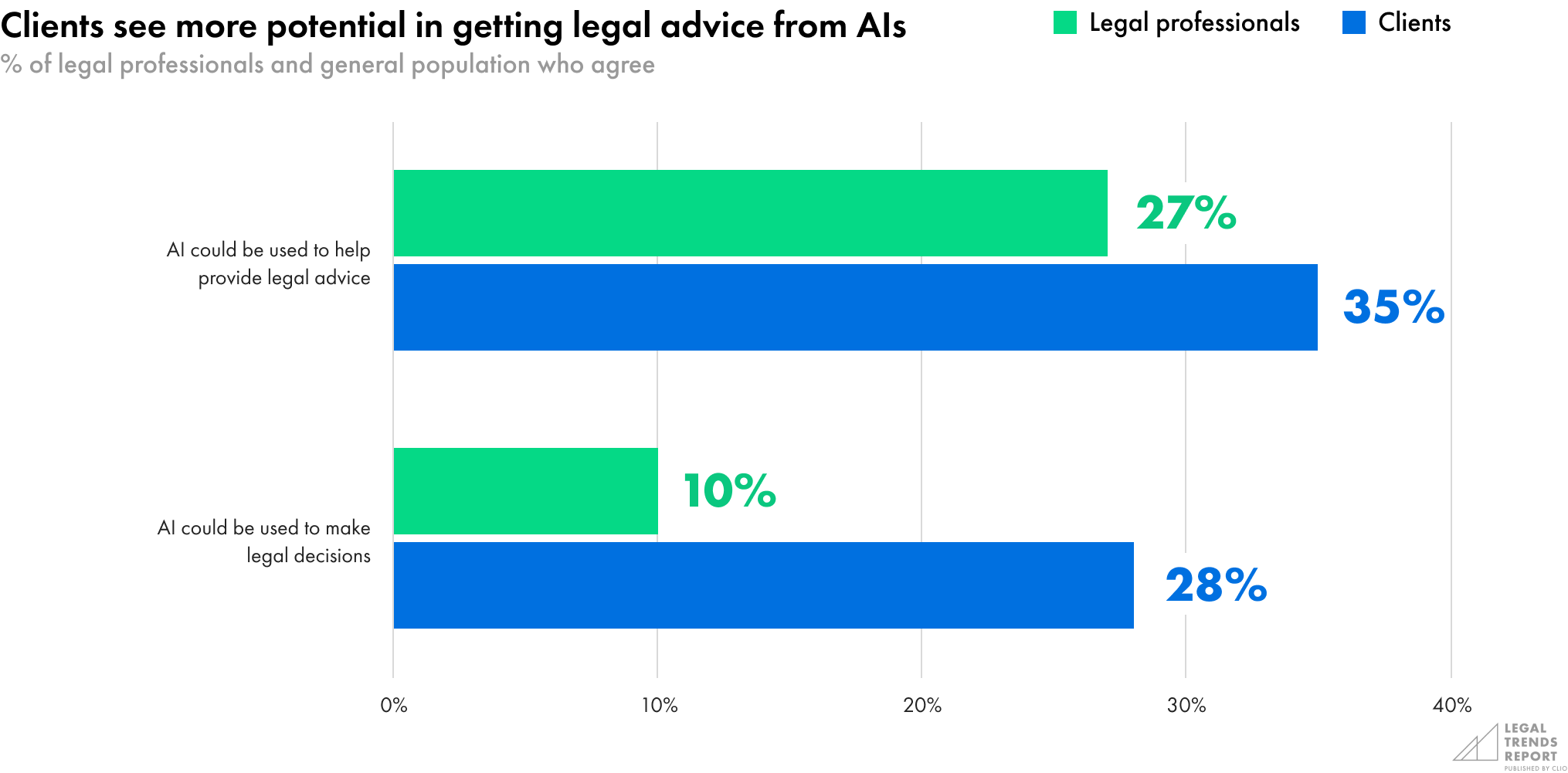

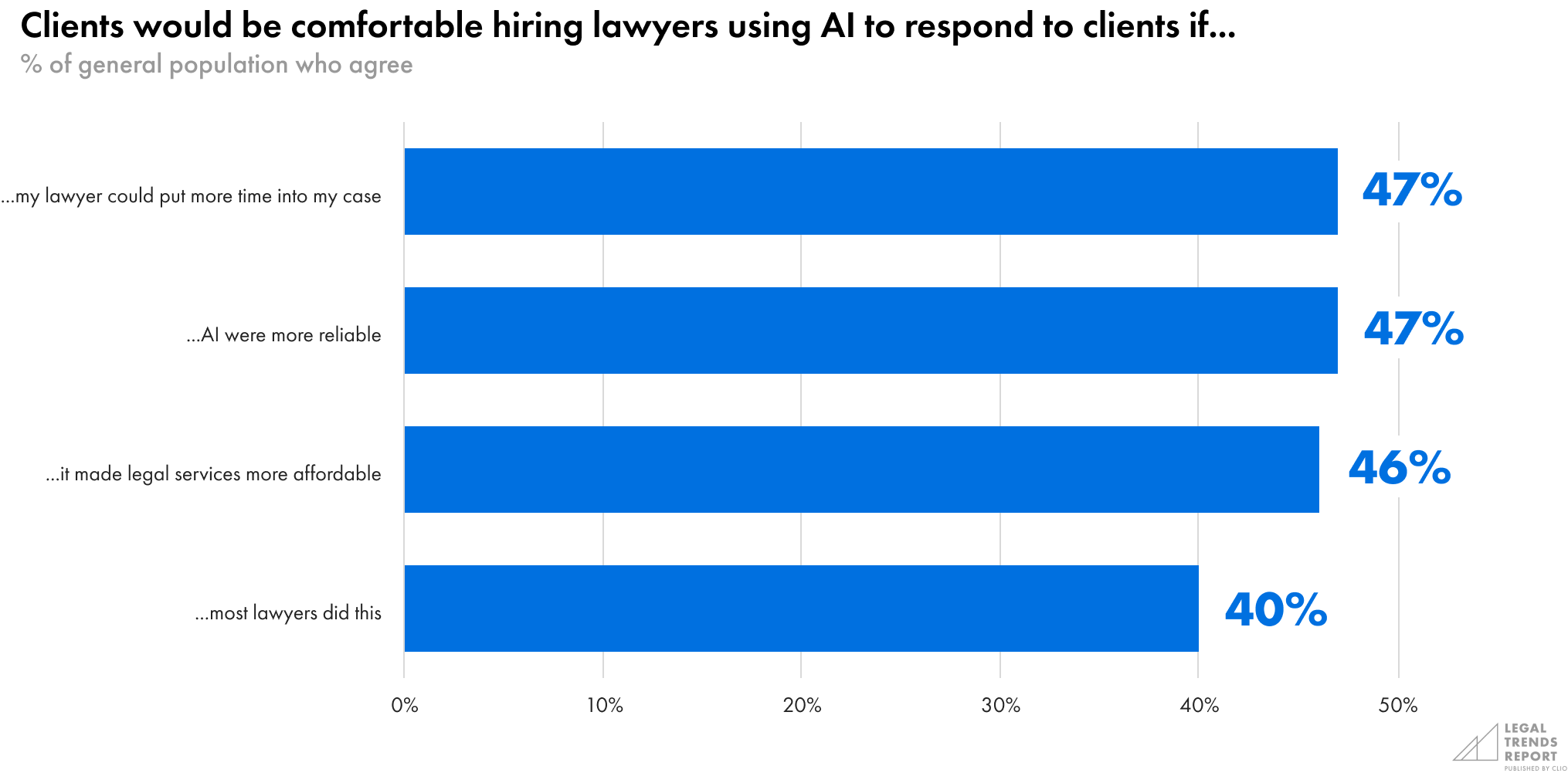

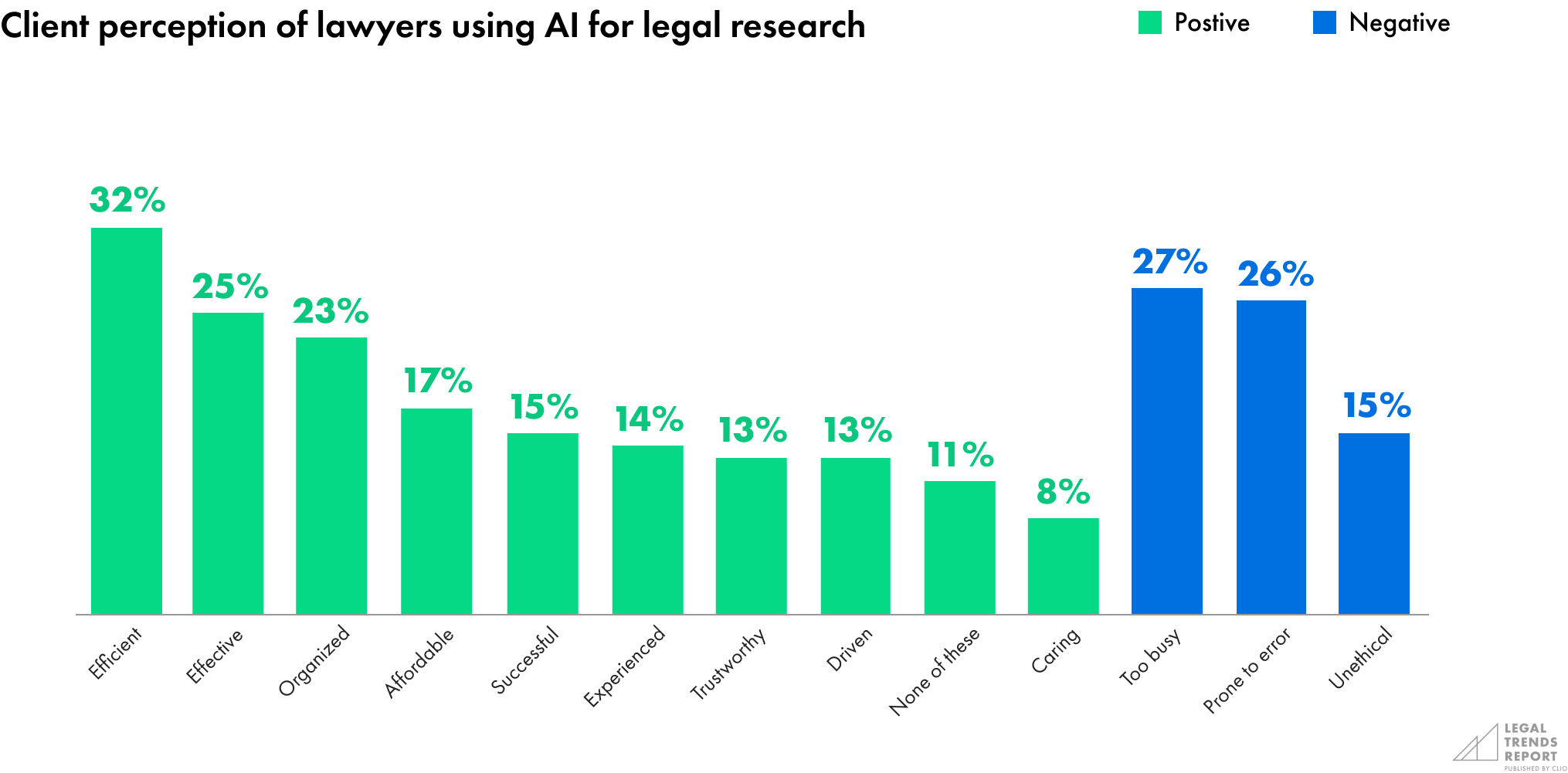

