-

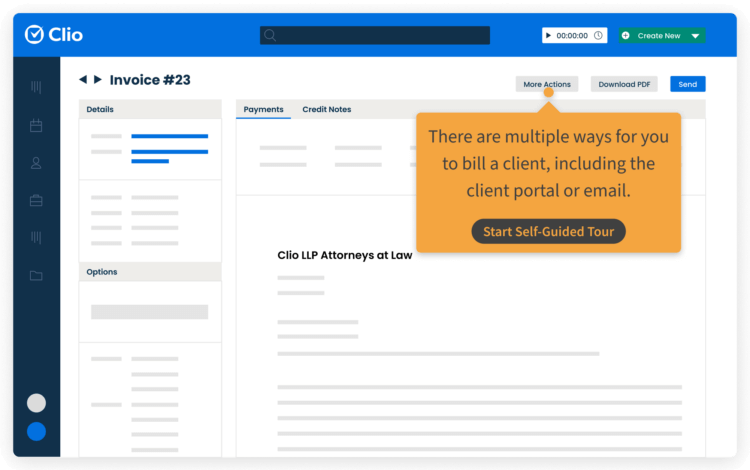

Quickly create beautiful, easy-to-pay bills

Speed up billing with custom bills, built in minutes and delivered via email or secure client portal. Make them easy to pay using credit, debit, or eCheck, or set up automated payment plans. See how in the Self-Guided Tour.

Built for law firms - Make it easy to pay and get paid

-

Your to-do-list is long enough and when it comes to payments, you’re likely chasing down outstanding invoices or struggling to keep up with billing. But it doesn’t have to be this way.

Make the collections process fast, automated, and convenient for you and your clients with online payments.

-

Get paid faster, waste less time, and provide a better payment experience

-

Handle billing and payments—all in one go

Stop struggling with disconnected workflows. Clio Payments automatically posts transactions to the appropriate matter or client account and syncs records with your accounting platform.

-

Flexible payment plans

Give your clients more flexibility with customized payment plans. Break large bills into manageable amounts on a schedule that fits their needs—helping you collect more of your outstanding balances.

-

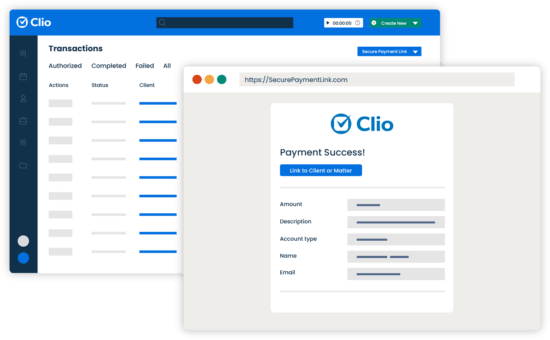

Make it easy for clients to pay online or in-person

Be client-centered by making it easy for clients to pay bills as soon as they’re received. For online payments, accept debit card, credit card, digital wallet (Apple Pay or Google Pay), or eCheck, through your website, click-to-pay links, or QR codes. For in-person payment, let clients pay using tap to pay in Clio's mobile app with their preferred card or digital wallet (Apple Pay or Google Pay).

A legal payments solution your firm can trust

-

Real time insights into your finances

Stay on top of all your transactions with financial reports and instant payment notifications to get a real-time view of any outstanding balances. Create automated payment reminders for any bills that need additional follow-up.

-

The simple solution to complex trust accounting

Clio handles all trust-related transactions in compliance with trust accounting and IOLTA rules. With earned and unearned funds kept separate, funds in your trust account are protected from all third-party debiting, including processing fees and chargebacks.

-

Operate in accordance with PCI legislation

Clio uses the payment industry's most advanced security measures—with bank-grade protection of client data and proactive fraud detection—so you can safely accept online payments. Clients can also store card details for future transactions.

Frequently Asked Questions

What is Clio Payments?

Built within the powerful Clio Manage infrastructure, it offers a faster, more transparent collections experience and real-time view of transactions. Payments get recorded automatically in Clio and are synced to your accounting platform—saving time and effort. And you can send trust payment requests and maintain evergreen retainers knowing Clio keeps you compliant with trust accounting rules. Ready to see Clio Payments in action? Try Clio for free.

Is Clio Payments PCI Compliant?

Clio Payments is built to ensure all payments are PCI compliant. The processing, transmission, and storage of card data is handled in a way that meets the highest level of certification available in the payments industry.

Where is Clio Payments available?

Clio Payments is available to customers in the US and Canada.

What is Clio’s secure eCheck?

For US customers, accept eCheck payments securely, without canceled checks or paperwork at an affordable flat fee of only 1% per transaction. With just a few clicks, your clients enter their financial institution information to securely deposit payment into your account. Unlike other providers, Clio instantly verifies your customer’s bank account with no waiting period.

How does Clio handle trust payments and IOLTA account protection?

Clio protects your trust account from any 3rd party debiting fees and processing fees are always taken from your operating account. In fact, Trust Account protection is listed in Clio’s terms of service. You are in control of where payments are deposited to – your trust account or your operating account and you can count on real-time and monthly reporting for all your trust accounting needs.

Can I get a report of a client’s transaction history?

Transactions can be viewed in real-time, unlike other payment solutions where these can’t be viewed until the end of the month.

Entire transaction history can be found in Clio’s transactions table. Every matter and client also has a record of associated transactions and legal credit card payments.

Clio Payments resources

More Clio Manage features

-

Case Management

Stay organized, and access the information you need—from anywhere, at any time.

-

Document Management

Edit, store, and organize your legal documents securely, from anywhere.

-

Artificial Intelligence

Meet Clio Duo, your legal AI partner—ready to help lawyers make the most of their workday with automatic summaries, personalized recommendations, and more.

-

Billing

Create custom bill plans based on fee structure and reduce manual data entry. Bill via email or our secure client portal.

-

Client Management

Easily organize contact details, documents, and communication logs from intake to invoice.

-

Accounting

Manage, record, and analyze every financial transaction in one system of record.

-

Calendaring

Meet every deadline, with legal-specific features like automatic court date scheduling.

-

Task Management

Manage firm productivity by assigning and tracking task completion.

-

Online Payments

Make it easy to pay and get paid with online payments.

-

Time & Expense Tracking

Seamlessly track time and expenses to make billing simple and accurate.

-

Law Firm Reporting

See how many hours your firm has recorded, billed, and collected from a single dashboard.

-

Client Portal

Enable clients to securely communicate and collaborate with their lawyer from desktop or mobile.

-

Law Firm Communications

Manage client and firm communication all on one platform.

-

Personal Injury

Close cases faster by organizing medical liens, damages, and settlements alongside your case files.