If you want your legal practice to be as successful as possible, you need an effective billing process. This involves moving beyond traditional paper billing and transitioning to electronic billing software for law firms. Thanks to advancements in technology, law firms can easily leverage legal software to save time, improve invoice accuracy, and offer a client-centred billing experience.

In this blog post, we will outline the key benefits of electronic billing software for law firms—from streamlined workflows to faster payments, and more. We’ll also offer tips for how to successfully implement legal electronic systems at your firm, and provide examples of billing software that can help your firm’s cash flow be as efficient as possible. To start, let’s look at the concept of legal electronic billing software for law firms.

What is legal billing software?

While traditional legal billing requires manually creating and sending paper invoices, electronic billing—or ebilling—for law firms is a system of legal billing where law firms create, review, and deliver invoices to clients electronically.

When working with large organisations and corporate clients that require specific invoice-related formatting guidelines, electronic billing software allows law firms to submit bills quickly, without using any paper. Firms can then easily review these electronic bills and set up templates, automations and more. For example, some organisations require electronic bills to follow specific guidelines for standard billing formatting, like the Legal Electronic Data Exchange Standard (LEDES). If an organisation uses LEDES formatting (which can also be paired with Uniform Task-Based Management System (UTBMS) codes for further clarity), it will reject invoices with errors or incorrect formatting.

Benefits of electronic billing software for law firms

Electronic billing software for law firms makes the billing process faster, more effective, and more accurate. Key benefits include:

Save time and money while improving billing accuracy

Electronic billing software for law firms optimises workflows by automating many of the traditionally manual tasks related to billing. These tasks include time tracking, invoice generation, and invoice delivery. Whether your law firm uses legal billing software to send invoices electronically to individual or corporate clients, it all adds up and saves your firm time.

When lawyers and staff spend less time manually managing invoices, law firms save money. Also, by using software to automate legal billing, firms improve accuracy by reducing the chance of manual error or oversight.

Get paid faster and improve cash flow

According to the 2021 Legal Trends Report, lawyers don’t collect on 12% of the hours they invoice. Pair this figure with overdue invoices, and it’s clear that the speed and effectiveness of collections impacts law firm cash flow.

Billing electronically can help close the gap between invoicing and collections in a couple of key ways:

- More accurate, clear bills get paid faster. Clients are less likely to reject or dispute invoices that are easy to understand and error-free. Clear and accurate invoices also save your law firm from unnecessary back-and-forth communication to explain line items or correct formatting errors.

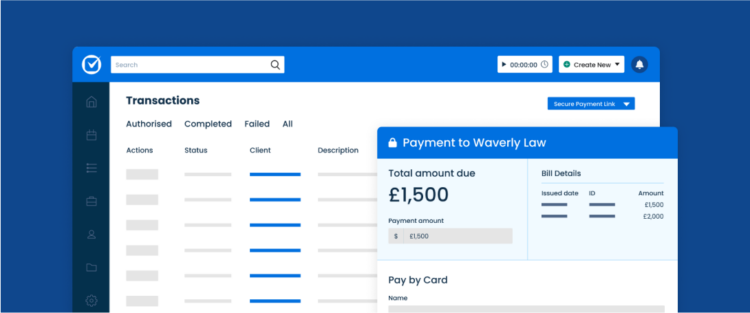

- Bills sent (and paid) electronically are more convenient for clients. Sending bills electronically removes delivery delays that can hold up payment. And, if firms allow clients to pay legal invoices by credit card, clients can settle and pay their invoices even faster. Legal software like Clio allows firms to send a secure payment link so clients can pay online.

Make data-driven business decisions

When it comes to making the best business decisions for your law firm, data is key. Electronic billing software for law firms captures billing data, tracks important legal analytics, and creates legal billing reports so you can accurately understand your firm’s billing-related key performance indicators. For example, here are some of the billing reports you can generate with Clio.

Armed with billing data, you can make decisions based on what’s working, and what areas your firm can improve.

Provide a client-centered experience

As Jack Newton explores in his book The Client-Centred Law Firm, today’s legal clients expect law firms to prioritise the client experience. Law firms can leverage electronic legal billing software to offer clients a better client experience through increased transparency and clarity in their bill structure—which leads to increased trust.

