Since 2016, legal professionals have relied on Clio’s annual Legal Trends Report for an impartial and comprehensive analysis of trends within the legal field.

As the most extensive analysis of the legal industry, the Legal Trends Report compiles essential data on law firm performance and identifies key factors driving changes in legal practice.

For lawyers in solo and small firms, we offer specialised insights through our annual Legal Trends for Solo and Small Law Firms report. We are excited to announce the release of the 2024 Legal Trends for Solo and Small Law Firms report, which examines these cohorts from various perspectives—including performance trends, strategies for improving payment collections, and attitudes towards artificial intelligence.

Below, we’ll present the key takeaways from this year’s reports—but be sure to explore the full 2024 Legal Trends for Solo and Small Law Firms report for an in-depth overview of the trends shaping practice today!

Solo and small firms are capturing more clients and revenue than ever, but only enjoying modest gains in billable hours

While solo and small firms are opening more new matters and billing and collecting more than ever, looking at this performance within a larger context indicates that solo and small firms are only making modest gains in overall performance—and, in some cases, being outpaced by larger firms in performance areas previously dominated by solo and small firms.

Compared to 2016, solo and small law firms have only experienced minor growth in the number of billable hours captured by their employees. Small law firms have captured over 8% more billable hours than in 2016, while solo firms have captured over 1% more. Both solo and small firms also appear to be experiencing a decrease in the number of billable hours captured compared to 2016. This performance trails significantly behind the growth enjoyed by larger law firms: since 2016, these firms have captured nearly 25% more billable hours.

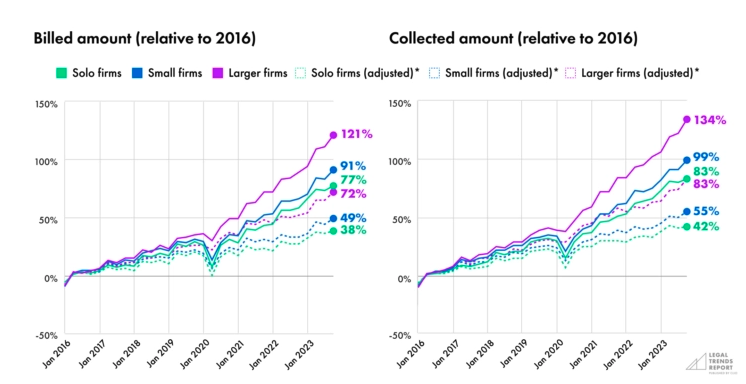

Despite the downward trend in billable hours among solo and small firms, the average lawyers in solo and small law firms are actually billing and collecting more than ever before. Solo lawyers are billing over 75% more and collecting over 80% more than in 2016, while small firm lawyers are billing over 90% more and collecting nearly 100% more than in 2016. Even when adjusting for inflation, solo firms are billing 38% more and collecting 42% more, while small firms are billing 49% more and collecting 55% more than in 2016.

But when we look at overall key performance indicators, we aren’t seeing the same levels of improvement.

Solo and small firms struggle with overall realisation and collection performance

Since 2016, utilisation rates (the percentage of time in an 8-hour workday that goes towards billable work) have generally risen steadily for firms of all sizes, suggesting that firms are finding more effective ways to streamline their workdays and put more time toward billable work. These increases are much more prominent among larger firms, who have consistently outperformed solo and small firms and, as of 2023, enjoy average utilisation rates that are 10% higher than small firms and 15% higher than solo firms.

Overall, solo and small firms have enjoyed similar overall increases in their realisation rates (or the percentage of billable work that ends up on an invoice) since 2016. Solos have managed to increase their realisation rates by 9% since 2016 while small firms have increased their realisation rates by 7%. Still, these improvements are outperformed by the improvements of larger firms, which have increased their realisation rates by 12% since 2016.

Finally, since 2016, solo and small firms have only increased their collection rates (the percentage of invoiced work that gets paid by clients) by 4%. Larger firms have not fared much better—they have only increased their collection rates by 5%. So, while firms of all sizes are improving their collection practices, it appears that they may not be fully realizing opportunities to more efficiently collect payment from clients.

You may like these posts

Some solo and small firms face significant struggles with lockup performance

Law firms must pay close attention to how quickly and consistently they are getting paid. Far too many firms find their revenue held in “lockup”—the period in which billable work has either not been invoiced or collected on.

Lockup consists of three components (measured in days):

- Realisation lockup. This is the amount of revenue that is unbilled at any given time (also known as “work-in-progress lockup”).

- Collection lockup. This is the amount of revenue that is uncollected at any given time (also known as “debtor lockup”).

- Total lockup. This is a combination of revenue held in both realisation and collection lockup.

Many solo and small firms face significant challenges in invoicing and collecting on outstanding payments. While the top 25% of solo and small firms generally outperform larger firms when it comes to realisation, collection, and total lockup, the bottom 25% of solo and small firms tend to perform worse than larger firms—suggesting that many solo and small firms tend to be either very good or very bad at issuing bills and following up on outstanding payments.