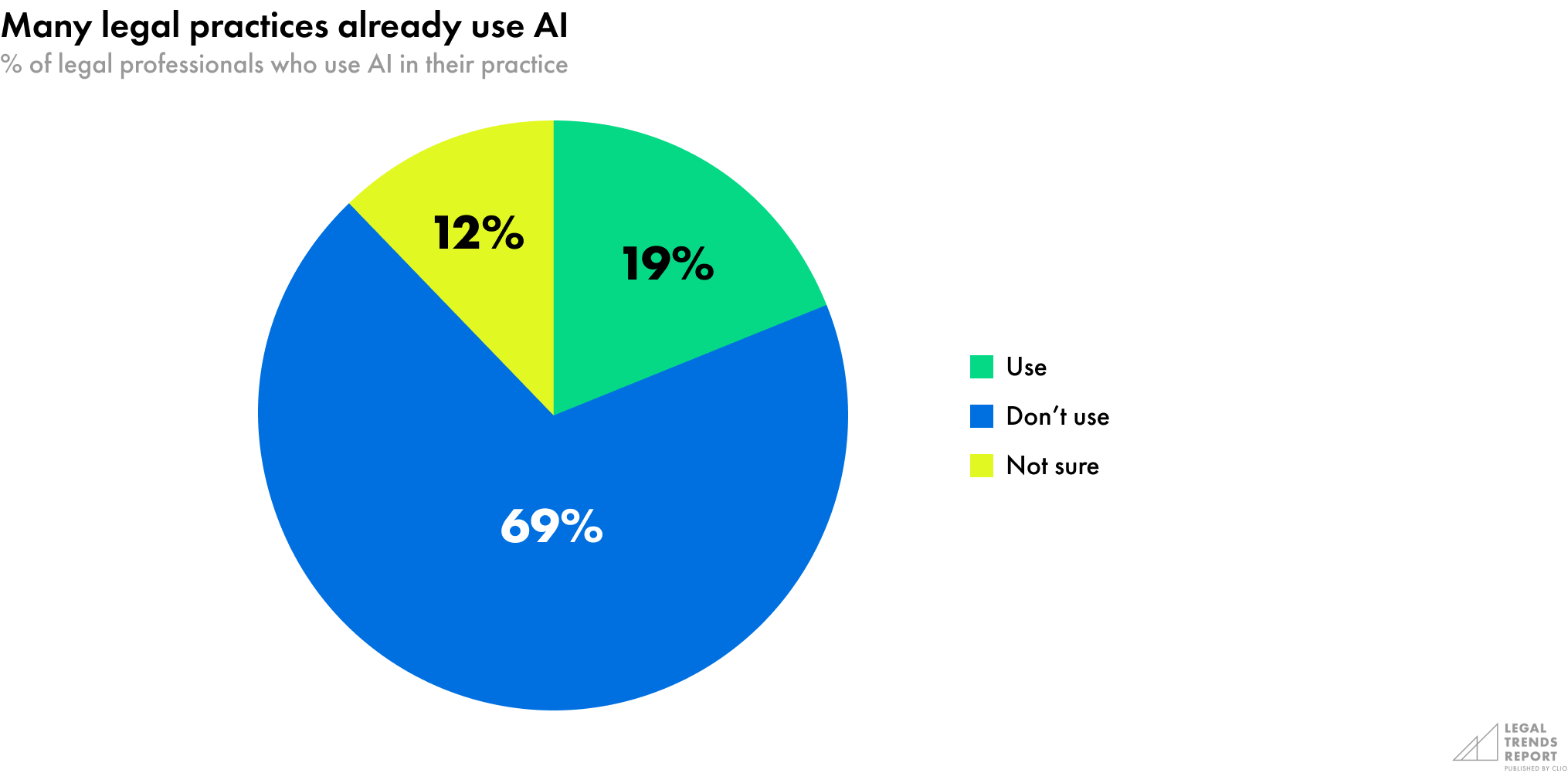

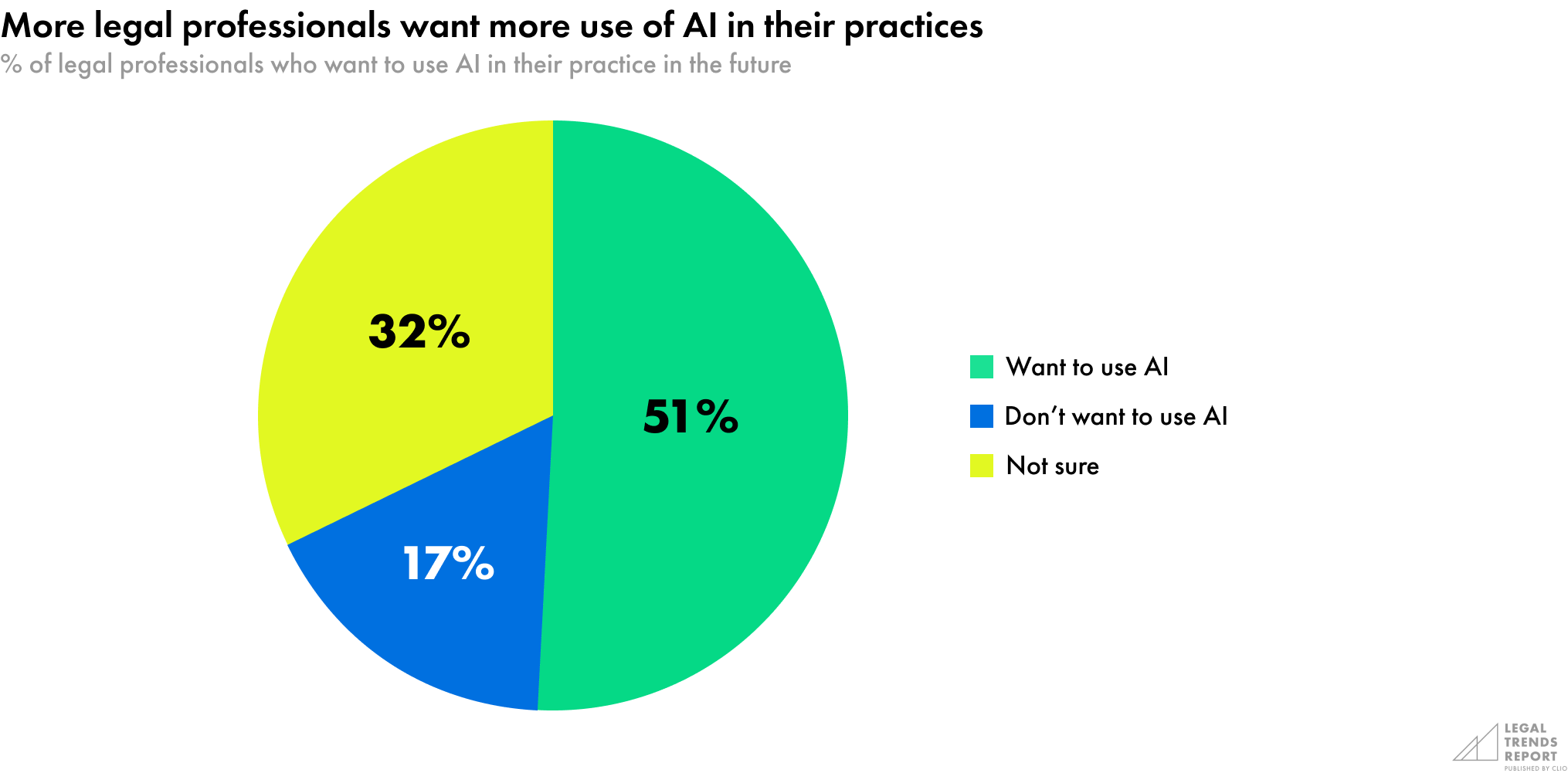

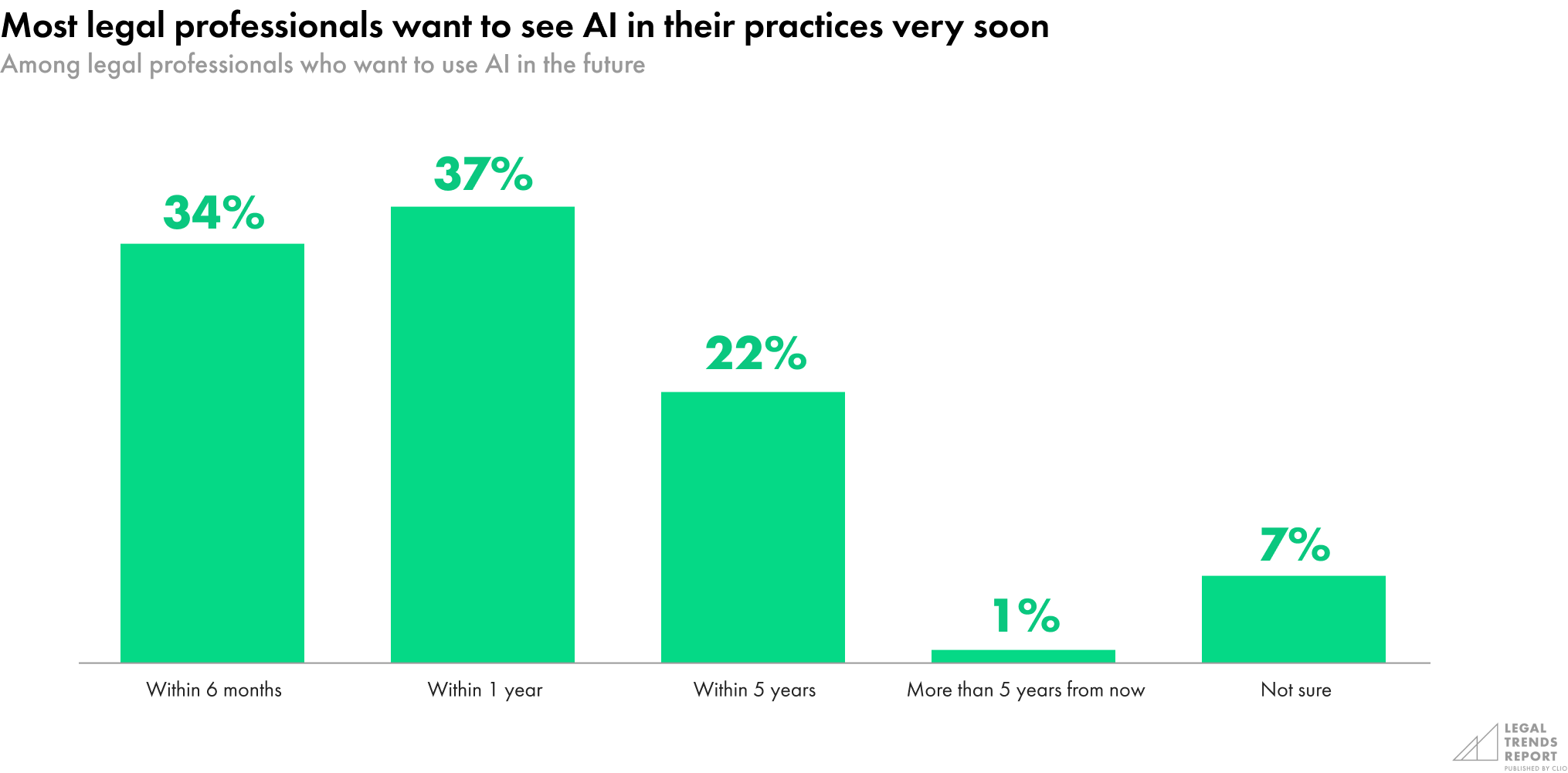

It’s no wonder, then, that 40% of lawyers see potential value in using AI for legal research, saying it would dramatically improve efficiency. But only 28% believe that AI would be reliable in performing legal research for a client and 38% said that using AI would lead to too much error in legal research. In other words, while lawyers see a lot of time-saving value in using AI for legal research, many remain cautious with respect to quality and the risks this could pose to client work.