When paying for their legal costs, clients today want three things: convenience, security, and flexibility. Law firms with limited lawyer payment methods aren’t giving their customers what they want and expect, ultimately hurting their bottom line.

The 2021 Legal Trends Report shows that 66% of consumers prefer online lawyer payment methods, such as:

- Debit and credit cards

- Online payment systems

- Alternative payment options

The main point: Firms that offer a variety of lawyer payment methods (especially online payment methods) make their clients’ lives easier. They also get their bills paid faster.

In this post, we’ll cover the various lawyer payment methods your clients want—and how you can effectively select and implement them.

Is your firm allowed to accept online lawyer payments?

More and more clients want to pay their legal fees by debit and credit card or other online payment methods.

But are lawyers allowed to accept payments online?

The short answer is, generally, yes.

The long answer is more nuanced because, as with many elements of practising law, law firms must take into account any relevant UK regulations and compliance guidelines.

The ethics of online payments

While many potential benefits are associated with accepting payments online, law firms must ensure that they proceed carefully and responsibly.

When considering accepting card payments, law firms must take the time to learn—and abide by—what is required to maintain payments compliance per their regulatory bodies.

For example, law firms in the UK cannot pass on credit card surcharges to the client.

While you must take time to research and learn the specific rules that apply to your law firm and jurisdiction, there are a few key areas to consider, including:

Law firm Accounts Rules

Solicitors in England and Wales must abide by the Solicitors’ Regulation Authority (SRA)—and the SRA Accounts Rules—when accepting online or card payments. In Scotland, the Law Society of Scotland sets these rules for solicitors practising in Scotland as does the Law Society of Northern Ireland for law firms practising in that jurisdiction. The accounts rules are generally the same in all three jurisdictions.

In brief, the rules govern how law firms handle client money and operate client accounts, including regulations related to:

- Separation of client accounts from lawyer and law firm accounts

- Keeping detailed financial records

- Security for client information

- Timeliness of banking transactions

- Communication with clients about payment methods and the handling of their financial information

- Reconciliation of client accounts

- Financial reporting

- Compliance with anti-money laundering (AML) regulations

Clients’ own accounts

Certain types of accounts require special care when considering accepting online card payments.

Clients’ own accounts, for example, are separate bank accounts that a law firm holds on behalf of a client for specific matters or transactions. If accepting card payments for clients’ own accounts, law firms must follow the relevant accounts rules in order to ensure compliance.

These steps include:

- Using secure, Payment Card Industry (PCI)-compliant law firm payment processing systems:

- Ensuring clear and transparent client communication regarding payments and transaction fees

- Monitoring and reconciling transactions

- Documenting and providing access to relevant information related to bills and card transactions

Third-party managed accounts

While third-party managed accounts (TPMAs) provide a secure alternative to accepting card payments into traditional client accounts, law firms must follow the SRA’s guidelines when working with TPMAs.

These guidelines include the need for firms to:

- Conduct due diligence on the TPMA provider to check for a reliable reputation

- Verifying that the TPMA provider’s systems and controls safeguard client funds

- Ensuring that the TPMA provider complies with SRA rules, anti-money laundering regulations, and data protection laws

- Reviewing the TPMA’s performance and adherence to regulations periodically

Anti-money laundering regulations

Anti-money laundering (AML) regulations are another important consideration for UK law firms implementing law firm payment processing systems.

In brief, law firms adhering to the AML regulations should adopt a risk-based approach that matches compliance efforts to identified risks. Practice-wide risk assessments should be used to look for potential risks, including clients, geographic areas, services, and transactions.

Solicitors practising in England and Wales can learn more about how to stay compliant with AML regulations when accepting payments here.

To explore more payment resources, check out our payment hub page.

You may like these posts

Key concerns for law firms accepting debit and credit cards

While the exact rules and regulations may differ based on jurisdiction, when it comes to accepting debit and credit cards at a UK law firm, the following questions can be considered:

- Can I accept payment for legal fees and expenses with a debit or credit card?

- Can I accept advance payment of fees by debit or credit card?

Law firms must also exercise care regarding how and in what instances they accept online payments via methods like PayPal, Apple Pay or Google Pay.

For instance, when accepting payment via any online payment method, law firms in England and Wales should ensure compliance with SRA Accounts Rules and to follow best practices to keep client money safe from misuse.

Lawyers must review and abide by specific rules for law firms on accepting credit cards and other online payment methods in their jurisdiction.

It’s also important to check regularly, as these rules evolve.