We also see that some Clio features are associated with a significant reduction in lockup, including Clio Payments, bulk billing, and Clio for Clients.

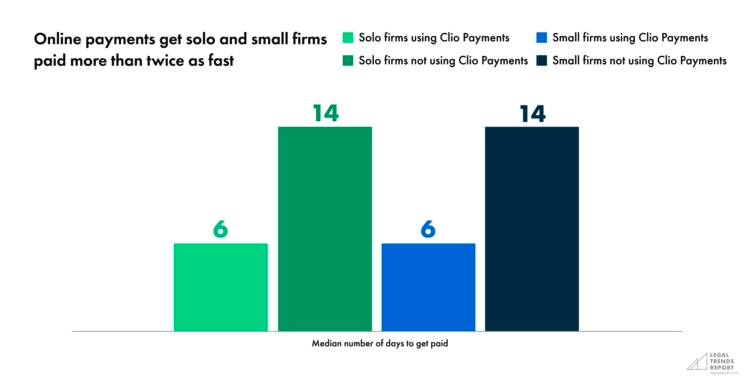

Solo and small firms using online payments get paid more than twice as fast

The average realisation and collection rates among solo and small firms were 86% and 90%, respectively.

While these numbers look great on their own, we also have to look at what’s missing—the 14% of billable hours that solo and small firms aren’t invoicing to clients, or the 10% of billed amounts that aren’t being collected from clients. Here, it becomes clear that solo and small firms have tremendous opportunities to improve their realisation and collection rates.

Both solo and small firm lawyers report struggling with their overall workload, growth, and the amount of revenue their firms bring in. Furthermore, many solo and small firms appear not to be offering the payment options that their clients are looking for.

Offering online payments significantly reduces the friction involved for clients in paying their legal bills while helping law firms get paid faster. This difference is pronounced among solo and small firms, which get paid more than twice as fast when using online payments. When looking at the number of days it takes to get bills paid, both solo and small firms have a median waiting period of 6 days (compared to 14 days for those not using online payments).

Lawyers in solo and small firms have similar attitudes towards AI use in the legal profession—but clients are even more enthusiastic about it

Many lawyers (in firms of all sizes) don’t believe that AI is advanced enough to be considered reliable. Despite these reservations, the vast majority of lawyers believe that the potential benefits of AI outweigh the costs and nearly one in five (19%) legal professionals claim that they are already using AI in some form in their practices.

Solo and small firms are generally aligned in their perspectives on AI: both cohorts intend to adopt AI technology at a much faster pace than larger firms and intend to use AI to handle routine administrative tasks, including payment and collection tasks. However, clients appear to be even more enthusiastic about the use of AI in the legal profession than lawyers in solo and small firms. Thirty-eight per cent of prospective clients believe that lawyers who use AI-powered software can offer more affordable services than those who don’t (compared to 31% of lawyers in small firms and 34% of solo lawyers), while 32% believe that lawyers can provide higher-quality services with AI software (compared to only 23% of small firms and 19% of solo lawyers). As a result, those firms that embrace the transformative power of AI may have a competitive advantage as AI begins to enjoy more widespread use.

Where does the data come from?

The Legal Trends Report uses a range of methodological approaches and data sources to deliver the best insights about the state of legal practice and strategies for future growth.

Aggregated and anonymised Clio data

We’ve examined aggregated and anonymized data from tens of thousands of legal professionals across the United States. This behavioural data offers valuable insights into current technology usage among legal professionals and its impact on firm performance.

Survey of legal professionals

Between May and July 2023, we conducted a survey of 1,446 U.S. legal professionals. The respondents included both lawyers and support staff—such as paralegals and administrators—who are involved in the management of their practices.

Survey of the general population

We surveyed 1,012 adults from the general U.S. population to understand their attitudes, opinions, preferences, and behaviours regarding the legal profession. The respondents included individuals who have previously hired lawyers or may do so in the future. This sample is representative of the U.S. population in terms of age, gender, region, income, and race/ethnicity, based on the latest U.S. census data.

Clio’s investment in solo and small firms

Clio is dedicated to supporting solo and small law firms by providing them with the tools and resources they need to succeed in today’s legal environment. We offer a comprehensive suite of features designed to streamline processes, enhance efficiency, and enable exceptional client service, all with the flexibility to work from anywhere.

Our solutions cover essential areas such as time recording, billing, document management, and client intake, freeing up time for solo and small firms with limited resources to remain competitive and grow. And, by investing in artificial intelligence through solutions like our forthcoming AI offering, Clio Duo, we are further streamlining routine tasks for solo and small firms through the power of automation.

We believe the success of solo and small law firms is crucial for the legal industry’s health and accessibility. By equipping these firms with innovative tools and robust support, Clio is helping to create a more efficient, client-centred legal landscape.

We published this blog post in June 2024. Last updated: .

Categorized in: Clio

Explore AI insights in our latest report

Our latest Legal Trends Report explores the shifting attitudes toward AI in the legal profession and the opportunities it brings for law firm billing, marketing, and more.

Read the report