How? Whether firms use electronic billing to create invoices through LEDES standards or another coding system, electronic billing standards offer an opportunity for clearer, more consistent bills. When law firms standardise bills, the bills become easier to understand, and clients spend less time trying to decipher their bills. This heightened transparency allows clients to increase trust in their lawyer—especially if they have a consistently smooth billing experience over time.

Better for alternative billing arrangements

While the billable hour is still the norm, many law firms are also adopting alternative billing arrangements. These billing arrangements include flat fees, unbundled legal services, and sliding-scale fees. Clients seeking greater cost predictability or access to legal services would benefit from having these alternative arrangements most.

The 2021 Legal Trends Report also notes that 78% of consumers say lawyers should adopt pricing and payment models to make legal services more affordable. While these alternative billing arrangements help meet client demand, billing can become very complex for your law firm if you’re still using traditional paper billing workflows.

Electronic billing software features make it simple to track and bill clients when using alternative billing arrangements. For example, Clio’s flat fee feature immediately adds a billable amount under the Work In Progress area of a Matter—making invoicing simple when it’s time to bill.

Electronic legal billing workflows

The general workflows for electronic legal billing are similar to those you’d find in a traditional billing process—you need to track time, create invoices and send them to clients. Then, clients pay the bill. However, electronic billing for law firms automates manual tasks so you can send bills to clients (and clients can pay) online.

For example, a law firm’s electronic billing process could follow this general workflow:

- Software automatically records lawyers time, fees, and expenses.

- Electronic legal billing software automatically generates bills, which firms can review and share with clients electronically.

- Once clients receive their bill, they can easily pay their bill—ideally, online. For example, a firm using Clio lets clients pay online by using Clio Payments.

- The law firm’s accounting team sends reminders automatically via electronic legal billing software.

Electronic billing software for law firms

While the right technology and tools are essential to unlocking the advantages and benefits of electronic billing, investing in billing software for law firms is a big decision.

Clio Manage’s legal billing software offers all of the key benefits of electronic legal billing—while also working with your legal practice management software for a smooth, streamlined process. Clio Manage’s electronic legal billing benefits include:

- Simple time and expense tracking. Track in real-time or add time entries from communications, emails, and more.

- Faster and more accurate invoicing. Draft bills in minutes.

- LEDES billing. You can use Clio to easily generate LEDES-formatted bills.

- Flexible online payments. Send bills to clients electronically, and then allow them to pay securely online with their credit card.

To learn more about new law firm billing features in Clio, watch this webinar on new billing features in Clio.

You may like these posts

How to implement electronic billing systems

While the specifics of how your law firm implements electronic legal billing systems will vary depending on what your clients need, it’s essential to start with a clear, consistent policy.

Create a clear electronic billing policy for your law firm

Just as you would create a policy for any type of law firm billing, you need to establish a policy for electronic legal billing. With a clear policy, lawyers, staff, and even clients are on the same page about how your firm handles electronic billing.

Outline your billing process

How well do you and your law firm staff understand your billing workflow and process? A good place to start your billing policy is by articulating your overall billing process—from start to finish. Then, look at how new electronic billing systems will fit into this process. When moving from manual workflows to electronic billing, you will eliminate certain manual steps. That’s why creating a standard process now can ensure consistency and avoid confusion moving forward.

Establish electronic billing guidelines and billing templates

While legal electronic billing software will provide certain billing templates, be sure to either create or establish the preferred templates for each aspect of your billing process. This could include:

- Billing-related communication templates (for example, you can create a bill message template in Clio Manage).

- Guidelines for when to send invoices to clients in certain situations.

- Language guidelines for billing line descriptions.

Set invoice review requirements

Whether clients have requested specific invoice requirements like LEDES billing or not, establish a standardised review process for lawyers at your firm when billing electronically. While electronic billing software automates much of the billing process, ensure everyone knows what review steps to take before sending an invoice to a client.

Include the finance team in your electronic billing process

How will you include law firm accounting and financial staff in your electronic billing process? Consulting with your accountant or financial team can help when creating your electronic billing policy. Getting a professional’s point of view will ensure the necessary billing information is included when you bill electronically.