What type of lawyer payment methods should you accept?

As a next step, you need to determine what lawyer payment methods to accept in your law firm.

Whether you’re a solo lawyer or a new firm, the key questions to consider include:

- What lawyer payment methods do your clients want?

- What are the regulations and guidelines for payments in your jurisdiction?

- What forms of lawyer payment can your firm handle?

Your law firm can still accept payment methods like cash and cheques. Most law firms will only accept cash up to a value of £500, which is limiting when it comes to paying legal fees. However, you must also look beyond these traditional methods and consider lawyer payment methods that deliver a more substantial client experience—online payments.

It’s not only your clients who benefit, though. Online payment methods also bring significant benefits to law firms, like getting paid faster, more revenue, and even more clients.

In fact, at Clio, we’ve seen that law firms that continually grow their revenue are the ones that harness the power of online payments. Specifically, the 2021 Legal Trends Report found that these firms are 37% more likely to use online payment solutions. This underlines the value that innovative lawyer payment methods can play in helping a law firm scale.

The three lawyer payment methods your clients want

Now that we’ve covered the basics, let’s discuss the types of lawyer payments your clients want you to offer.

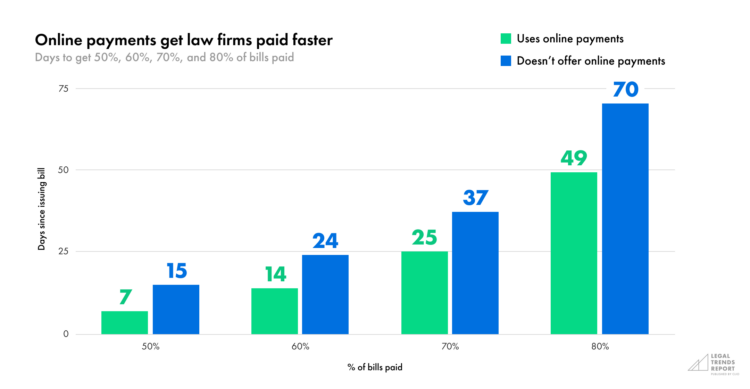

Law firms offering more payment methods—especially those that make it easier and more convenient for clients—can lead to faster payments (and more revenue). Specifically, the 2023 Legal Trends Report notes that law firms using online payments collect, on average, 50% of their bills within seven days of issuing them and 80% within 49 days.

If your firm wants to get paid faster and improve your law firm cash flow, you should consider the following lawyer payment methods:

1. Debit and credit cards

As we’ve already outlined, card payments (specifically online debit and credit card payments) can be an excellent payment method. That’s because:

- They’re familiar. For many clients, debit and credit card payments are already their preferred payment methods in their day-to-day life (be it big-ticket purchases, daily expenses, or utilities).

- They’re more convenient. Familiarity aside, online card payments allow clients to pay their legal bills quickly, easily, and securely.

- Online credit card payments give clients more flexibility when they want to pay immediately but don’t have cash readily available.

- Online debit payments allow clients to easily make legal payments without worrying about interest payments.

- Apple Pay and Google Pay allow clients to pay using their preferred card, which is stored in their digital wallets, meaning they don’t have to reach for their debit or credit card.

- They help your firm get paid faster. When paying is effortless, clients tend to pay their legal bills sooner. Online card payments also reduce the delay between the client making a payment and your firm receiving it.

They give clients the flexibility they want. In cases where clients don’t have the cash on hand to pay a hefty legal bill, alternative fee arrangements may better serve them. Firms that use payment plans via credit card provide further payment flexibility for clients. As the 2022 Legal Trends Report found, it’s wise to do so: 70% of consumers want the option to pay a lawyer via a payment plan.

Choosing debit card and credit card processing solutions

Choosing debit card processing and credit card processing solutions is essential. Our guide to choosing the best debit card and credit card processing service for lawyers explains that the right card processors for lawyers should be safe, secure, and specialise in card payment processing for law firms. Additionally, they should offer solutions that:

- Integrate with law firm processes. Legal credit card processors should integrate with your firm’s billing, accounting, and practice management software. When your firm’s tools work together, you can save time, reduce redundant data entry, and lower the chance of human error.

- Offer competitive pricing. Take into account the processors’ monthly and per-transaction fees.

- Are PCI compliant. Any businesses accepting credit card payments, including law firms, must comply with a specific set of PCI standards. These standards are designed to help secure and protect credit card data for cardholders.

