Wouldn’t it be nice to know the secrets behind the successes of top-performing law firms? Several years ago, our research team undertook a multi-year study to find out precisely that.

More specifically, we wanted to better understand what distinguishes thriving law firms from others and uncover the factors that led to sustained revenue growth amongst those highly successful law firms. By doing so, we hoped to find powerful examples of successful businesses in the legal field—and to define best practices that other legal professionals could adopt.

The results? After experimenting with some baseline parameters, our team identified the following:

- A substantial group of law firms that increased revenues consistently to achieve 200% growth since 2013.

The bottom line is that Growing firms are adopting online payment processing more rapidly.

Read on as we break down how our team was able to link the adoption—and use—of online legal payments to more robust performance against key performance indicators (KPIs).

Defining our cohorts

A quick note on responsible data management: Clio takes the utmost care in ensuring its customers’ data security and privacy. We conducted our analysis using aggregated and anonymised data and did not identify individual law firms.

Our first step in our research was identifying a group of law firms that had unquestionably outperformed others.

To determine what high performance looks like, our research team looked at data as far back as 2013 to design a comparative analysis that zeroed in on three distinct groups. These groups were defined by their total revenue growth since 2013.

We then compared performance data between these groups:

- Growing firms. Firms that grew their revenues by 20% or more over five years. This group also made up our high-performing firm, which we intended to learn from by comparing them to the other groups.

- Stable firms. Firms that neither increased nor decreased their revenue by more than 20% over five years.

- Shrinking firms. Firms that saw revenues decline by more than 20% over five years.

Findings: Growing law firms have tripled their revenue

When assessing new data from all three cohorts, our research team observed that each cohort’s performance has remained relatively consistent beyond the initial five-year period.

In fact, the Growing firms have continued to grow their revenues by over 200% since 2013.

This means that, on average, firms in this group managed to triple their revenue in this period.

For comparison, firms in the Shrinking group saw revenues decline by more than 30%.

While revenue remains the top-line measure for this analysis, and likely what most firm managers are interested in, there are a series of key performance indicators (KPIs) that function as essential inputs to earning more money.

Specifically, there are three inputs, or, KPIS. These KPIs help indicate why certain law firms—in this case, our Growing firms—have outperformed other groups.

You may like these posts

- A Comprehensive Guide To Improving Law Firm Accounts Receivable

- Electronic Payments for Law Firms : Benefits, Best Practices & Implementation Strategies

- Top Free Accounting Software for Solicitors: Streamline Your Firm's Finances

- Boost Efficiency and Accuracy: Why Law Firms Need Electronic Billing Software

Key inputs to revenue growth

The relevant KPIs that help provide insight into more granular areas of performance are:

- Utilisation rate. How much of a working day do individual lawyers put toward revenue-generating work.

- Realisation rate. How much revenue-generating work actually makes it to a client-facing invoice after any discounting or cancelled fees.

- Collection rate. How much of all invoiced amounts get paid to the firm.

To see how these metrics affect revenue performance when comparing utilisation rates, Growing law firms consistently put twice as many hours toward billable time as Shrinking firms.

Additionally, Growing firms increased both realisation and collection rates.

This data suggests that, while the overall amount of work these firms handled may have decreased, they were able to realise and collect more revenue for their business—resulting in stable business performance during that challenging year (Legal Trends Report).

Each of these KPIs speaks to the healthy management of key areas of a business. For instance:

- A strong utilisation rate indicates that a firm has a good pipeline for new business, and its lawyers can put time toward working on cases in the interest of their clients.

- Strong realisation and collection rates indicate that firms have effective systems to manage all billing and payments—and everything to do with client communications surrounding these processes.

This now brings us to the success trends we’ve seen.

Growing law firms use online payments

A consistent trend we’ve seen in the Growing cohort is that these firms adopt technology at a quicker rate than firms in the other two groups. Specifically, online payments.

To help explain how Growing firms have been able to consistently outperform their counterparts in terms of their realisation and collection rates in recent years, our team looked at the adoption of billing and collection capabilities.

Our analysis showed that Growing firms adopted online legal payments at a faster rate.

This resulted in Growing firms being 50% more likely to use this technology than Shrinking firms. It could certainly help to explain the strong advantage in revenue growth this group has seen over the years.