Establish a standard dispute and collection process

While electronic billing can help reduce errors and make it more convenient for clients to pay their legal bills faster, disputes and collections issues can always occur. When creating your electronic billing policy, create a set process for what to do if a bill is:

- Rejected (for example, due to incorrect invoice formatting).

- Disputed (for example, if a client disagrees with a line item on their invoice).

- Unpaid.

This process should include guidelines for who will review and follow up on these issues, and when. In some instances, technology can help. For example, with unpaid bills, you can use Clio Manage to send automated bill reminders.

Sharing your electronic billing policy with clients

Your law firm’s legal electronic billing policy should be clearly communicated to all your clients. By informing your clients of your policy from the start, they will know what to expect, how they can pay, and when they’ll need to pay. Once you’ve created your policy in writing, be sure to share it with clients at the beginning of their client journey (for example, after their initial consultation).

Electronic legal billing best practices

Electronic billing allows firms to streamline their billing process while ensuring it’s more effective, clear, and accurate. To make the most of electronic billing for law firms, consider the following best practices:

Follow standard invoice requirements

No matter what size or type of client organisation your firm is working with, it’s important to set up—and stick to—a set of standard, consistent invoicing requirements. These invoice requirements will provide consistency for your firm (for a more efficient billing process) and your clients (for a better client-centred experience).

However, as previously mentioned, it’s also important to consider standard invoicing requirements larger companies may require when electronically billing for law firms.

When creating a standardised invoicing system for your law firm billing, consider:

- Law firm billing codes. Let’s say your firm uses an internal system (such as codes like “Meeting” or “Research”) to describe the activities that a client is being for. Or your firm may need to use standard billing codes—like LEDES formatted bills with UTBMS codes. Either way, your billing codes should be consistent, clear, and compliant with any applicable invoice requirements.

- Billing templates. Using a billing template can bring consistency to your invoicing, without the manual effort each time you bill a client. Electronic legal billing software may offer options to make this simple. For example, Clio’s legal billing software, lets you choose from bill themes to accommodate your clients’ reporting requirements.

Set clear expectations with clients

Let clients know from the start that your firm uses electronic billing, and what that entails for them. For example, if they will receive their invoice via email. By setting and communicating clear expectations early on, you can give clients a better experience.

Track time accurately

Tracking time accurately has always been important for lawyers, but electronic billing makes it easier to account for your time and work accurately—with less manual work. For example, with Clio Manage’s legal time recording feature you can create time entries from calendar events, tasks, and more.

Use clear descriptions

One of the key benefits of electronic billing for law firms is that it lets you give clients a more transparent and smooth client experience. So be sure to master the art of writing clear, concise billing descriptions. Follow these best practices for billing descriptions:

- Make them clear. Include enough context and necessary information so that anyone can understand what the description is referring to. For example, “Research” does not give enough detail to be useful, while “Legal research to build an argument for hearing in November.” explains the line.

- Make them concise. On the other hand, avoid being long-winded just for the sake of it. There’s no need to write a paragraph about the minutiae—just describe relevant information.

- Use plain language. Keep legal jargon and overly complex language to a minimum.

Bill consistently and frequently

Don’t let invoices—especially electronic invoices—go unsent. By billing clients regularly, you can help establish clear client expectations while avoiding larger bills that build up over time.

Final thoughts on electronic billing software for law firms

While legal billing was once exclusively about traditional paper billing, electronic billing software for law firms is now the norm. By using electronic legal billing software and tools, firms can save time, while delivering a more consistent and convenient billing experience for clients—even those who require certain unique coding and formatting for electronic legal billing.

Though electronic legal billing for law firms may carry an investment in learning new systems and acquiring new software, if your firm is still dependent on traditional paper billing, you—and your clients—could be missing out on the benefits of legal electronic legal billing.

Book a Demo

See exactly how Clio’s legal billing software can help your firm by scheduling a personalised product walkthrough with one of our Clio experts.

See Clio in ActionWe published this blog post in August 2024. Last updated: .

Categorized in: Legal Accounting

Explore AI insights in our latest report

Our latest Legal Trends Report explores the shifting attitudes toward AI in the legal profession and the opportunities it brings for law firm billing, marketing, and more.

Read the report