- Ensure compliance with client accounts regulations. Law firms must ensure that their card processors will keep them compliant with rules for client accounting in their jurisdiction. For example, law firms should choose credit card processing systems that are secure, legal specific, and that do not allow chargebacks on client accounts (nor do they take fees from client accounts). This is imperative, as a chargeback could lead to an inadvertent accounts rules violation (i.e., if a client disputes a charge and this results in a chargeback and the credit card company taking money from a client account).

Ensuring client accounts’ compliance is essential when accepting credit card payments online—and the right credit card processor can help. A law-specific solution like Clio Payments helps your firm stay compliant by ensuring that you have separate operating and client accounts and that card processing fees are only deducted from your operating account.

Learn more about how to accept card payments at your law firm.

By accepting multiple online payment options, law firms make it easier for clients to pay, which can help grow their practice.

Providing various convenient lawyer payment methods is one way to prioritise the client-centred experience.

To learn more about why the client experience matters, listen to this episode of Clio’s Matters podcast.

2. BACS Payments/Pay-by-Bank Payments

BACS, formerly known as “banker’s automated clearing service,” is a commonly used type of electronic money transfer between banks. BACS Payments in Clio are called Pay by Banks Payments and offer another lawyer payment method that you should consider, making payments faster, secure, and more convenient.

BACS Payments function similarly to bank transfers—and are generally processed at a lower cost than debit or credit cards.

Lawyers should be aware and careful to follow any rules and guidelines when accepting payments via BACS, just as they would with any lawyer payment method.

Read more: Free Pay by Bank Payments: A Guide to Streamlined Payments for Law Firms

3. PayPal

Law firms can also consider online payment systems like PayPal when looking for lawyer payment methods clients want.

PayPal offers a convenient, easy-to-use payment option that appeals especially to certain generations of clients, such as millennials.

However, platforms like PayPal come with different considerations than other lawyer payment methods. In particular:

- PayPal takes a cut of payments—which can impact revenue.

- Law firms must ensure payments accepted via platforms like PayPal follow all compliance rules.

As mentioned earlier, the nature of PayPal could make it challenging to ensure compliance when accepting payment for retainers or funds for a trust account.

Check your jurisdiction’s rules about accepting legal payments via PayPal to ensure you can stay compliant.

Streamline your billing and payments with an all-in-one solution

If you’re considering updating your lawyer payment methods, an all-in-one billing and payment solution is the best place to start.

You can establish smooth, streamlined workflows by connecting your billing process and payments. This ultimately saves you time and money on your billing and collections process.

The right solution can also help you avoid potential compliance issues while still accepting the online payments that clients want.

Take Clio Payments, for instance.

Clio’s built-in online payment processing solution lets you automate your billing workflows and securely collect card, and BACS payments. This gives clients the convenient, client-centred experience they want.

With Clio Payments, you can safely accept online payments in accordance with PCI legislation and with the peace of mind of Clio’s security measures, like bank-grade protection of client data and proactive fraud detection.

Clio Payments also helps your firm stay compliant while handling client accounting-related transactions. It keeps operating and client funds separate, with funds in your client account protected from third-party debiting (such as processing feeds or chargebacks).

Final notes on lawyer payment methods

Payment is an integral part of a successful law firm’s billing process. And savvy law firms are making it a top priority to give legal clients what they want when it comes to payments.

That being said, while today’s technology makes a variety of potential payment methods available, not all options are suitable for law firms. You should look for an all-in-one solution that integrates with other firm tools (such as practice management software) and allows them to accept multiple payment methods.

For example, Clio Payments makes online payment processing for law firms simple. And, because online payments in Clio Manage is a component of legal practice management software, it works seamlessly with your billing workflows to save you time and help your firm get paid faster.

Moving beyond traditional payment methods can reveal many benefits for law firms, such as increased revenue. But the core advantage centres around clients. Client-centred law firms put their clients’ experience first—and today’s clients want more options and convenience when it comes to payment.

The information in this article applies only to customers in the UK. This post is provided for informational purposes only. It does not constitute legal, business, or accounting advice.

What are credit card surcharges?

For law firms, a surcharge refers to when a firm passes on the credit card processing fees to a client. Credit card surcharges are prohibited in some places, including the UK. In jurisdictions where surcharges are allowed, there are often strict rules dictating how they may be used.

We published this blog post in March 2025. Last updated: .

Categorized in: Business, Technology

Explore AI insights in our latest report

Our latest Legal Trends Report explores the shifting attitudes toward AI in the legal profession and the opportunities it brings for law firm billing, marketing, and more.

Read the report