Giuliana Antonelli, FidLaw, gives an example of how her billing and payment processing software helped to increase their revenue by 50% and makes collections easier and more convenient for both her firm and her clients:

“We love how it’s all part of the one solution, and sending bills with payment links included was so seamless. It has improved our cashflow and saved us a great deal of time in reconciling the ledgers and in facilitating billing and collections.”

More than revenue advantages: Benefits of online payments extends to your clients

We’ve established that Growing firms have adopted online legal payment capabilities at a more rapid rate than Shrinking firms.

Yet, our study revealed another interesting trend.

While Growing firms have adopted online payment capabilities at a more rapid rate than shrinking firms, they are also much more likely to use them when collecting payments from clients.

In fact, of those who have adopted online payments, Growing law firms averaged twice as much online payment revenue each month compared to Shrinking law firms.

This is an important distinction, one we’ll explore in the next section.

New technology vs. actually using the technology

While bringing new technology into your law firm is a good first step, the process of actually incorporating the new capabilities into daily workflows is how its true benefits are realised.

When considering implementing new technologies, law firms will typically weigh how it will benefit the firm and its clients.

But another important aspect to consider is what solutions will be easier to implement to begin with.

For instance, finding capabilities that work with existing tools means your law firm experiences a smoother transition. You:

- Avoid introducing new burdens and inefficiencies.

- Create seamless automations that result in net new time-savings.

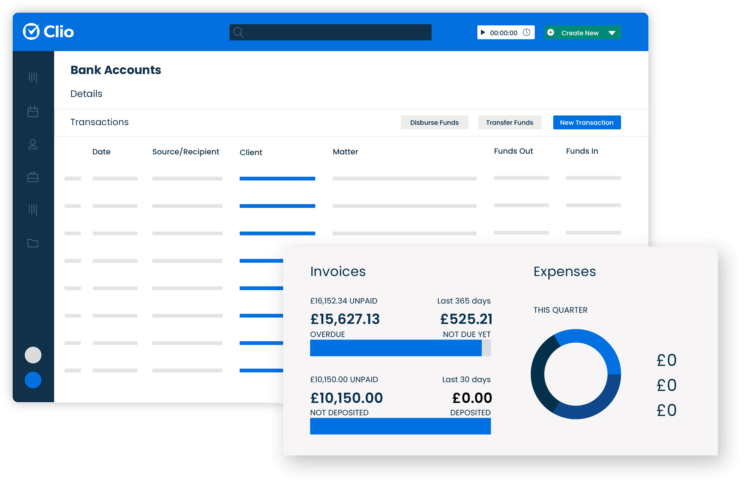

Within our Growing firm cohort, we measured online payment adoption based on their use of the payment processing features offered within Clio Manage. This means payment workflows are deeply connected to firm processes, thus making it much easier to collect payments from clients.

To explore more payments topics, be sure to check out our legal payments resource page.

Tools that enhance business performance

Time and billing software for law firms greatly improve key revenue-generating processes. For instance, they:

- Allow lawyers to capture their billable hours easily.

- Ensure that time tracked is associated with a client and matter.

- Automatically pull tracked time into an invoice.

Online legal payment capabilities make these workflows even more efficient by automating the payment process with clients, as well as reconciling those payments with their associated bills. Firms can send a payment link with online bills, giving clients the ability to pay instantly. Your bill’s status is automatically updated once it’s paid. This ensures all records are always up to date.

Using legal payment technology for revenue growth

The results of these analyses make a strong case for how technology—and specifically online legal payments—can dramatically benefit law firms. Finding the right solutions can increase a firm’s capabilities and make them easier to manage.

But as legal professionals continue to expand the range of solutions at their firms, they should look to find ways to adapt their existing systems and processes. This is where it’s important to be proactively selective when investing in solutions and ask the right questions to find the best legal payments provider.

For any firm looking to expand its capabilities, the most important thing is to know which areas of their practice to improve and to make the most of their software investments.

For more on the revenue advantages of online payments, be sure to check out our Legal Trends Report for helpful findings and tips.

We published this blog post in May 2024. Last updated: .

Categorized in: Legal Accounting

Explore AI insights in our latest report

Our latest Legal Trends Report explores the shifting attitudes toward AI in the legal profession and the opportunities it brings for law firm billing, marketing, and more.

Read the report